March Punctuates Uneven First Quarter for ETF Flows

Investors poured into bond ETFs, and stocks swirled in March.

Key Takeaways

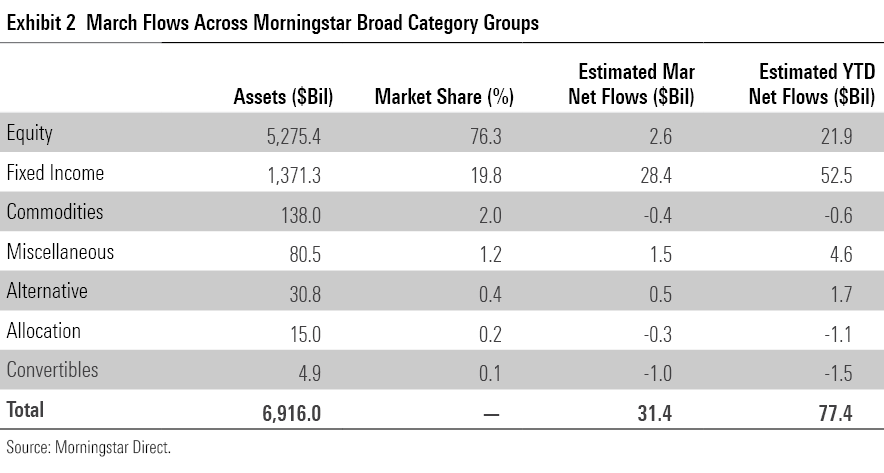

- U.S. exchange-traded funds reeled in more than $31 billion in March, bringing their first-quarter haul to about $77 billion.

- Bond ETFs claimed about 68% of the first-quarter flows despite representing only one fifth of the market.

- International-stock ETFs absorbed about $30 billion in the first quarter, while their U.S. counterparts incurred their first quarterly outflows since 2016.

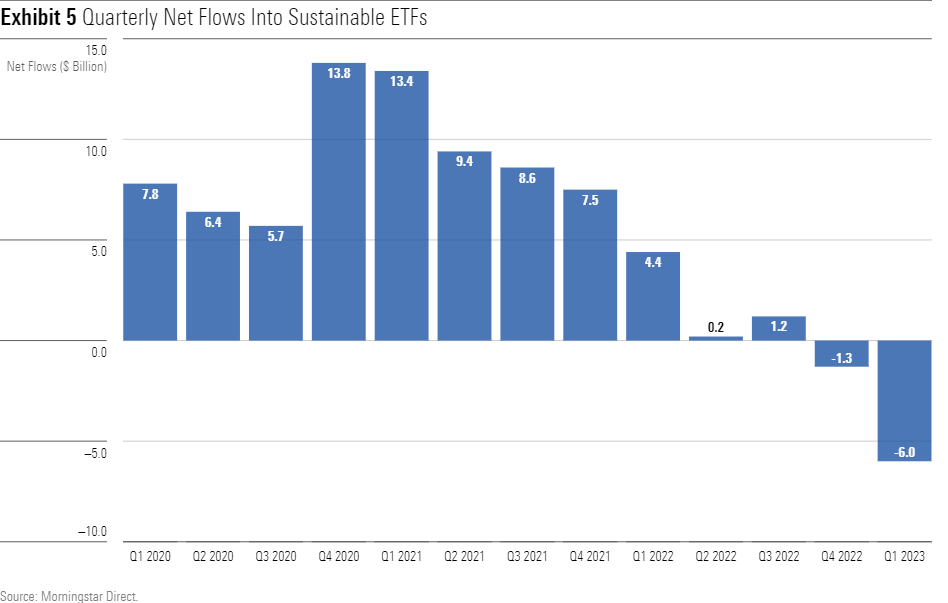

- Sustainable ETFs saw $6 billion exit in the first quarter, their worst figure to date.

