Markets Brief: What to Watch in the February Jobs Report

Forecasts call for continued strong hiring, but investors should keep an eye on any revisions in the data.

On the heels of the surprising strength in the January reading on the jobs market, the key question for the Federal Reserve and investors is whether that strength will continue with the February jobs report.

When it comes to forecasts for the February jobs report, the answer is: For the most part, yes. Another blowout surge in hiring isn’t predicted, but the underlying trend of strength in the labor market is expected to continue.

The January report, which showed the U.S. economy created 517,000 new jobs during the month, surprised the markets and led investors to expect the Fed to keep rates higher for longer. The market’s current expectations for rate hikes center around the Fed raising its benchmark rate up to a range of 5.25%-5.00% by June and keeping it elevated through the rest of the year.

That leaves investors wondering: When will jobs growth start to really slow down?

That’s “the critical question,” says Eric Winograd, senior economist and strategist at AllianceBernstein. “Until the pace of hiring slows significantly, the Fed won’t be able to think about pausing rate hikes.”

Winograd’s perspective—along with that of many other economists—is that the jobs market is already proving much more resistant to the Fed’s rate hikes than had been anticipated.

“I would’ve expected to see jobs growth already slowing,” he says.

(Find the latest Morningstar outlook for the U.S. economy here.)

On March 10, the Bureau of Labor Statistics will release the February Employment Situation report. Economists are keeping a keen eye on the headline number and any data revisions for hints on the full picture of the jobs market.

February Jobs Report Forecast Consensus:

- Nonfarm payroll employment up 200,000 versus a 517,000 increase for January.

- An unemployment rate of 3.4%, unchanged from January.

