Top 10 Buys and Sells From Our Ultimate Stock-Pickers

Funds see value in a diverse range of sectors.

For roughly the past decade, our primary objective with Ultimate Stock-Pickers has been to uncover investment ideas that our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we analyze the quarterly and monthly holdings of 26 separate investment managers: 22 managers oversee mutual funds covered by Morningstar’s manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As the data from their holdings becomes available, we identify trends and outliers among their holdings as well as meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our early read on our Ultimate Stock-Pickers’ individual purchasing activity during the fourth quarter of 2022—focused on high-conviction and new-money buys that were made during the period, based on the holdings of almost all our top managers. Now that all but one of our Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers’ high-conviction holdings, purchases, and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions—we will provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help them along the way.

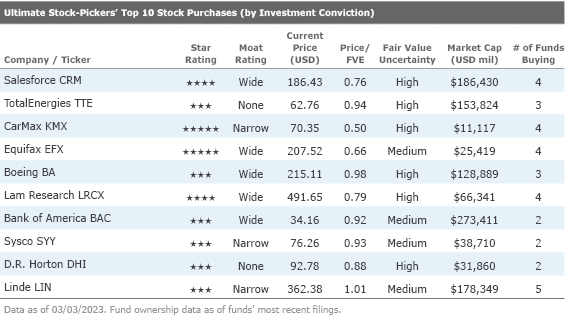

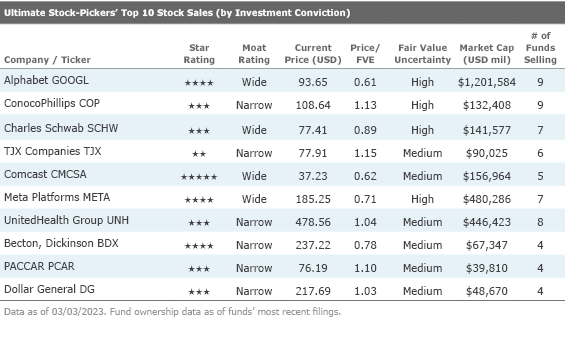

Morningstar’s analysis shows eight of the top 10 conviction holdings have a wide economic moat, with the other two having a narrow moat. Five companies on the conviction purchases list have wide economic moats, while three have narrow moats, and two are without a moat. On the conviction sales list this quarter, four companies have a wide moat, and the remaining six have a narrow moat.

Considering that many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the majority of the names composing our top 10 conviction holdings list were the same as the prior quarter. Alphabet GOOG (Google’s holding company) and Microsoft MSFT retained the top two spots on our list with 19 and 16 funds holding, respectively. Similar to last quarter, our Ultimate Stock-Pickers’ conviction holdings this quarter favored the financial services sector, with five companies making the top 10 list. Also in our conviction holdings list, our Ultimate Stock-Pickers hold two names from the technology sector and one name each from the communication services, consumer cyclical, and healthcare sectors. Our current fair value estimates imply that at the time of writing, Marsh & McLennan Companies MMC is trading at a premium and therefore overvalued.

All the names on our top 10 conviction holdings list were held by at least 12 of the funds we examined. In this edition of Ultimate Stock-Pickers, we’ll take a closer look at Mastercard Inc MA, which is a new addition to our top 10 conviction holdings list compared with the previous quarter and currently sits in 3-star territory. We also highlight Boeing BA, which was a high-conviction purchase in the fourth quarter, and Becton, Dickinson and Co BDX, which appeared on our high-conviction holdings and high-conviction sales lists.

Wide-moat Mastercard was held by 12 funds at the time of this article’s writing. This medium uncertainty stock currently trades in line with Morningstar analyst Brett Horn’s fair value estimate of $369. Mastercard is the second-largest payment processor in the world, having processed close to $6 trillion in purchase transactions during 2021. Mastercard operates in over 200 countries and processes transactions in over 150 currencies.

Mastercard has multiple characteristics that should draw investors’ attention. First, despite the evolution in the payment space, Horn believes a wide moat surrounds the business and views Mastercard’s position in the current global electronic payment infrastructure as essentially unassailable. Second, Mastercard benefits from the ongoing shift toward electronic payments, which provides plenty of opportunities to utilize its wide moat to create value over the long term. Digital payments, on a global basis, surpassed cash payments just a few years ago, suggesting that this trend still has a lot of room to run, and we think emerging markets could offer a further leg of growth even if growth in developed markets starts to slow. Finally, Mastercard is something of a tollbooth business, and the company is relatively agnostic to smaller shifts in the electronic payment space, as it earns fees regardless of whether payment is credit, debit, or mobile.

Mastercard is not without issues in the near term. Cross-border transactions, which are particularly lucrative for the networks, came under heavy pressure due to the fallout from the pandemic and a reduction in global travel. Horn expects a full recovery, and this should drive relatively strong underlying growth in the near term. However, a stronger dollar will be an offsetting headwind in the near term. From a longer-term point of view, we think it is likely that smaller and more regional networks are building out capacity for cross-border transactions, which could eat into growth a bit in the coming years, but we haven’t seen a material effect yet.

