3 Undervalued Renewable Energy Stocks

These clean energy stocks are focused on green energy and trading at attractive valuations.

The clean energy industry is fast-growing, and it’s good for the planet—an attractive combination for investors.

So what’s the catch? With so much hype in the space, it’s not as simple as it might sound to find companies with the two-pronged attributes of being focused on green energy and trading at valuations that offer the prospects of solid long-term investor returns.

Even with passage of the Inflation Reduction Act—the largest climate and renewable energy investment in American history with over $400 billion in subsidies for clean technology—clean energy investing is difficult and complex.

Finding True Renewable Energy Stocks Is Challenging

“Pure” clean energy investing plays such as solar stocks have tended to be volatile, overpriced, and largely commoditized. On top of that, these green energy “pure-plays” make up a tiny portion of the North American market. Other big players in clean energy are giant fossil fuel companies, traditional utilities, and semiconductors. But the bulk of their businesses aren’t especially climate friendly.

“Renewable energy—particularly solar power—is going to grow by leaps and bounds over the next 20 years, no question” says Brett Castelli, clean energy equity analyst at Morningstar. “But investing in the space isn’t easy.”

“It’s not as simple as just buying any electric vehicle or renewable energy stock and expecting to make money,” he says. “The clean energy space is very competitive because there is so much growth,” Castelli says. “It’s very important to find potential companies with some kind of differentiation that are trading at the right valuations.”

When investing in renewable energy, “You have to be very careful,” says Lucas White, lead portfolio manager for Climate Change strategies at GMO. “Big picture, it’s not a simple place to invest. Lot of stories, lots of hype. It’s important to find businesses that are actually profitable and attractively valued.”

Clean Energy Stocks to Invest In

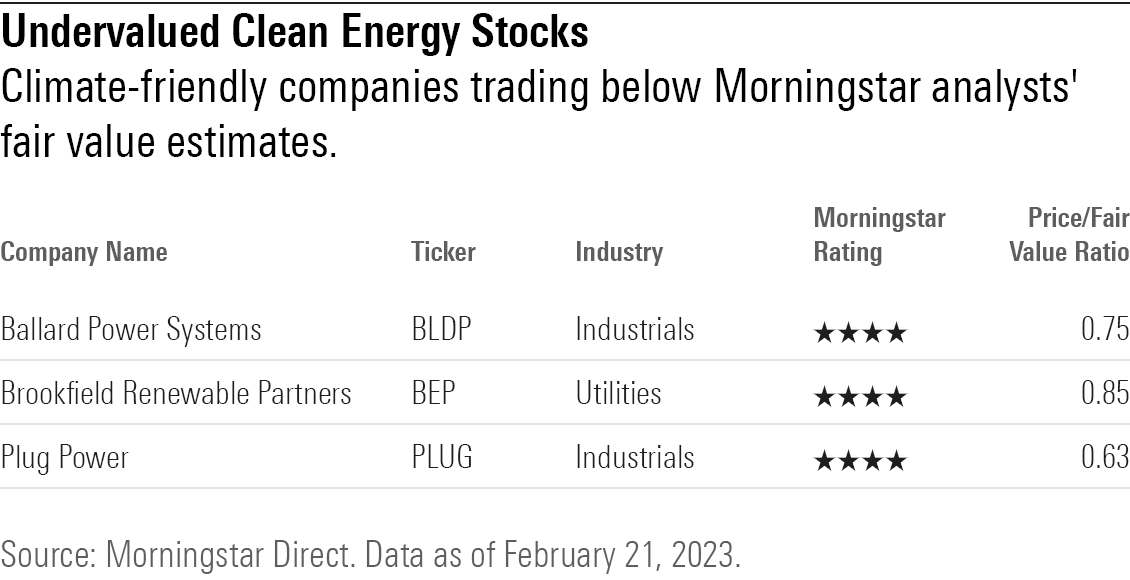

Currently, just three renewable energy stocks covered by Morningstar stock analysts are trading at especially low valuations:

(The full list of clean energy companies covered by Morningstar analysts can be found at the end of this article.)

It’s Not Easy Doing Green Investing

Renewable energy investments may be tough to find, but experts say investors who look carefully will reap the benefits.

“It’s really hard to see a world where clean energy doesn’t substantially outgrow the U.S. market over the next 10 years or so,” says GMO’s White.

Fierce competition and falling renewable energy costs are among the main reasons it’s challenging to locate good opportunities in the “pure-play” clean energy space, says Lori Keith, director of research and portfolio manager at Parnassus Investments.

