The Top Female Portfolio Managers to Invest With Now

Morningstar’s highest-rated female portfolio managers have shattered glass ceilings across asset classes.

The financial field continues to be male-dominated, and there hasn’t been a substantial shift in the number of female portfolio managers over the past decade. Only about 12.5% of portfolio managers across U.S.-domiciled active and passive funds were female in 2022, a similar proportion as a decade prior. Despite that low representation and the systemic obstacles they face, women have been making their mark in portfolio management. Morningstar analysts have identified a number of lead female portfolio managers or all-female teams as being more skilled than their average Morningstar Category peer.

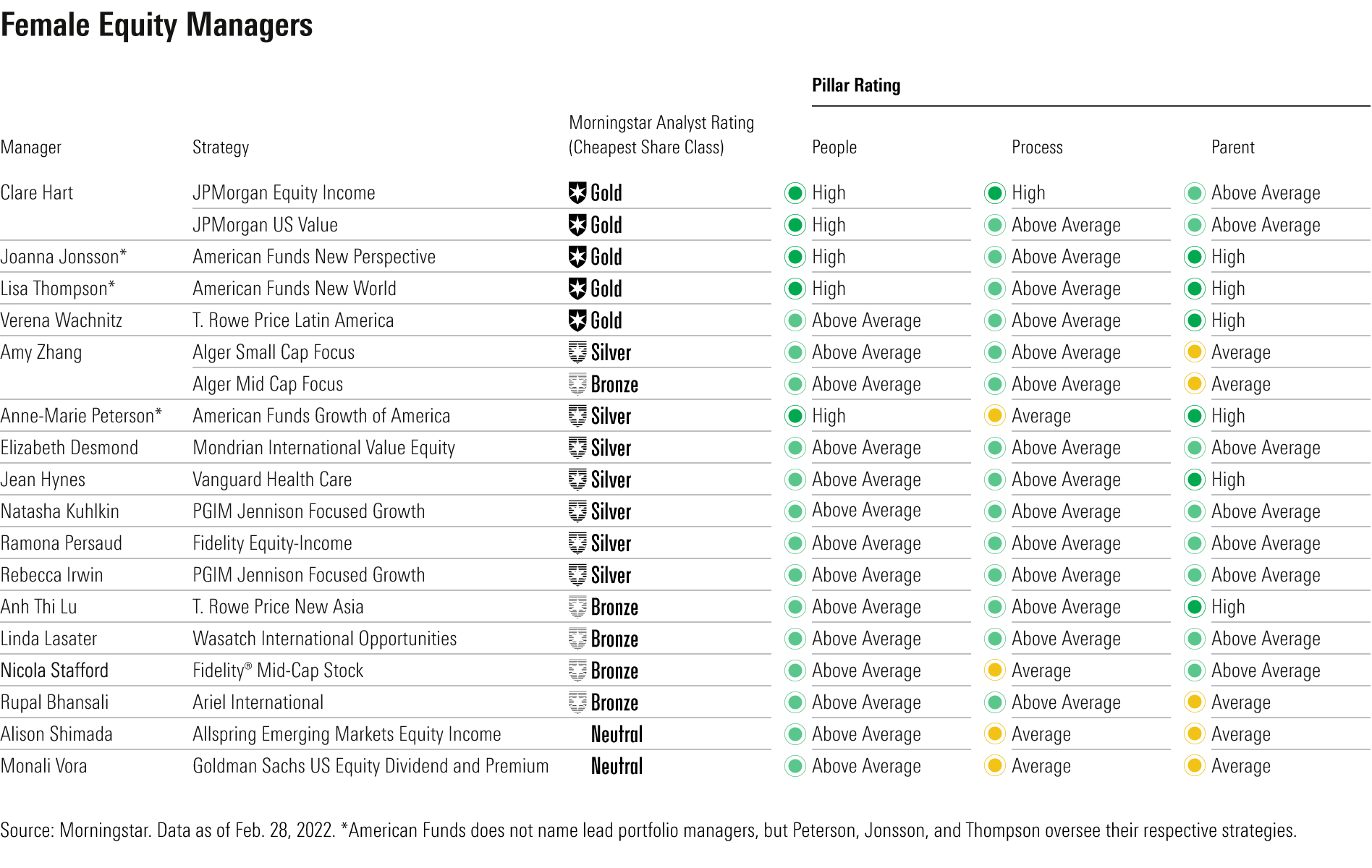

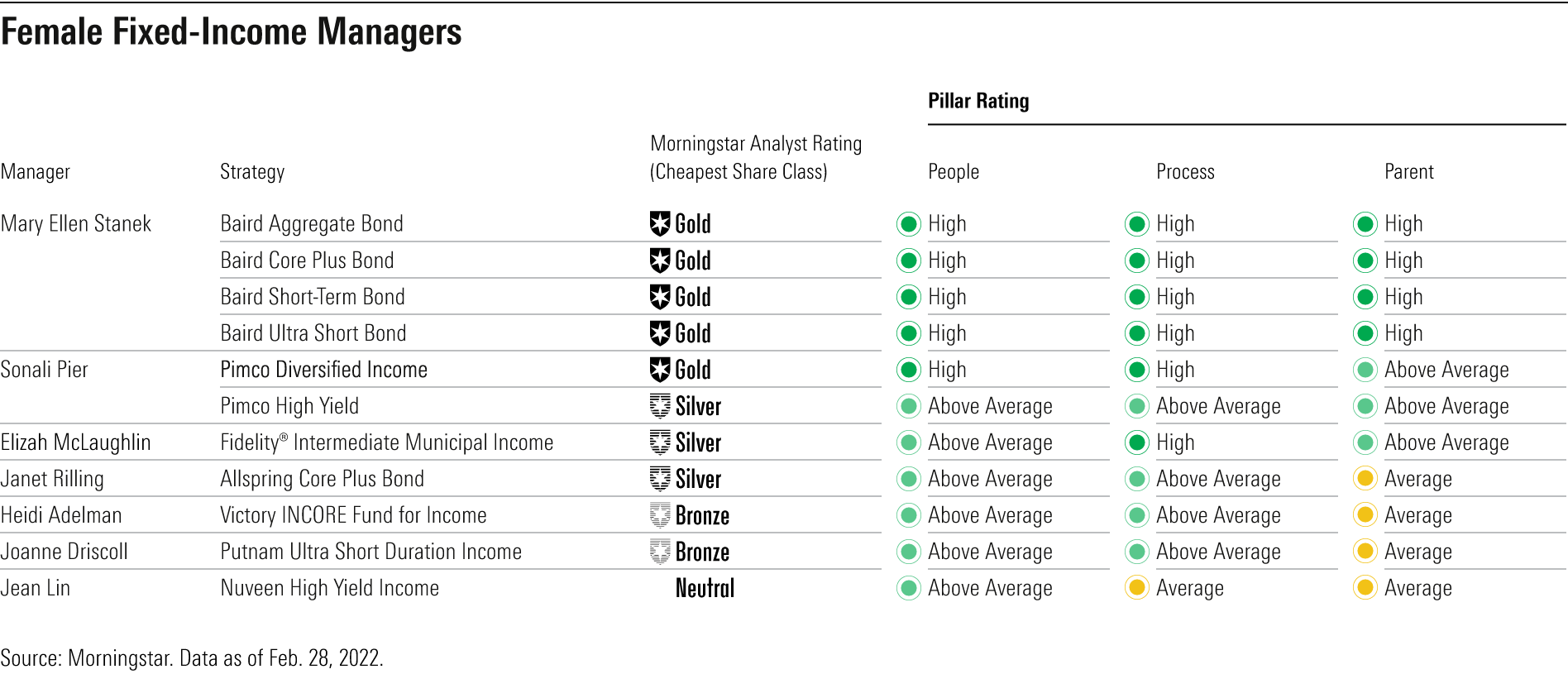

In honor of International Women’s Day, we highlight the 31 female lead portfolio managers and teams of women managers that earn the coveted High or Above Average People Pillar ratings from Morningstar analysts in the United States. Last year, we spotlighted the 27 female managers who earned those grades. Star portfolio managers like Ramona Persaud, Sonali Pier, and Michelle Black are just a few of the women who have spearheaded their respective funds and have led investors to financial success under their leadership. Below we showcase those three exceptional women.

Ramona Persaud, Fidelity

Ramona Persaud has built an impressive career at Fidelity and demonstrated her skill as a diversified value-oriented manager. She never rests on her laurels; instead, her drive to improve paired with the analytical rigor she applies to her process have led to continued excellence.

