How a Top T. Rowe Manager Keeps Beating the Markets

David Giroux’s contrarian approach has kept investors ahead of both the stock and bond market.

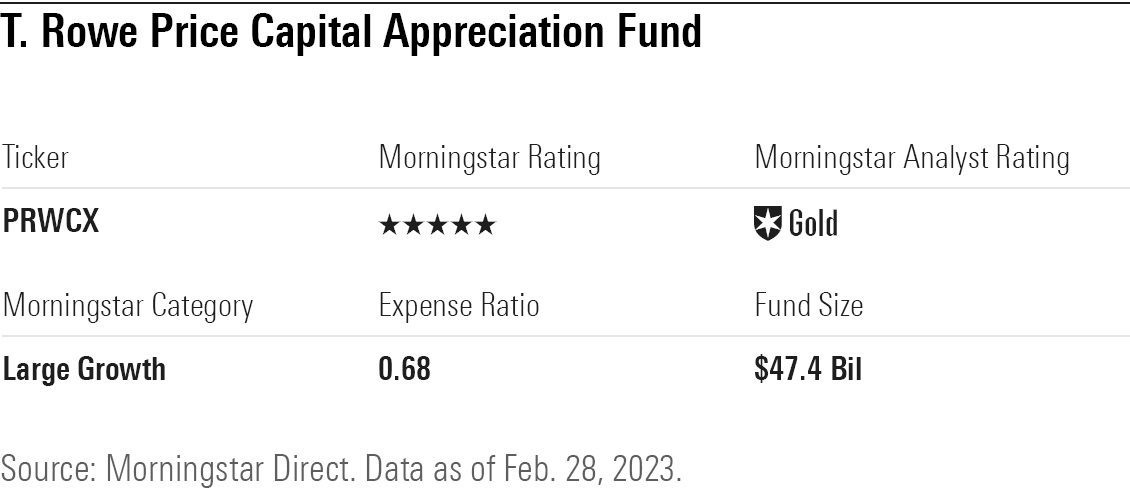

David Giroux, manager of T. Rowe Price Capital Appreciation PRWCX, has built a track record of rewarding shareholders by zigging when everybody else zags.