“There are hundreds of these kinds of companies trying to participate, and the barriers to entry are low,” Keith says. “The vast majority are doing something that a new entrant could do pretty easily.”

“And in terms of financials, many clean energy pure-play companies are not profitably or highly levered,” she says.

In addition, Keith says, production costs for wind and solar power have plummeted, placing pressure on the industry margins and profits. “We’re seeing a long-term decline in the costs of the technology for solar- and wind-manufacturers. And prices are still getting cheaper.” Keith says that the cost of the modules that go into solar panels have come down from $3.00 in 2006 all the way to just $0.20 today, with room to fall further. Because of the intense competition in the space, profitability gets crushed: The lower costs get passed on to consumers.

As a result, Keith has shunned these so-called “pure plays” in favor of less-direct clean-energy-related investments including semiconductors, which she says will play a mission-critical role in the widespread adoption of electric vehicles.

She maintains strong faith in the long-term future of clean energy investing, saying “decarbonization is a significant and persistent theme we’ll be seeing over the coming decades.” Keith says, “Ultimately, it’s the companies that have the ability to generate strong free cash—that they can reinvest or eventually provide dividends and buybacks—that will create a lot of compelling returns for investors over the next decade.”

Renewable Energy Investing Is a Small (but Growing) Opportunity

Another factor complicating the picture for climate-minded investors is that renewable energy investing opportunities are limited compared with what’s available in the rest of the energy market.

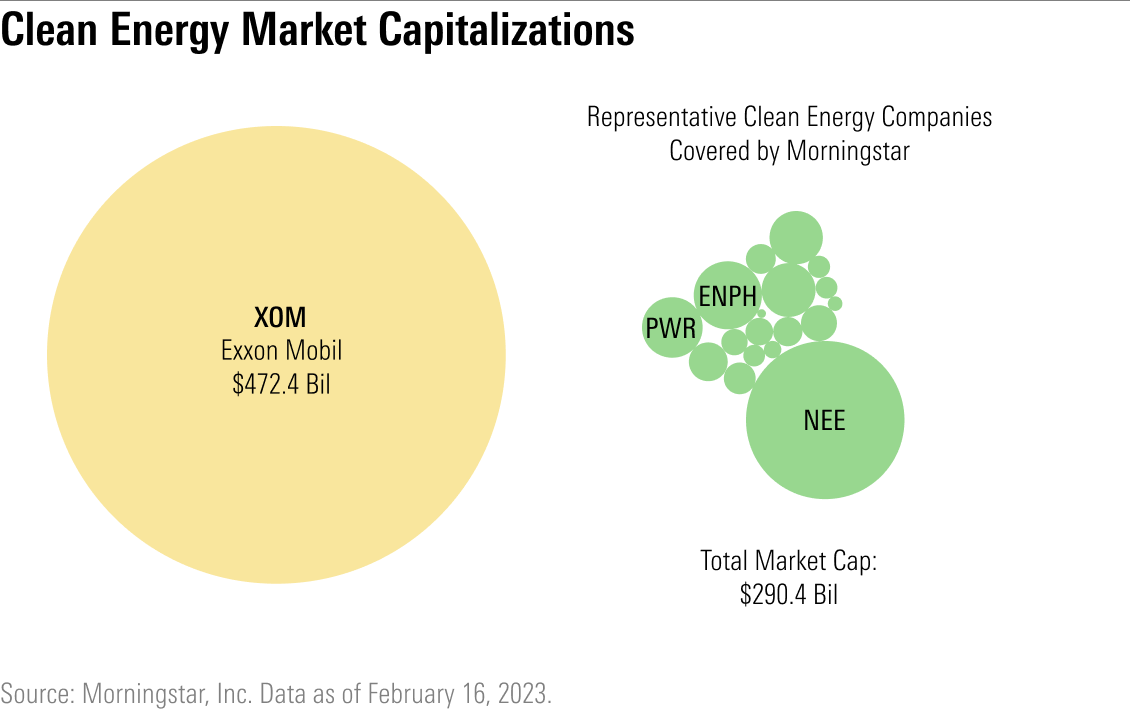

“Renewable energy is a small investing space,” GMO’s White says. The largest clean energy companies in the world, excluding Tesla TSLA, are no bigger than $15 billion in market cap today, he says. That’s a stark contrast to the oil and gas space, which includes giants such as Exxon Mobil XOM, with a market cap of nearly $500 billion, and Chevron CVX, with a current market cap of $315 billion.