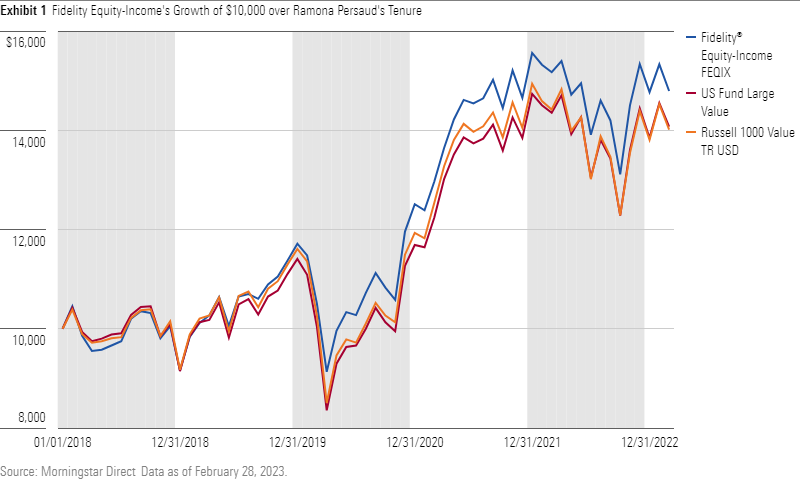

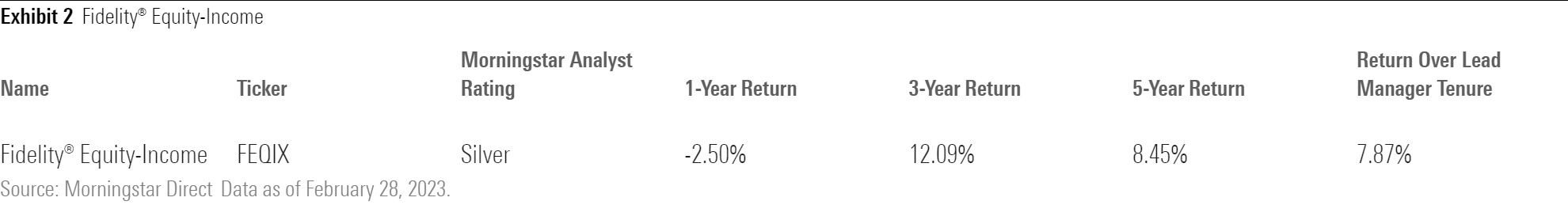

Over her tenure on both Fidelity Equity-Income FEQIX (which earns a Morningstar Analyst Rating of Silver) and Fidelity Global Equity Income FGILX (Analyst Rating of Bronze), her methodical approach has delivered relatively smooth rides and steady income to investors. She deftly makes excellent stock picks and isn’t afraid to embrace out-of-benchmark stocks. Though her tenure on Fidelity Equity-Income dates back to 2011, she became the lead more recently in early 2018. Since taking the wheel, she has astutely navigated her mandate and delivered high total and risk-adjusted returns compared with the fund’s large-value category peers and benchmark (Russell 1000 Value Index).

Sonali Pier, Pimco

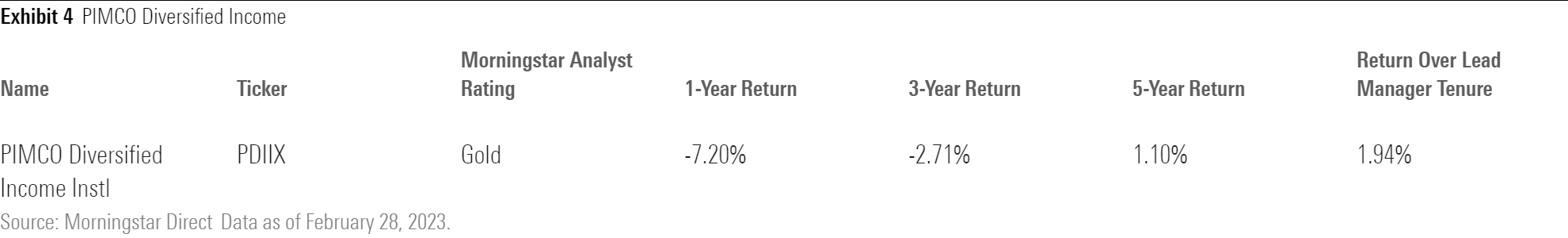

Sonali Pier has demonstrated her sharp analytical eye and willingness to think beyond the norms. That has allowed her to quickly rise to a leadership position at bond giant Pimco, where climbing the ranks is particularly competitive. Her ability to become an influential stakeholder at the firm and deliver strong performance on Gold-rated Pimco Diversified Income PDIIX supported her winning Morningstar’s Rising Star award in 2021.

