The New Frontier of Active Investing

Active managers’ adoption of the ETF structure has changed the game for investors.

Five years ago, much of the actively managed exchange-traded fund market was barren, left untouched by most renowned active managers. Only 11 active ETFs garnered over $1 billion in assets under management. Of those 11, 10 were fixed-income ETFs, with a majority targeting short-duration or bank-loan strategies. Active ETFs were the dream of few.

In 2019, the SEC approved Rule 6c-11, also known as the ETF Rule, thus igniting the “space race” in active ETFs. A new wave of active managers launched their first strategies in an ETF wrapper, seeking the tax efficiency of the ETF structure and newly available portfolio management tools by virtue of custom creation/redemption baskets made possible by the ETF Rule.

Powerful active strategies have entered the ETF market. As they have gained a foothold, more mutual fund managers must recognize the writing on the wall, lest they become artifacts of a prior generation of investing. Many have taken note: By the end of 2022, the number of asset managers with active ETFs had quadrupled from the end of 2017.

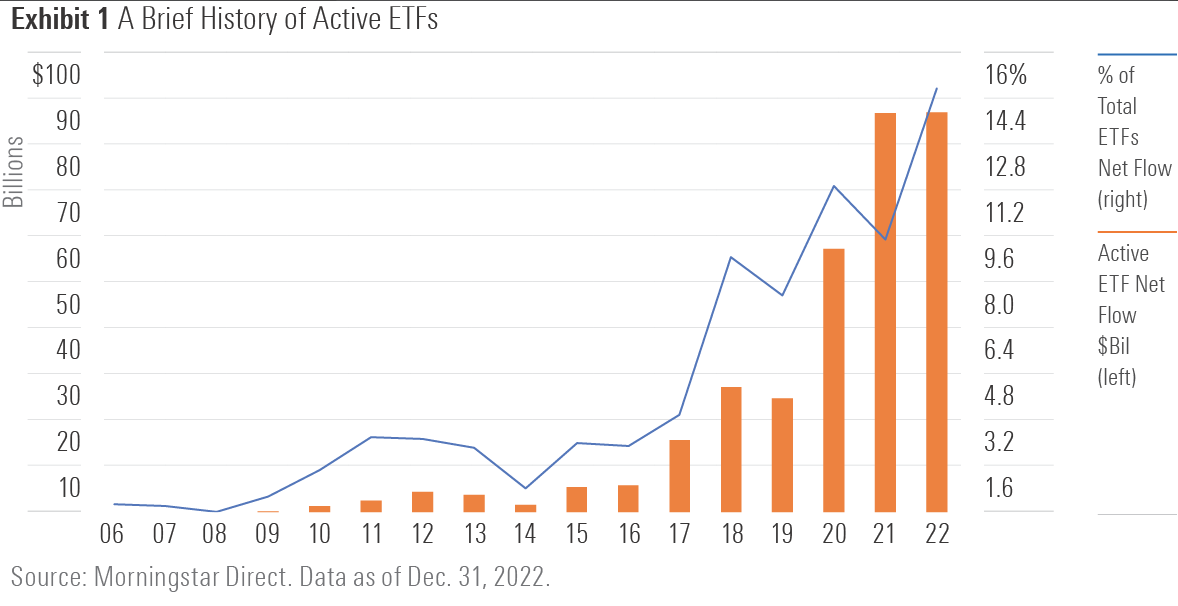

Exhibit 1 shows that ETF issuers weren’t the only ones seeking new opportunities in active ETFs. Investors were adding their dollars at an increasingly high rate. Active ETFs’ share of total ETF net flows increased fourfold over the past five years, topping out at nearly 15% in 2022.

The menu of active ETFs that reached $1 billion in AUM continues to expand. By the end of 2022, 62 had reached that mark, and the current list features a more diverse range of strategies than it did in 2017. The 62 ETFs from 21 different providers were split almost evenly between equity and fixed-income strategies, with a couple of commodities ETFs sprinkled in.

For investors, active ETFs have landed and completed their first moon walk. Topnotch active strategies with reasonable fees have spread throughout the ETF market.

Exploring the Growing Universe of Active ETFs

1) Standard Criteria

The advice that papers the walls of the Morningstar ETFInvestor newsletter remains intact when focusing on active strategies: A diversified, low-cost portfolio with a consistent track record still suits most investors.

Diversification

The importance of diversification is murkier in active strategies than passive ones. The typical argument against diversification is that investors should want an active manager’s highest-conviction picks. In other words, investors wouldn’t want their fund diluted by an active manager’s 101st-favorite stock.

