Shareholders Demand Accountability on Gender Equity. It’s Good Management.

Gender-related resolutions jumped 46% in the 2022 proxy season. Key themes were harassment and reproductive rights.

As we mark International Women’s Day, asset managers have been pushing companies to move the needle on gender-equity issues. Even as women worldwide have made great strides toward gender equity and empowerment, there is still a gap between women’s and men’s earnings, participation in the workforce, and overall workplace experience. Thus, asset managers have been prioritizing gender equity as a key theme in their stewardship of client investments.

Companies Focused on Women’s Inclusion Are Seen as Better-Run

Mostly, asset managers regard gender equity as good management. “Diversity, equity, and inclusion is very much a key theme on which asset managers are seeking better disclosure and improvement in practices on the part of their investee companies,” says Lindsey Stewart, director of investment stewardship research at Morningstar. “Actions that advance women’s inclusion and reduce gender-based discrimination are a core part of this. Asset managers clearly see gender equity as a societal good, but also a key governance indicator: Companies that are conscientious on women’s inclusion are perceived as more likely to be well-run businesses.”

Resolutions submitted by company shareholders, rather than management, at annual meetings show how investors are responding to environmental, social, and governance themes like this one. Morningstar’s in-depth analysis of U.S. companies shows that in the 2022 proxy-voting year, the number of environmental and social resolutions jumped 60%. (A proxy-voting year represents the 12 months to June 30, as most shareholder meetings are held in the first half of the calendar year.) There were 273 such proposals in 2022, versus 171 the previous year.

