Markets Brief: Investors Look Past Turmoil and Drive Stocks Higher in Q1 2023

Even as the Fed looks to pause rate hikes, reasons for caution abound.

Check out our weekly markets recap at the bottom of this article.

The stock market in the first quarter of 2023 might go down in history as the “What, Me Worry?” market even though it behaved as the Everything Everywhere All at Once market.

Investors drove stock prices higher in the first quarter of 2023, seemingly unfazed and undaunted by inflation that won’t quit, the ninth interest-rate hike in a year, and a regional bank crisis that is leading to tighter credit conditions and raising financial stability concerns. The focus for investors remains on interest rates and expectations that the Federal Reserve will pause its rate-hike campaign and cut rates as soon as the third quarter.

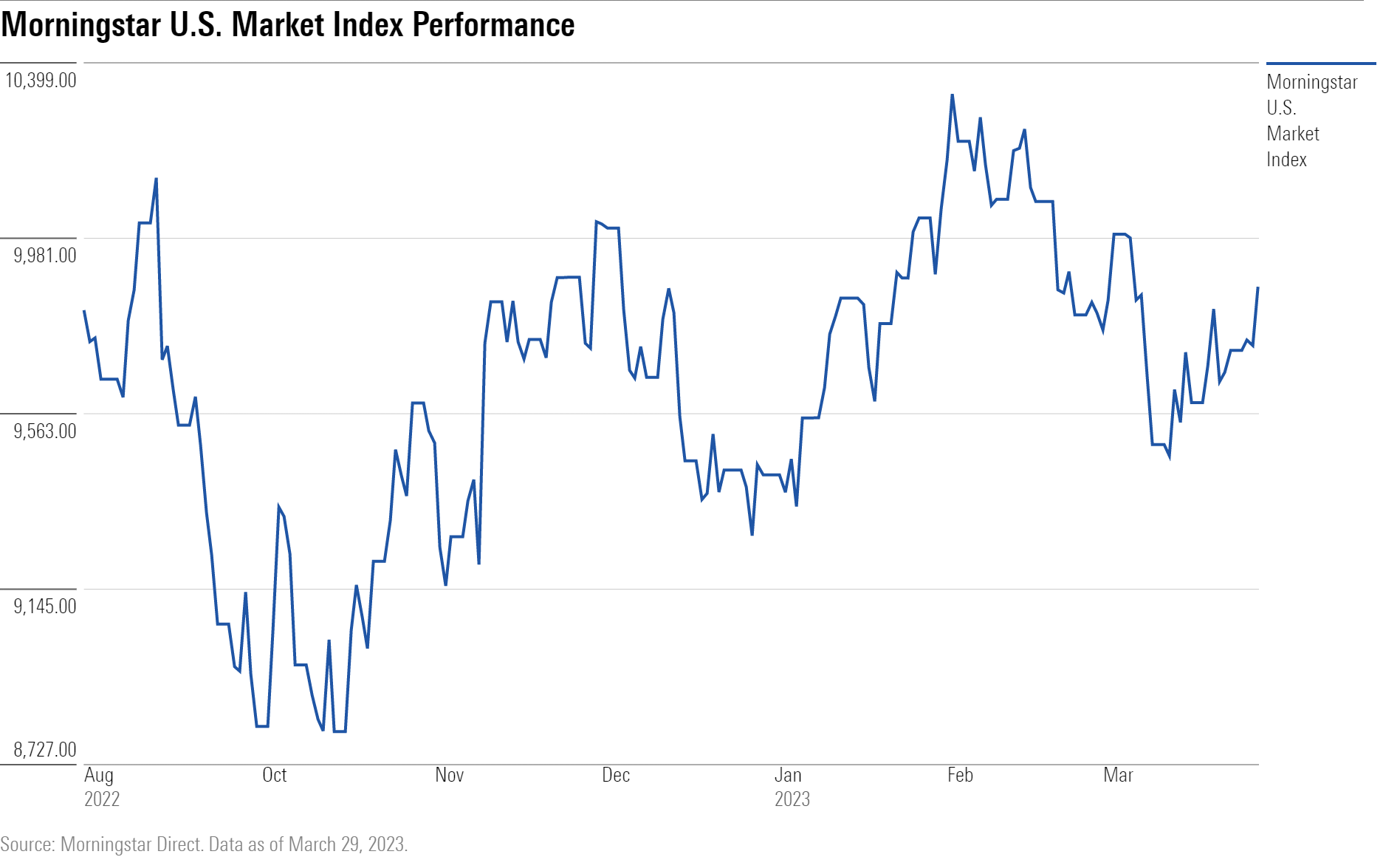

However, despite the first-quarter bounce, stocks remain in a bear market and have been trapped in a relatively tight trading range since August.

While it may be that stock investors can breathe a sigh of relief as the Fed winds down its rate hikes, there are still many reasons for caution:

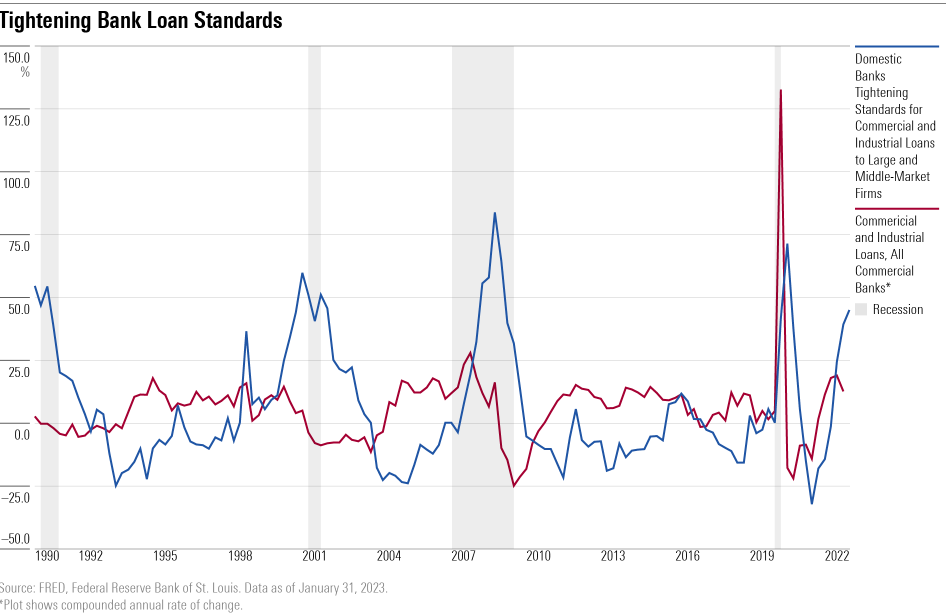

- Tightening bank lending standards

- Potential for corporate earnings disappointments

- Unemployment likely to rise

- Narrow stock market leadership

Mega-Caps Fuel Gains

The Morningstar US Market Index finished the quarter up 7.4%, with mega-cap technology stocks fueling the gains. Tech stocks benefited as investors flooded into the beaten-up group, expecting it to benefit from a Fed pause and move to cut interest rates. Also, mega-cap techs are seen as having fortresslike balance sheets able to withstand a serious downturn.

But the first quarter was anything but an easy ride.

“It was a quarter that saw tectonic shifts in forecasting Fed policy,” says James St. Aubin, chief investment officer at Sierra Investment Management in Santa Monica, California, calling the first-quarter action a “roller-coaster ride” in which investor expectations around inflation and how the Fed would respond to it changed multiple times from start to finish.

“We were completely whipsawed,” says Nanette Abuhoff Jacobson, global investment and multi-asset strategist at Wellington Management.

Investors bid the stock market up 8% by early February on improving inflation data and hopes of a soft landing, she notes, only to give back those gains plus some after a series of jolts that included a stronger-than-expected jobs report and higher prices in the services sector. Then followed two bank failures and a rescue of a third. After dropping sharply on March 9 on news that Silicon Valley Bank was in trouble, stocks have regained their lost ground since then.