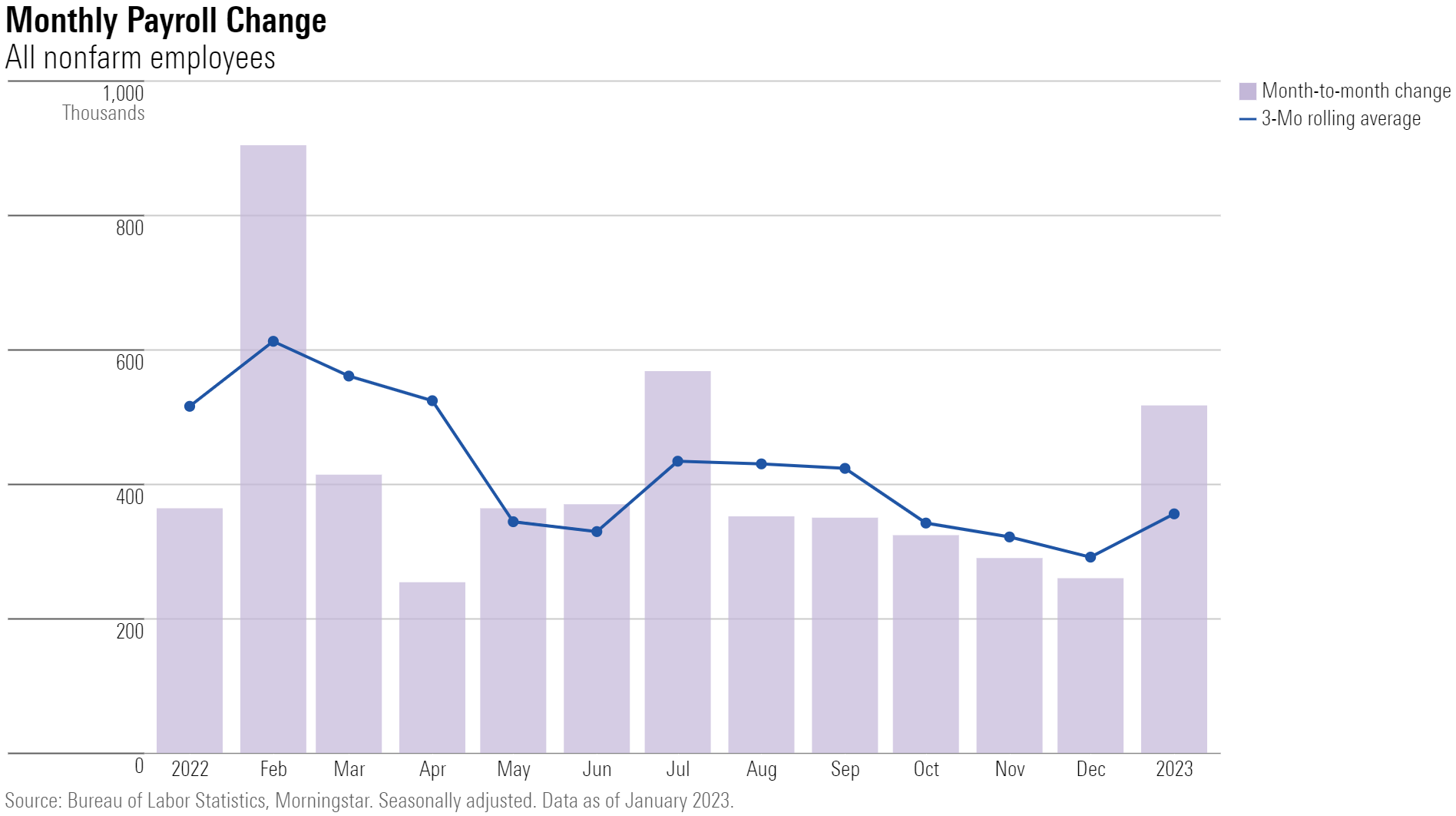

After the January jobs report showed new employment carrying on at a confoundingly strong pace, economists are expecting a slower month for job gains in February. Nonfarm payroll employment is expected to post an increase of 200,000 for February, according to FactSet’s consensus. That would follow an increase of 517,000 in January and 260,000 in December.

Forecasts call for the unemployment rate to hold steady in the February jobs report at 3.4%, its lowest level in over 50 years.

“Given what we know for February, the jobs number is almost guaranteed to be weaker than January’s gangbuster number,” says Joe LaVorgna, chief economist at SMBC Nikko Securities America. But, he says, “it could still show healthy growth.”

If jobs growth comes in stronger than expected, LaVorgna says, the market would start to fully price in an additional rate hike beyond the three which are already expected for March, May, and June. “A stronger-than-expected jobs report will likely push the market to thinking the Fed will raise rates again in July.”

Here are some key data points to watch in the February Jobs Report:

February Payroll Change

“The path of monetary policy is highly uncertain right now,” Winograd says. “We won’t know when the Fed can stop raising rates or pivot until we get a sense of the true picture of the labor market and how that has evolved.”

Winograd doesn’t forecast monthly jobs numbers, as he’s most concerned with the direction of the overall trend. But, he says, “I think we’ll see a much slower pace of hiring reflected in the next jobs report. It will be weaker than the last.”

SMBC’s LaVorgna is forecasting nonfarm payroll employment growth of 250,000 for February, slightly higher than consensus. “I’m anticipating that sometime between now and summer we’ll see a much more noticeable slowdown in the labor market.”

Data Revisions

Economists say it’s common for January jobs data to be later revised, especially in sensitive times when a recession is looming. SMBC’s LaVorgna says that back in 2001, a payroll gain of nearly 300,000 was reported that January. “We later found out that it was all revised away,” he says.

“I’ll be interested to see if we can pick away at what was certainly a gangbuster number.”

If January’s jobs growth gets revised downward, that could show that the jobs market is already slowing, lending hope to the idea of the Fed pausing rate hikes after May.

Unemployment Rate

Unemployment has been hovering at historically low levels. In 2022, from March through December, the unemployment rate ranged between 3.4% and 3.7%

The unemployment rate could fall even further, LaVorgna notes, if February payroll numbers turn out strong, but his forecast is for the number to come in at 3.4%, unchanged from January and in line with consensus expectations.

