5 Ultra-Short-Term Bond Funds With High Yields

Rising interest rates have made these low-risk funds a more attractive destination for cash.

For the first time in years, investors have more choices when looking for a place to store cash that is both low-risk and paying high yields. One of those options: ultra-short-term bond funds.

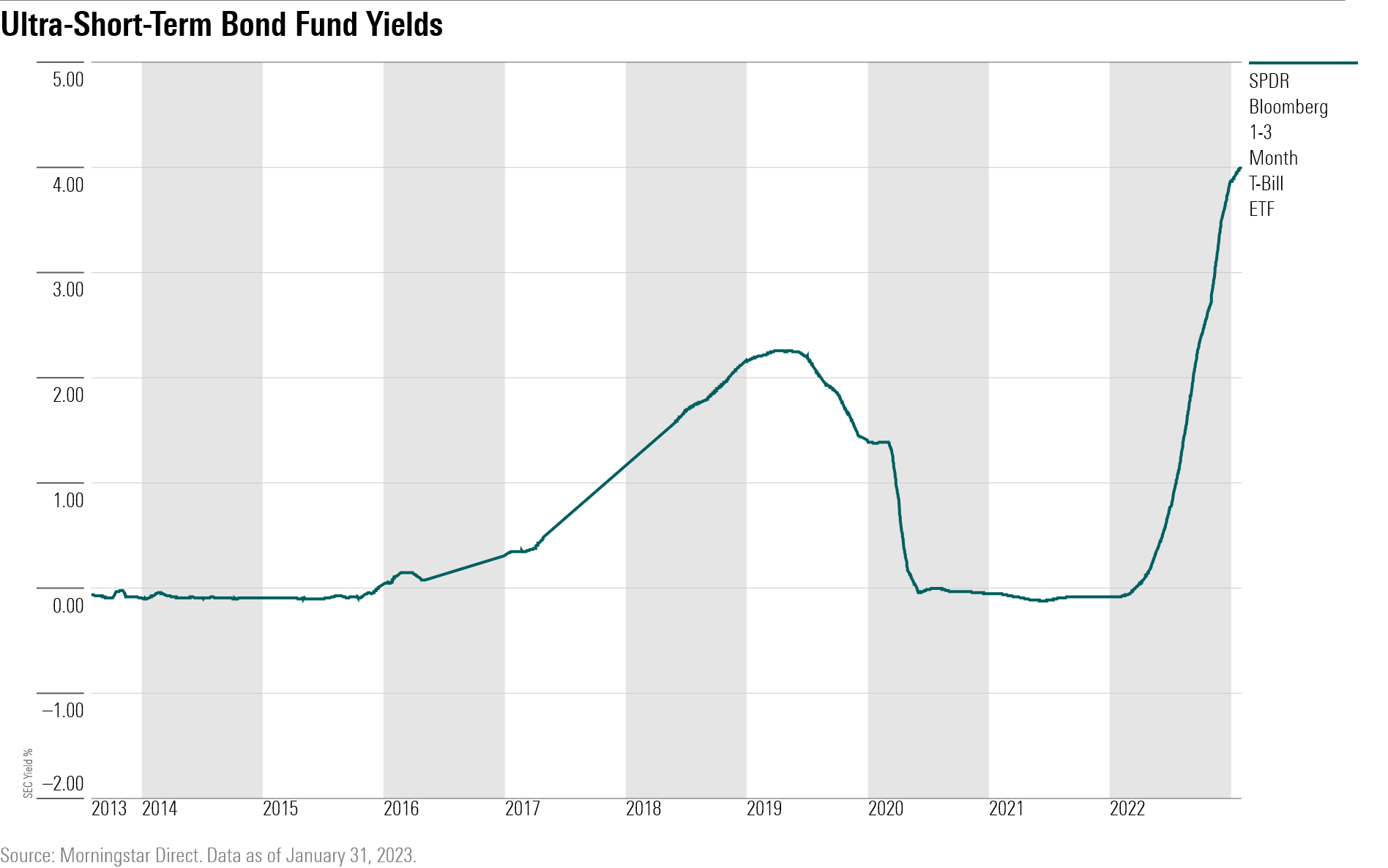

After eight interest-rate hikes from the Federal Reserve, short-term rates have risen to decadelong high levels. The average fund in the ultrashort Morningstar Category currently yields around 4.2%; a year ago, it yielded less than 1%.

As investors experienced quite painfully in 2022, when interest rates rise, bond prices fall. But an ultra-short-term bond fund limits the sensitivity to changes in interest rates.

