Regional Bank Turmoil Reveals Risks and Opportunities for Bond-Fund Managers

Morningstar Medalist bond funds have emerged largely unscathed from recent bank collapses.

Rapidly unfolding events in the bond market in the wake of two regional bank failures and the infusion of billions in cash into a third by its larger banking peers have left the bond market roiling. Drawing on insights from a lengthy research piece Morningstar just published, this article reviews what has happened in the banking sector and bond market, its impact on Morningstar Medalists and funds more generally, and how two top-tier bond managers are walking a fine line between risk and reward.

Bond Markets in Turmoil

Silicon Valley Bank’s March 10 collapse startled already-jittery markets. The failure of cryptocurrency industry lender Signature Bank on March 12 added to the market stress and renewed investor concern over the U.S. financial sector. Although the FDIC bailed out the two failed lenders’ depositors and the Federal Reserve and U.S. Treasury joined forces over the weekend to establish an emergency liquidity facility to shore up the banking sector, bond investors have continued to shun the debt of banks and financial-sector issuers in the ensuing days.

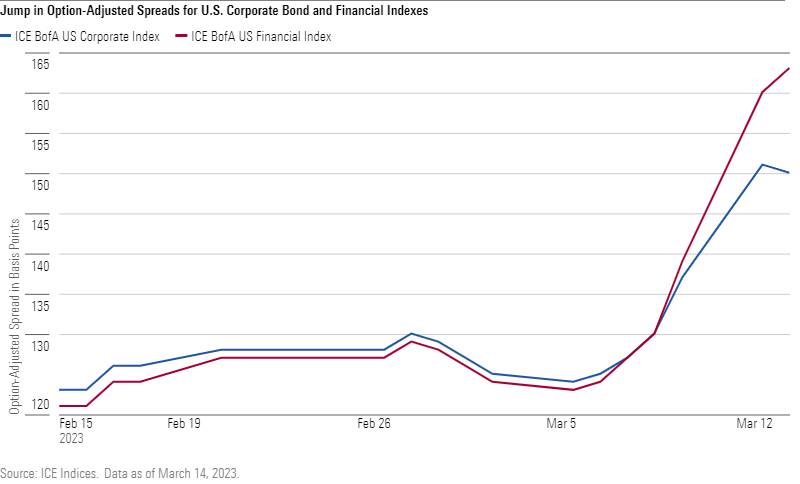

Although the excess yield U.S. corporate bonds pay over government debt has increased across the board, this has occurred most dramatically within the financial sector, as the benchmark comparison in the exhibit shows. This spread widening hasn’t been confined to investment-grade debt of U.S. financial-sector issuers. A similar credit-spread spike has occurred in the lowest-tier subordinated debt of banks and insurers. In this context, the ratings agency Moody’s on March 14 cut its outlook for the U.S. banking system to negative, citing “rapidly deteriorating operating environment.”

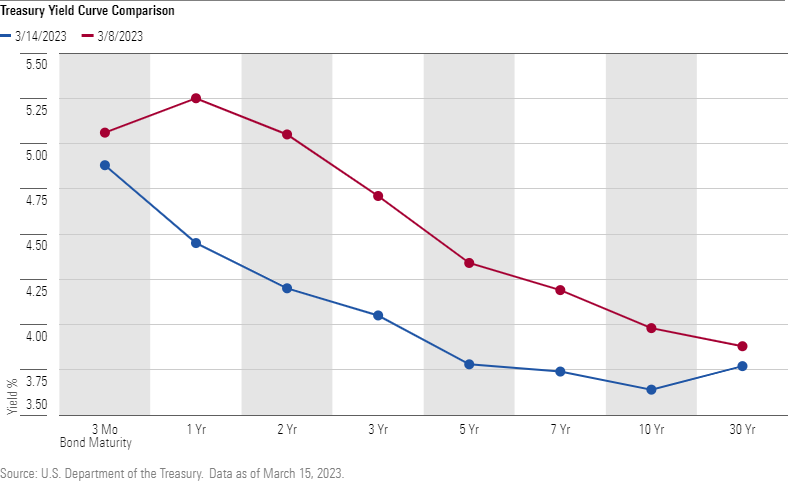

The volatility also carried over to U.S. Treasury markets, where yields had risen since the start of the year amid persistent inflation and hawkish remarks from Fed Chair Jerome Powell. Following the collapses of Silicon Valley Bank and Signature Bank, many market observers revised their expectations for the Federal Reserve’s upcoming Federal Open Market Committee meeting, speculating that the Fed could skip hiking rates in March to alleviate pressure on the banking sector. On Monday, March 13, the yield on the U.S. Treasury two-year note saw its biggest one-day drop since October 1987 as investors bid up the prices of short-dated government debt in a flight to quality, which in turn motivated hedge funds that had been betting on those prices falling to unwind their increasingly unprofitable trades.

