Women Make Progress on Corporate Boards, but C-Suite Gains Are Scant

Stocks perform better in the long term when their companies’ boards and management include more women.

Women have made good progress in corporate board membership, thanks to mounting shareholder and regulatory pressure. But in the C-suite, gains are scant, according to Morningstar’s Executive Insight Data.

At the end of 2022, some 28% of Russell 3000 board members were women, up from 16% in 2017. For the largest 100 companies, female board-member representation reached 33%, up from 24% in 2017, according to annual tracking by the 50/50 Women on Boards campaign.

C-Suites Are a Long Way From Gender Parity

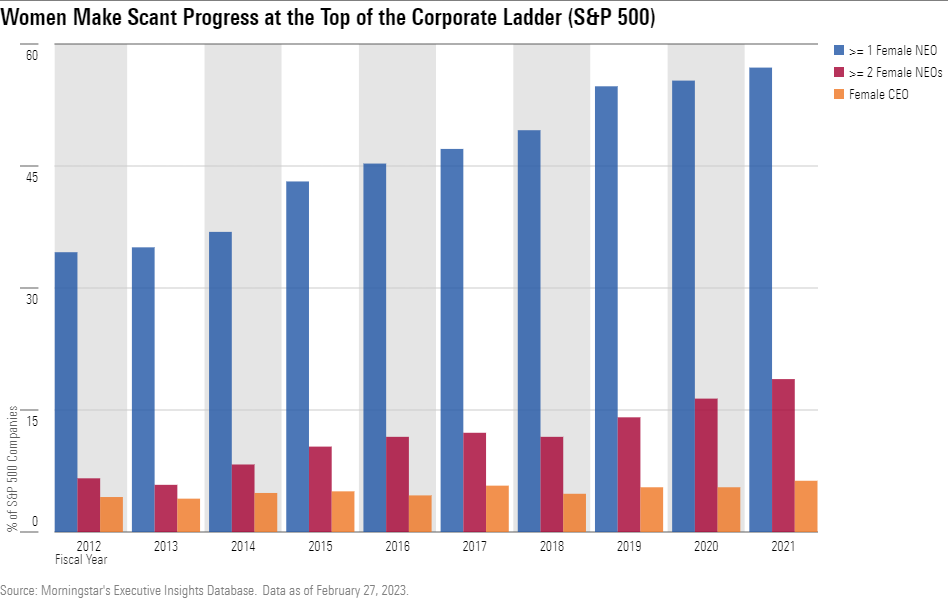

Progress on gender representation in the C-suite has been far less impressive. In 2021, women made up 15% of all S&P 500 named executive officers—these being the CEO, the CFO, and at least three other highest compensated executives. Women’s share of NEO positions grew just 6 percentage points over 10 years. That rate shows no sign of accelerating and will not deliver gender parity until well into the second half of this century.

For investors this will have repercussions, as over the longer term, better stock price performance and value-creation strategies are associated with greater female representation on boards and management teams. For 43% of the largest companies in the United States, the topmost layer in the corporate hierarchy is all male. This is an improvement from 66% all-male NEO teams in 2012. But companies have been slow to add a second woman to their top ranks, our data shows

Female CEOs remain an extreme rarity: Just 6.3% of all S&P 500 companies were led by a woman at the close of fiscal 2021—barely 2 percentage points higher than 10 years ago.