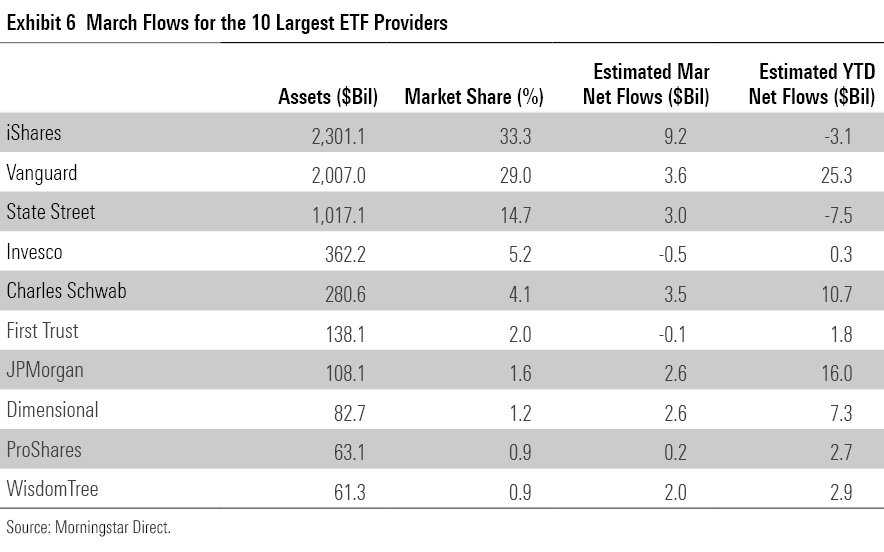

- Vanguard led all ETF providers with $25 billion of inflows in the first quarter.

- The Morningstar US Market Index climbed 7.4% over the first three months, as growth and large-cap stocks rallied but value and small caps stumbled.

- Slowing interest-rate hikes pushed the Morningstar US Core Bond Index to a 2.92% first-quarter gain.

