Consumer Spending Strong but Consumer Credit Shows Signs of Stress

Delinquencies and charge-offs are rising as interest rates move higher.

Consumers spent at the highest monthly pace in two years in January despite continued high inflation and rising rates, as wage gains, a boost to Social Security checks, and pandemic savings lifted disposable incomes. Looser financial conditions in January in the form of lower mortgage rates and a buoyant stock market also put folks in the mood to spend on items such as motor vehicles and parts, recreational goods, restaurants, and lodging.

The activity defied expectations and was further evidence of how resilient consumers have been throughout a tumultuous time in the economy. Yet, there are worrisome signs that consumers are beginning to feel squeezed: Cracks are showing in consumer credit as volati and charge-offs rise at credit card and auto lenders. Consumers’ financial health is a closely watched barometer because consumer spending is a major driver of the U.S. economy, accounting for more than two thirds of gross domestic product.

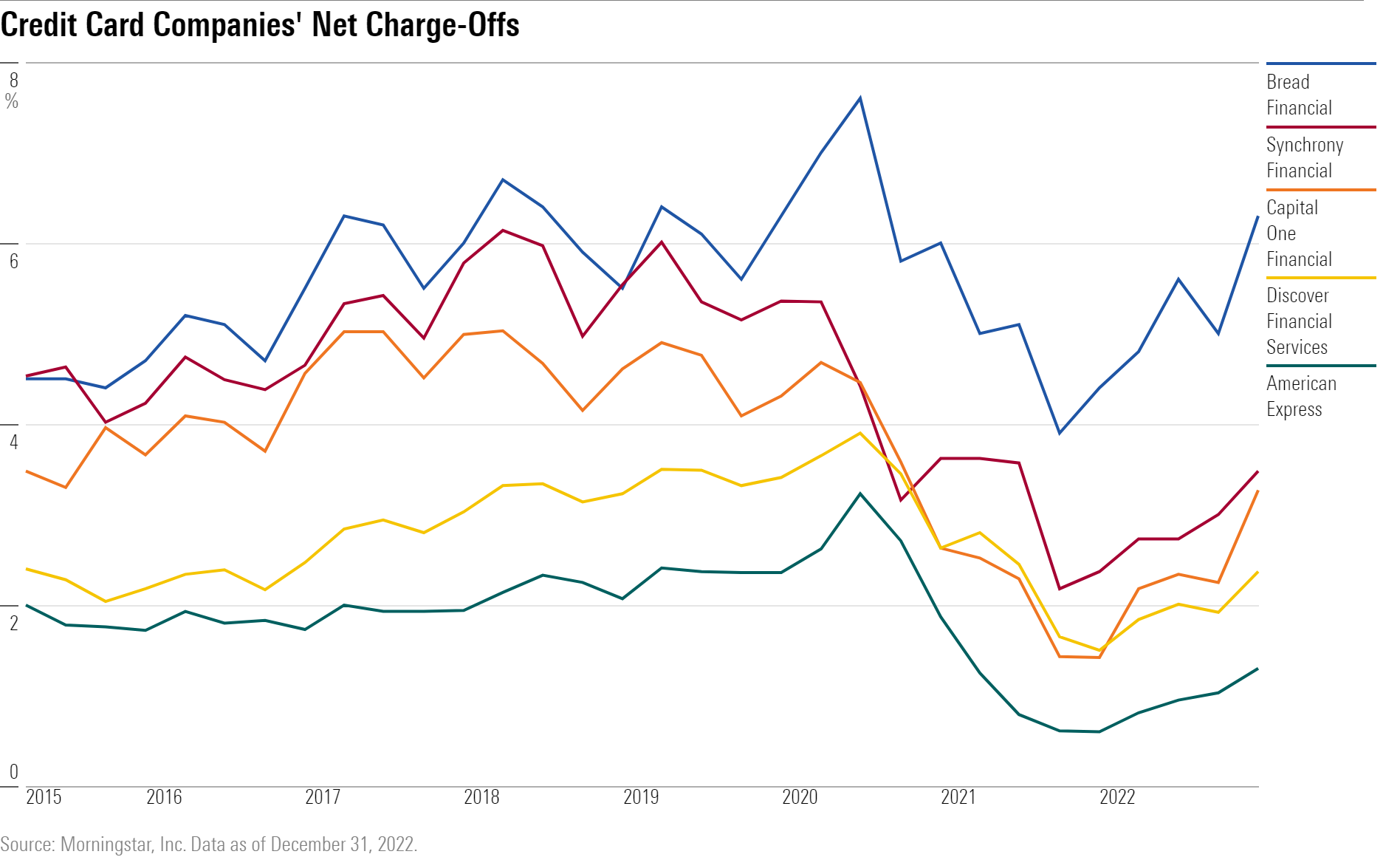

“Credit risk is affecting everyone broadly,” says Michael Miller, an equity analyst who follows consumer credit companies at Morningstar, noting the pace of charge-offs at credit card companies has increased in recent months and delinquency data suggests higher net charge-offs in 2023. Charge-offs occur when a creditor considers a debt uncollectable, typically after 120 to 180 days of nonpayment. Anticipating charge-offs, lenders bolster their loan-loss reserves, which detracts from earnings.