In the C-Suite, Women Earn Just $0.82 for Every Dollar Earned by Men

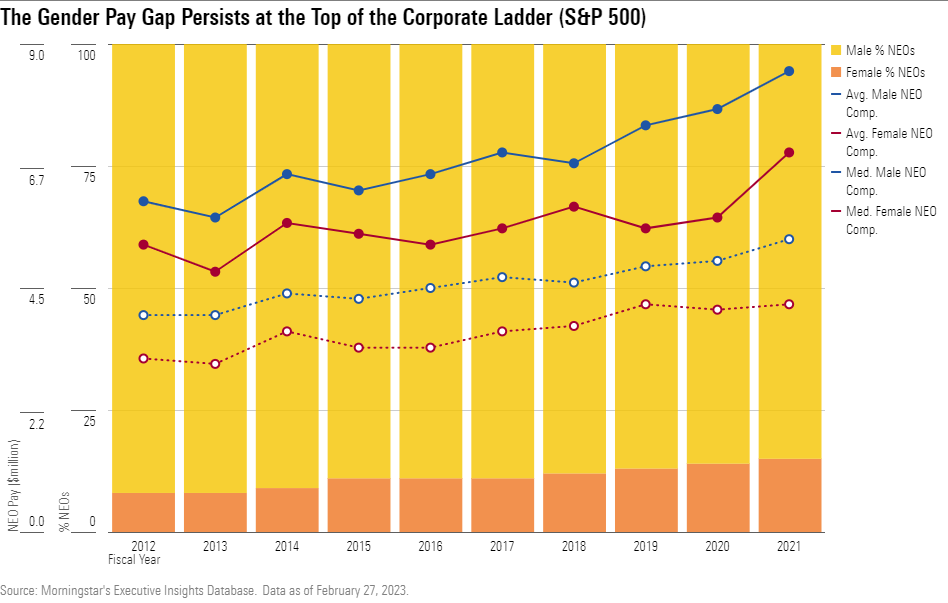

C-suite gender pay differentials have proved similarly intractable: During fiscal 2021, women earned $0.82 for every dollar earned by men in top corporate roles, according to NEO compensation data reported by companies in 2022. Of course, women are disproportionately absent from the top-paying CEO roles. However, even among non-CEO NEOs, women earned just $0.91 of what men earned in 2021.

This gender pay disparity, compounded by the representation gap, drove $18 billion more into men’s pay packages than women’s in the most recent fiscal year for which full compensation data has been reported. Over the 10 years of the study, the cumulative S&P 500 NEO gender-based difference amounts to about $152 billion.

The numbers also show that both men and women in the C-suite—CEOs in particular—have enjoyed substantial pay growth, far outpacing workers’ earnings and the performance of the broader economy. That exacerbates the society-wide gender-based economic imbalance. In 2021, average S&P 500 CEO pay grew 21.5%. During that time, workers’ real average hourly income fell.

Investors Lose When Women Are Underrepresented in Corporate Leadership

Besides the real implications for societal inequality, C-suite gender gaps also challenge corporate commitments to create more equitable workplaces because they indicate persistent obstacles to the advancement of women in the workplace. According to McKinsey’s annual Women in the Workplace survey, women are less represented further and further up the corporate ladder, largely due to difficulties they face landing early-career promotions into higher-paying jobs—which the report calls the “broken rung”—as well as other headwinds they face in the workplace and outside. Importantly, the survey finds that women are no less likely to aspire to more-senior positions.

Yet, research suggests that women may bring a longer-term view to business leadership. This benefits investors and other stakeholders, because many of the most important challenges facing business are of a long-term nature. It’s over the long term that value is created in firms and markets.

Morningstar research conducted in 2021 shows stronger longer-term stock price performance and lower risk among the few U.K. companies that have greater than 50% female representation on boards and management teams. By contrast, the stock performance of all-male board and management teams appeared to be the most volatile over a three-year period. Similarly, Harvard researchers tracked appointments and found that when women join the C-suite, they catalyze a shift in corporate thinking that may support new longer-term, internally cultivated value-creation strategies. For example, management teams become more likely to focus on R&D versus M&A and more open to change, yet less open to risk.

A particularly pressing long-term challenge for businesses is building climate resilience into corporate strategy. PwC’s 2022 board member survey found that 66% of female directors agree with prioritizing climate action, even if it affects short-term financial performance, whereas 45% of male directors endorsed this position. Evidence presented in two recent academic studies (Al-Najja & Salama, November 2022 and Altunbas et al, 2022) shows that having more women in senior leadership roles translates into better corporate environmental performance.

Resolutions coming to vote over the past several proxy seasons asking boards to set policies and targets on board diversity have regularly earned majority shareholder support and spurred meaningful engagements. Investors have also supported mandating better reporting on diversity.

U.S. corporate C-suites have a long way to go to gender parity, but investors have the power, and good reason, to accelerate this change.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)