Stocks’ Sporadic Quarter

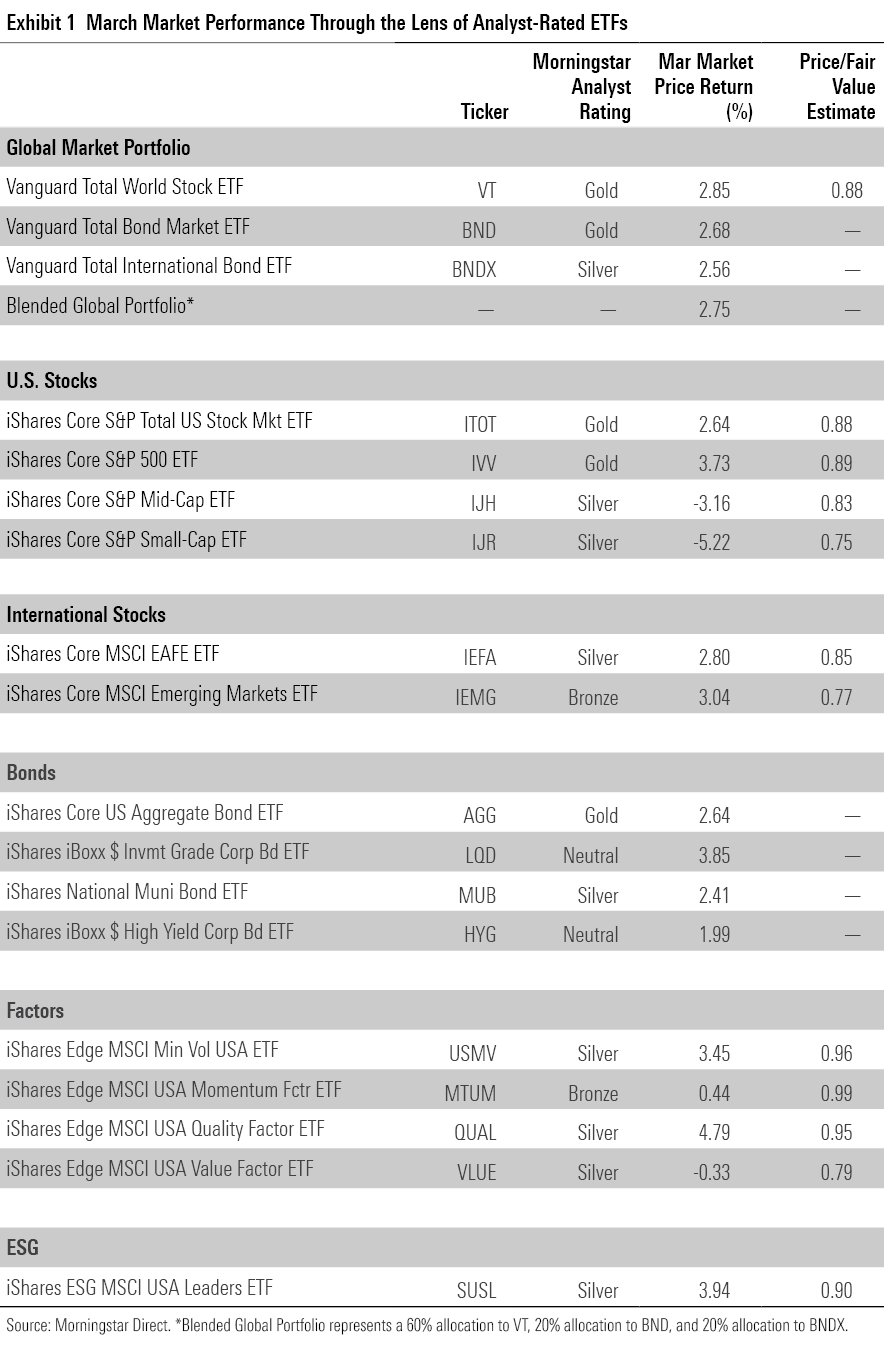

Exhibit 1 shows March returns for a sample of Morningstar analyst-rated ETFs that serve as proxies for major asset classes. Investors in a blended global portfolio earned a 2.75% return last month, as stocks and bonds offered balanced returns in March.

Vanguard Total Stock Market ETF’s VTI 2.85% March return concealed a hectic month for U.S. stocks. In early March, Silicon Valley Bank was forced to recognize losses on its held-to-maturity assets. That cast doubt on the status of uninsured deposits and sparked a modern-day bank run. More falling dominoes sent the financials sector deeper into a tailspin: Financial Select Sector SPDR ETF XLF booked a 9.55% March loss by month’s end. Regional banks were the main culprit—SPDR S&P Regional Banking ETF KRE plummeted 28.13%—but the concerns dragged national banks, insurance providers, and asset-management firms into the mud, too.

Technology and communications stocks continued their tremendous start to the year. Technology Select Sector SPDR ETF XLK climbed 10.86% on the month—its best since July 2022—and Communication Services Select Sector SPDR ETF XLC advanced 8.65%. Some investors may have sought safety in enormous, profitable firms like Apple AAPL and Microsoft MSFT.

But even historically volatile tech stocks ended a blistering quarter on a high note. After it shed half its value in 2022, Nvidia NVDA rocketed a staggering 90.1% in the first quarter to claw back nearly all it lost. Stocks like Advanced Micro Devices AMD and Meta Platforms META launched milder but impressive turnarounds. Increased belief that the Federal Reserve will soon pause interest-rate hikes has likely fueled gains from these rate-sensitive firms.

The recent sector divergence cemented a resounding victory for growth stocks in the first quarter. Vanguard Growth ETF VUG beat Vanguard Value ETF VTV by more than 8 percentage points in March and about 18 percentage points in the first quarter. VTV suffered from losses in the energy, utilities, and healthcare sectors, some of last year’s standouts. Perhaps no growth ETF has been positioned better than Invesco QQQ Trust QQQ so far this year. It stashes half its portfolio in tech and excludes financials stocks altogether, a recipe that produced a 20.71% return in the first quarter.

March brought uneven returns along the market-cap spectrum, too. IShares Core S&P 500 ETF IVV advanced 3.73%, while iShares Core S&P Small-Cap ETF IJR slid 5.22%. That marked the widest monthly gap between the funds since March 2020, when investors turned to heftier firms for stability amid the pandemic-fueled drawdown. Regional banks widened the chasm this time around: Entering March, IJR stashed about 10% of its portfolio in regional bank stocks, compared with 1% for IVV. U.S. small-cap stocks now look undervalued through the lens of Morningstar’s price/fair value metric, though that may be cold comfort for small-cap investors who were burned in March.

