The Politics of Social Security Reform

Are meaningful changes possible?

Washington’s Gridlock

I had intended for my two previous columns on Social Security to suffice. “The Two Great Myths of Social Security Reform” points out that, despite impressions to the contrary, the Social Security system is relatively well funded, by the federal government’s standards. “How to Balance Social Security’s Books” then establishes addressing the program’s deficit requires only adjustments, not an overhaul.

So far, so good. But as many readers reminded me, it’s one thing to show that Social Security’s finances can readily be squared, and quite another to indicate how that might occur, given the nation’s political polarization. For decades now, Democrats and Republicans have been unable to hold even a cursory conversation about Social Security reform, aside from a brief flirtation between former President Barack Obama and the then House Speaker, John Boehner.

That is a strong objection. No question, in my desire to discuss the numbers, I glossed over Social Security reform’s political barriers. It is not only quite possible that the two parties will maintain their standoff, with Democrats preventing benefit cuts and Republicans resisting revenue increases, but perhaps even probable. If so, the “Social Security Trust Fund” will inexorably dwindle, expiring circa 2035. (My “Two Great Myths” article explains the reason for the irony quotes.)

The GOP’s Predicament

Changing the inflation computation would put Republicans in a bind. They could not by themselves pare Social Security’s benefits, because of the program’s popularity. Doing so would require a bipartisan effort, as with the Social Security Amendments of 1983, which (among other items) effectively reduced payouts by extending the eligible age for maximum benefits from 65 to 67. That bill received strong support from both parties, before being signed by President Ronald Reagan.

In such a scenario, Republicans would face two choices. One, they could agree to higher payroll taxes to resupply the Social Security Trust Fund, which under current regulations is the only source from which Social Security payments can be made. Or they could attempt to avoid a tax hike by seeking to change the funding rule so that Social Security benefits could be paid from general government revenue, rather than from a segregated (albeit largely fictitious) account.

That would be an unsavory choice. The GOP’s predicament would likely unleash a political battle that would make debt-ceiling discussions look like a Sunday evening bridge quarrel. (I am old enough to recall not only playing Sunday bridge myself, but also reading Sports Illustrated’s tournament coverage.) Nor would the resolution necessarily be happy. Peace treaties breed different emotions than bipartisan agreements. Such a treaty could be the next Versailles.

My hope is that this outcome will not occur, because as 2035 approaches, with the attendant publicity that something must be done, Democrats will feel overt pressure to bargain. Political moderates will make it clear that they will accept neither a large and abrupt tax hike, nor permit the Social Security system to run an explicit ongoing deficit by paying for the program through general revenue.

But, of course, I could be wrong. (Such will be my epitaph.)

One Possibility

If I am correct, though, there are many feasible solutions. Below is one. My political assumptions are:

1) Democrats will not accept direct benefit cuts.

2) Nor will they accept means-testing, as they believe that the program’s popularity owes in part to its universality.

3) Republicans will resist redistributive efforts, such as increasing the salary cap on the payroll tax.