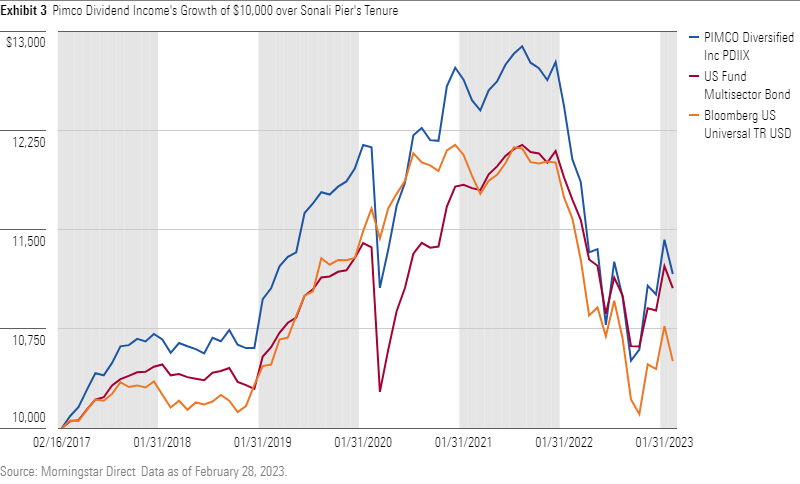

Pier was named manager of Pimco Diversified Income in February 2017, after working at the firm for four years, and manager of Silver-rated Pimco High Yield PHIYX in 2019. She sits on the firm’s executive committee and previously served as a rotating member of the investment committee, demonstrating her valued voice and continued impact on the firm, particularly within the multisector credit group. Despite Pimco Diversified Income’s leniency to take risk, she paves a contrarian path that demonstrates she is able to take less risk without sacrificing returns. Her results speak for themselves. Over her tenure from February 2017 to February 2023, the fund’s annualized and risk-adjusted returns top both its multisector bond category peers and benchmark (Bloomberg US Universal Index).