Volatility Will Continue, New Lows Ahead

Market veterans see the volatility continuing and the economy hurtling toward a recession on tighter credit conditions and the potential for the market to break the October lows. (The Morningstar second-quarter stock market outlook can be found here.)

The single-minded focus “on falling interest rates alone borders on magical thinking,” says Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management. “This is a question of huge amounts of excess liquidity meeting a long business cycle where investors have unlearned the lessons of history. Investors have been trained to believe in outsized returns and brief bear markets where the Fed will come to the rescue.”

This time, however, she notes that if the Fed cuts rates, it won’t be because it has finished fighting inflation but because it is balancing “rising financial stability risks with still sticky services inflation.”

“Market resilience threatens to shrug off rising chances for a hard landing, a profit recession, and the risk of stagflation,” says Shalett. “We think that placing new funds in the market at these prices is dangerous when what’s ahead of us is a 10% to 20% drawdown.”

“I don’t think the equity markets are pricing in the uncertainty and slower growth in the outlook,” says Sierra’s St. Aubin. “The cost of credit has risen. What happens with the availability of credit could cause real growth issues. Credit is the oxygen of the economy, and we’re sucking out the oxygen at a rapid pace.”

“If we hit a hard landing, and that’s looking increasingly likely, we will see new lows,” he says.

