6 Undervalued Consumer Defensive Stocks

These wide-moat consumer defensive stocks are trading at discounted prices.

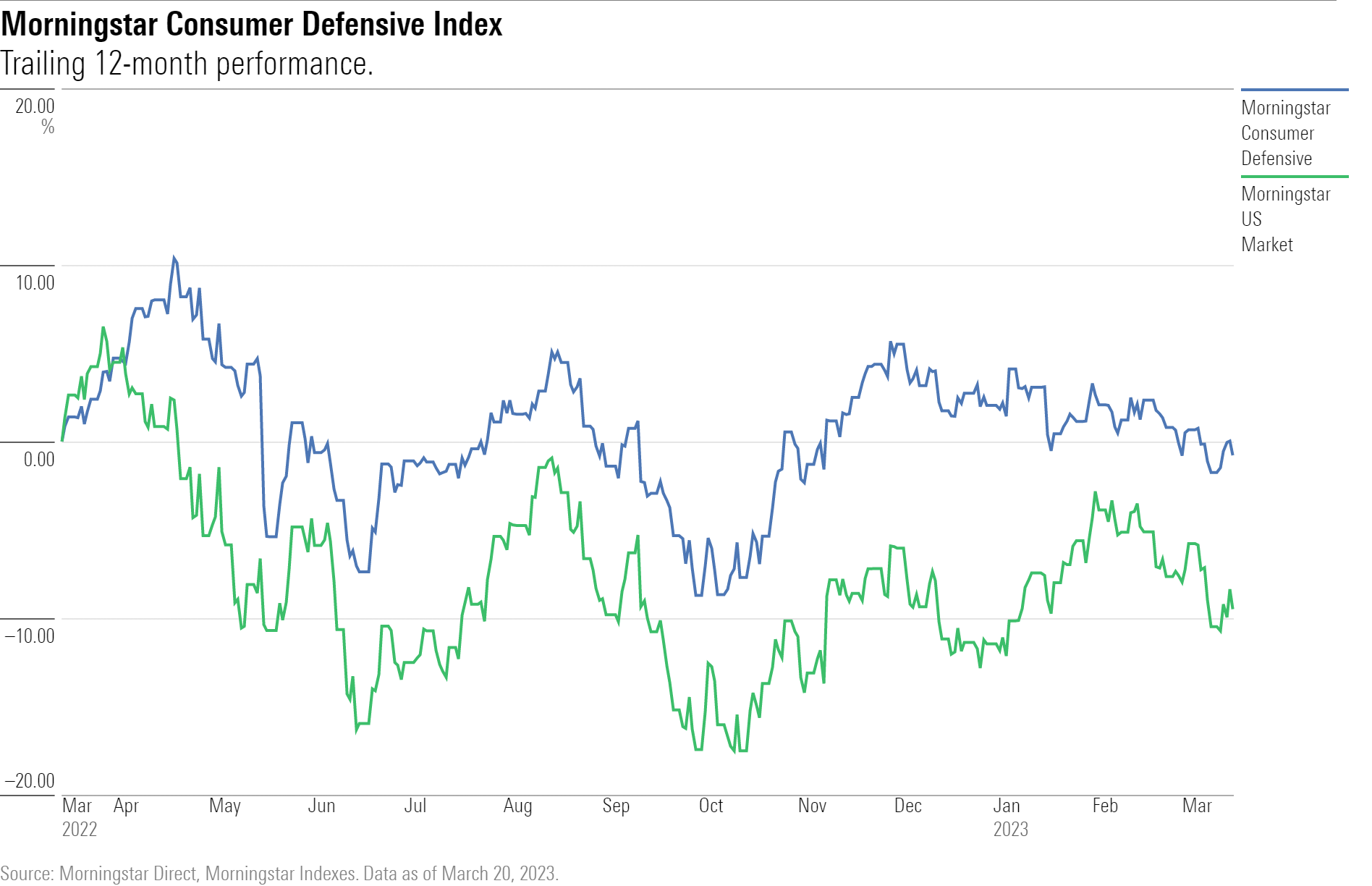

Over the course of the current bear market for equities, consumer defensive stocks have lived up to their reputation as a relative safe haven for investors.