“The unemployment rate is a measurement fraught with difficulties,” LaVorgna says. “But since the Fed focuses on it, investors will too.”

Events Scheduled for the Coming Week Include:

- Tuesday: Dick’s Sporting Goods DKS and CrowdStrike CRWD report earnings.

- Wednesday: Adidas ADDYY reports earnings.

- Thursday: Gap GPS, Oracle ORCL, and DocuSign DOCU report earnings.

- Friday: February Jobs report.

For the Trading Week Ended March 3:

- The Morningstar US Market Index rose 1.96%.

- The best-performing sectors were basic materials, up 4.50%, and technology, up 3.00%.

- The worst-performing sector was utilities, down 0.79%.

- Yields on 10-year U.S. Treasuries inched up to 3.97% from 3.94%.

- West Texas Intermediate crude prices rose 4.40% to $79.68 per barrel.

- Of the 843 U.S.-listed companies covered by Morningstar, 606, or 72%, were up, and 237, or 28%, declined.

What Stocks Are Up?

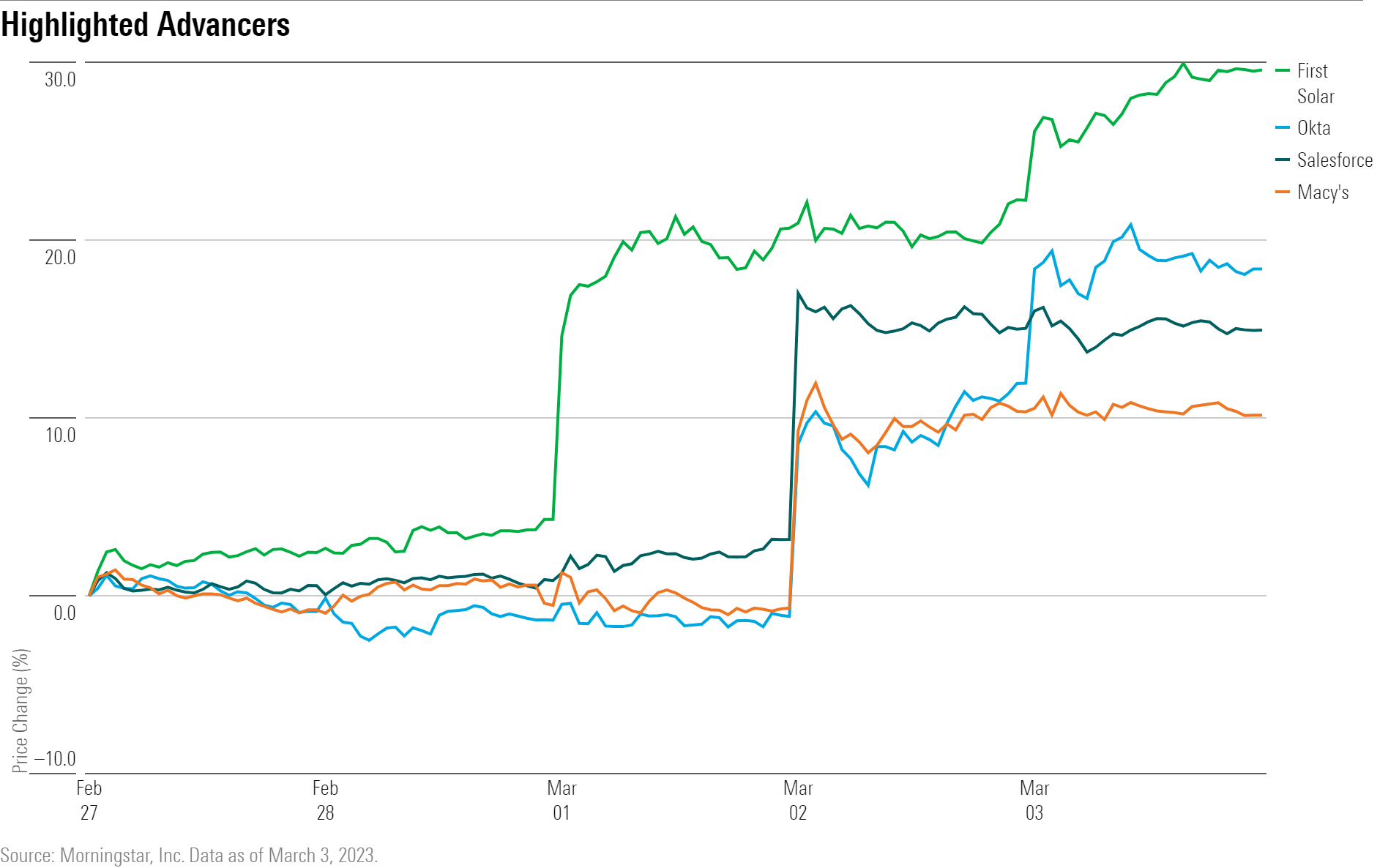

Renewable energy firm First Solar FSLR stock surged after the company announced strong fourth-quarter earnings results. The company reported a loss per share of $0.07, better than the FactSet consensus estimate of a $0.17 loss per share. The company’s bookings also impressed “with 12 gigawatts booked since its last earnings call, bringing the company’s backlog to an unprecedented nearly 68 gigawatts. First Solar’s capacity is sold out through 2025 and nearly half sold in 2026-2028,” says Brett Castelli, Morningstar equity analyst.