Cracks in Consumer Credit

The weakening credit outlook comes on the heels of rapid growth in consumer credit in 2022, particularly in credit card issuance, Miller says. He notes that most credit card debt is tied to the federal-funds rate. As rates have risen rapidly in the last year, monthly interest on balances is now is growing faster than balances.

Indeed, most credit card and auto lending stocks got walloped in the past month after the companies reported fourth-quarter results that showed rising delinquencies and charge-offs, and issued cautious outlooks on trends for 2023.

- Ally Financial ALLY, a major auto lender as well as credit card company, saw its shares drop 12.49% in the past month to $29.44 for a year-to-date return of nearly 20.41% through March 8.

- Bread Financial Holdings BFH fell 9.95% in the past month to $37.57 and is down 0.24% this year to date.

- Capital One Financial COF stock, at a recent $104.94 per share, lost 10.48% in the past month, bringing its year-to-date return to 12.89%.

- Discover Financial Services DFS stock shed 4.33% in the past month and is now trading at $110.45 per share, representing a gain of 13.05% so far this year.

- Synchrony Financial SYF shares fell 5.35% in the past month to $34.48. Its shares are up 4.93% this year to date.

- American Express AXP, which caters to higher-end customers, turned in the best performance in the past month. Its shares fell 2.33% to $174.83 per share, bringing its year-to-date return to 18.33%

Citing the uncertain economic climate and with credit losses expected to worsen as the year goes on, Miller is cautious on the group as a whole. He warns that Bread and Synchrony could be particularly rate because their customer bases tend to pose higher risks, though Synchrony has been improving its mix in the past three years. His favorite pick in the group is Discover, which has a 4-star Morningstar Rating and on March 8 traded at a 24% discount to Morningstar’s fair value estimate of $146 per share. Its strong balance sheet, he says, should help it withstand the headwinds of deteriorating economic conditions and the rising charge-offs and increases in provisioning he sees on the horizon for 2023.

Delinquencies Rising Amid Low Unemployment

Typically, loan defaults are tied to unemployment levels, says Miller. “It’s unusual to see them rising now without a corresponding rise in unemployment.”

Unemployment, at a recent 3.4%, is at a 53-year low currently. Payroll and benefit administrator Automatic Data Processing ADP reported March 8 that private payrolls increased 242,000 in February, higher than the estimated 205,000 and above the 119,000 reported in January. In addition, the U.S. Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey also remains elevated with 1.9 workers for every available job.

“Although historically low unemployment has kept consumers’ financial footing generally strong, stubbornly high prices and climbing interest rates may be testing some borrowers’ ability to repay their debts,” says Wilbert van der Klaauw, economic research advisor at the Federal Reserve Bank of New York.

In its Quarterly Report on Household Debt and Credit, the New York Fed noted that total household debt balances rose by $394 billion, or 2.4%, to $16.9 trillion in the fourth quarter, the largest nominal increase in 20 years. Overall debt balances are $2.75 trillion higher than they were at the end of 2019.

Growth in mortgage balances composed the bulk of the debt, but the $61 billion rise in credit card balances was the biggest increase since the New York Fed started tracking the data in 1999. In addition, the year-over-year surge in credit card balances of $130 billion in December 2022 also represented the largest annual growth in balances. Total credit card balances reached $986 billion, exceeding the prepandemic high of $927 billion.

The New York Fed report noted that the share of current debt becoming delinquent increased again in the fourth quarter as it had for the previous three quarters for nearly all debt types, following two years of historically low delinquencies.

According to the New York Fed, an increasing number of credit card borrowers are missing their payments and entering into serious delinquency status, which occurs when payments are more than 90 days past due. Younger borrowers, in particular, are struggling and have surpassed their prepandemic delinquency rates. Delinquency rates for older borrowers are rising, too, but have not yet reached their prepandemic levels.

Another issue for younger borrowers: “The end of student debt forbearance is a risk factor,” says Miller, referring to the eventual end of the government’s student debt relief program.

