Does Your Sustainable Fund Always Vote in Favor of ESG? Apparently Not.

Proxy voting decisions will help investors select funds that best reflect their sustainable-investing priorities.

There’s never been a greater focus on proxy voting as a signal of how asset managers are evaluating environmental, social, and governance themes in their overall investment approach. The recent rise in the number of shareholder resolutions on environmental and social themes at U.S. companies has brought this into sharper focus.

Sustainable-fund investors have always wanted to know which companies their funds are invested in. But these days, they’re also looking for data about whether their funds are voting in line with their own expectations of what the companies they invest in should be doing—and avoiding.

Investors might expect sustainable funds to support a strong majority of shareholder resolutions on ESG. Instead, the data shows that’s not always the case. On the whole, the largest U.S. asset managers’ sustainable funds supported these resolutions only around half of the time over the last three years. And these sustainable funds’ voting patterns on ESG resolutions, for the most part, matched those of their firms more broadly.

Sustainable Funds’ Voting Patterns Broadly Similar to the Firms’

Ahead of this year’s proxy season, we reviewed voting decisions of the top 20 asset managers in the United States by fund assets, covering 241 key shareholder resolutions on environmental and social topics over the last three proxy years (that is, years ended June 30). We define key shareholder resolutions as those that gain the support of at least 40% of a company’s independent shareholders.

One key takeaway was that, in 2022, asset managers reduced their level of support for ESG shareholder resolutions amid a steep increase in the volume of such proposals. However, our paper also examines how the largest U.S. asset managers’ sustainable funds voted compared with their portfolios as a whole. Here, there are also some interesting observations to be made.

All leading U.S. fund managers emphasize their focus on materiality and long-term value generation when considering shareholder proposals. But our research shows that they often reach different conclusions on issues addressed by key resolutions. This is because they take different approaches to how they incorporate environmental and social sustainability themes when they invest. These differences in voting decisions between managers occur in both sustainable and conventional funds.