Bonds Cap Off Bounceback Quarter

Bond ETFs fared well in March after inflation concerns stung them in February. Vanguard Total Bond Market ETF BND climbed 2.68% in March to finish up 3.25% for the quarter. Those numbers moved nearly in lockstep with Vanguard Total International Bond ETF BNDX. Bonds may have been pushed up by a new crop of investors that were scared away from March’s stock market turmoil.

Interest-rate risk went in and out of style in the first quarter. Longer-dated bond funds fared well in January and March but badly in February. IShares 20+ Year Treasury Bond ETF TLT finished the quarter 4.84% higher than where it started, compared with just 0.51% for iShares Short Treasury Bond ETF SHV. Riskier bond funds mostly climbed in the first quarter. IShares Broad USD Investment Grade Corporate Bond ETF USIG added 3.79% over the past three months, and SPDR Bloomberg High Yield Bond ETF JNK advanced 4.24%.

Fixed-Income ETF Flows Return With Force

After a February of modest outflows, bond ETFs bounced back in March with $28.4 billion of inflows. That pushed their first-quarter haul to $52.5 billion, or about 68% of all ETF net flows for a cohort that only represents about 20% of the market.

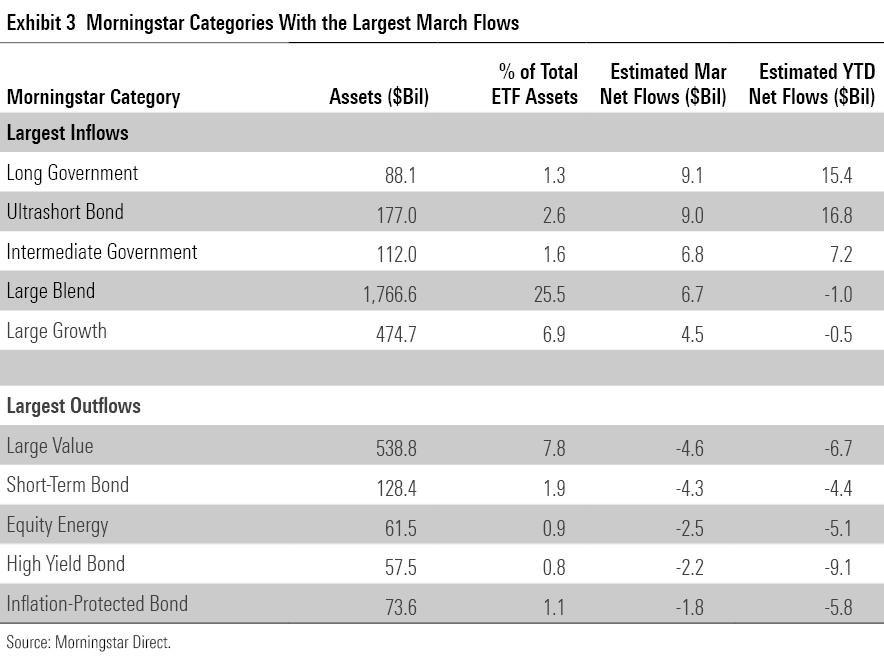

Ultrashort bond funds reeled in $9 billion in another lucrative month for this conservative Morningstar Category. These funds’ $17 billion first-quarter collection marks a stellar follow-up to their record-setting 2022. Strong yields have likely attracted a swath of new investors. At the end of March, the three-month Treasury bill yield was at its highest level since before the global financial crisis. Stock market turmoil in March could have sent investors to safer pastures, too. IShares 0-3 Month Treasury Bond ETF SGOV and SPDR Bloomberg 1-3 Month T-Bill ETF BIL led the way in the first quarter with nearly $4 billion in flows each.

