How Are U.S. Asset Managers Voting on Corporate Political Activity?

Investors need transparency from managers to make informed decisions on how to invest their values.

Sustainable investing has become a political matter in the United States. Specifically, asset managers are taking a hard look at corporate lobbying practices and political spending as part of their role as stewards of investors’ capital, and they are voting on a range of related proposals during the proxy season.

Already, there is broad recognition of the need for this kind of study, with regard to climate change and companies’ net-zero strategy. As a recent analysis by the London School of Economics and Political Science highlights: “There is growing scrutiny of the alignment of corporate lobbying practices with the statements companies make on how they will act on climate change.”

Investors Need Transparency to Invest Their Values

But more and more, investors also require greater transparency on corporate political activity across a range of environmental and social issues in order to make informed decisions on how to allocate their capital in line with their values. This places a responsibility on asset managers to ensure that companies’ lobbying practices align with their statements on sustainability.

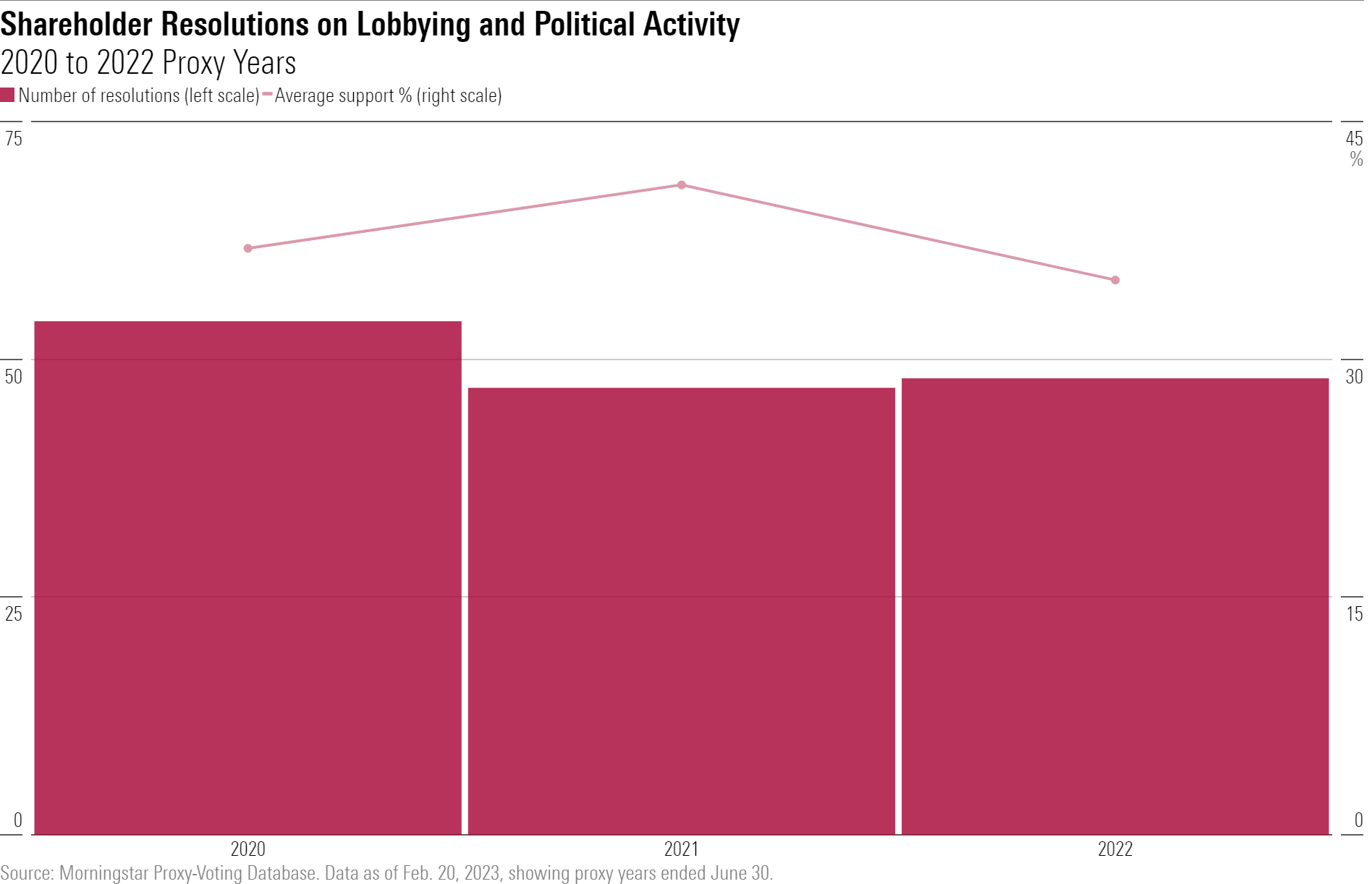

A steady stream of shareholder resolutions at U.S. companies requesting greater transparency on lobbying and political activity over recent years illustrates the level of interest in this topic. In our latest research paper, we take a closer look at all U.S. shareholder resolutions on lobbying and political activity over the last three proxy years, assessing how the top 10 U.S. asset managers are voting on this topic generally and with respect to climate matters. According to Morningstar’s proxy-voting database, there were 149 shareholder resolutions addressing U.S. companies’ lobbying and political activity in the last three proxy years (which end on June 30 to align with most companies’ shareholder meeting calendars). There were 54 such resolutions in 2020, 47 in 2021, and 48 in 2022.

Resolutions on this topic generally request greater transparency on lobbying activities and political spending and are usually quite well supported. Company management is generally expected to respond to shareholder resolutions that gain 30% support, and average support for shareholder resolutions on lobbying and political activity tends to exceed this threshold.

On average, these resolutions gained 38% of the shareholder vote, peaking at 41% in the 2021 proxy year. Average support fell slightly in 2022 to 35%, in line with a general trend of lower support for shareholder resolutions seen by some managers as either highly prescriptive or duplicative of ongoing efforts by companies.