Money Market Funds Saw Dramatic Inflows

Meanwhile, these events prompted a rush of assets into money market funds, as uninsured U.S. bank depositors (those with more than $250,000 in bank accounts) searched for alternative places to park their cash. According to Morningstar data, U.S. money market funds saw inflows of $118 billion for the month to date through March 14. At this pace, money markets are on track to have their greatest monthly inflows since April 2020, when they took in $392 billion. Longer-dated fund categories did not see corresponding outflows, implying that many of the assets likely came from bank accounts.

Active Bond Funds With Exposure to Silicon Valley Bank and Signature Bank Debt

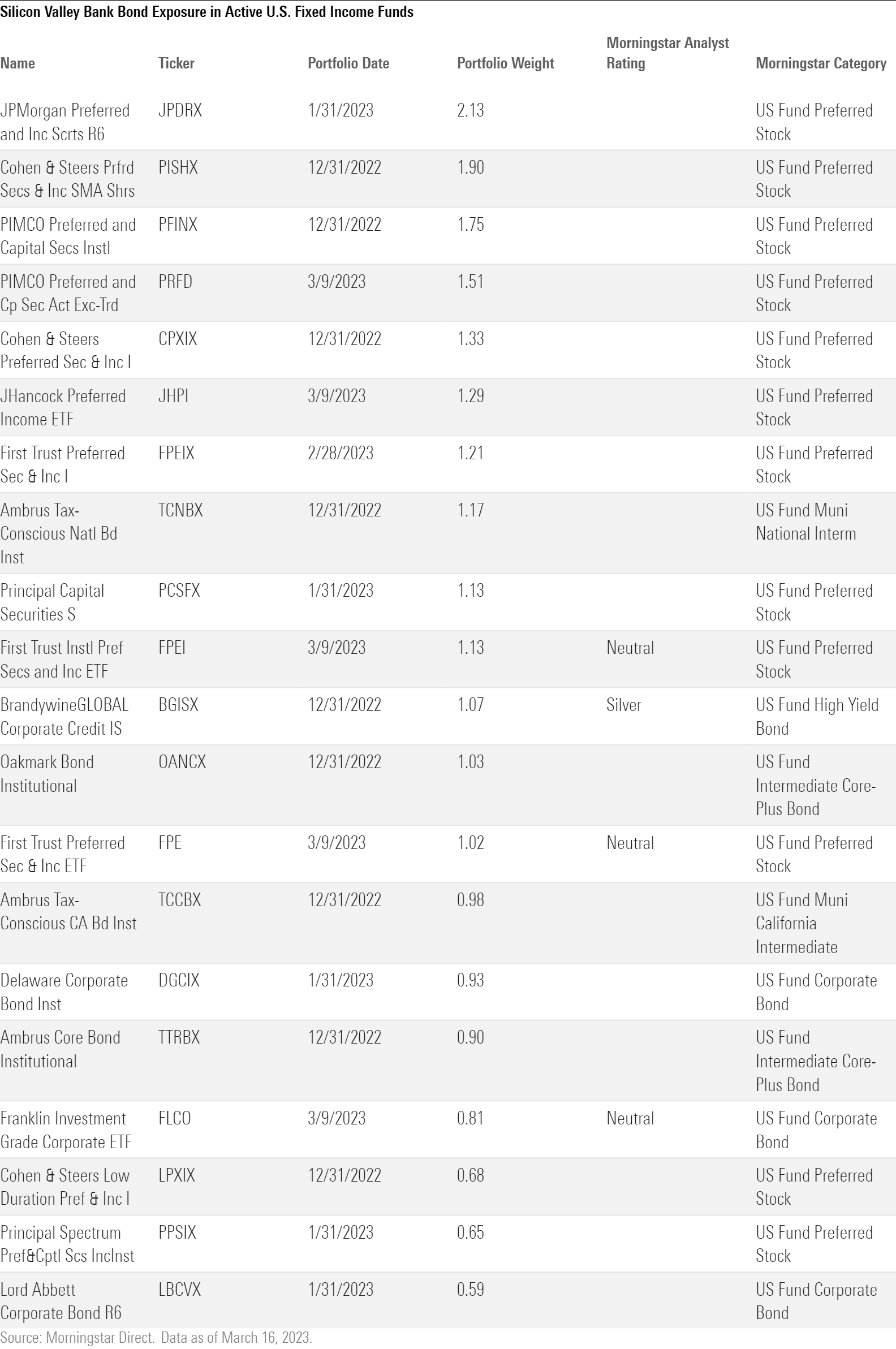

The collapses of Silicon Valley Bank and Signature Bank appear to have had little to no impact on U.S. active Morningstar Medalist bond funds. More insights will emerge as standard industry data lags expire, however, and we can’t be sure that funds with positions in either bank kept them or that funds without positions didn’t initiate them. Bearing that caveat in mind, the only medalist with substantial exposure to the debt of either bank based on its most recent portfolio disclosure was BrandywineGLOBAL Corporate Credit IS BGISX, which has a Morningstar Analyst Rating of Silver, with a combined 1.07% exposure to Silicon Valley Bank at year-end 2022.