However, despite their more-buoyant performance compared with many other corners of the market, there remain names that are trading at discounted prices according to Morningstar analysts. That includes companies such as Constellation Brands STZ and Kellogg K.

To look for undervalued consumer defensive stocks, we turned to the Morningstar US Consumer Defensive Index, which measures the performance of companies engaged in the manufacturing of consumer items.

As of March 20, 2023, the index lost 0.8% for the trailing 12-month period, while the broader market fell 9.5%, as measured by the Morningstar US Market Index.

There are a total of 82 stocks in the Consumer Defensive Index, 39 of which are covered by Morningstar equity analysts. Of those, 14 are undervalued as of March 20, 2023.

What is a Consumer Defensive Stock?

Defensive stocks are generally resistant to economic cycles because their products are necessary in good times or bad. Consumer defensive companies are engaged in the manufacturing of food, beverages, household/personal products, packaging, or tobacco. Procter & Gamble PG, PepsiCo PEP, and Costco Wholesale COST are among the largest companies in the consumer defensive index.

Consumer Defensive Stocks to Buy Now

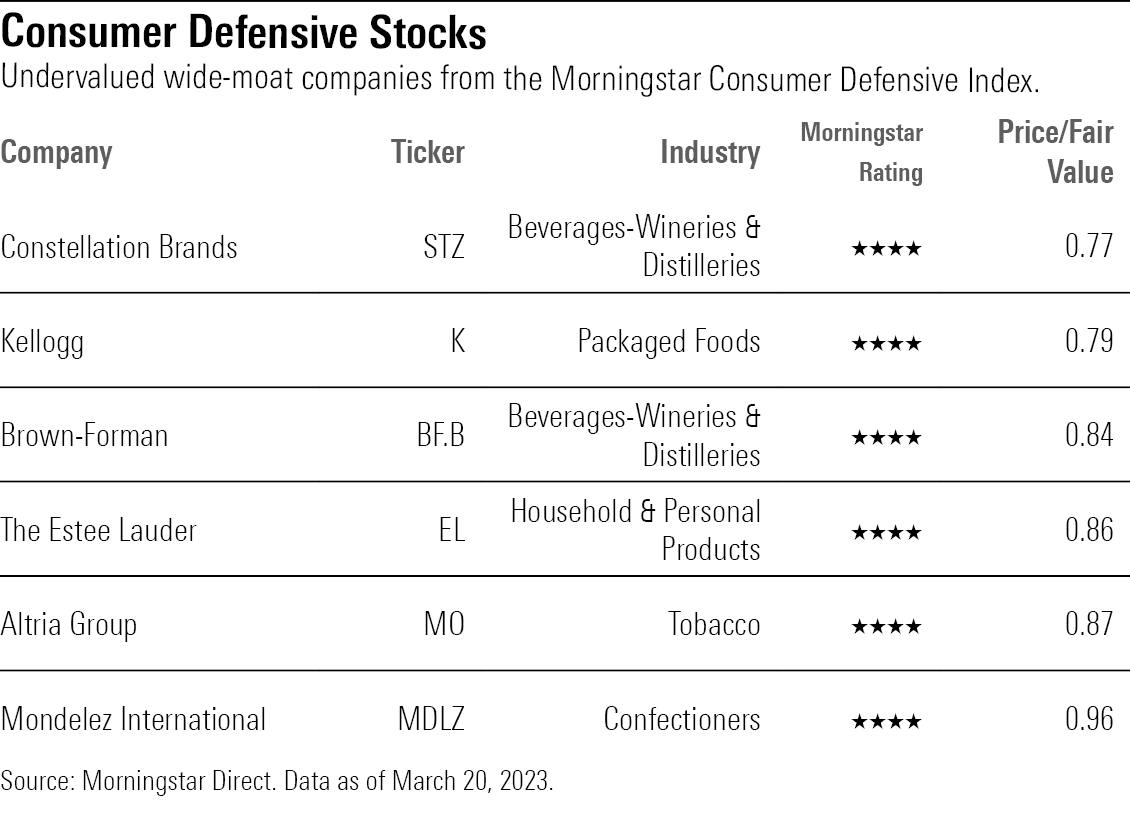

We looked for the most undervalued stocks in the Morningstar Consumer Defensive Index that currently carry a Morningstar Rating of 4 or 5 stars. Then we screened for stocks that have earned a Morningstar Economic Moat Rating of wide in order to screen for companies with durable competitive advantages. Historically, undervalued stocks with economic moats have performed better over time than less-profitable and more highly indebted counterparts. They also tend to protect against downturns and be less risky than lower-quality stocks.