Government-bond ETFs were another common choice in March. Long-term government bond funds led all categories with $9.1 billion in March flows—inching its first-quarter figure to $15.4 billion—but medium- and short-term offerings also fared well. In 2022, government bond funds accounted for 38% of bond ETF flows with only 18% of the market share. Ultrashort bond funds have taken over the mantle in 2023, but these categories still sit near the top of the heap.

At the other end of the bond spectrum, riskier bond categories continued to endure outflows in March. Another $2.2 billion rushed out of high-yield bond funds, which brought their first-quarter exodus to over $9 billion, the most of all categories. Bank-loan funds shed another $1 billion in March, and emerging-markets bond funds saw modest outflows. All of these categories started the year hot, but investors have soured on risk over the past two months and left them with subpar first-quarter flows.

International Stock ETFs Carry the First Quarter

The $22 billion that stock ETFs collected in the first quarter was nothing to scoff at, but it marked their leanest inflow since 2020′s second quarter. U.S. stock funds were the main culprit. They bled over $4 billion—their first quarter of outflows since 2016—as their international-stock peers reeled in nearly $30 billion.

International-stock ETFs saw mild March inflows but still finished with a strong first quarter. The Europe stock category led the charge with $8.4 billion of new money, which translated into a 24% organic growth rate. Most of the flows poured into JPMorgan BetaBuilders Europe ETF BBEU, whose $5.7 billion first-quarter inflow led all category peers by a wide margin. The foreign large-blend and diversified emerging-markets categories also posted solid first-quarter flows, hauling in $7.2 billion and $6.2 billion, respectively.

In the United States, large-value ETFs bore the brunt of the pain. Investors pulled $4.6 billion from these funds in March to saddle them with $6.7 billion of outflows so far this year, marking their worst quarter of flows on record. Large-growth funds finished the quarter with modest outflows but collected $4.5 billion in March to recapture some of their early losses. A pair of Nasdaq 100 Index trackers—QQQ and Invesco Nasdaq 100 ETF QQQM—led the way with more than $1 billion of inflows apiece. As the value index and dividend funds that held up best in 2022 have swiftly fallen out of favor, faster-growing portfolios have started to return to the limelight.

On the heels of the Silicon Valley Bank collapse, investors didn’t waste time buying the dip in regional bank ETFs. KRE nearly doubled in size when it reeled in more than $1 billion in March. IShares US Regional Banks ETF IAT had a banner month as well: The $284 million it absorbed translated into a 37% organic growth rate. Whether these funds prove to be valuable buys or falling knives remains to be seen.