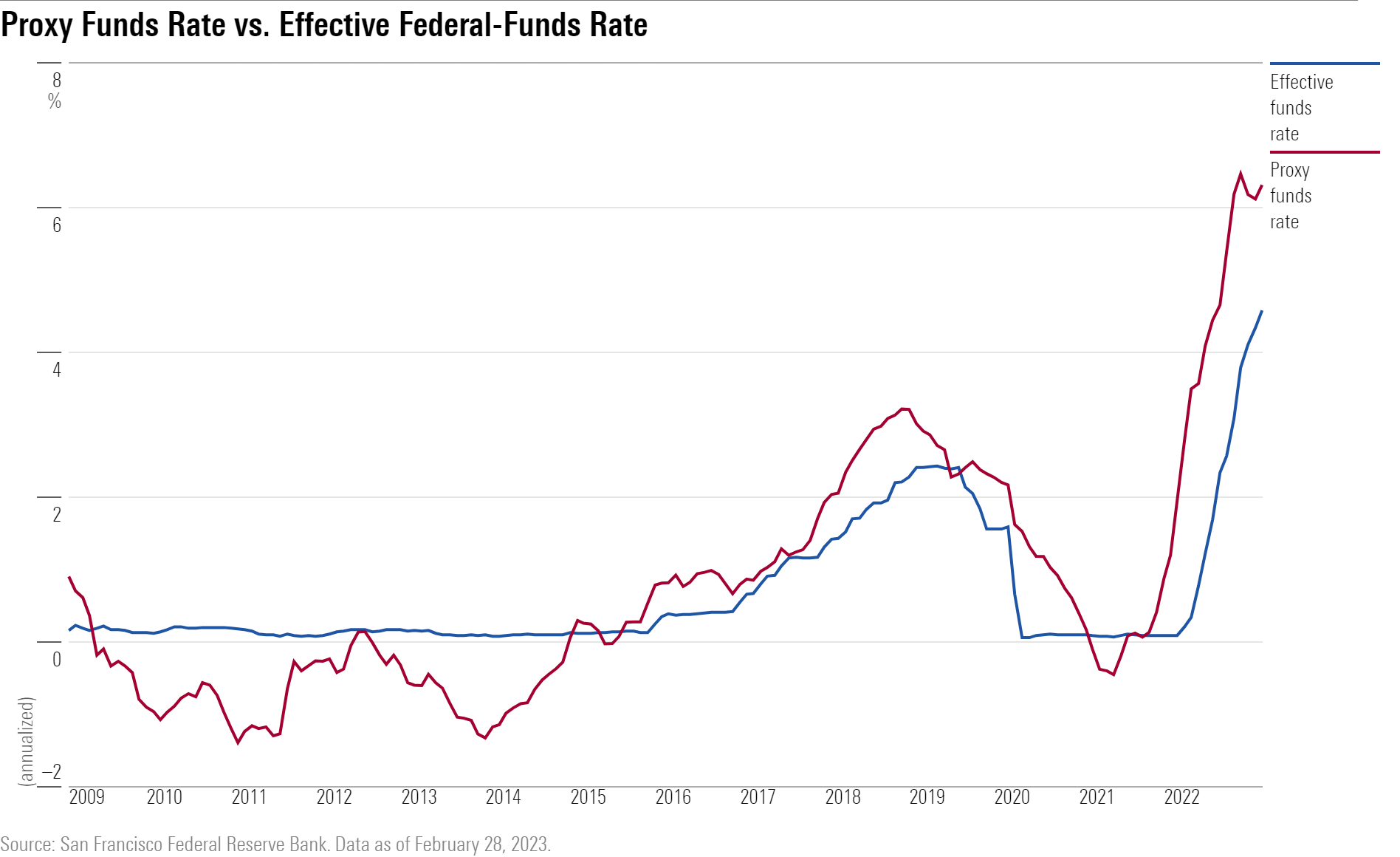

St. Aubin points to a data point from the San Francisco Federal Reserve Bank called the proxy funds rate. The proxy funds rate takes a broader view of monetary policy and considers the other tools the Fed uses to influence rates such as forward guidance and changes to the Fed’s balance sheet to gain a clearer picture of where rates would be if driven strictly by the federal-funds rate.

The proxy funds rate stands at over 6%, well above the current official federal-funds rate range of 4.75% to 5%, a sign that rates are already quite restrictive.

Pressure on Earnings

In addition to tighter credit, slowing growth, and rising unemployment, corporate earnings are expected to weaken, and that, too, could hurt stocks.

In the first quarter, earnings at large-cap stocks are expected to decline by more than 6%, down sharply from the 0.3% drop forecast at the quarter’s start, according to data tracker FactSet Data Systems. It would mark the biggest year-over-year decline since the second quarter of 2020, when earnings fell nearly 32% in the aftermath of the coronavirus pandemic lockdowns.

Wall Street analysts have been lowering their estimates for the quarter based on an increased level of negative guidance from companies. Yet, estimates for the rest of the year and through 2024 remain elevated and pose a risk for stocks if they come down, says Wellington’s Jacobson.

“We are cautious on risk assets generally,” she says. “Our base case is a mild recession this year. It’s inevitable that we will see more volatility and downside to equities.”

Jacobson sees stocks potentially falling 10% to 15% from current levels.

In the wake of the crisis, regional banks will be under pressure to raise capital levels as they come under greater regulatory scrutiny, explains Jacobson. They will also be forced to raise deposit rates to stay competitive. Interest rates on loans will move higher, too.