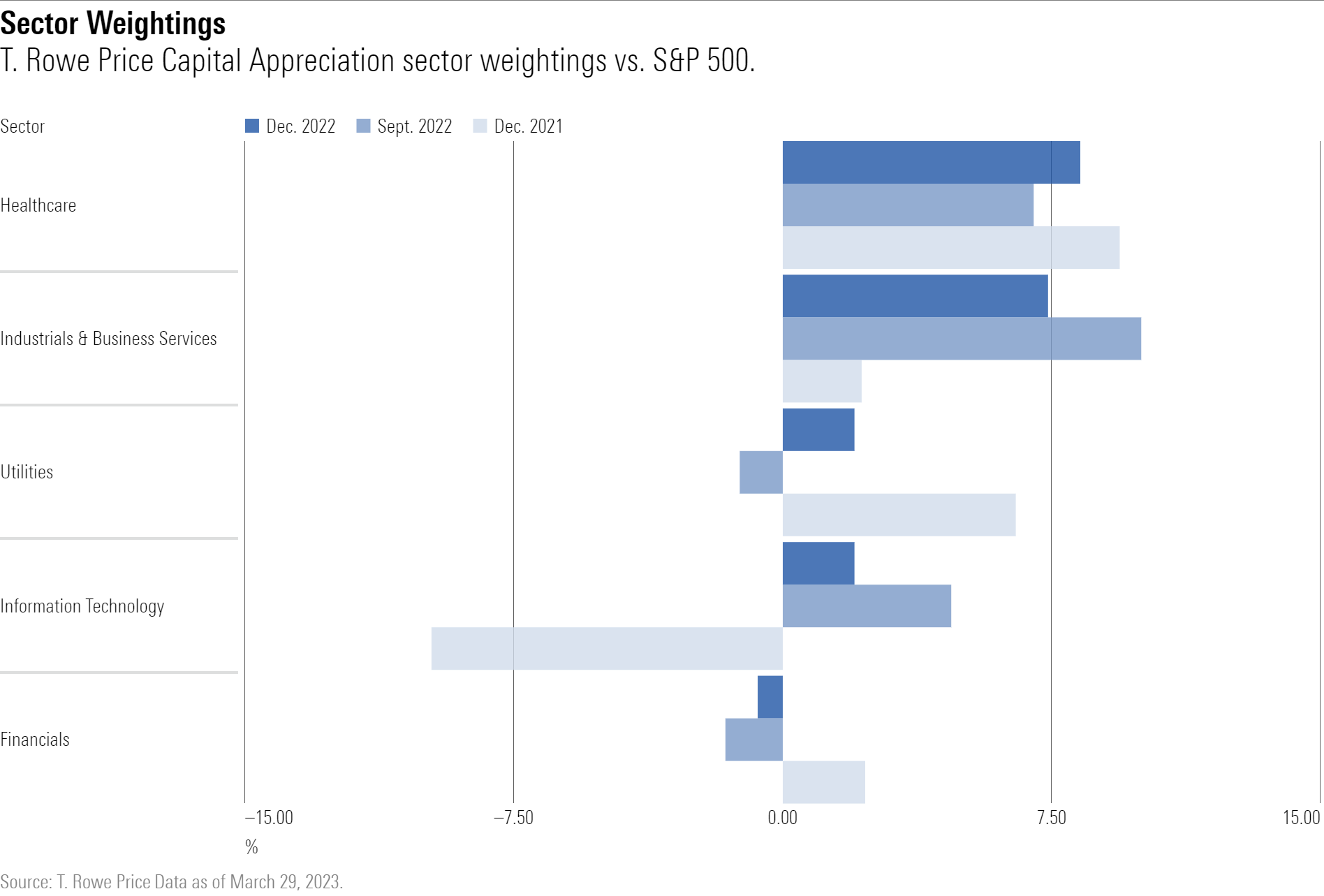

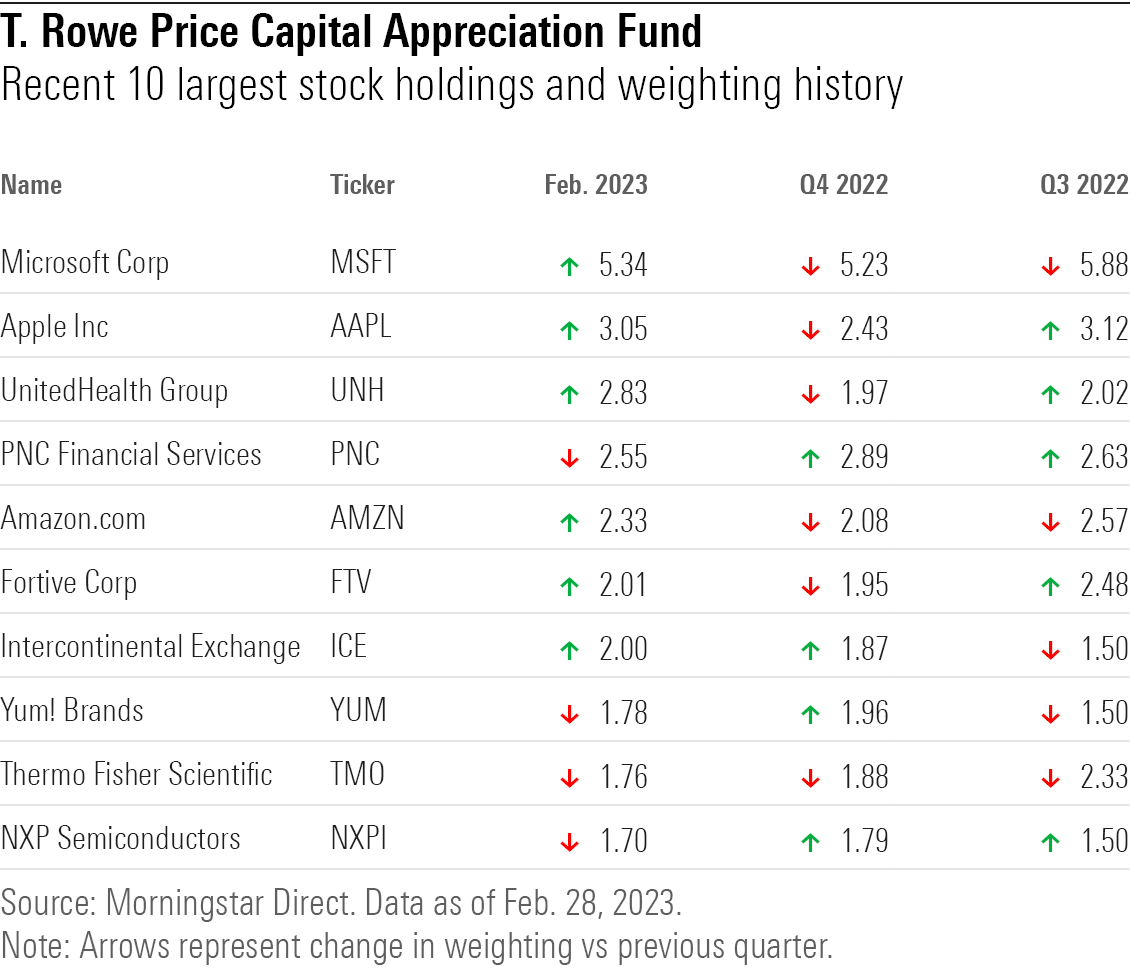

Take how Giroux has navigated the market over the past several quarters. In the second half of 2022, he was buying technology stocks such as Microsoft MSFT and Amazon.com AMZN while other investors were bailing. Energy stocks were riding high, but T. Rowe Price Capital Appreciation had a lower weighting in the red-hot sector. When utilities stocks were lagging this year, Giroux went overweight. In the bond market, when U.S. Treasury yields were north of 4% and many investors were convinced the bond bear market would continue, T. Rowe Price Capital Appreciation was buying.

For investors in the $47.4 billion fund, which holds a blend of stocks and bonds, these were the right moves to make. So far in 2023, the fund is up 4%, ahead of 91% of funds in its Morningstar peer group.

“We try to be one step ahead of the market,” says Giroux. “We were buying things the market didn’t like.”

This is no flash in the pan. T. Rowe Price Capital Appreciation is the top-performing fund in its category for the past one, three, five, 10, and 15 years.

Despite holding a mix of equities and fixed-income investments, the fund’s 9.3% annualized gain from July 2006 (when Giroux started managing it) through February 2023 matches the return on the all-stock S&P 500 index but with less volatility.

During 2022, for example, T. Rowe Price Capital Appreciation lost 11.9%. While a meaningful decline, it compared with a 19% decline in the stock market and a roughly 13% loss in bonds, as measured by the Morningstar US Core Bond Index.

Meanwhile, Giroux has been nominated six times for Morningstar’s Outstanding Portfolio Manager award—including this year—and has won twice.

Giroux “has been able to find pockets of value in areas where other asset allocators aren’t venturing,” says Morningstar analyst Adam Millson. “That’s coupled with his ability and willingness to move swiftly in such scenarios to capture the opportunity.”

Buying Into the Bear Market