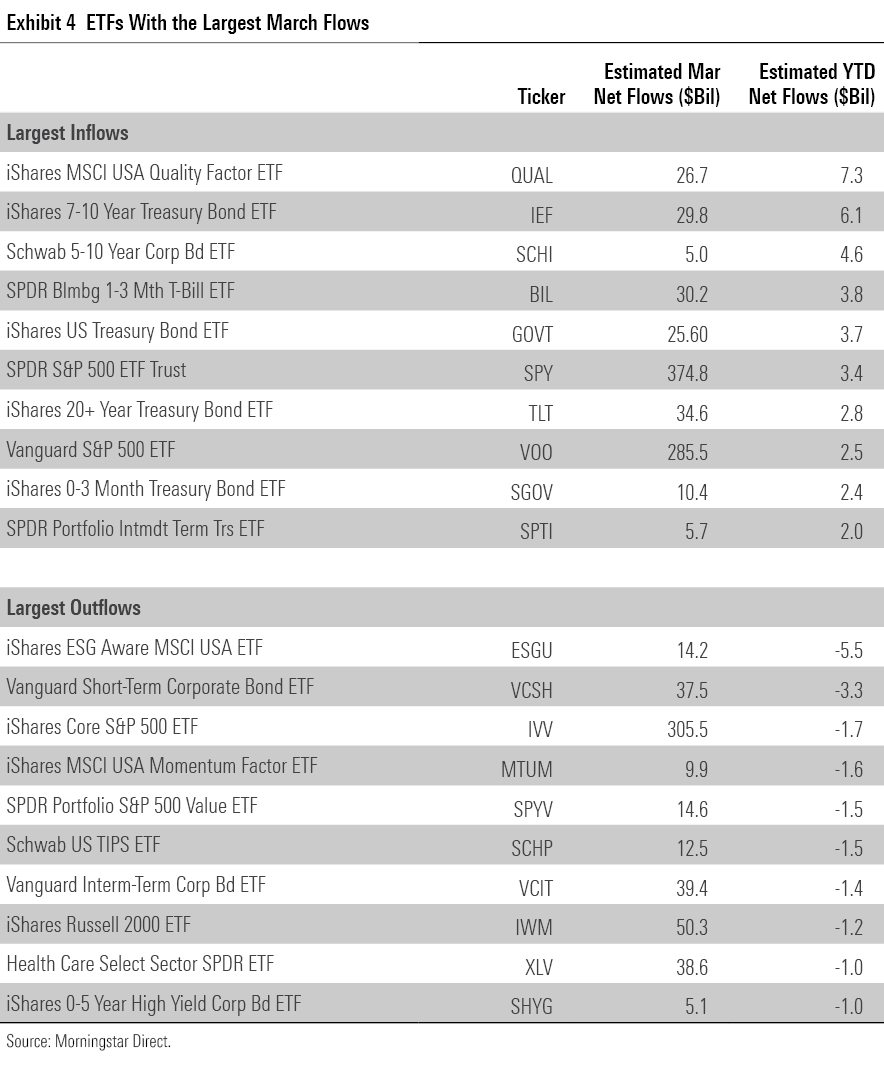

The March flows crown goes to iShares MSCI USA Quality Factor ETF QUAL, whose tidy $7.3 billion inflow more than doubled its previous monthly record. IShares ESG Aware MSCI USA ETF ESGU finished last with $5.5 billion of outflows. Behind both was an update to a series of widely-followed BlackRock model portfolios, in which QUAL replaced ESGU. This left a black eye for sustainable funds as a whole. ESGU is about twice the size of the next-largest sustainable ETF. The exodus from it left sustainable ETFs with about $6 billion of first-quarter outflows, shattering the previous outflow record set in 2022′s finale.

IShares’ Mixed Bag

IShares bounced back from a difficult start to the year with $9.2 billion of March inflows, tops among all ETF providers. Its Treasury ETF lineup has carried last year’s flow momentum into 2023. These funds entered the year with about $142 billion in assets, which constituted about 60% of the overall Treasury ETF market. So far, iShares has stayed on track: The $19 billion its Treasury ETFs collected in the first quarter accounted for about 63% of all inflows into such strategies.

While this trend is a positive for iShares, the firm needs its stock ETFs to kick into high gear for it to stay competitive with Vanguard, whose $25 billion first-quarter inflow led all ETF providers. IShares’ U.S. stock funds bled $28 billion in the first quarter. IVV, iShares Russell 1000 Growth ETF IWF, and iShares Russell 1000 Value ETF IWD shed between $3 billion and $5 billion apiece. And with the exception of QUAL, its single-factor strategic-beta ETFs endured hefty outflows, too. So far in 2023, iShares has felt the pain of U.S. stock funds’ outflows more acutely than anyone.

Healthy first-quarter flows into bond and international stock ETFs boded well for Charles Schwab. At the end of March, it ranked as the third-largest international-stock ETF provider and fourth-largest bond ETF provider. Those avenues helped it absorb nearly $11 billion in the first quarter, third behind Vanguard and JPMorgan ($16 billion). Schwab 5-10 Year Corporate Bond ETF SCHI paced the firm with a $4.6 billion first-quarter haul. Schwab U.S. Dividend Equity ETF SCHD and Schwab Short-Term U.S. Treasury ETF SCHO racked up more than $3 billion each.