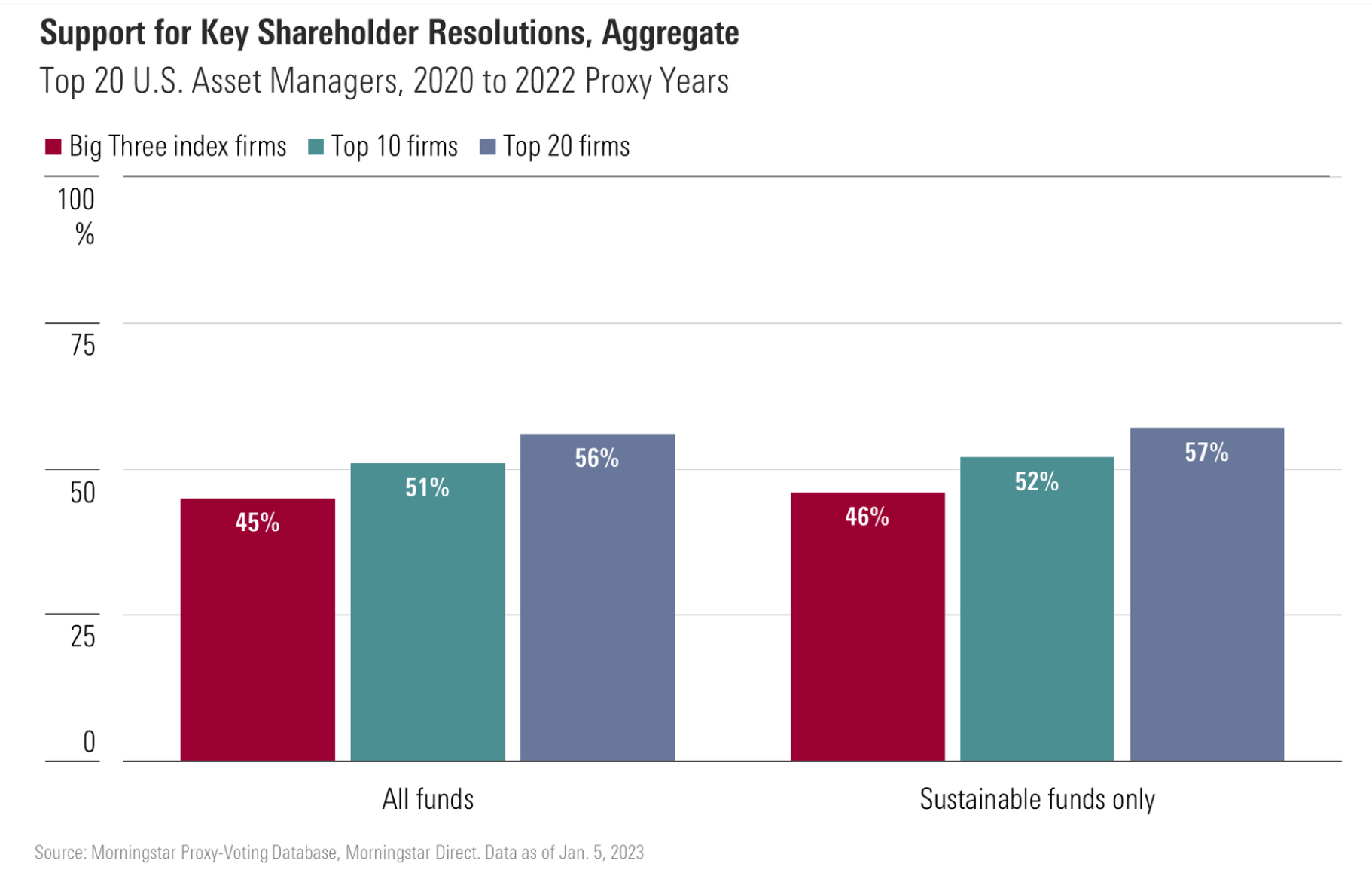

As shown in the chart below, in aggregate, the top 20 managers cast just over half their fund votes in support of key ESG resolutions, a moderate level of support. Furthermore, larger firms showed lower support for these resolutions than the smaller ones among the 20. For example, the Big Three index firms—Vanguard, BlackRock, and State Street—cast 45% of their fund votes on key resolutions in support of them, while the comparable number for the top 20 firms is 56%, indicating much higher support among the smaller firms in the group.

Let’s look only at votes cast by these firms’ sustainable funds, which make up around 5% of the total fund vote population for the 20 firms over the last three years. We see that the sustainable funds’ level of support for key resolutions is broadly similar to those of the firms’ as a whole in each case.

JPMorgan, Invesco: Strong Relative Support for ESG in Sustainable Funds

We also analyzed 13 of the top 20 managers’ sustainable funds voting data, where this data was available in sufficient volume. (Capital Group, Dodge & Cox, Lord Abbett, and MFS are excluded because they have no sustainable funds that voted on the 241 key resolutions. Janus Henderson JHG, Charles Schwab SCHW, and T. Rowe Price TROW are excluded because of a low number of sustainable-fund votes on key resolutions.) These managers’ sustainable funds generally show similar or slightly higher levels of support for key resolutions than their fund ranges as a whole.