T. Rowe Price Capital Appreciation generally holds 40 to 60 stocks with a target equity allocation of just over 60%, with the rest in bonds and cash. However, Giroux will raise and lower his holdings of stocks, bonds, and cash based on where he finds opportunities. (The fund lands in the allocation—50% to 70% equity Morningstar Category.)

“Given the highly flexible approach, that exposure—and the traditional stock/bond split—can swing meaningfully during periods where he identifies enticing opportunities,” says Morningstar’s Millson.

In late 2019, for example, the fund’s stock exposure—which Giroux calculates after adjusting for covered calls, convertibles, and other derivatives—was south of 55%. But in late June 2022, equity exposure topped out at 68%. Then, when stocks rallied more than 9% in July of last year, Giroux pared back on his overweight stance in the equity market, which went on to set a new bear-market low.

On the surface, being a contrarian investor seems simple: Buy whatever is out of favor. The trick for any contrarian strategy, though, is to avoid so-called “value traps,” where stocks are cheap for a very good reason such as bad management or failing products.

Giroux “favors misunderstood companies that are facing controversy but sticks to those with strong forward-looking fundamentals and skilled management teams,” says Millson.

Avoiding the Bad Banks

When it comes to stocks, Giroux solves for the value-trap problem in large part with an investment strategy built around looking for companies that excel at capital deployment. “Companies that are really good with capital allocation can improve the quality of their portfolio, reduce the cyclicality, and increase their growth rate,” says Giroux. “If you find companies that are deploying capital wisely … your valuations should expand over time.”

The focus on capital allocation is one reason Giroux has held PNC Financial Services Group PNC as a top-10 holding but also avoided the collapse of regional bank stocks this year.

