Which Funds Are Taking Big Losses on First Republic Bank Stock?

A wide range of actively managed stock funds had outsize bets on the struggling bank.

While the collapse of Silicon Valley Bank SIVB has grabbed the headlines, for many mutual funds, a much bigger headache has been the plunge in First Republic Bank’s FRC stock.

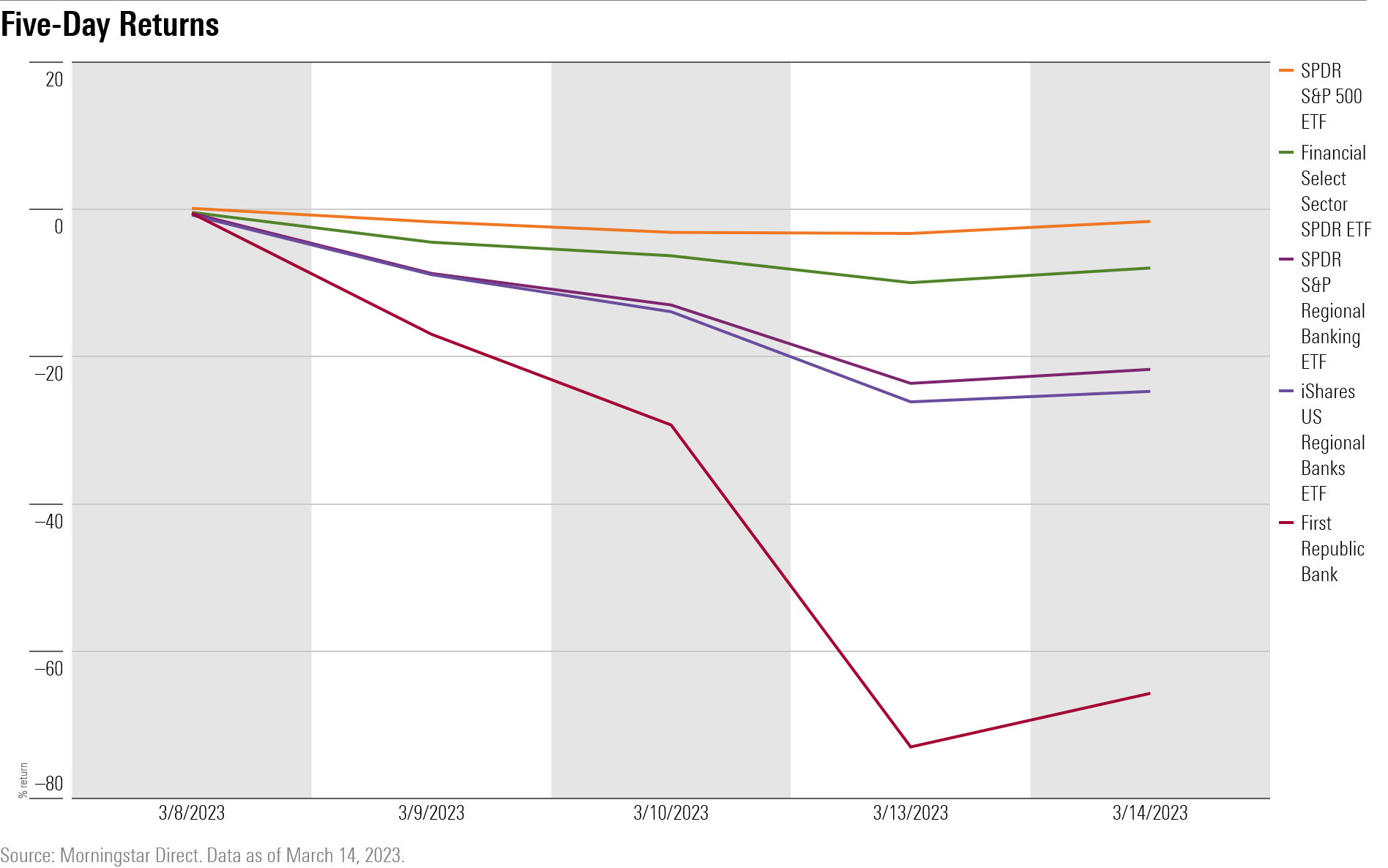

Shares of the San Francisco-based regional bank are down nearly 70% over the past five days, even with a 25% bounce on Tuesday. Dozens of actively managed mutual funds held outsize positions in First Republic Bank, meaning that the stock’s precipitous decline has hit them particularly hard.