The balancing act between conviction and diversification is highly dependent on a fund’s strategy. Some funds employ top-down research, starting with a market portfolio and tilting toward the characteristics the managers believe will deliver an advantage. Others take a bottom-up approach, building their portfolios based on deep company-specific research.

The former approach should be paired with substantial diversification, targeting a healthy portion of the opportunity set of the chosen market. The latter approach tends to result in more-concentrated portfolios. Research shows that funds with high levels of active share—those that barely resemble their benchmark—tend to come with higher volatility and fees. Managers of concentrated strategies may have valid reasons for setting their sights on their highest-conviction stocks. But even bets with good odds of success can lead to failure if not sized properly.

Cost

Our research shows that low fees are a good predictor of success. Furthermore, the most recent Morningstar Active/Passive Barometer found that the cheapest decile of active funds posted success rates 13 percentage points higher than the most expensive quintile. In fact, we found that success rates were higher for cheaper funds in 14 of 15 stock Morningstar Categories (the lone exception had the same success rate between the cheapest and most expensive funds).

The evidence for investing in low-cost funds is clear. Starting with ETFs issued by asset managers that receive our highest Parent Pillar rating is a great way to identify low-cost, sensible active strategies. ETF providers with a High Parent rating include Capital Group, Dimensional, T. Rowe Price, and Vanguard. And each launched several active ETFs in recent years, many of which mimic their long-standing mutual funds.

Past Performance

The SEC requires a disclaimer in all prospectuses that past performance is no guarantee of future results, and with good reason. Investors don’t receive past performance when they buy a fund. Chasing short-term performance is a primary reason investor returns tend to be lower than the returns of the funds they hold.

Past performance has its place as it can help investors identify strategies worthy of their dollars. It should demonstrate that an active strategy has consistently hewed close to the intentions of its manager. Style drift can take a manager out of their circle of competence and lead to poor results. Consistent performance patterns can also set clear expectations for investors, which can promote better investor behavior during bad stretches.

Dimensional US Core Equity 2 ETF DFAC serves as a prime example. Dimensional introduced this ETF in mid-2021 through one of the fund industry’s first mutual-fund-to-ETF conversions. While it has existed for just 1.5 years, it inherited the 15-year track record of its outgoing mutual fund and follows the same process. This strategy provides broad diversification by pulling in 2,700 U.S. stocks, similar in breadth to its Russell 3000 Index benchmark. Instead of market-cap weighting, it tilts toward stocks with lower valuations, higher profitability, and small market capitalizations.

The research underpinning these tilts away from the market portfolio, along with Dimensional’s implementation process, should fuel DFAC’s index-relative performance. But its long-term advantages can get distorted in the short term. Investors should expect it to outperform the Russell 3000 Index in the long run, but not necessarily every year. It should hold an advantage in years that the value factor is rewarded, such as the past two years. Likewise, investors should expect the fund to underperform when large-growth stocks lead the market, like they did in 2020.

Investors can take comfort in a strategy when performance patterns match their expectations of the strategy. This shows that the fund’s managers have consistently applied the strategy, making it less likely that an investor will pull the ripcord on a fund like DFAC when the value factor is simply out of favor.

2) ETF-Specific Criteria

Active ETFs come with two major differences from active mutual funds: ETFs can’t close to new investors when their strategy reaches capacity, and ETFs trade on exchanges.