In general, Giroux says he avoids financials where he often sees poor deployment of capital in mergers and acquisitions. But PNC, he says, has been a different story.

He points to a history of deals that he says have helped the bank grow smartly. That history goes back to 2008, when PNC roughly doubled in size through its acquisition of National City. PNC bought the rival regional bank at a rock-bottom price during the financial crisis after the Cleveland company spiraled into collapse as a result of the subprime-mortgage crisis.

Another smart deal, Giroux says, came in 2020 when PNC cashed out of its stake in BlackRock, which it had bought in 1995 for $240 million and exited when its worth was some $17 billion. From there, Giroux notes, PNC used the proceeds to acquire the U.S. operations of BBVA at a discounted price and expanded its footprint by another 25%.

“When you look at a stock like PNC, they have the best management, the best balance sheet, the best execution,” says Giroux.

He contrasts that to the situation at First Republic Bank FRC and other regional banks that have come under significant pressures as depositors have fled in the wake of Silicon Valley Bank’s collapse.

“We didn’t know that First Republic Bank (stock) was going to blow up,” says Giroux. However, keeping First Republic Bank out of the fund “was not a hard decision,” he says.

Giroux said there were plenty of warning signs for investors to see. The stock had “more earnings volatility, more interest-rate sensitivity, and a worse balance sheet,” he says. On top of that, First Republic Bank “had a very high valuation.”

While the high valuation may have come with the stock’s “growth bank” reputation, “if you did the due diligence, you would have known that there was a lot of things to find wrong with that.”

Utilities are a sector that Giroux has often favored. “Utilities get no love sometimes, but the high-quality utilities we own are growing earnings at 7% a year now with a 2.5%-3% dividend yield,” he says. “I would argue that, over a full market cycle, to be able to generate a 10% (return) with half the market volatility is really, really attractive.”

Still Giroux will apply a tactical approach to his utilities weights as well. “Everybody hated utilities early this year,” he says. That was a cue for Giroux to overweight the sector—in time for it to outperform in March.

Swimming Against the Tide in Stocks

In late 2021, Giroux was also swimming against the tide as technology stocks led the market higher. At that time, technology was T. Rowe Price Capital Appreciation’s largest underweight compared with the S&P 500, against which the fund measures its performance. “We thought valuations were excessive,” he says.

In fact, the fund was generally underweight equities compared with its benchmark. “The market was expensive,” he says. Giroux also felt the bond market was in a perilous position, with interest rates at too low levels.

Against this backdrop, the fund’s biggest stock weightings were in defensive—and, at the time, out of favor—sectors: healthcare and utilities. As stocks fell into a bear market, these positions helped the fund remain more buoyant than the overall market.

Meanwhile, Giroux loaded up the fund on leveraged loans, which are short-term debt securities that generally have little sensitivity to changes in interest rates. By September 2022, the fund held 15.3% in leveraged loans.

This was a prescient call; in a year when the broad bond market was down roughly 13%, the Morningstar LSTA US Leveraged Loan Index posted a 0.77% loss.

“As a general rule, when I think about leverage loans and when I think about high-quality, high-yield bonds, the riskiest returns of those asset classes are typically far superior to that of equities,” says Giroux.

“You have to balance all of our objectives, but theoretically, the high risk-adjusted returns in the market are typically found in bank debt and high yield where even today where you are earning, let’s say, 6.5%, 7%, or 8% kind of yields for something like 20% of the market’s risk,” says Giroux. “So, if you are getting 80% of the market’s return but 20% of the market’s risk, that’s a really good risk-adjusted return.”

Giroux’s contrarian streak also applies to the bond portion of the portfolio. As the U.S. bond market was in the midst of selling off in 2022, Giroux aggressively bought U.S. Treasuries, just the fourth time he has done so on the fund. Initially, Giroux moved the fund into five-year Treasuries. But as rates moved higher and the yield on the U.S. Treasury 10-year note broke above 4%, he picked up the longer-term bonds.

“People said Treasury yields were going to the moon,” says Giroux. But since then, yields have fallen dramatically, taking bond prices higher.

Added together, the fund has continued its long stretch of outperformance into 2023. “A lot of things have gone in our favor, but it wasn’t by accident,” says Giroux.

Correction: A previous version of this article incorrectly reported that the PNC Financial bought its BlackRock stake for $240 billion.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)