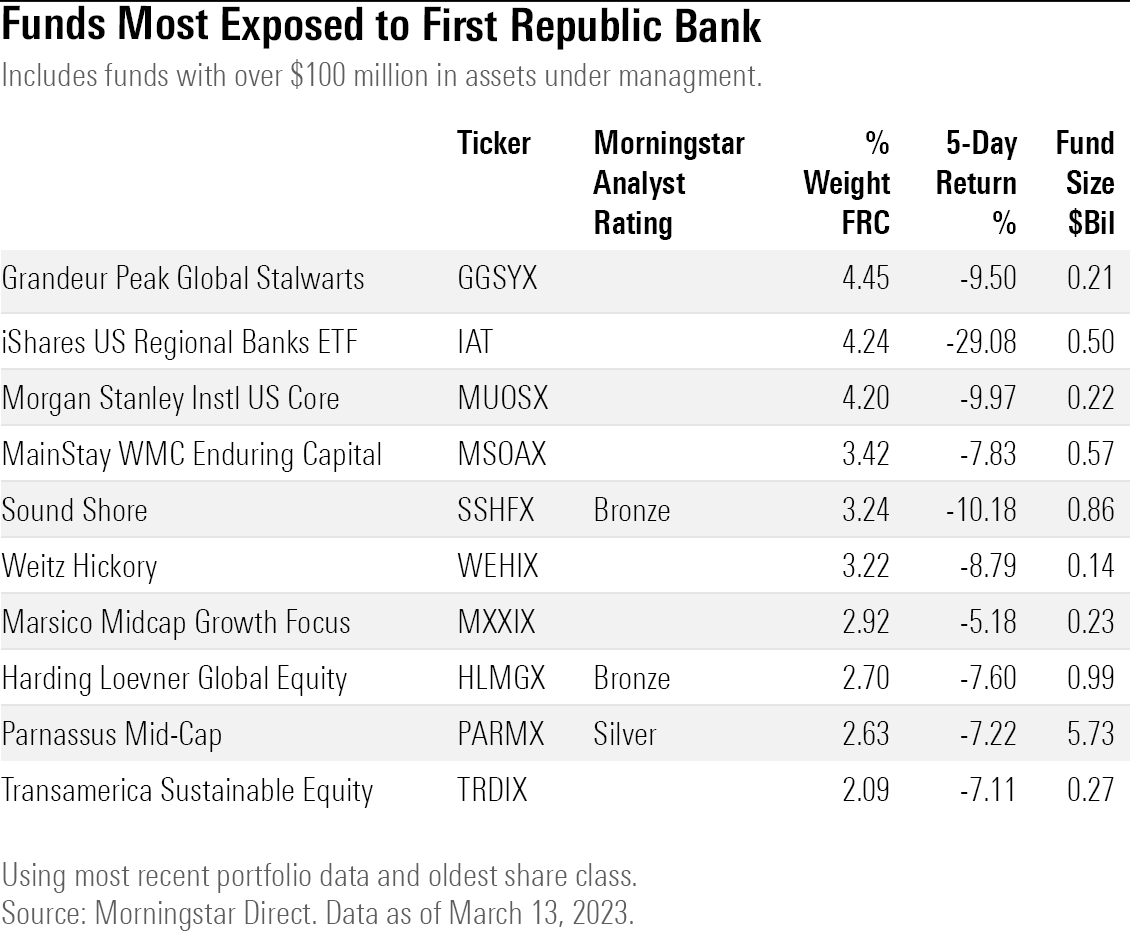

Using the most recently available portfolio data for all diversified stock funds, 89 funds held more than 1% of their assets in First Republic Bank stock; 33 had more than 2%; and 11 had stakes equal to more than 11% of their assets.

Among the larger funds with bets on First Republic Bank:

- Parnassus Mid-Cap PARMX held 2.6% of the fund in First Republic stock as of Jan 31.

- Hartford MidCap HFMCX held 1.3% of the fund in First Republic stock as of Jan 31.

- Diamond Hill Large Cap DHLAX held 1.2% of the fund in First Republic stock as of Feb. 28

- ClearBridge Mid Cap SBMAX held 2% of the fund in First Republic stock as of Dec 31.