“Those forces will constrain lending, and lending is the central nervous system of the economy,” she says. “Even if there are no more accidents in banking, or commercial real estate, or in leveraged loans, the reaction will be to tighten credit further.”

With small regional banks accounting for about half of all commercial and industrial loans, 70% of all commercial real estate loans, and nearly 40% of residential mortgages, any tightening of credit will have a direct impact on jobs and consumer spending, says Morgan Stanley’s Shalett, noting that small businesses account for two thirds of all jobs in the economy.

The Federal Reserve sees unemployment rising to 4.5% this year from the current 3.6%.

Weakness Under the Surface

Despite the overall gains in the market in the first quarter, wide divergences among sectors exposed weaknesses lurking beneath the surface.

“Not all stocks showed so much resiliency during this first quarter,” says Fernando Soto, senior vice president in Brown Brothers Harriman’s private banking division, noting only five of 11 sectors showed positive returns.

The stars of the quarter were the worst performers in 2022: The Morningstar US Technology Index rose about 22% in the quarter, and the Morningstar US Communication Services Index advanced almost 17%. Those gains were in contrast to the more than 24% drop in the Morningstar US Banks-Regional Index. And last year’s top sector, energy, fell by nearly 7%.

Against this backdrop, market leadership is a concern.

“We are most concerned with investors piling into mega-cap names,” says Ed Clissold, chief U.S. strategist at Ned Davis Research. “That makes for a narrow market, not a healthy market.”