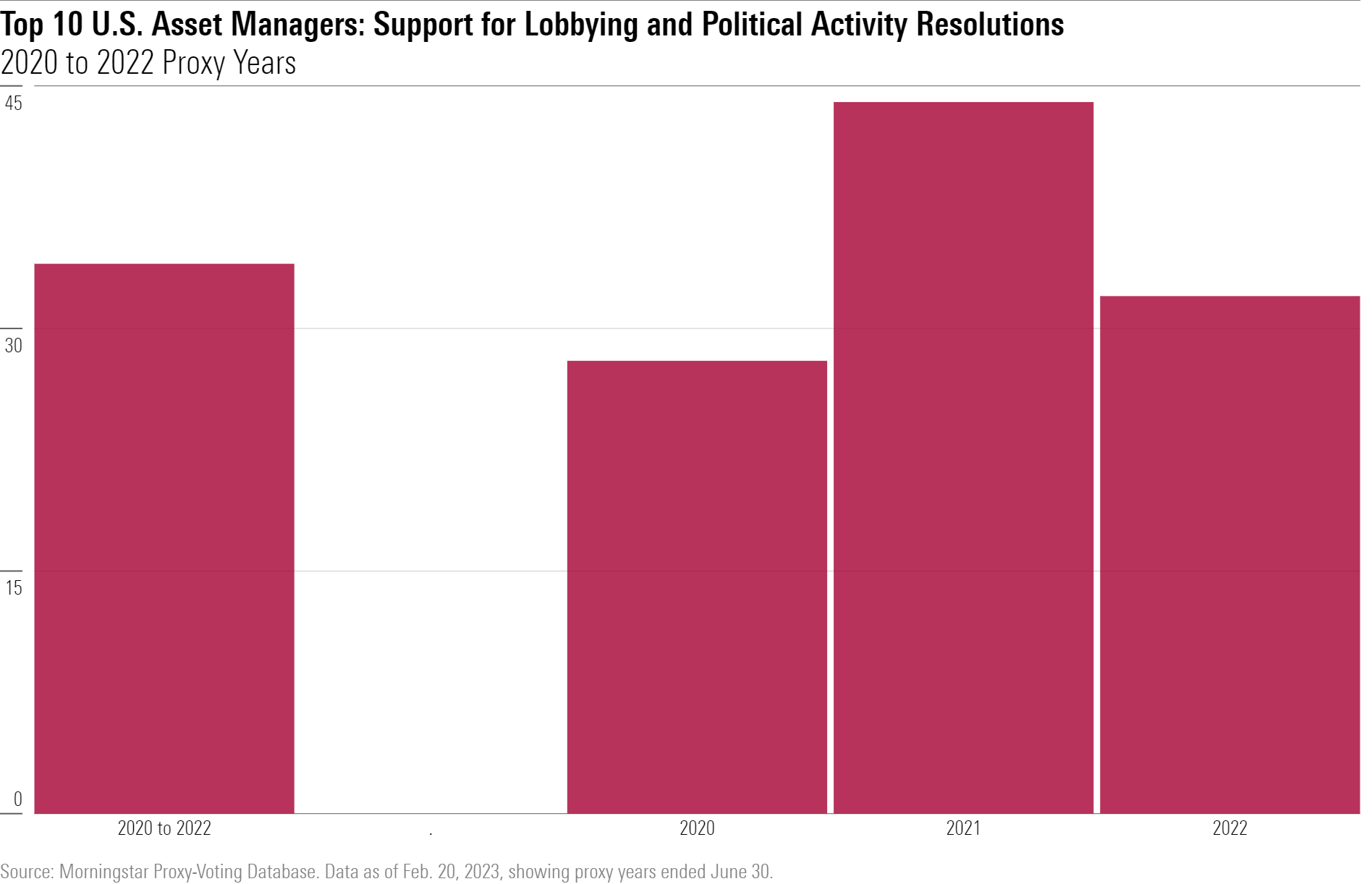

We reviewed the voting record of the top 10 U.S. asset managers by fund assets on the 149 lobbying and political activity resolutions. The managers are Vanguard, BlackRock, Fidelity Investments, Capital Group, State Street Global Advisors, T. Rowe Price, Invesco, J.P. Morgan Asset Management, Dimensional Fund Advisors, and Franklin Templeton Investments.

Top U.S. Managers Support Transparency on Lobbying

Overall, the top 10 U.S. managers cast 34% of their fund votes in support of resolutions on lobbying and political activity over the last three proxy years. This is slightly lower than the 38% overall shareholder support for these resolutions mentioned earlier. The average for the top 10 is pulled slightly downward by the lower level of support for these resolutions by the top two managers: Vanguard and BlackRock.

Vanguard and BlackRock accounted for more than one third of the 32,000 votes in Morningstar’s database on the topic over the last three proxy years. Both managers cast less than 20% of their votes in support of these resolutions over the period, generally believing that the investee companies’ existing actions and disclosures, or their ongoing efforts, on the topic were sufficient. Where they have supported such resolutions, the two firms often state that the proposal is in shareholders’ long-term best interest and not overly prescriptive.