Traditional energy companies such as Exxon and Chevron are also making investments in clean energy, but today, those efforts only make up a small portion of their overall business.

Parnassus’ Keith is staying away: “We are not investing directly in those companies,” she says of oil and gas giants. “There’s still a lot of work to be done before their business models are fully transformed,” she says. “In terms of trying to participate in decarbonization, that won’t play out in these companies for many years. We’d need to see more evidence before investing.”

Although the current clean energy investing space is small, GMO’s White says, there will be more, bigger companies five to 10 years into the future. “Climate change is a major disaster. The world needs to move much more aggressively; solar and wind and biofuel production will have to ramp up as rapidly as possible: The space is set to grow fast.”

Renewable Energy Stocks Don’t Just Come From the Energy Sector

“Clean energy encompasses more than just wind and solar power,” says Travis Miller, senior equity analyst at Morningstar. “A big component of it is all the infrastructure that goes to support that power.”

That’s where utilities come into the picture, Miller says.

“What will it take to get renewable energy into the system so that it can serve as much demand, as efficiently as possible?” he says. “The big growth opportunity here is not necessarily building wind and solar farms—it’s all the infrastructure that supports getting renewable energy to the people and businesses who will use it.”

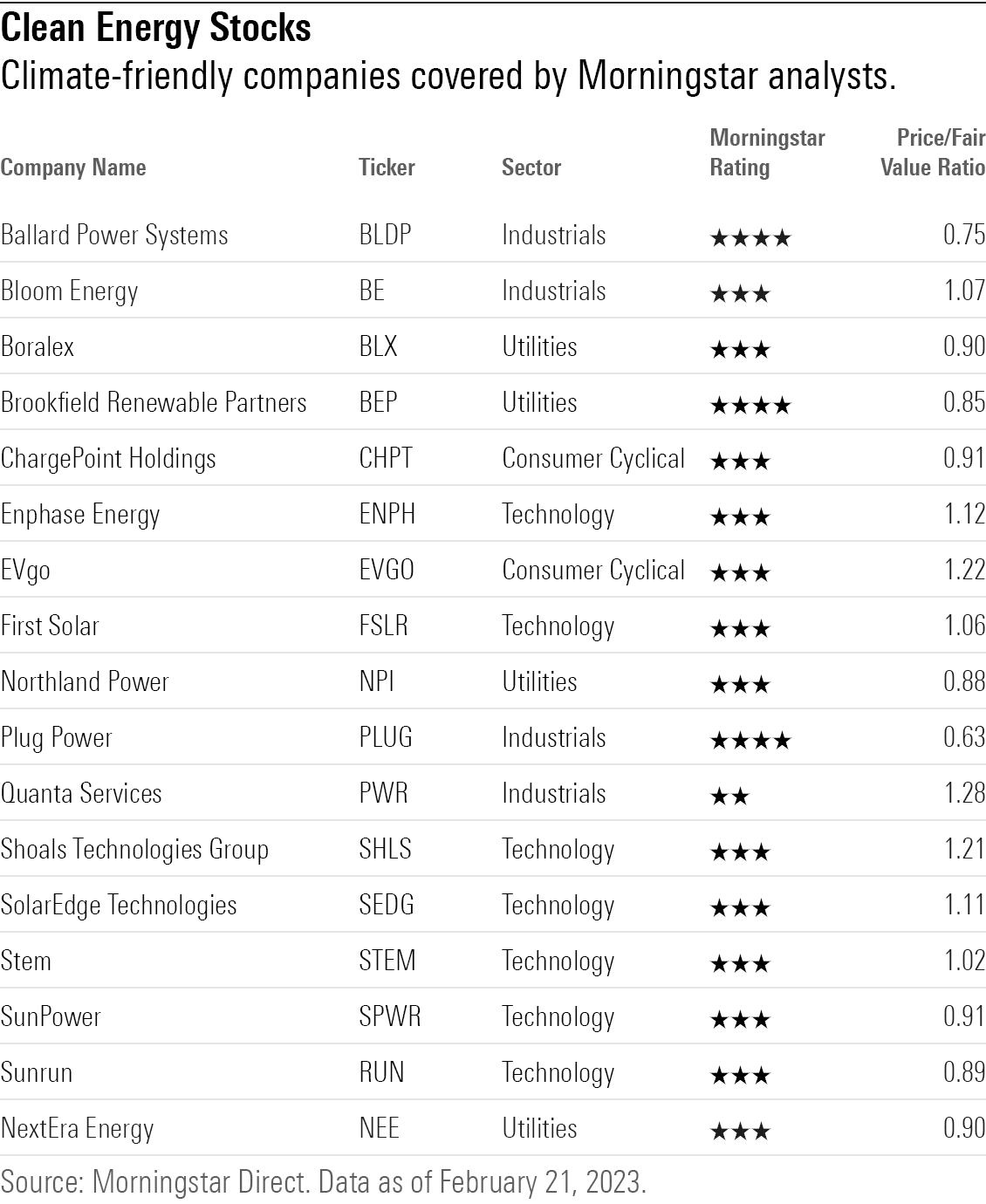

By market cap, 60% of the 18 U.S. clean energy companies covered by Morningstar come from the utilities sector and an additional 26% come from the technology sector. In fact, none of the companies in the list of U.S. clean energy plays are actually from the energy sector.

Undervalued Renewable Energy Stocks

We screened the list of companies representing the North American clean energy space covered by Morningstar stock analysts to find the most discounted names.

The list spans a wide range of renewable energy companies: solar and wind equipment companies, hydrogen producers, battery storage providers, sustainable construction engineering firms, and renewable developers, among others.

Currently, the three undervalued companies in the list are Ballard Power Systems, Brookfield Renewable Partners, and Plug Power, all of which are trading at 4-star discount prices.

Ballard Power Systems

- Ticker: BLDP

- Industry: Specialty Industrial Machinery

- Market Cap: $1.7 Billion

“Ballard has one of the longest histories in the fuel cell industry, with a particular focus on transportation applications.

“Given Ballard’s focus on transportation end markets, the company’s strategy faces risks from battery electric technology. This is particularly acute for the bus and light-duty truck end markets, whereas heavy-duty trucking, rail, and marine are likely to have more difficulty adopting battery electric solutions given the reduction in cargo capacity from large batteries.