Pressure From Rising Rates to Continue

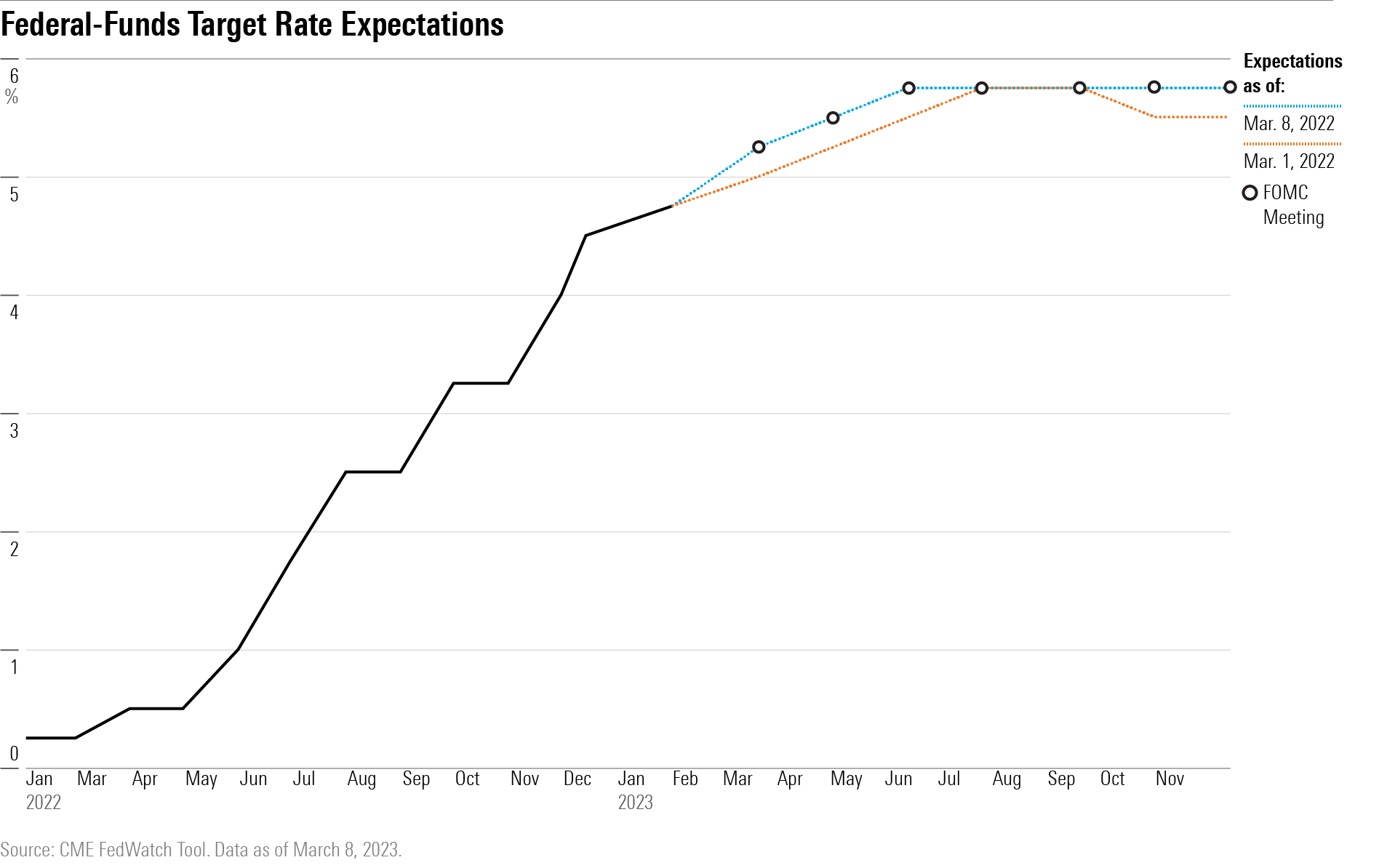

“We’re seeing increasing pressure on households and consumers amid increasing expectations for faster and more Fed rate hikes,” says Scott Anderson, chief economist at Bank of the West/BMO Harris Bank. “Monetary policy is starting to bite.”

Federal Reserve Chair Jerome Powell reinforced the expectations for higher rates on March 7 when he appeared before the Senate Banking Committee. Powell said the Fed would consider raising the fed-funds rate by half a percentage point at its meeting this month and likely will boost rates to a higher extent than previously expected in the face of high inflation and a strong job market.

The Fed’s preferred measure of inflation, the personal consumption expenditures price index, rose 5.4% in January from the previous month. At its last two meetings, the Fed scaled back the magnitude of its increases, raising rates by 0.25% in February and by 0.50% in December after four straight 0.75% hikes. In the past year, the Fed has raised rates eight times to a range of 4.50% to 4.75% from 0.25% to 0.50%.

Consumer Outlooks Growing Gloomier

The latest readings of the Conference Board’s Consumer Confidence Index also show consumers growing more uncertain, says Anderson. Consumer confidence declined for the second straight month in February.

The Expectations Index, which measures consumers’ short-term outlook for income, business, and labor market conditions, worsened considerably to 69.7 from a downwardly revised 76.0 in January, notes Anderson. A reading of 80 often signals a recession within the year and the index has been well below that level for 11 of the past 12 months.

“Consumers may be showing early signs of pulling back spending in the face of high prices and rising interest rates,” the Conference Board said, noting that “fewer consumers are planning to purchase homes or autos and they also appear to be scaling back plans to buy major appliances.” It added, too, that vacation plans also declined in February.

While Anderson sees consumer spending growth of 2% annualized in the first quarter, he expects the pace to slacken considerably and show back-to-back quarterly declines of 0.05% in the second and third quarters for the first time since early 2020, the onset of the coronavirus pandemic. He sees a mild recession occurring and a progressively weaker job market.

“While job gains have remained solid thus far despite higher interest rates, the economy is projected to shed net jobs in the second and third quarters of this year and push the jobless rate up to a peak of around 4.8% by the first quarter of 2024,” says Anderson, “The real death knell for the consumer is when the labor market shows deterioration.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)