The past week has been a rough one for a number of funds reeling in the wake of the collapse of Silicon Valley Bank and Signature Bank. For many funds last week was their worst week since 2020.

Many of these invested in not just one, but many, regional banks that are seen as carrying risks similar (albeit smaller in scale) to those that took down Silicon Valley Bank and Signature Bank.

Some fund managers acknowledged struggles among their regional bank stock investments in year-end 2022 shareholder commentaries, but stood by their stakes in the companies. They hoped that when the Federal Reserve stopped raising interest rates—an underlying cause of the bank woes hitting some regional banks—the stocks would turn around.

Now, with First Republic Bank under pressure, these funds are facing massive losses in the stock, often on top those suffered on investments in Silicon Valley Bank or Signature Bank stock.

Index Funds With First Republic Bank Stock Losses

For broad market tracking index funds, the decline in First Republic hasn’t been much of an issue.

While 15% of the SPDR S&P 500 ETF SPY is allocated to financial firms, JPMorgan Chase JPM is the sole financial company that takes up more than a 1% weight in the exchange-traded fund. First Republic Bank is only a 0.07% weighting in the S&P 500 ETF and just a 0.06% weight in Vanguard Total Stock Market ETF VTI.

In the Financial Select Sector SPDR ETF XLF, First Republic amounted to 1.1% of the fund as of March 8; the fund is down 12.2% over the five days ending March 13.

Regional bank ETFs, of course, have been holding greater positions in First Republic, but the exposure varies. Ishares US Regional Bank ETF IAT is much more concentrated than other financial ETFs and held 4.24% in First Republic Bank. The fund is down 29.1% over the past five days. Meanwhile, SPDR S&P Regional Banking ETF KRE carried 1.9% in First Republic Bank as of March 8 and has lost 26.1%.

Active Stock Funds With Likely First Republic Stock Losses

The real damage from First Republic Bank’s stock price plunge has been among actively managed stock funds. In many cases the funds owned both Silicon Valley Bank and First Republic.

These funds run the gamut of strategies. They include growth-stock funds, value funds, and blend funds, and also include large-cap funds and mid-cap funds. (Most actively managed funds report their holdings with a lag, so positions may have changed since the last available data.)

For Grandeur Peak Global Stalwarts GGSYX, First Republic Bank was its largest holding as of Oct. 31, 2022, the most recently available portfolio data. The stock was 4.5% of the $210 million fund. The fund also held 1.9% In Silicon Valley Bank. Over the past five trading days the fund has fallen 9.5%.

In a fourth-quarter letter, the managers said First Republic Bank was one of the biggest detractors for the fund’s performance. They pointed out the fund’s poor net interest margin in the quarter. “The market has been spooked,” they wrote.

Still, they were sticking with the bank. “Our view is that the worst is now over for net interest margin compression, weaker short-term momentum has been priced into the stock, and the long-term outlook for the company remains strong,” they wrote.

Morgan Stanley US Core MUOSX held 4.2% in First Republic and 2% in Silicon Valley Bank as of Dec 31. The fund is down 10% over the past five days.

Sound Shore SSHFX is another fund where investors are facing big losses from investments in both First Republic and Silicon Valley Bank. The $860 million fund lost 10.1% in just five days. More than 3% of the fund was invested in First Republic Bank and another 2.9% was allocated to Silicon Valley Bank. Senior analyst Gregg Wolper says Sound Shore has invested in financials in significant amounts over the years. “It’s been an up and down experience for the fund,” he says.

Harding its lar Global Equity HLMGX was invested in both First Republic Bank and Silicon Valley Bank, with a 2.7% weighting in First Republic.

The manager discussed the Silicon Valley’s struggles extensively in a fourth-quarter commentary.

“SVB Financial Group and First Republic Bank failed to meet investor expectations that their hefty deposit bases would allow them to benefit from rising U.S. short-term interest rates. Both suffered demand deposit outflows as savers found better returns elsewhere, and SVB suffered from the woes of the venture capital ecosystem.”

Parnassus Mid-Cap PARMX held outsize exposure to both First Republic and Signature Bank. In a commentary the managers described Signature bank as a “big loser” for the $5.7 billion fund last year.

“When the Federal Reserve pauses its rate hikes, Signature’s profitability should improve meaningfully as its deposit costs stabilize and its loans gradually reprice at higher rates,” they wrote.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)