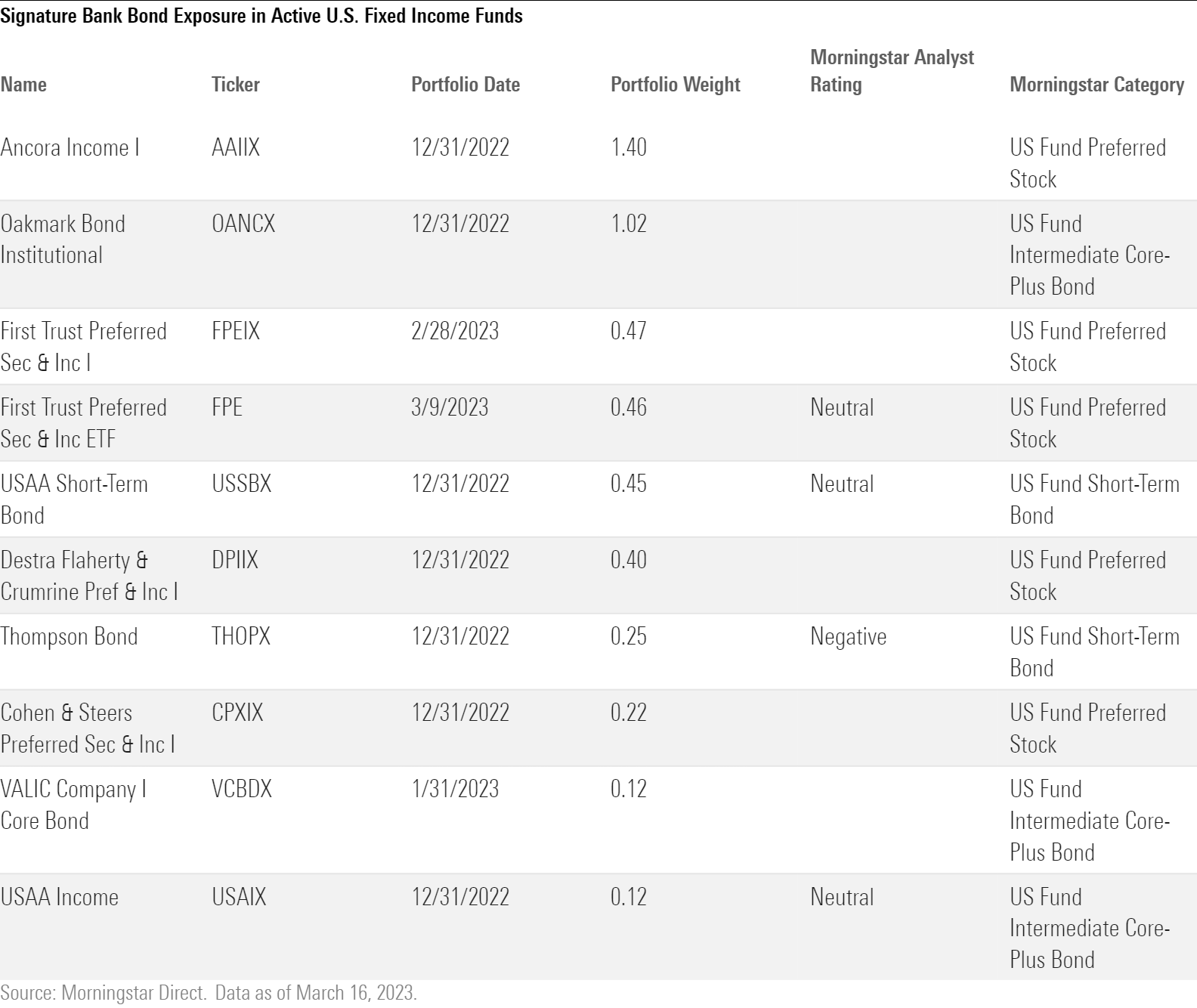

Neutral-, Negative-, and unrated funds had more exposure. Such funds within the preferred stock Morningstar Category include JPMorgan Preferred and Income Securities’ JPDRX top 2.1% weighting in Silicon Valley Bank debt and Ancora Income’s AAIIX top 1.4% stake in Signature Bank bonds. Overall, preferred stock funds accounted for 12 of the top-20 Silicon Valley Bank bondholders and five of the top-10 Signature Bank holders. That’s not surprising, though, as subordinated bank debt makes up a sizable portion of the preferred share universe.

Some funds doubled up on exposure to the failed banks. That’s true of two First Trust Preferred Securities and Income strategies, Cohen & Steers Preferred Securities and Income CPXIX, and Oakmark Bond OANCX. The latter’s 2% combined weighting in the debt of Silicon Valley Bank and Signature Bank, the highest of all funds in the Morningstar database, has likely contributed to its 0.29% bottom-decile return for the year to date through March 16.

Finding Opportunity Amid the Risks

While top-tier active bond managers have largely shied away from Silicon Valley Bank and Signature Bank, some have told Morningstar analysts that they are still comfortable overweighting financials, while others have even stressed the opportunities that they now see in the banking sector.

Mohit Mittal, a comanager on Silver-rated Pimco Investment Grade Credit Bond PIGIX, thinks the events at Silicon Valley Bank and Signature Bank do not pose a systemic risk to the financial sector. Emphasizing the distinction between top-tier banks, larger regional banks with diversified deposit bases, and smaller regional banks like Silicon Valley Bank, Mittal observes that more than 80% of Pimco funds’ financials overweights are concentrated in the top-tier category. The managers’ preference for the financial sector stems from their confidence in the regulatory oversight of the top-tier banks and the trends of deleveraging balancing sheets and de-risking that they see across banking businesses.