Castelli now values the firm at $174 per share, up from $152 after incorporating the results into his model.

Shares of Okta OKTA rallied after the firm posted a better-than-expected profitability outlook for its fiscal 2024 year. The company set guidance for full-year earnings per share in 2024 between $0.74 and $0.79, exceeding FactSet estimates of $0.37. Morningstar equity analyst Malik Ahmed Khan updated his fair value estimate for Okta to $76 from $71.

Salesforce’s CRM stock jumped after posting earnings per share of $1.68, beating estimates of $1.36. Revenue also came in higher at $8.38 billion versus estimates of $7.99 billion.

“We were most impressed by Salesforce’s profitability, where the firm achieved a non-GAAP operating margin of 29.2%, versus 15.0% last year and our near-consensus estimate of 21.8%. Management previously guided for 25% margins in fiscal 2026, but now believes it will achieve 27% in fiscal 2024,” says Dan Romanoff, senior equity analyst at Morningstar. Romanoff raised his fair value estimate to $245 from $220 following results.

Macy’s M stock rallied after it posted earnings per share of $1.88, beating estimates of $1.58. While sales were in line with expectations, Morningstar senior equity analyst David Swartz acknowledges this as a positive, given the “excess inventories across the apparel retail industry and softening consumer spending amid high inflation.”

What Stocks Are Down?