Big Discounts for Small Caps

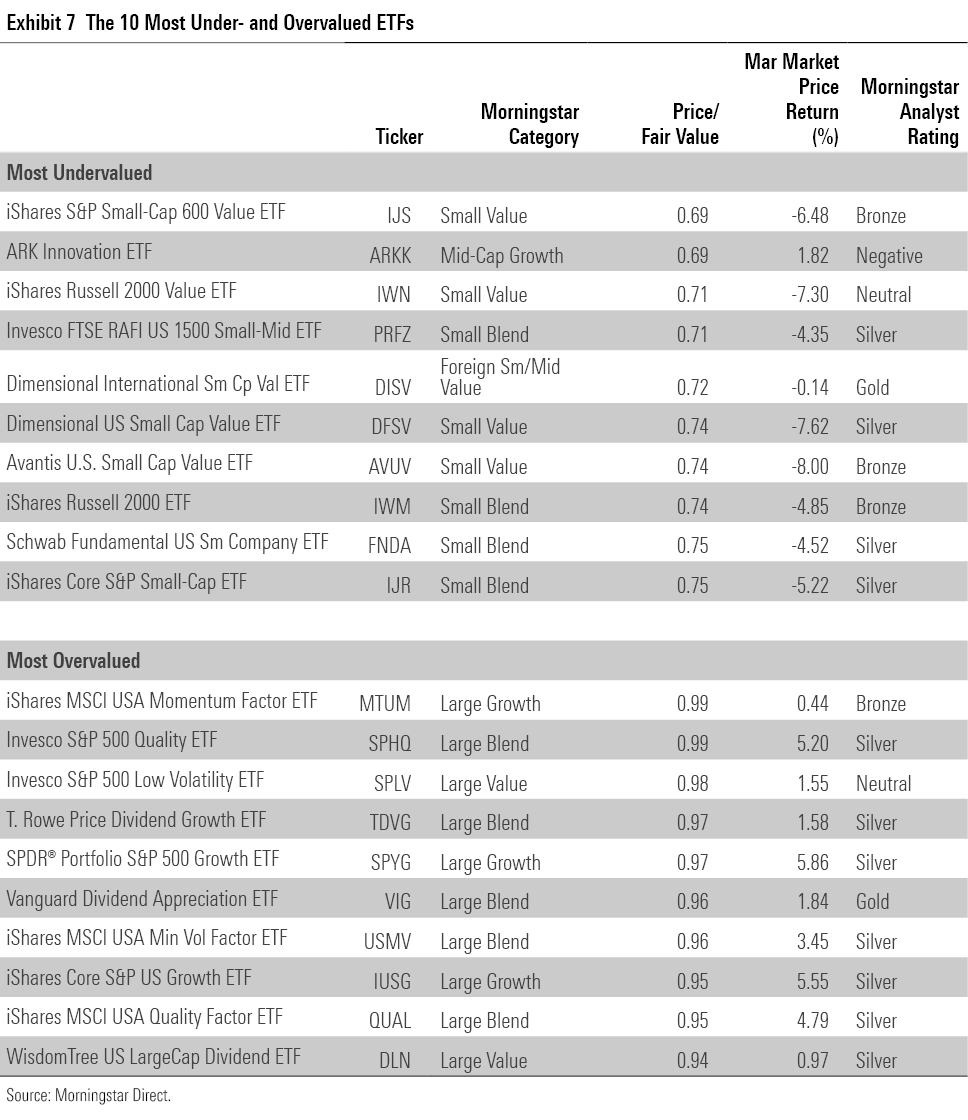

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

Stock ETFs look cheap no matter where you look. Each of the 177 Morningstar analyst-rated stock ETFs traded below their fair value at March’s end. IShares S&P Small-Cap 600 Value ETF’s IJS 31% discount was the steepest, and even iShares MSCI USA Momentum Factor ETF MTUM traded 1% below fair value, the artifact of middling recent returns. The broad U.S. market, as proxied by VTI, was 11% off. Foreign stocks (represented by Vanguard Total International Stock ETF VXUS) came at a 14% discount.

At first quarter’s end, the best value may be in small-cap ETFs. These funds were hit hardest by the banking crisis and may have room to run on the recovery road. Those that focus on the cheaper half of the small-cap market and incorporate measures of quality—like Dimensional U.S. Small Cap Value ETF DFSV and Avantis U.S. Small Cap Value ETF AVUV—should fare well.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)