“Ballard is considered by some as the ‘grandfather’ of PEM fuel cells. The company has over 30 years of research and development on its fuel cell technology, much of which has been focused on the PEM fuel cell stack. While competitors have diversified their businesses beyond fuel cells to hydrogen production or electrolyzers, in recent years Ballard has kept a narrow focus on its core fuel cell technology. As such, we view Ballard’s most credible argument in support of a moat to be its intellectual property around PEM fuel cells (and to a lesser extent its brand, given its long history). However, we do not believe its level of IP is sufficient to award an economic moat.”

Brookfield Renewable Partners

- Ticker: BEP

- Industry: Utilities - Renewable

- Market Cap: $7.6 Billion

“Brookfield Renewable holds a well-diversified global portfolio of clean energy technologies assets. The company targets 12%-15% returns via a combination of organic growth and mergers and acquisitions. Brookfield utilizes a primarily contrarian approach to M&A.

“In addition to renewable energy assets, Brookfield Renewable expanded its investment scope in 2022 to include broader energy transition asset classes. These include novel areas such as carbon capture as well as traditional fossil fuel and nuclear power generation.

“Brookfield Renewable primarily invests in assets alongside Brookfield Asset Management’s private equity funds. This approach brings the benefit of increased scale, allowing the company to pursue larger opportunities, but results in frequent acquisitions and disposals. Management seeks to add value through aggressive cost and revenue optimization. The company was historically primarily an acquirer of operating assets but has added development capabilities in recent years.”

Plug Power

- Ticker: PLUG

- Industry: Electrical Equipment and Parts

- Market Cap: $9.8 Billion

“Plug Power seeks to be a leader in the green hydrogen economy. The company’s strategy is centered on its vertical integration approach to provide customers a complete hydrogen solution—from fuel cell technology to green hydrogen fuel.

“Green hydrogen as a fuel to decarbonize is in its infancy. Customers face numerous challenges with adopting hydrogen technology, including economics and lack of green hydrogen production and infrastructure. Within this context, we view Plug’s efforts to provide customers a one-stop-shop solution of technology and fuel as aiming to lower the barriers for customer adoption. While this strategy brings greater capital intensity, it positions Plug as the only all-in-one provider within the industry.

“We emphasize the ambition of Plug’s strategy stands out relative to peers who focus on simply providing fuel cell or electrolyzer solutions.”

More Clean Energy Stocks Covered by Morningstar

The following is the full list of clean energy stocks covered by Morningstar’s stock analysts. The renewable energy stocks in this list come from a wide range of sectors: utilities, technology, industrials, and consumer cyclical.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)