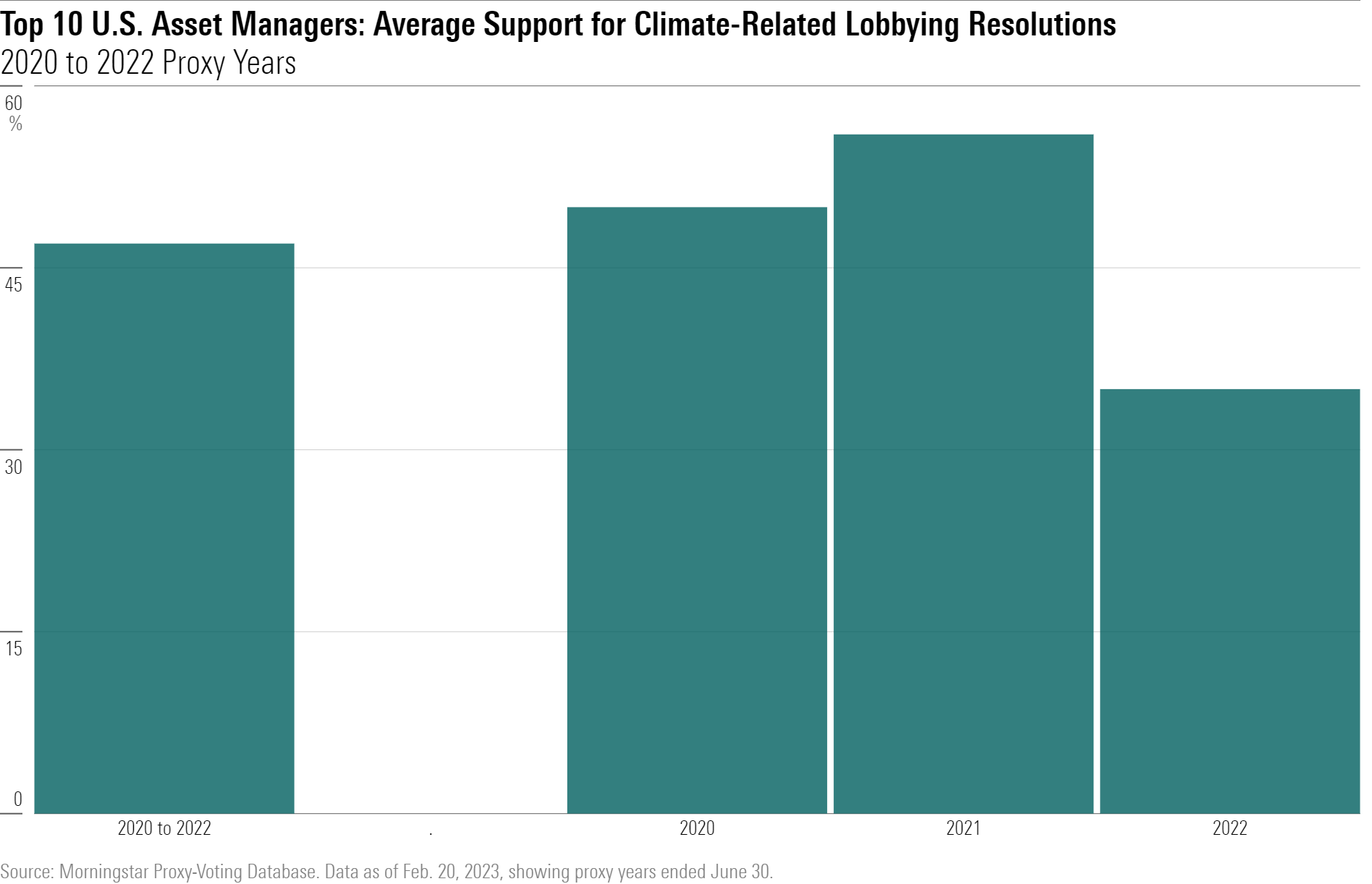

Our paper also takes a closer look at resolutions on climate-related lobbying, amid increasing investor expectations that companies’ lobbying on greenhouse gas emissions reduction should reflect the Paris Agreement’s ambition to limit global warming to less than 1.5 degrees Celsius.

BlackRock’s Support for Climate Lobbying Proposals Declines

The top 10 U.S. asset managers showed considerably stronger support for climate-related lobbying resolutions compared with those on lobbying and political activity more broadly. As shown in the chart below, the 10 firms cast 47% of their fund votes in support of the 12 resolutions on climate-related lobbying in the last three proxy years. However, their support fell to 35% for the three such resolutions in the 2022 proxy year amid a pushback on highly prescriptive proposals. In particular, BlackRock—which supported none of the three such resolutions in 2022—called out proposals “directing climate lobbying activities, policy positions or political spending.”

In Europe, Asset Managers Wholeheartedly Support Climate-Lobbying Resolutions

On resolutions involving climate matters, European asset managers often demand more of companies than U.S. managers. Climate-related lobbying appears to be no exception. The top 10 U.S. managers’ support for the 12 resolutions on climate-related lobbying is considerably lower than that of their European peers.

We selected eight large European asset managers who publicly disclose their voting decisions and analyzed their votes on these 12 resolutions: Abrdn, Allianz Global Investors, AXA Investment Managers, BNP Paribas Asset Management, Fidelity International, Legal & General Investment Management, Schroders, and UBS Asset Management. On average, these eight managers showed over 90% support for climate-related lobbying proposals, with five managers supporting all 12 such resolutions.

Overall, our research on these votes shows that, while asset managers are broadly committed to aligning lobbying and political activity with corporate values, there is a wider range of views on how companies should demonstrate and disclose on that alignment. This means that sustainability-conscious investors will need high-quality reporting from companies and asset managers to ensure that their chosen investment approach well reflects their own values.

The 2023 proxy season is just around the corner, and investors have demonstrated over several years that they are highly engaged on a wide range of environmental and social topics. With political interest in sustainability matters having never been higher, we are sure to see more resolutions calling for increased transparency on companies’ political activity. We can only hope that such action will lead to more consistent disclosure across the board on matters of interest to shareholders where sustainability and politics intersect.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)