Similarly, Greg Peters of Silver-rated PGIM Total Return Bond PTRQX and Silver-rated PGIM Global Total Return PGTQX and his team have kept a financials overweight for some time, but they have avoided smaller regional banks in favor of the senior debt of large financial-center banks. Since Silicon Valley Bank’s collapse, the team has been taking advantage of market volatility to add to the positions in senior debt from the six largest U.S. money-center banks, which they think will benefit as depositors migrate away from smaller banks that lack strict government oversight.

Both Mittal and Peters have changed their expectations for an interest-rate hike at the March 22 Federal Open Market Committee meeting. Neither expects a 50-basis-point hike, as previously thought. Instead, Peters now expects a 25-basis-point increase on the way to a peak federal-funds rate of 5.5%, while Mittal thinks the Fed will either stay put and apply a wait-and-watch approach or unfold a 25-basis-point hike.

The managers differ in how they see the near-term future. Mittal believes that recent events may lead to more regulations for regional banks, which could in turn lead to tighter lending conditions. Peters, on the other hand, thinks Silicon Valley Bank’s collapse adds to the likelihood of the Fed imposing precautionary rate cuts toward the end of the year, which could loosen conditions.

However the future unfolds, the sudden collapse of two banks and the turmoil that has wrought provide a stark reminder of bond managers’ need for vigilance. These events may also in retrospect highlight the importance of seizing the opportunity, lest the moment pass.

Associate analyst Elizabeth Templeton was a contributing author to this market update.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/31069962-a596-4b9a-abf7-079fbbeb77ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/31069962-a596-4b9a-abf7-079fbbeb77ed.jpg)