Stock Funds Off to Hot Start in 2023

A growth-led rally made up for some lost ground after 2022′s shellacking.

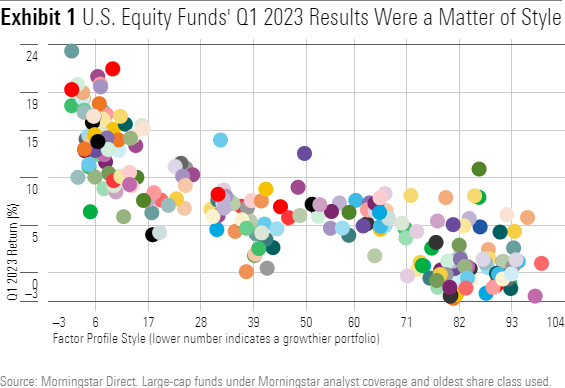

After an abysmal 2022, growth funds got off to a hot start in 2023. Of the nine Morningstar Style Box categories, the large-growth Morningstar Category’s 11.6% gain was tops while the large-value category inched up 0.8%. Non-U.S. growth stock funds also tended to beat their value peers, but size also mattered; large-cap funds outperformed their small- and mid-cap peers.

The foreign large-growth category gained 9.6%, which beat the foreign small/mid growth category by nearly 4 percentage points. The same held true for the value categories: Foreign large value gained 7.4% while foreign small/mid value rose 5.5%.

One trend remained constant across both markets: Many of last year’s goats looked like heroes in the first quarter. A rebound in the beaten-down tech sector drove growth funds’ rebound while bank failures caused financials and other traditional value sectors like energy to stumble.

U.S. Growth Managers Off to a Hot Start

Managers who held the hardest-hit names in 2022 tended to come out on top in the first quarter. After falling more than 31% in 2022, the Morningstar U.S. Tech Index finished the quarter up 22.5%. Stocks such as Tesla TSLA, Carvana CVNA, and Meta META gained more than 65% in the first quarter. Meanwhile, falling oil prices and the collapse of several regional banks, like Silicon Valley Bank and Silvergate SI weighed on energy and financial stocks. The Morningstar U.S. Banks—Regional Index plummeted 23.5% in 2023′s first quarter.

Loomis Sayles Growth LSGRX, which receives a Morningstar Analyst Rating of Gold, was among the rally’s biggest beneficiaries. The strategy gained more than 21% during the first quarter while the Russell 1000 Growth Index rose 14.4%. Manager Aziz Hamzaogullari took advantage of tech’s selloff in 2022 and bought Tesla, Shopify SHOP, and Netflix NFLX. Such holdings helped the fund’s first-quarter and long-term record. The fund’s 14.6% annualized gain since Hamzaogullari’s May 2010 start through March 2023 almost matched the index’s 14.8% rise and beat the typical large-growth peer.

Negative-rated ARK Innovation ARKK rebounded in 2023′s first quarter following a 67% 2022 plummet. Cathie Wood’s aggressive-growth strategy does well in markets that favor stocks that trade more on high expectations than fundamentals, such as Coinbase COIN and Tesla. The strategy’s 29.1% gain in the first quarter, however, is still a long way from making up for its dismal 2022 performance or for its other fundamental weaknesses, including key-person risk and weak risk management. Although results since the strategy’s 2014 inception are positive, it’s debatable whether they have been worth the strategy’s risks.

While growth strategies prospered, value-oriented strategies like Silver-rated Diamond Hill Mid Cap DHPYX didn’t. The fund’s February 2023 portfolio had a 3.5% stake in SVB Financial and helpings of other regional banks that got clobbered such as First Republic Bank FRC. The strategy fell roughly 2% in the quarter and lagged nearly 91% of its mid-value category peers. Following the blowups, manager Chris Welch admitted he underestimated the risks of uninsured depositors fleeing faster than the bank could raise capital from its alternative sources. Diamond Hill Small Cap DHSIX, which Welch had comanaged before handing lead duties to Aaron Monroe in February, did not own the failed banks, and did much better than peers and the benchmarks in the quarter, illustrating how much financial sector exposure and stock selection affected results.

Neutral-rated Victory Integrity Discovery MMEYX, for example, had nearly one fourth of its assets in hard-hit banks, such as First Internet Bancorp INBK and Washington Trust Bancorp WASH, and dropped nearly 3% in the quarter.

Non-U.S. Stock Managers Also Fared Well

Non-U.S. stock funds posted more modest gains than their U.S. counterparts in the first quarter. Large-cap and growth-oriented funds prevailed over their small- and mid-cap value peers.

Bronze-rated Morgan Stanley Institutional Global Opportunities MGGIX was one of the biggest gainers. The strategy’s 42% decline in 2022, and subsequent 20.6% gain in 2023′s first quarter exemplified its ups and downs. Manager Kristian Heugh’s compact portfolio can look out of favor, but the team’s deep fundamental research and knack for finding durably growing companies has paid off over the long term. Since the strategy’s May 2008 inception, Heugh has topped the MSCI ACWI Growth Index by more than 3.5 percentage points annualized through March 2023.

Value-oriented, Gold-rated Oakmark International OAKIX also finished the quarter with double-digit returns. Since inception manager David Herro, a two-time winner of Morningstar’s International Stock Manager of the Year Award, has gone against the grain looking for stocks that he thinks are worth considerably more than their current share prices, and he is willing to hold them for five to 10 years until value and price converge. It’s been a bumpy but profitable ride. The strategy’s 9.1% annualized gain topped the MSCI ACWI Ex USA Value Index and the typical large-value category peer by about 1 and 2 percentage points, respectively, over the trailing 20-year period ending in March 2023.

Bronze-rated Wasatch Global Investors’ WAIOX 2022 woes continued in 2023. The strategy’s 1.8% return in the first quarter ranked in the bottom decile among its foreign small/mid category peers. Financial services holdings such as VEF AB VEFAB and City Union Bank CUB fell more than 20% in the first quarter and combined for roughly 2% of the December 2022′s portfolio’s assets. Although its perennially high fees don’t help, the fund’s trailing 10- and 15-year returns through March 2023 are more promising; Linda Lasater became a manager in June 2016, after contributing to the portfolio as an analyst for roughly a decade prior.

Neutral-rated Horizon Kinetics Inflation Beneficiaries ETF INFL was another notable laggard during the quarter. The fund dropped 1.7% this quarter and lagged more than 96% of its global small/mid category peers. The fund’s 4.7% stake in Texas Pacific Land TPL at the end of March 2023 weighed on performance as the stock has declined 27% this year to date.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)