Morningstar Awards for Investing Excellence: Outstanding Portfolio Manager Nominees

These three managers deserve recognition for their talent, diligence, and thoughtful approaches.

Today, Morningstar unveiled the nominees for its 2023 Morningstar Awards for Investing Excellence: Outstanding Portfolio Manager. They are Columbia Threadneedle’s Scott Davis, T. Rowe Price’s David Giroux, and BlackRock’s Rick Rieder.

The nominees come from a pool of investment strategies that earn Morningstar Analyst Ratings of Gold or Silver for at least one vehicle or share class. They stand out for their long histories of consistent results, disciplined yet not hidebound investment philosophies and processes, and commitment to serving investors’ interests. All three deserve recognition for their talent, diligence, and thoughtful approaches, but Morningstar will announce one winner, in addition to the Exemplary Steward honoree, later this month.

Here is more on why each nominee stands out.

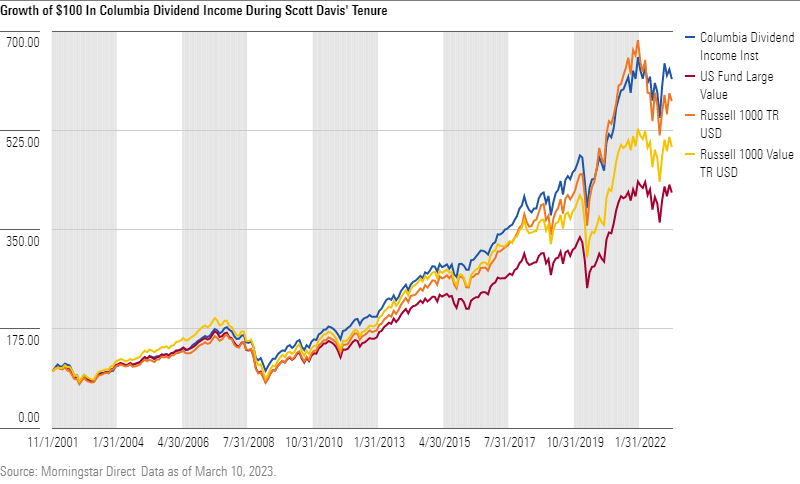

Scott Davis, Columbia Threadneedle

Davis may be the least well-known nominee. He runs a big fund—the $36.3 billion Columbia Dividend Income GSFTX—and has posted strong results but keeps a low of a profile. That is due not only to his temperament but also to his approach, which is not designed to produce eye-catching results in any given year; rather it is built to compound investors’ capital quietly and steadily over time.

That is what Davis has done. Since the early November 2001 start of Davis’ tenure through the end of February 2023, Columbia Dividend Income’s nearly 9% annualized gain for its institutional shares beat the large-value Morningstar Category and the Russell 1000 and Russell 1000 Value indexes in absolute and risk-adjusted terms. The fund also has been competitive with passive dividend-focused offerings, such as Vanguard Dividend Appreciation ETF VIG and Vanguard High Dividend Yield ETF VYM since their 2006 creation. During Davis’ run, Columbia Dividend Income’s institutional shares turned a $10,000 investment into more than $62,500 through the end of February 2023, while the same sum in the Russell 1000 Value and Russell 1000 indexes became about $50,400 and $58,900, respectively.

These results required a delicate balancing act. Davis looks for stocks that offer not only compelling yields but also profitable business models that enable their companies to keep paying, and even increasing, dividends. That is easy to say but difficult to do. It requires research and judgment to avoid shares that offer high yields because of their distressed underlying businesses or firms prone to suspending or cutting their payouts when conditions sour. Davis, who will retire this June after 38 years in the industry, has done a commendable job sidestepping such hazards. As a result, the strategy has provided consistent downside protection and enough upside participation to produce one of the more solid risk/reward profiles among active U.S. equity funds.