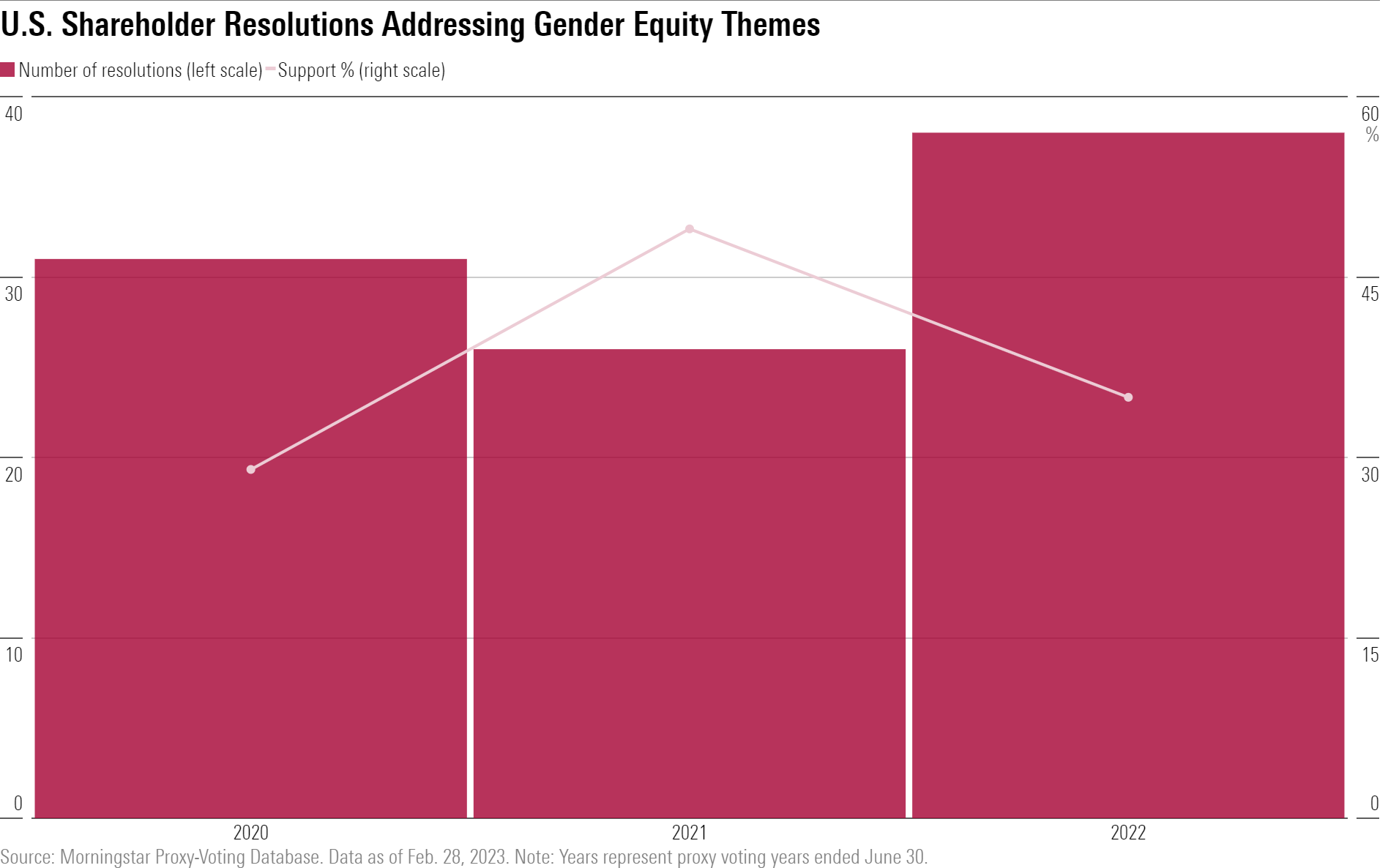

Resolutions on issues affecting women in the workplace reflected this trend. These issues included disclosing the gender breakdown of companies’ workforce and leadership, pay fairness, reproductive rights, and countering harassment and discrimination. The proposals generally requested greater transparency into how, and how equitably, companies are addressing these issues. There were 38 such resolutions in the 2022 proxy year as the chart below shows, a 46% increase from 2021.

Solid Support for Gender-Related Resolutions

The level of support for resolutions addressing themes around women’s equity has been solid. As a general rule, U.S. shareholder resolutions with more than 30% support are considered a strong prompt for management action. Average support levels for resolutions addressing gender-equity themes has consistently been at or above this level in the past three proxy years. However, the average has fluctuated. A sharp increase in 2021 to 49%, a year when support for resolutions on many ESG themes hit a high, was followed by a fall to a still-significant 35% in 2022. The drop reflected a wider pullback in support for shareholder resolutions on environmental and social topics by asset managers in the most recent year. (Some asset managers considered many of the resolutions filed amid 2022′s increased volume of proposals to be unduly prescriptive or repetitive of prior asks of companies.)

