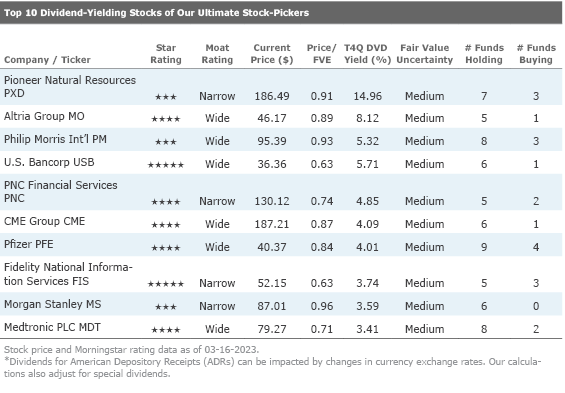

Our Ultimate Stock-Pickers’ Top 10 Dividend-Yielding Stocks

A majority of the top 10 dividend-yielding names are undervalued.

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to find the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in our Ultimate Stock-Pickers’ portfolios and then narrow it down by concentrating on firms that we believe have maintainable competitive advantages that should allow them to generate the excess returns necessary to continue their dividends over the longer term. We also look for firms with lower uncertainty on our analysts’ part regarding future cash flows. We accomplish this by screening for widely held holdings (by five or more of our top managers) that are yielding more than the S&P 500, have wide or narrow economic moats, and have uncertainty ratings of either low or medium.

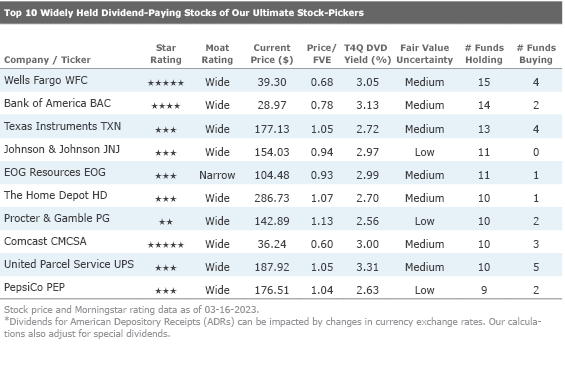

Once our filtering process is complete, we create two different tables—one that reflects the top 10 stocks with the highest dividend yields and another that lists stocks that are widely held by our Ultimate Stock-Pickers and pay dividends in excess of the S&P 500, which is currently yielding 1.74% as of March 2023. We note that the dividend yield calculations in each of our two tables are based on regular dividends that have been declared during the past 12 months, with the exception of Pioneer Natural Resources PXD, which paid special dividends in the period.

Looking back to our list of top 10 dividend-yielding stocks from last time around, we note that the new list is mainly composed of names that were not present on the list that we published in September 2022, aside from Altria Group MO. New names include Pioneer Natural Resources, Philip Morris International PM, U.S. Bancorp USB, PNC Financial Services Group PNC, CME Group CME, Pfizer PFE, Fidelity National Information Services FIS, Morgan Stanley MS, and Medtronic MDT.

Looking forward, we stress that we are in unprecedented times amid the banking crisis, and near-term, forward-looking results may be skewed as the financial sector and government act to remedy the current situation.

In the last edition of the Ultimate Stock-Pickers article discussing dividend yielding stocks, we noted the volatility in the market was likely pushing fund managers toward noncyclical sectors, such as healthcare and consumer defensive. In the most recent quarter, we saw a similar trend brought on by persistent volatility. Our list of the top 10 widely held dividend-paying stocks contained five names from the financial or finance-related sector, two from consumer defensive, two from healthcare, and one from energy. We note that the energy stock, Pioneer Natural Resources, paid hefty dividends to its shareholders as profits soared over the last year, with its most recent quarterly payout implying an 11% yield. As profitability in the energy sector changes, this dividend is also likely to change.

Searching for yield in this type of environment can be risky. Price risk remains elevated as does the risk that companies may not be able to maintain current dividends due to economic strain. The average price to fair value estimate for the top dividend-yielding stocks was 0.8, indicating that we view these high-yielding stocks as currently undervalued.

For the top 10 widely held dividend-paying stocks, the sector mix was more varied and contained two consumer defensive names, two from finance, and one name each from communication services, consumer cyclical, energy, healthcare, industrials, and technology.

Looking more closely at the two lists, none of the names appeared on both lists, which is unique to what we see in most quarters. Aside from the banks (Wells Fargo WFC and Bank of America BAC) and Comcast CMCSA, this period’s list of widely held dividend-paying stocks was less undervalued than the top dividend-paying stocks. In fact, five out of the 10 stocks were trading at a premium to their fair value.

We continue to believe that the best way for investors to protect their capital is to invest in quality businesses that are trading at attractive prices. Our valuation shows that wide-moat-rated Comcast is trading at a significant discount to fair value, so we will focus on it in this piece. We also highlight wide-moat Pfizer and wide-moat Medtronic in this edition of Ultimate Stock-Pickers.