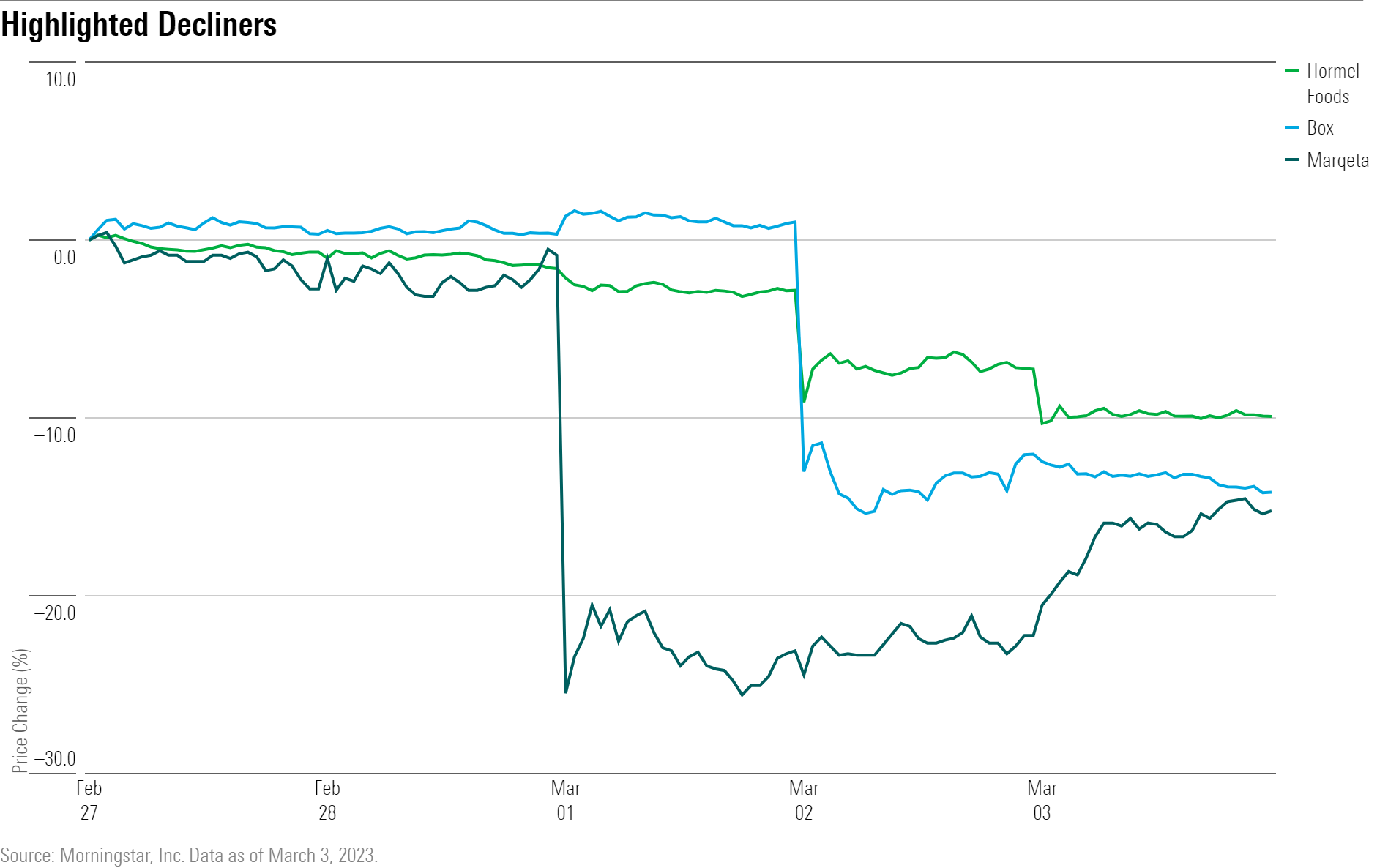

Marqeta MQ, a card-issuing technology platform, fell as the firm gave lower-than-expected gross profit growth guidance of 14% to 16% in 2023. Morningstar equity analyst Michael Miller attributes this to a number of headwinds to the firm’s margins, which include lower prices in client contract renewals.

Furthermore, “Marqeta remains deeply reliant on revenue from Block SQ, which accounted for 71% of total revenue in 2022. With Marqeta’s contracts with Block coming up for renewal in 2024, this overconcentration is a major risk point for the firm.” Miller reduced his fair value estimate to $10 per share from $12.50 after adjusting his model.

A disappointing outlook led to a drop in Box’s BOX stock as the cloud storage company set fiscal 2024 revenue guidance at $1.05 billion to $1.06 billion, undercutting analyst expectations of $1.098 billion, according to data from FactSet.

Hormel Foods HRL declined as the firm reported a number of disappointing metrics for its fiscal 2023 first quarter. “Sales fell 2% on a nearly 12% drop in volumes, gross margin contracted 100 basis points to 16.7%, and operating margin shrank 80 basis points to 9.7%,” says Erin Lash, Morningstar’s director of equity research, consumer.

Lash says one of the more troubling notes from the company’s results was the business failing to respond to changing demand, leading to production exceeding demand in various product categories. The company’s management also cut its full 2023 year EPS outlook to $1.70 to $1.82, from $1.83 to $1.93.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)