For the rally to continue, the number of stocks participating needs to broaden to include small caps and value stocks, says Clissold.

“We would push back on the tech rally,” says Wellington’s Jacobson. “There’s a schism between mega-cap techs and other techs that are less profitable. Yet, we think the mega-caps will be less profitable as their businesses continue to normalize to a prepandemic world.”

Morgan Stanley’s Shalett also warns against jumping on the tech train. “There’s a belief these companies are bulletproof and ironclad,” she says. “While they have extraordinary business models, these companies will face massive challenges” in a slowdown.

Events Scheduled for the Coming Week:

- Friday: March Jobs Report. Stock and bond markets closed in observance of Good Friday.

For the Trading Week Ended March 31

- The Morningstar US Market Index rose 3.7%.

- All 11 stock sectors were up, with the best-performing sectors being consumer cyclical, up 5.7%, and energy, up 5.4%

- Yields on 10-year U.S. Treasuries rose to 3.49% from 3.38%.

- West Texas Intermediate crude prices rose 9.3% to $75.67 per barrel.

- Of the 844 U.S.-listed companies covered by Morningstar, 806, or about 95%, were up, and 38, or about 5%, declined.

What Stocks Are Up?

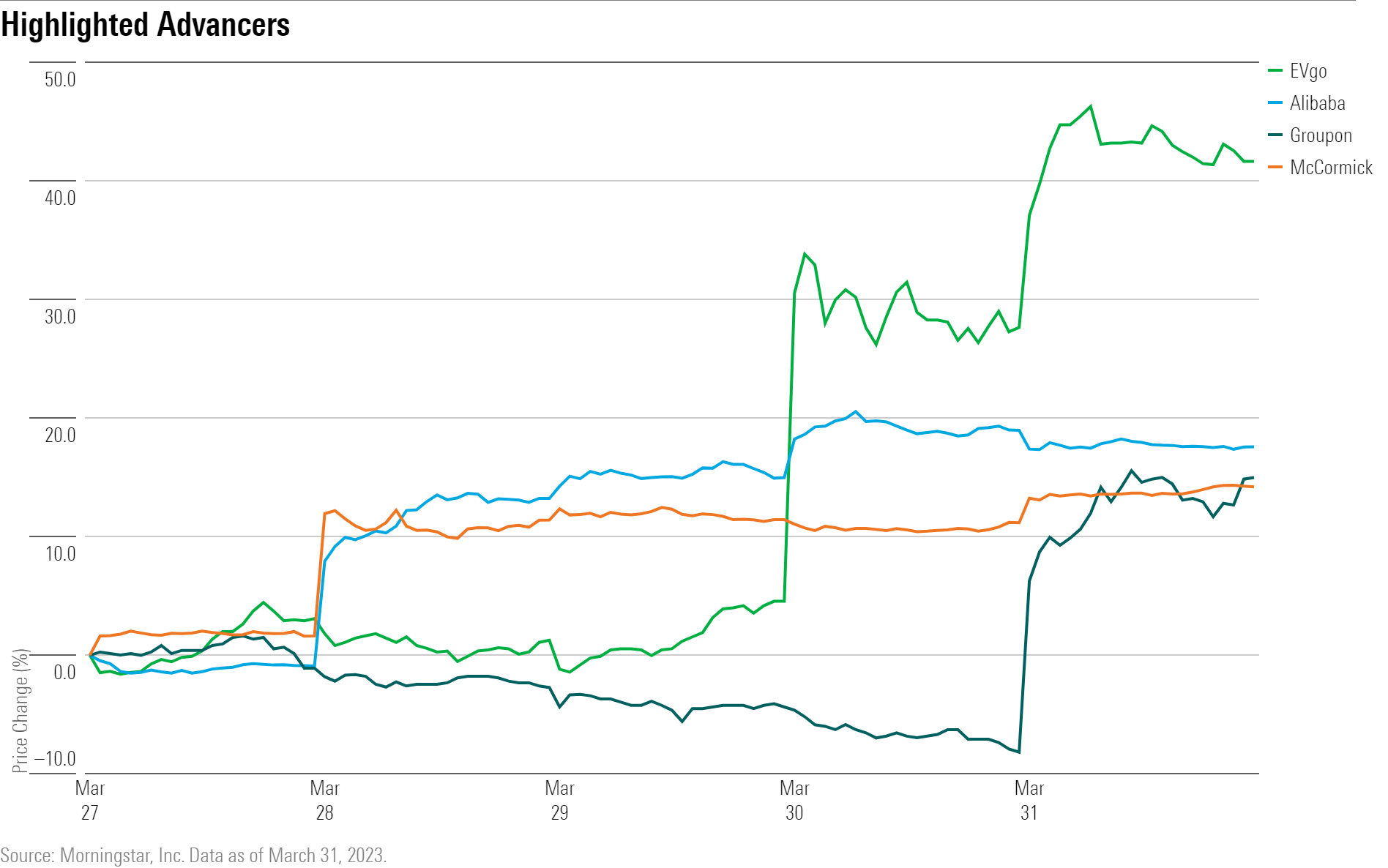

Electric vehicle charging network operator EVgo EVGO saw its shares surge after reporting fourth-quarter 2022 results that beat expectations. The firm reported a loss per share of $0.06, beating FactSet consensus estimates of a $0.16 loss per share. Revenue came in higher at $27.2 million, versus estimates of $19.9 million.

Morningstar analyst Brett Castelli sees the higher revenue being driven by EVgo’s partnership with General Motors GM and Pilot Flying J, which operates various truck stops, to expand EVgo’s network of fast charging stations.

Chinese e-commerce giant Alibaba BABA saw its ADR shares surge as the firm unveiled plans to split itself into six companies. “We expect this restructuring to enhance the operating efficiency and margins of Alibaba Group’s business units,” says Morningstar senior equity analyst Chelsey Tam.

McCormick & Company MKC shares rose after the packaged goods company reported better-than expected first-quarter 2023 results. Earnings clocked in at $0.59 per share versus estimates of $0.50 while revenue met expectations at $1.57 billion. “We’ve opined that the rash of challenges plaguing McCormick would prove transitory … and first-quarter marks give credence to our sentiment,” says Erin Lash, director of equity research, consumer. The firm also showed organic sales growth of 6%.

Groupon GRPN stock rallied after news that Pale Fire Capital CEO Dusan Senkypl would be replacing Kedar Deshpande as interim Groupon CEO to be effective immediately. “The move may create a bit more urgency in turning the company around; it could also indicate that the firm is seeking a buyer,” says Morningstar equity analyst Ali Mogharabi.

“Pale Fire has a private equity side, so this move could also be in preparation to sell Groupon’s stake in SumUp, which is valued at around $6 per share, much higher than Groupon’s current stock price, and then take the firm private,” he says.