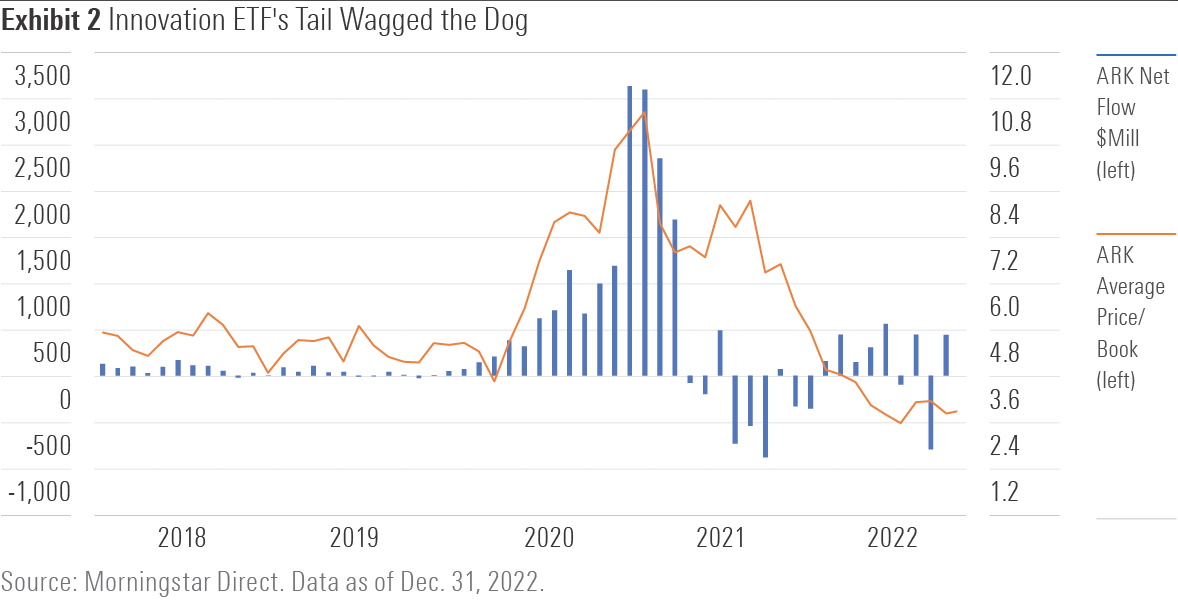

Active ETF investors would be wise to invest in strategies that maintain their edge when assets balloon. At a minimum, investors should periodically monitor their ETF’s AUM, especially when investing in more-niche strategies. Concentrated strategies in young industries may not have a lot of investment opportunities that align with a fund’s objective. And too much money chasing after a limited number of companies can create asset bubbles that will eventually pop when they become highly popular. In other words, you don’t want the money flowing into an ETF to heavily affect the valuation of its holdings.

Exhibit 2 illustrates a case where the tail wagged the dog for ARK Innovation ETF ARKK, resulting in awful outcomes for performance-chasing investors. As new money flowed in, the valuation of the fund’s holdings expanded alongside its assets in 2020 and early 2021. Performance—and the fund’s price/book ratio—collapsed as flows slowed then reversed later in 2021.

While capacity is an ongoing concern, an ETF’s tradability is always critical right off the bat. Investors should shy away from ETFs with wide bid-ask spreads that may force them to pay a significant premium to buy shares (and sell shares at a discount when exiting a position).

Active ETF Stars

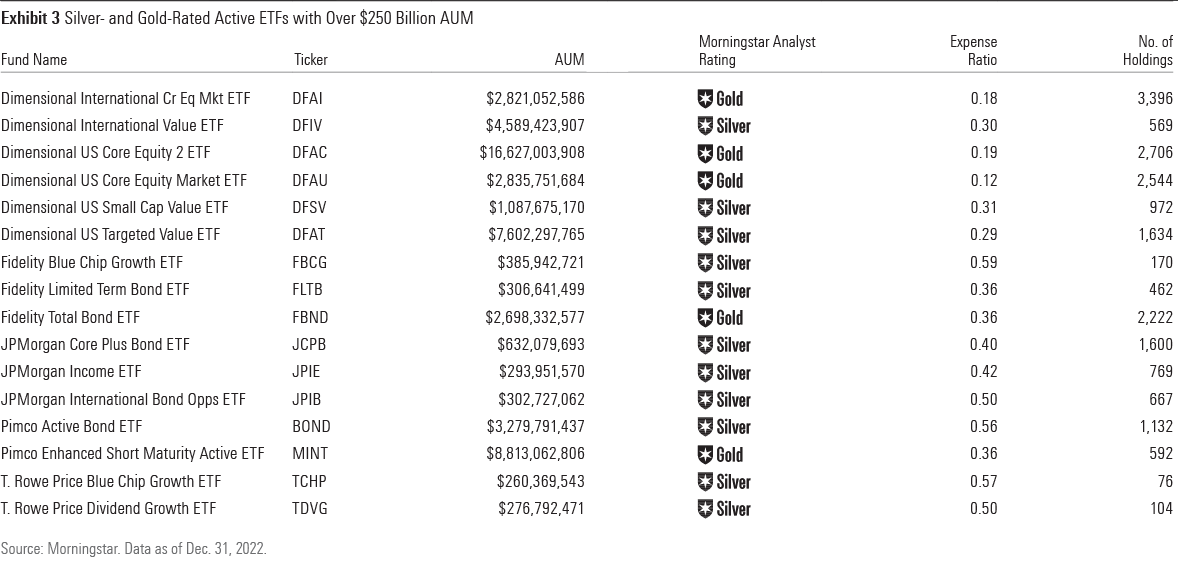

Exhibit 3 lists the active ETFs with Morningstar Analyst Ratings of Gold or Silver and at least $250 million in AUM. These are our current favorites, and they should remain great options for investors in the future. But the burgeoning active ETF market continues to grow quickly, so keep an eye out for active ETF newcomers and those starting to establish a reliable track record that haven’t made this list just yet.

This article first appeared in the January 2023 issue of Morningstar ETFInvestor.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)