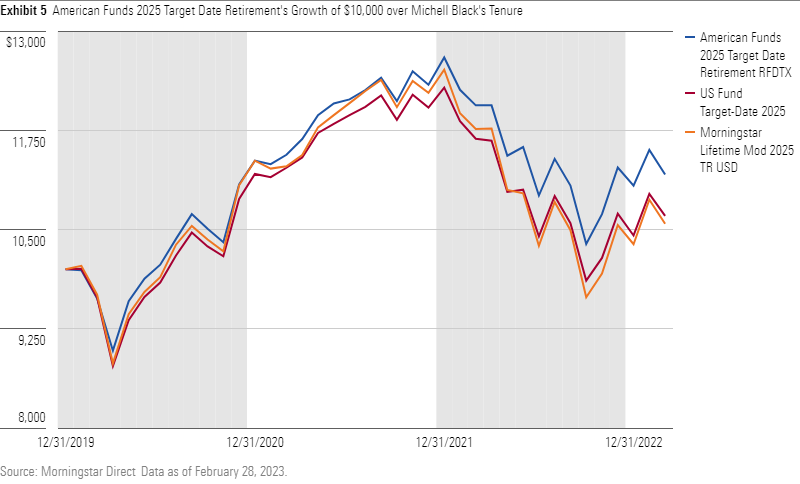

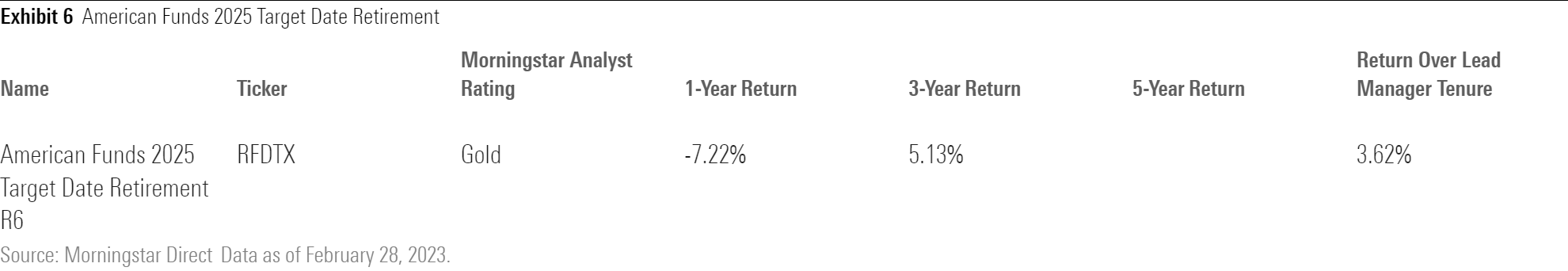

Michelle Black, American Funds

Michelle Black serves as the principal investment officer on the American Funds Target Retirement series, and her impact has kept it a step ahead in the highly competitive target-date landscape. She has chaired the firm’s target-date solutions committee since its formation in January 2020. Prior to that, she oversaw asset allocation for the firm’s private high-net-worth clients. Her experience building portfolios for a variety of client needs lends itself well to leading the research underpinning this series across the glide path.

Since she joined the team, it has finally struck the right balance between the firm’s renowned bottom-up security selection and top-down asset-allocation research, which has led to sensible changes over the past two years. The series now makes more use of its underlying funds’ flexibility to allocate across geographies and sectors. That plays squarely into the firm’s strengths and should benefit target-date investors over the long term.

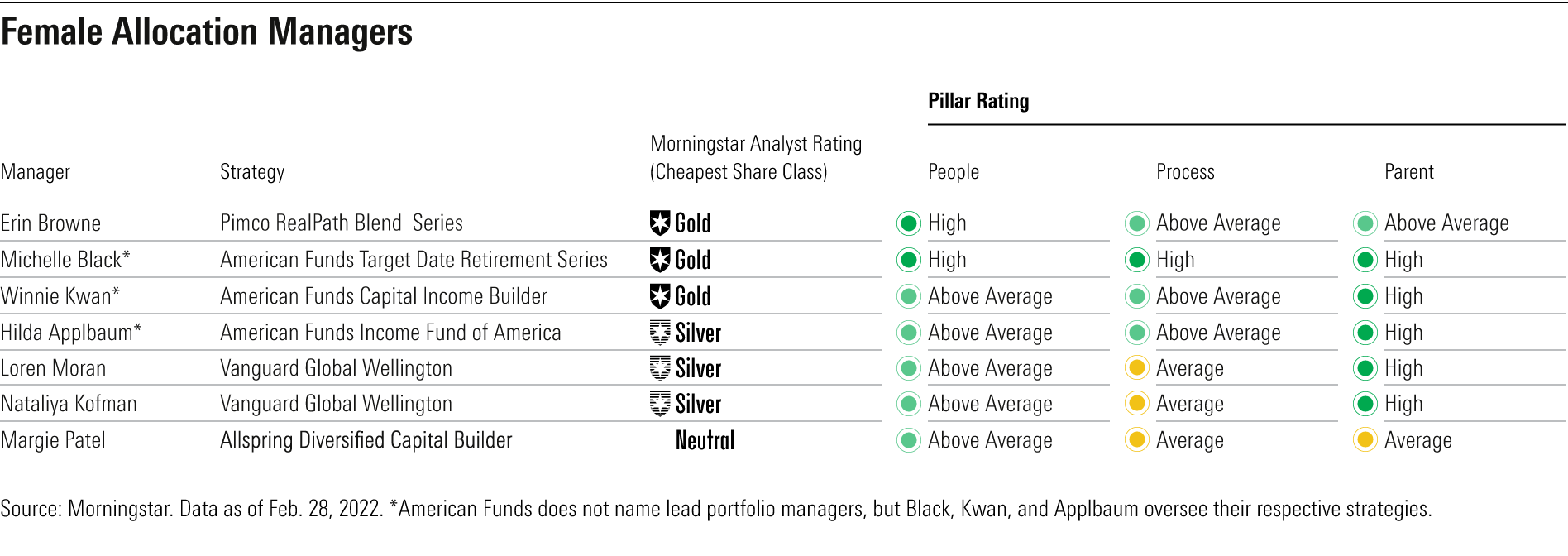

Morningstar’s Top Female Managers of 2023

These are just a few of the excellent female portfolio managers under our coverage. Below we list the sole lead female or team of women managers across the U.S. that earn Above Average or High People Pillar ratings, indicating Morningstar analysts’ confidence in the portfolio management team and the strategy. Each of these women’s Morningstar Medalist funds deserves a spot on investors’ watchlists.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a659ddb3-1d6f-4405-a4c4-9c325330c2da.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a659ddb3-1d6f-4405-a4c4-9c325330c2da.jpg)