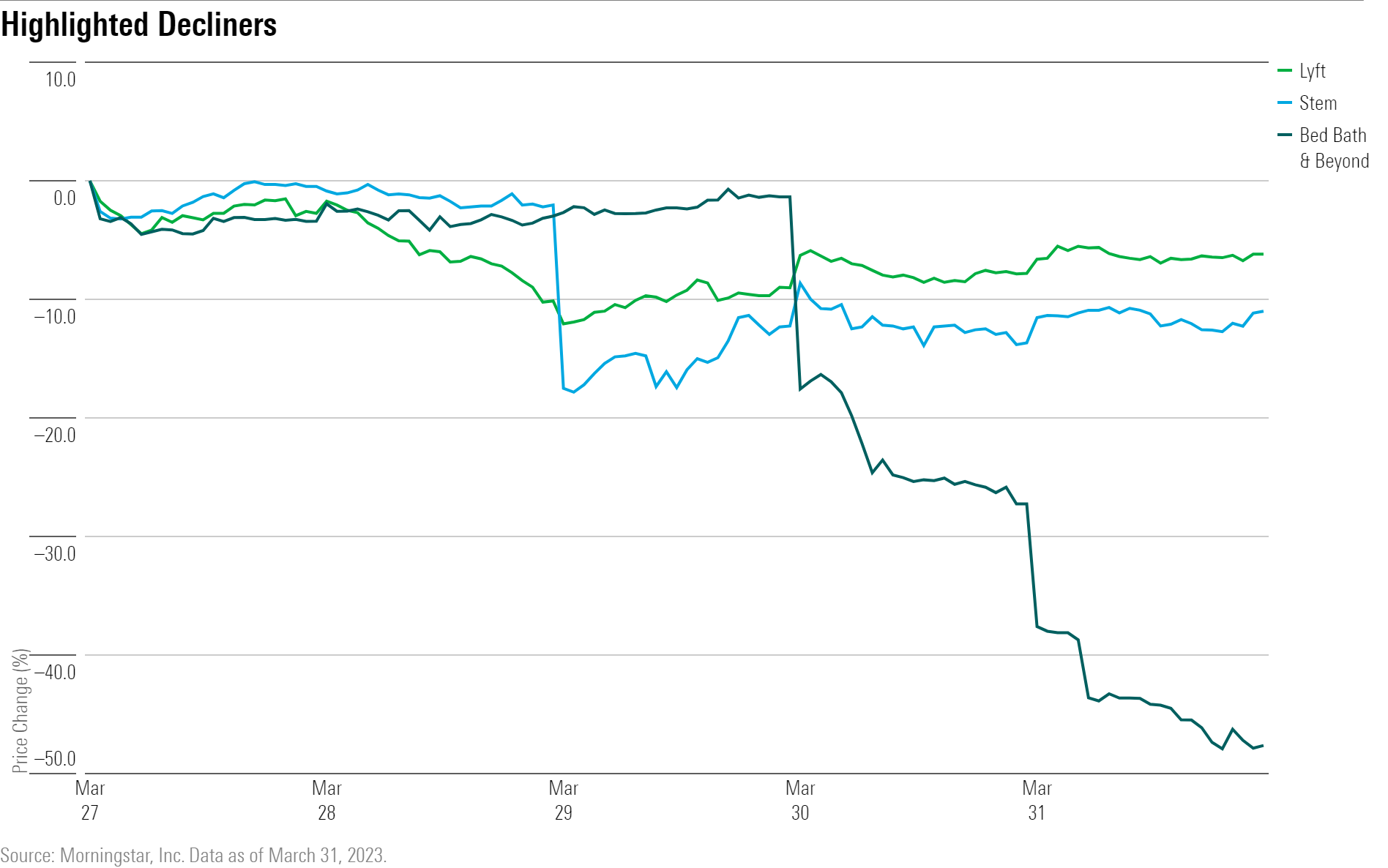

What Stocks Are Down?

Bed Bath & Beyond BBBY stock sank to new lows, with shares now closing the week at $0.43 after the firm said it expects sales to decline to $1.2 billion in its fourth-quarter results from $2.05 billion a year ago. The company also announced an equity offering program, where it would sell up to $300 million in new stock at market prices to raise liquidity.

Morningstar senior equity analyst Jaime M. Katz still expects the firm to eventually declare bankruptcy, “Even if Bed Bath can miraculously remain a going concern, we don’t think there’s an opportunity for shareholders to find return in the stock … our existing outlook fails to see feasible profits until 2026—and that’s only if it can figure out a way to avoid running out of cash in the next few months.” she says.

Shares of Stem STEM, an energy storage system provider, declined after the firm announced a $200 million convertible debt offering, raising concerns of share dilution.

Ride-hailing servicer Lyft LYFT saw its stock fall on news that the company’s founders would be leaving their executive management positions. Current CEO and co-founder Logan Green will become chair of the company’s board and will be replaced by David Risher on April 17. Co-founder John Zimmer will leave his position as the company’s president on June 30 but will remain vice chairman of the board.

The changes “could signal that the firm may be considering investing more aggressively in its Lyft delivery business, which is likely to benefit from Risher’s extensive experience at Amazon’s U.S. retail. Another possibility could be that the firm may begin seeking buyers, which without the founders at the helm may be preferred by some potential bidders,” says Morningstar’s Mogharabi.

Correction: An earlier version of this article incorrectly reported that the Morningstar US Market Index rose 6.9% in the first quarter.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)