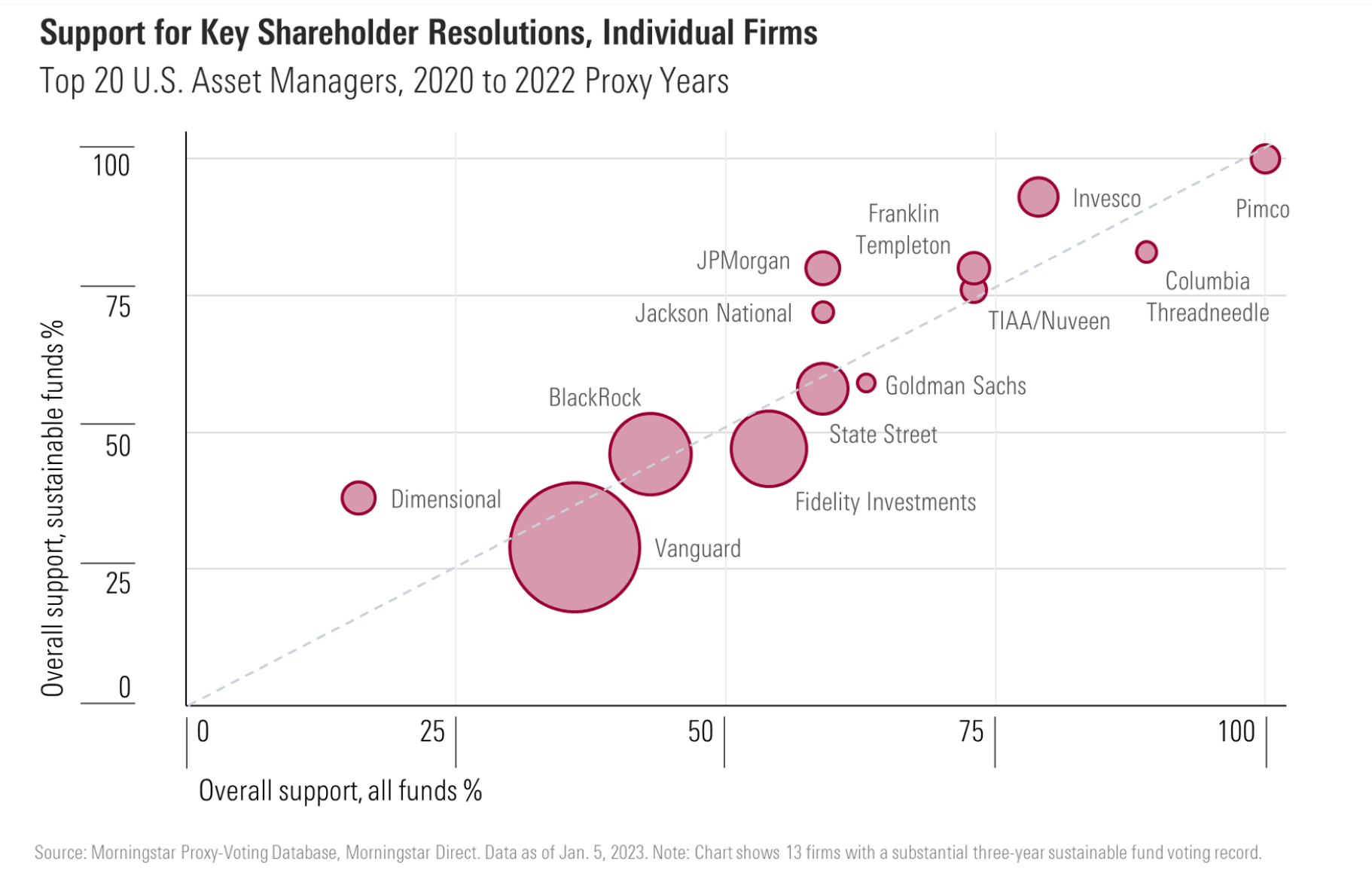

The chart below plots each asset manager’s support for the last three years’ key resolutions in its sustainable-fund range (on the vertical axis) against support for those same resolutions in the entire fund range (on the horizontal axis). The size of each bubble illustrates the relative size of each firm’s fund assets.

The dotted line shows where support for key resolutions’ by sustainable funds is equal to that of the entire fund range. Sustainable funds in firms that appear above the line showed greater support for key ESG resolutions compared with the fund range as a whole; those below the line show a lower level of support.

Invesco’s IVZ and JPMorgan’s JPM sustainable funds both show considerably higher support for key resolutions in the last three proxy years compared with their fund range as a whole. Their support is also high in absolute terms—over 75% in both cases. Dimensional also sits well above the dashed line but with a much lower level of support, both overall and in its sustainable-fund range.

In contrast, Vanguard and Fidelity Investments’ sustainable funds show noticeably lower support for key resolutions compared with their wider fund range. They are the only two firms of the 13 whose support for key resolutions in sustainable funds is less than 0.9 times that of the firm as a whole (indicated by the dotted line in the chart below).

Is It Greenwashing?

Investors often expect that funds labeled as sustainable would show stronger support for shareholder resolutions on environmental and social themes than conventional funds. So, when this is not the case, investors might reasonably ask, “Is this greenwashing?”

The answer is a matter of perspective. Many of the firms—BlackRock BLK being a prominent example—aim to take a consistent line on voting on ESG themes across the entire fund range. The results shown above indicate that this has largely been the case. Managers will see that outcome as a successful implementation of a consistent firmwide voting policy, even if it may leave some sustainability-conscious investors disappointed that a stronger line was not taken on certain issues.

Overall, the key for investors is that expectations of very high support for ESG resolutions by sustainable funds may not always match the reality. Much depends on the firm’s overall philosophy on addressing environmental and social themes—whether the firm views such topics purely through a risk management lens or is seeking to deliver impact.

The firmwide voting policy the manager has chosen to implement is another important factor, as well as the extent to which the firm’s sustainable funds (or their subadvisors) can make bespoke voting decisions to address ESG priorities specific to those funds.

As scrutiny of voting patterns increases—both by investors and regulators—clear information from asset managers on voting policies and actual voting decisions is key. This will help investors select funds that best reflect their sustainable-investing priorities.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)