These are the six most undervalued stocks in the Morningstar Consumer Defensive Index as of March 20:

- Constellation Brands

- Kellogg

- Brown-Forman BF.B

- The Estee Lauder Companies EL

- Altria Group MO

- Mondelez International MDLZ

The most undervalued consumer defensive stock is Constellation Brands, trading at a 23% discount to the fair value estimate set by Morningstar analysts. The least undervalued on the list is Mondelez International, trading at a 4% discount.

Constellation Brands

- Industry: Beverages-Wineries & Distilleries

- Stock Price: $210.90

- Morningstar Fair Value Estimate: $274

“While Constellation Brands historically made its bones as a winery and distillery, we now view the firm as one of the most stellar brewers across our global coverage. After parlaying AB InBev’s BUD antitrust quandary (allowing it to acquire Mexican brewer Grupo Modelo) into exclusive U.S. ownership rights to brands like Corona and Modelo, we see the firm’s overall Mexican beer portfolio as auspiciously situated at the confluence of unwavering secular and demographic trends. With an enviable growth profile and best-of-breed margins, we have confidence that the beer business can thrive even amid an evolving industry landscape.

“The increase in political, social, and cultural clout of the Hispanic population in the U.S. is widely expected to continue, which augurs well for Constellation’s intangible assets. The firm is not resting on its laurels, however, as it continues to expand its addressable market by widening the gamut of categories in which it competes. One of the primary avenues through which it is seeking to do this is innovation, with line extensions like Corona Refresca and Fresca Mixed being quintessential illustrations. Management seeks 25% of its growth to be driven by innovation, a mark we think is achievable given the broad resonance of its trademarks. Another avenue is through acquisition, currently embodied by its controlling stake in Canopy Growth CGC. Even as the outlook for cannabis in the U.S. remains uncertain, we remain sanguine on the optionality that this investment affords.”

—Jaime M. Katz, senior equity analyst

Kellogg

- Industry: Packaged Foods

- Stock Price: $64.74

- Morningstar Fair Value Estimate: $82

“Although near-term uncertainty persists, we think the firm’s robust exposure to these regions (far outpacing the negligible contribution its domestic packaged-food peers derive) will prove advantageous over a longer horizon. In addition, we surmise organic and inorganic pursuits to tailor its mix to local trends, bolster the affordability of its fare, and expand its routes to market should aid its growth prospects. When combined with our expectations for favorable demographic and income trends for those regions longer term, we forecast mid-single-digit annual sales growth to emanate from these faster-growing regions on average over the next decade, versus the low-single-digit growth we expect from its developed market regions in aggregate.”

“We think its position as a leading packaged food manufacturer and its arsenal of resources have afforded Kellogg the ability to maintain valuable shelf space for its offerings, even in the cereal aisle, where category dynamics have languished from the onslaught of competition resulting from lower-priced private-label fare, other branded operators, and the encroachment of smaller foes from within the category and other breakfast alternatives. We see little to suggest this competition will subside, but we think the strength of Kellogg’s relationships with its retail partners should ultimately ensure its edge persists longer term.”

—Erin Lash, senior director

Brown-Forman

- Industry: Beverages—Wineries & Distilleries

- Stock Price: $61.66

- Morningstar Fair Value Estimate: $73

“Brown-Forman has established itself as a stalwart in matured spirits, an enclave of the distillation industry that we view as particularly attractive. In addition to brand recognition and distribution, companies in this industry benefit from scarcity value, the result of the consumer perception surrounding the aging of this type of alcohol, and the pricing power that this begets. Against this industry backdrop, we believe Brown-Forman’s portfolio, anchored by the Jack Daniel’s brand, boasts some of the highest cachet globally.”