In the near term, Horn views the state of the economy as Mastercard’s biggest risk. A downturn in the economy would slow overall growth, as Mastercard’s revenue is sensitive to the volume and dollar amount of consumer transactions. The company saw growth decline significantly during the early stages of the pandemic. However, Horn does not see any industry trends that could impede Mastercard’s ability to maintain double-digit growth in the coming years, and the company looks poised to continue to modestly outperform its larger peer, wide-moat Visa V.

The Ultimate Stock-Pickers’ Top 10 stock purchases list contained many companies with moats that were distributed across a range of sectors, including consumer cyclical, consumer defensive, energy, finance, industrials, and technology. In particular, we would like to highlight Boeing, which was purchased by three funds during the quarter.

Wide-moat Boeing trades on par with Morningstar analyst Nicolas Owens’ fair value estimate of $220. Boeing is a major aerospace and defense firm. It operates in four segments: commercial airplanes; defense, space & security; global services; and Boeing capital. Boeing’s commercial airplanes segment competes with Airbus in the production of aircraft ranging from 130 seats upward. Boeing’s defense, space & security segment competes with Lockheed LMT, Northrop NOC, and several other firms to create military aircraft and weaponry. Boeing’s global services segment provides aftermarket support to airlines.

Boeing’s narrow-body business was severely battered by the extended grounding of its 737 MAX due to two fatal crashes of the plane before the COVID-19 pandemic. The pandemic cut air travel by two thirds between 2019 and 2020, and Boeing’s primary competitor, Airbus EADSY, saw a one third drop in airplane deliveries while Boeing had to cease deliveries of its workhorse plane for 20 months to rework the navigation and other systems on hundreds of jets. Owens sees pent-up demand for air travel adding to the long-term increase in demand for air travel in emerging market economies. He anticipates that Boeing will grow 737 MAX production to meet that demand. Critical to his thesis is at least some normalization of U.S.-China trade relations, as his forecast anticipates Chinese carriers will take up to one quarter of new airplanes in the next decade.

Owens expects wide-body demand to take longer to recover from the pandemic than narrow-body demand because wide bodies are used for longer and international trips, which are bouncing back at slower rates than domestic routes. In Owens’ view, Boeing’s 787 Dreamliner is a fantastic aircraft for long-haul travel, but it, too, experienced a months-long halt of production as manufacturing quality issues were ironed out and planes refurbished. Deliveries recommenced in August 2022, and Owens expects them to return to 2018 levels by 2024.

Boeing also supplies military products to governments and aftermarket services to its commercial customers. These businesses together generate just over one third of its operating income over a cycle. Owens broadly stipulates GDP-like growth in the defense business and expects the services business will regain profitability faster than Boeing as a whole because aftermarket revenue increases directly with flight activity.

Similar to the previous quarter, the selling activity on the top 10 conviction sales list was a mix this quarter in regard to sector. Two of the names appear on both the holdings and sales lists in the quarter. Approximately half the names on the conviction sales list trade at a discount to our fair value estimates, while one name (TJX Companies TJX) trades in 2-star territory. Of note this period was Becton, Dickinson and Co, which currently trades at a discount to Morningstar analyst Alex Morozov’s fair value estimate of $306.

Becton, Dickinson is the world’s largest manufacturer and distributor of medical surgical products, such as needles, syringes, and sharps-disposal units. The company also manufactures diagnostic instruments and reagents as well as flow cytometry and cell-imaging systems. BD Interventional (largely the former Bard business) accounts for 24% of revenue. International revenue accounts for 43% of the company’s business. After a tumultuous few years, Becton, Dickinson is undergoing course correction. The COVID-19 revenue windfall has been reinvested, which should lift the firm’s core business growth in the upcoming years once the testing revenue fades. The biggest uncertainty remains around the return of BD’s pump infusion system (Alaris) to the market, which could be a material catalyst for the company whenever it occurs.

Historically, BD was considered a virtually recession-proof business. The essential nature of many of its medical products typically shielded the firm from any capital spending-related volatility, and this business continued to fare fine during the COVID-19-induced hospital admission deceleration. However, many of the businesses acquired with Bard have exposed BD to revenue volatility. Combined with the setbacks and revenue deceleration in the peripheral segment, the Bard acquisition has not been a smashing success. Morozov is not quite ready to call that deal capital-destructive even though the steep price paid has given BD very little margin for error. With hospital activity returning to more normal levels, Morozov sees momentum in the surgery segment that came with Bard, and while peripheral is no longer the star of the portfolio, businesses acquired are lifting BD’s growth profile from its historic levels.

Alaris continues to be a headache for BD, and this recall represents a significant blemish on the company’s previously very clean execution track record. The magnitude of the damage to the pump franchise is still not certain, but Morozov thinks BD will still end up ceding material market share in this area by the time the pump returns to the market (which could be as far out as 2025). The company needs almost flawless execution in the upcoming years to reverse investors’ growing skepticism regarding its performance.

Disclosure: Ari Felhandler has an ownership interest in Microsoft and Lockheed Martin. Rue Shetty and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar’s Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZP7H3U7MTNHJ5H3WWEUKGBUQGE.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)