Comcast CMCSA

In Morningstar analyst Michael Hodel’s view, Comcast’s core cable business enjoys significant competitive advantages but will likely see growth slow as competition for incremental customers heats up. NBCUniversal isn’t as well positioned but holds unique assets, including core content franchises and theme parks, that should help ease the transition away from the traditional television business. Overall, Hodel expects Comcast will deliver modest growth with strong cash flow for the foreseeable future.

Comcast’s cable business has steadily gained broadband market share over its primary competitors, phone companies like AT&T and Verizon, as high-quality internet access has become a staple utility. Hodel estimates the firm has increased broadband market share in the areas it serves to about 67% from 50% a decade prior, meaning Comcast’s customer base in the typical market area is twice the size of its rivals’. That gap is far larger in areas where the phone companies haven’t invested in recent years. With a network than can be upgraded at modest incremental cost, Hodel expects that Comcast will remain the dominant broadband provider in many parts of the country and compete well in areas where the phone companies are building fiber. The high margins on internet access should offset the decline in the traditional television business, where margins have plunged in recent years.

Comcast has managed NBCU well, more than doubling cash flow since the 2011 acquisition of the business through 2019, prior to the pandemic. However, the TV business is rapidly evolving, which presents challenges for NBCU as traditional cable revenue declines and the firm works to attract customers directly via the Peacock service. That effort has developed slowly, creating uncertainty around the long-term prospects for the business. However, Hodel likes that the firm is aggressively expanding its parks business, creating experiences that leverage and support key content franchises.

Pfizer PFE

Morningstar analyst Damien Conover takes the view that Pfizer’s foundation is solid, based on strong cash flows generated from a basket of diverse drugs. Conover believes the company’s large size confers significant competitive advantages in developing new drugs. This unmatched heft, combined with a broad portfolio of patent-protected drugs, has helped Pfizer build a wide economic moat around its business.

Pfizer’s size establishes one of the largest economies of scale in the pharmaceutical industry. In a business where drug development needs a lot of shots on goal to be successful, Pfizer has the financial resources and the established research power to support the development of more new drugs. Also, after many years of struggling to bring out important new drugs, Pfizer is now launching several potential blockbusters in cancer, heart disease, and immunology.

Pfizer’s vast financial resources support a leading salesforce. Pfizer’s commitment to post-approval studies provides its salespeople with an armamentarium of data for marketing campaigns. Further, Pfizer’s leading salesforces in emerging countries position the company to benefit from the dramatically increasing wealth in nations such as Brazil, Russia, India, China, and Turkey. Pfizer’s recent decision to divest its off-patent division, Upjohn, to create a new company (Viatris) in combination with Mylan should drive accelerating growth at the remaining innovative business at Pfizer. With limited patent losses and fewer older drugs, Pfizer is poised for steady growth (excluding COVID-19 product sales).

Further, Conover believes Pfizer’s operations can withstand the eventual generic competition, and its diverse portfolio of drugs help insulate the company from any one particular patent loss. Following the merger with Wyeth several years ago, Pfizer has a much stronger position in the vaccine industry with pneumococcal vaccine Prevnar. Vaccines tend to be more resistant to generic competition because of the manufacturing complexity and relatively lower prices.

Medtronic MDT

Medtronic’s standing as the largest pure-play medical device maker remains a force to be reckoned with in the med-tech landscape. From Morningstar analyst Debbie Wang’s view, pairing Medtronic’s diversified product portfolio aimed at a wide range of chronic diseases with its expansive selection of products for acute care in hospitals has bolstered Medtronic’s position as a key partner for its hospital customers.

Medtronic has historically focused on innovation, designing and manufacturing devices to address cardiac care, neurological and spinal conditions, and diabetes. All along, the firm has remained focused on its fundamental strategy of innovation. It is often first to market with new products and has invested heavily in internal research and development efforts as well as acquiring emerging technologies. However, in the postreform healthcare world where there are higher hurdles for securing reimbursement for next-generation technology, Medtronic has slightly shifted its strategy to include partnering more closely with its hospital clients by offering greater breadth of products and services to help hospitals operate more efficiently. By partnering more closely and integrating itself into more hospital operations, Medtronic is well positioned to take advantage of more business opportunities in the value-based reimbursement environment. In particular, Medtronic has been pioneering risk-based contracting around some of its cardiac and diabetes products, which we think is attractive to hospital clients and payers alike.

Wang appreciates Medtronic’s diverse portfolio, where certain waning product lines would be offset by growth in other categories. The addition of devices and consumables used in the surgical suite should further stabilize potential speed bumps in individual product lines. The COVID-19 disruption added more near-term turbulence, especially with supply chain issues and delays in nonpandemic patient volume, but Wang remains confident that underlying demand for many of these therapies and Medtronic’s ongoing innovation should prevail over the longer term.

Disclosure: Rue Shetty, Ari Felhandler, and Eric Compton have no ownership interest in any of the securities mentioned here. It should also be noted that Morningstar’s Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)