“Brown-Forman is also benefiting from growth abroad, buoyed by the broader resurgence in global demand for bourbon. We expect developed markets like the United Kingdom as well as developing economies like Mexico to be increasingly pertinent to its overall trajectory.

“Still, the company’s path will not be completely unencumbered. Tariff relief remains a near-term tailwind, but dollar strength figures to slow demand for (proportionately) more expensive U.S. exports. Go-to-market changes also add a degree of execution risk. Despite a successful transition to owned distribution in the U.K., where it previously partnered with Bacardi, future transitions (such as in Taiwan) may not yield similar results. Additionally, while COVID-19 accelerated secular trends in developed markets, developing markets face a more precarious outlook, particularly amid a backdrop of swelling inflation in nondiscretionary spending categories. Nevertheless, we expect that Brown-Forman’s embedded advantages and experienced management team will help the company navigate these risks.”

—Sean Dunlop, equity analyst

The Estee Lauder Companies

- Industry: Household & Personal Products

- Stock Price: $234.56

- Morningstar Fair Value Estimate: $273

“Although the pandemic is presenting challenges for Estee and its peers, we remain optimistic about its competitive position and long-term strategy. Estee has made significant investments in omnichannel, marketing, and innovations that are helping the firm recover briskly from the pandemic and the subsequent inflation and supply chain disruptions.”

“In addition to the firm’s dominance in global prestige beauty, Estee also adds value to its retail partners by periodically launching new products exclusively with a specific retailer, in order to drive excitement and traffic for the retailer and the brand.

“We believe that Estee’s cost advantages also help to solidify its competitive edge. Given the firm’s position as the dominant player in prestige beauty, we think it is afforded scale-based advantages related to procurement, manufacturing, and logistics.”

—David Swartz, senior equity analyst

Altria Group

- Industry: Tobacco

- Stock Price: $45.32

- Morningstar Fair Value Estimate: $52

“Altria is the leading tobacco manufacturer in the United States. In fact, with Philip Morris International PM owning the international rights to Marlboro, the U.S. is currently Altria’s only market, resulting in more-concentrated regulatory risk than for the other major tobacco players, which are multinational. We think it is logical, in the face of that risk, that Altria is pursuing a multiprong approach to cigarette substitutes, even though we harbor doubts about the long-term profitability of some of the emerging categories.”

“Investors in tobacco companies, particularly those holding shares in a single-market pure play like Altria, should have the stomach for fat-tail risk. The shifting sands of regulation have created some new risks to Altria’s business model in recent years, and our Morningstar Uncertainty Rating is Medium.

“Litigation risk still remains, but adverse judgments have been manageable recently. While it is almost impossible to forecast the magnitude of any awards against the tobacco industry, we expect payouts to be within Altria’s annual free cash flow.”

—Philip Gorham, director

Mondelez International

- Industry: Confectioners

- Stock Price: $66.40

- Morningstar Fair Value Estimate: $69

“Since taking the helm at Mondelez more than five years ago, CEO Dirk Van de Put has orchestrated a plan to drive balanced sales and profit growth by extending the distribution of its fare, fueling investments behind its local and global brands, empowering its local leaders, and increasing its innovation agility (aims that are hitting the mark). Against this backdrop, Mondelez targets 3%-5% sales growth long term as it works to sell its wares in more channels and reinvests in new products aligned with consumer trends at home and abroad. Further, it has looked to acquire niche brands to build out its category and geographic exposure, which we think has been prudent.”

“Raw material costs of cocoa, sugar, dairy, and grains can fluctuate and may eat into Mondelez’s profits from time to time. This is particularly poignant now given concerns around the health of global consumers, who are facing heightened prices at the shelf and increasing interest rates. While these forces could prompt consumers to rein in their spending (and ultimately trade down or out of the categories in which Mondelez plays), this has yet to manifest meaningfully in the biscuit and confectionery aisles. We believe that regardless of the economic climate, continued brand investments should blunt any lasting demise in volumes and market share. We aren’t of the opinion, though, that merely directing more resources toward its brands will insulate its competitive position. Rather, we think the firm will need to remain focused on ensuring these investments are utilized to align its fare with consumers’ changing palates and to ensure consumers are aware of this differentiation.”

—Erin Lash, senior director

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)