Increased Focus on Harassment and Discrimination, Reproductive Rights

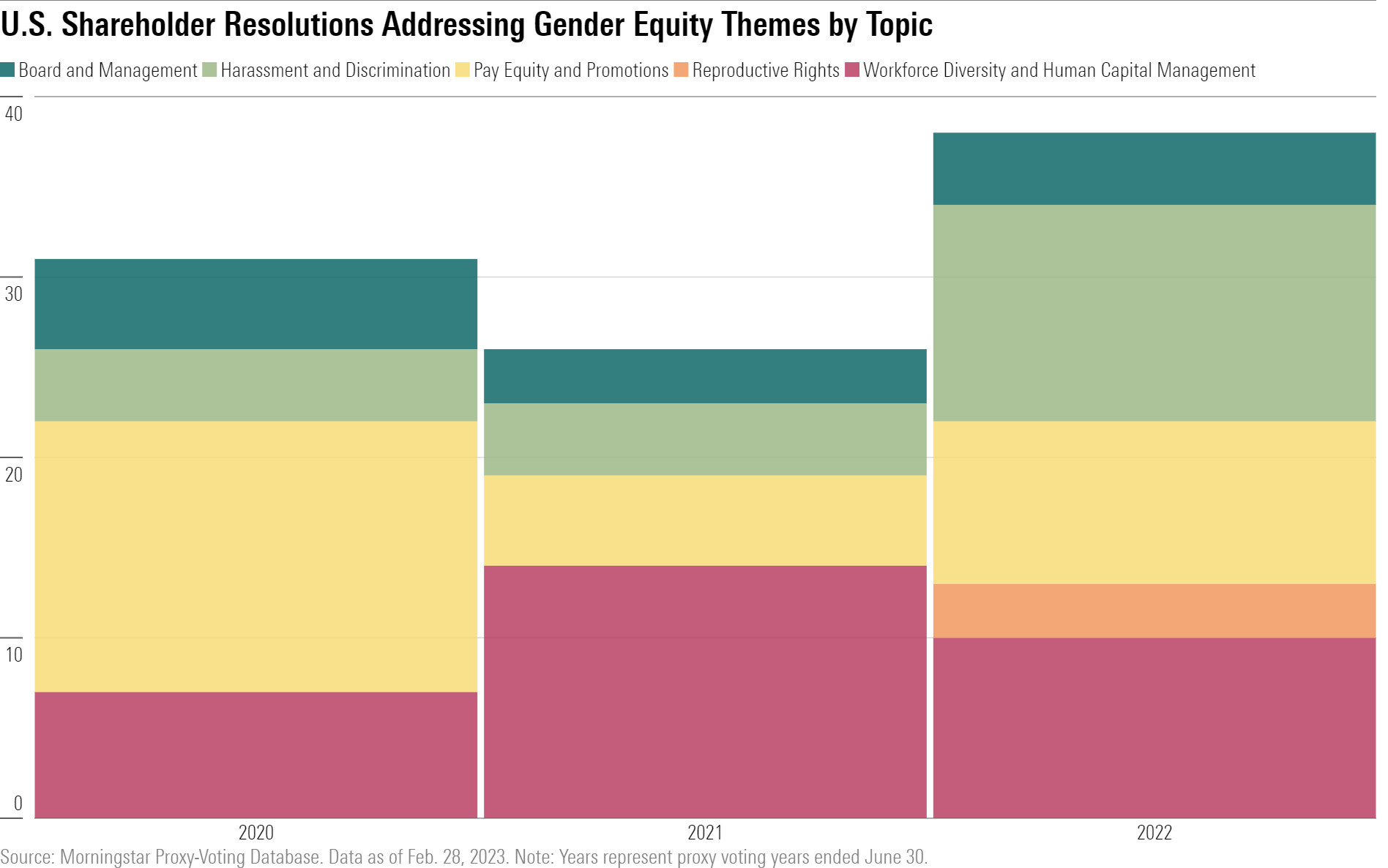

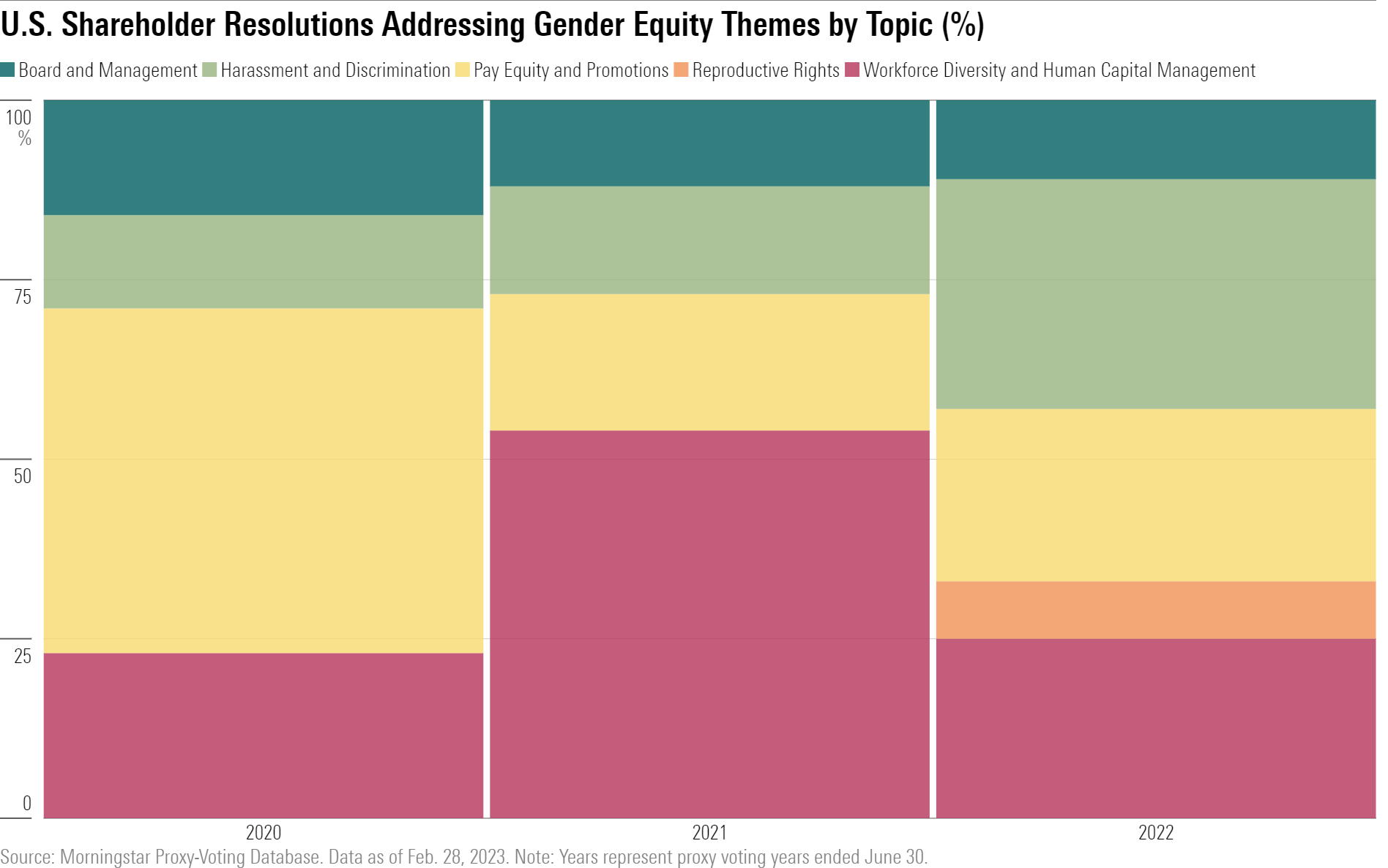

Over the past three years, the themes addressed by these proposals have expanded. In the 2020 proxy year, the bulk of resolutions focused on human capital management, including practices around pay equity and promotions, alongside requests for disclosure on how gender inclusion was being considered both at board level and within the wider workforce.

By 2022, things had shifted. Proposals requesting disclosure regarding company policies and actions on harassment and discrimination increased from 15% of proposals in 2021 to 32% in 2022, making them the most common such theme that year. Additionally, reproductive rights entered the agenda for the first time following the U.S. Supreme Court’s decision to overturn Roe v. Wade. Shareholder proposals requesting reports on the impact of this decision were filed at three companies: Walmart WMT, Lowe’s LOW, and TJX Companies TJX. Shareholders requested reports detailing any risks and costs associated with newly enacted legislation, as well as how these companies planned to mitigate those risks and costs. All three proposals received 30% or more support from those companies’ independent shareholders.

Looking Forward: Gender Equity Takes a Front Seat

The increase in shareholder resolutions addressing gender equity and continued significant support for them clearly demonstrate demand among investors for companies to improve transparency into their workplace practices that most affect women. Shareholders want to know what kinds of working environments they’re investing in and how companies are responding to shifting legislation, culture, and feedback from shareholders themselves. With a new proxy-voting season starting, we’re likely to see even more action on this crucial topic in the future.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/s3.amazonaws.com/arc-authors/morningstar/90dd7e65-5786-4175-a9e7-b6e413f68ca3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/90dd7e65-5786-4175-a9e7-b6e413f68ca3.jpg)