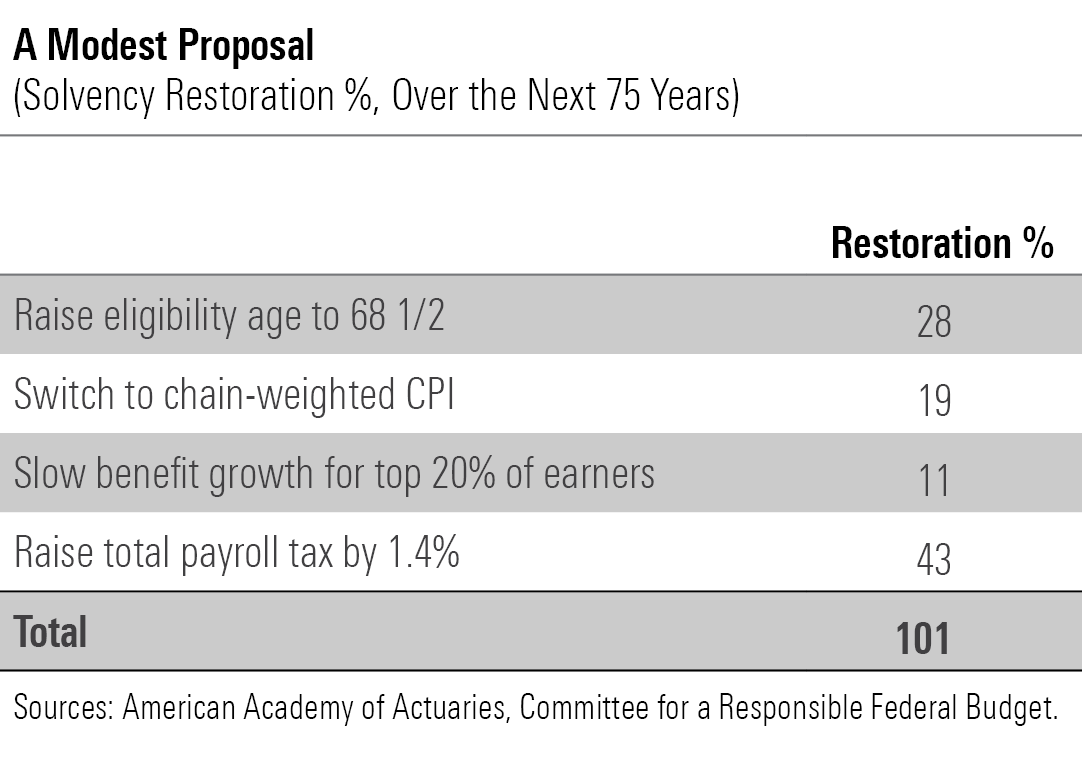

Guided by those precepts, I offer the following suggestions:

1) Raise the eligibility age for maximum benefits to 68 1/2 from 67.

Concession Democrats. This would indeed be a benefit reduction, but in disguise, as the amount of the potential payment would remain unchanged. The Democrats have crossed this bridge once before. Presumably, they can be persuaded to do so again.

2) For the cost-of-living adjustment, use the chain-weighted version of the Consumer Price Index.

Concession Democrats. Doing so would slightly reduce the program’s cost-of-living raises. The change would be initially imperceptible, becoming noticeable only during a retiree’s later years.

3) Reduce future benefit growth for higher-income participants.

Concession Republicans. Although technically a form of means-testing, this proposal should appeal to Democrats, as it retains all participants. Nor would such a provision cut any worker’s Social Security distributions, either today or later. Rather, it would lower future payment growth (over time, Social Security benefits rise in tandem with workers’ real incomes).

4) Raise the payroll tax.

Concession Republicans. To be sure, the GOP dislikes tax increases in all forms. However, if the Democrats can accept benefits cuts, then the Republicans should be able to tolerate a modest tax hike that applies to all, as opposed one that redistributes income from the wealthy. (The suggested 1.4% increase would be split among workers and employers, with each paying an additional 0.7%.)

As with my “How to Balance” article, the results for this proposal come from calculations hosted by the American Academy of Actuaries and the Committee for a Responsible Federal Budget. The percentages represent the amount by which each suggested change is estimated to close Social Security’s budget, with a total of 100% implying that the program would be entirely self-funded for the rest of this century.

Wrapping Up

Ultimately, Social Security’s fate rests in the public’s hands. The people elected representatives who refuse to negotiate, by ousting in primary elections those politicians who dare to bargain with their perceived enemies. If that is what the people continue to desire, then Social Security reform is unlikely to occur. The arguments will continue, without meaningful new legislation being passed.

Ultimately, I believe, voters will seek solutions, and will therefore elect politicians who promise them results, rather than principled inaction. If so, then Social Security can and will be reformed. If not … shrug. The water is there, even if the horses will not drink.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)