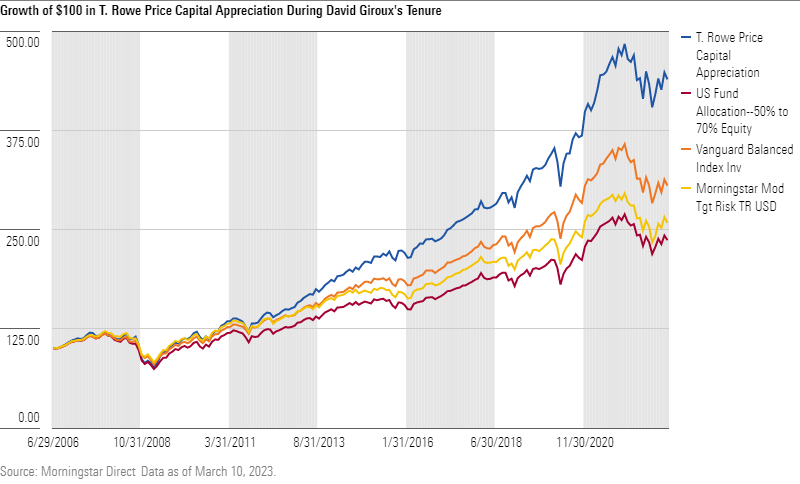

David Giroux, T. Rowe Price

Giroux has been here before. The manager of T. Rowe Price Capital Appreciation PRWCX won Morningstar Allocation Manager of the Year honors in 2017 and 2012 and often has been in the running in other years. It is not hard to see why. Giroux, who now is also CIO and head of investment strategy for T. Rowe Price Investment Management, has been one of the most wide-ranging and consistently excellent active managers of the past two decades. The strategy has rarely finished any calendar year ranking lower than the allocation—50% to 70% equity category’s top fourth since Giroux started in 2006. While T. Rowe Price Capital Appreciation has suffered some short, sharp downturns when it has taken on additional risk a little early, it has made up for the extra volatility with superior absolute and risk-adjusted results on Giroux’s watch. Its 9.3% annualized gain from July 2006 through February 2023 beat the peer group mean and the Morningstar Moderate Target Risk Index by big margins and even matched the all-equity S&P 500′s gain in that time with far less volatility.

Giroux has proved adept at selecting stocks and bonds and setting the strategy’s overall asset allocation, but he has not rested on his laurels. Giroux has been able to step back, evaluate, and evolve his process over time. In 2018, he started reducing the portfolio’s stock holdings from between 50 and 70 to about 40 because his analysis showed the fund was better off focusing on its best ideas. He also has created custom sectors for S&P 500 stocks to better understand their relative valuations and risks.

A contrarian streak has served Giroux and his investors well. He has made timely against-the-grain portfolio decisions. And while a performance record like this one might tempt other firms to turn the strategy into an asset-gathering dreadnought, T. Rowe Price has kept it closed since June 2014 to preserve Giroux’s investment flexibility, a decision he appreciates and supports.

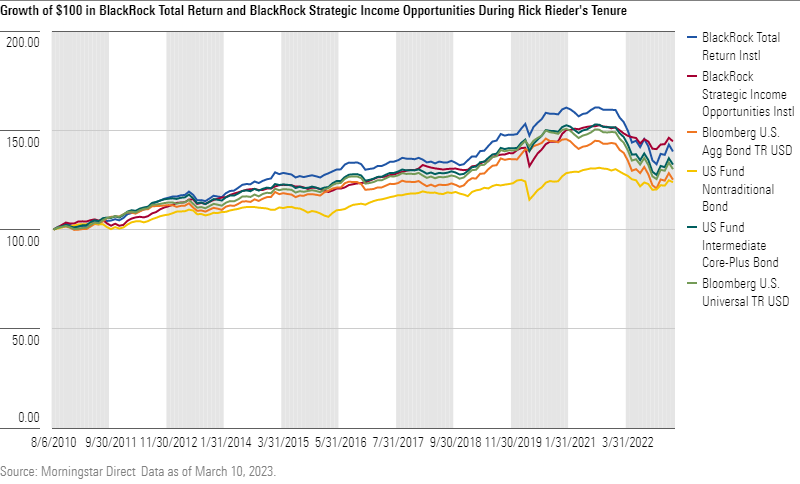

Rick Rieder, BlackRock

Rieder took over a fixed-income operation in 2010 that was still smarting from the global financial crisis and manager turnover and built it into one of the strongest bond investing teams in the industry. Since then, Rieder, who runs BlackRock Strategic Income Opportunities BSIIX and BlackRock Total Return MAHQX, among other strategies, has navigated credit selloffs and rallies, falling and rising rates, liquidity crunches, emerging-markets crashes, global recessions, a pandemic, and 2022′s bond bear market. His approach has helped him stay the course and deliver long-term success across multiple categories.

That approach entails devouring copious quantities of research, distilling it into a diversified collection of small bets rather than a few large ones, and monitoring risk like a border collie patrolling for strays and wolves. Rieder is known for his insatiable and omnivorous appetite for data and command of the minute details of everything from global monetary policies to the smallest positions in the many strategies on which he is a named manager. Yet his focus on risk control prevents Rieder from getting too enamored with, and betting the farm on, any one idea. Rieder fights for every basis point of performance, concedes nothing, and deconstructs successes and missteps to glean lessons for the future. He concluded, for example, that underestimating China’s support for the property sector in 2021 cost BlackRock Strategic Income Opportunities 30-40 basis points of performance—a very small fraction of the strategy’s overall results—and he was still talking to Morningstar analysts about it in early 2023.

Rieder has assembled a large and talented team to assist him, but he orchestrates it. On his watch, BlackRock Total Return, one of Rieder’s largest funds, has beaten both its average intermediate core-plus bond category peer and relevant bond benchmarks, such as the Bloomberg U.S. Aggregate Bond Index, over his tenure on both an absolute and volatility-adjusted basis.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)