It’s critical for investors to know up front that ultra-short-term bond funds can lose money and so are not an exact substitute for cash or investments such as money market funds and bank-issued certificates of deposit. Many ultra-short-term bond funds did suffer losses in 2022. The average ultra-short-term bond fund lost 0.1% in 2022, while other corners of the bond universe experienced double-digit declines.

But as was the case last year, losses on ultrashort bond funds have historically been very small because of the nature of the investments. Last year was the first time since 2008 that, on average, ultrashort bond funds posted a loss. On average, over the past 10 years, ultrashort bond funds recorded a 1% gain annually. This pales in comparison to the returns generated by stocks and other bonds in the same time period, but ultra-short-term bond funds are meant to be higher-yielding alternatives to money market funds and certificate of deposits.

What Are Ultra-Short-Term Bond Funds?

Ultra-short-term bond funds invest in bonds that have durations of less than a year. Duration is a measure of a bond’s sensitivity to changes in interest rates and has been the primary driver of bonds’ poor performance over the past year.

In addition, most ultra-short-term bonds stick to higher-quality bonds such as government and investment-grade corporate bonds. However, some managers venture into riskier asset-backed securities—such as those backed by car loans—and bank-loan debt for higher yields. These kinds of bonds could be vulnerable to losses if the U.S. slides into a recession, and investors worry about the potential for issuers defaulting on their interest payments.

As a result, investors should be careful to consider their ability to stomach even a small loss in an ultra-short-term fund before committing money to the investment.

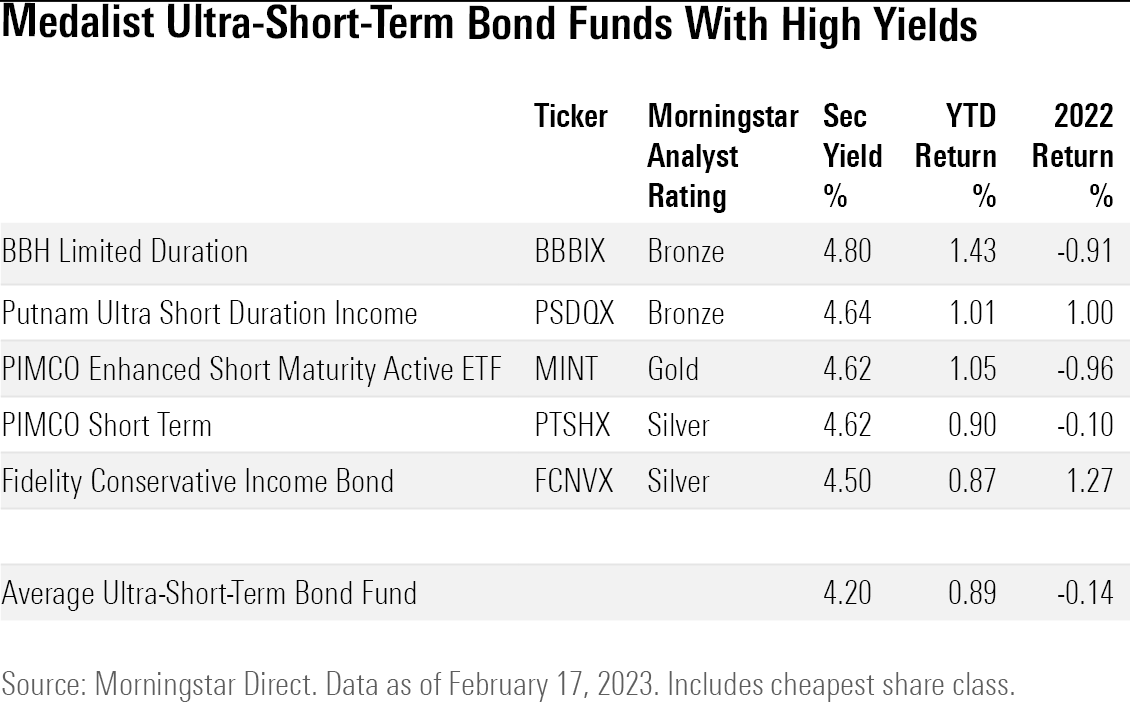

For investors wanting to capitalize on high short-term rates, these are Morningstar Medalist ultrashort bond mutual funds and exchange-traded funds that come with higher-than-average yields.

Top-Rated Ultra-Short-Term Bond Funds

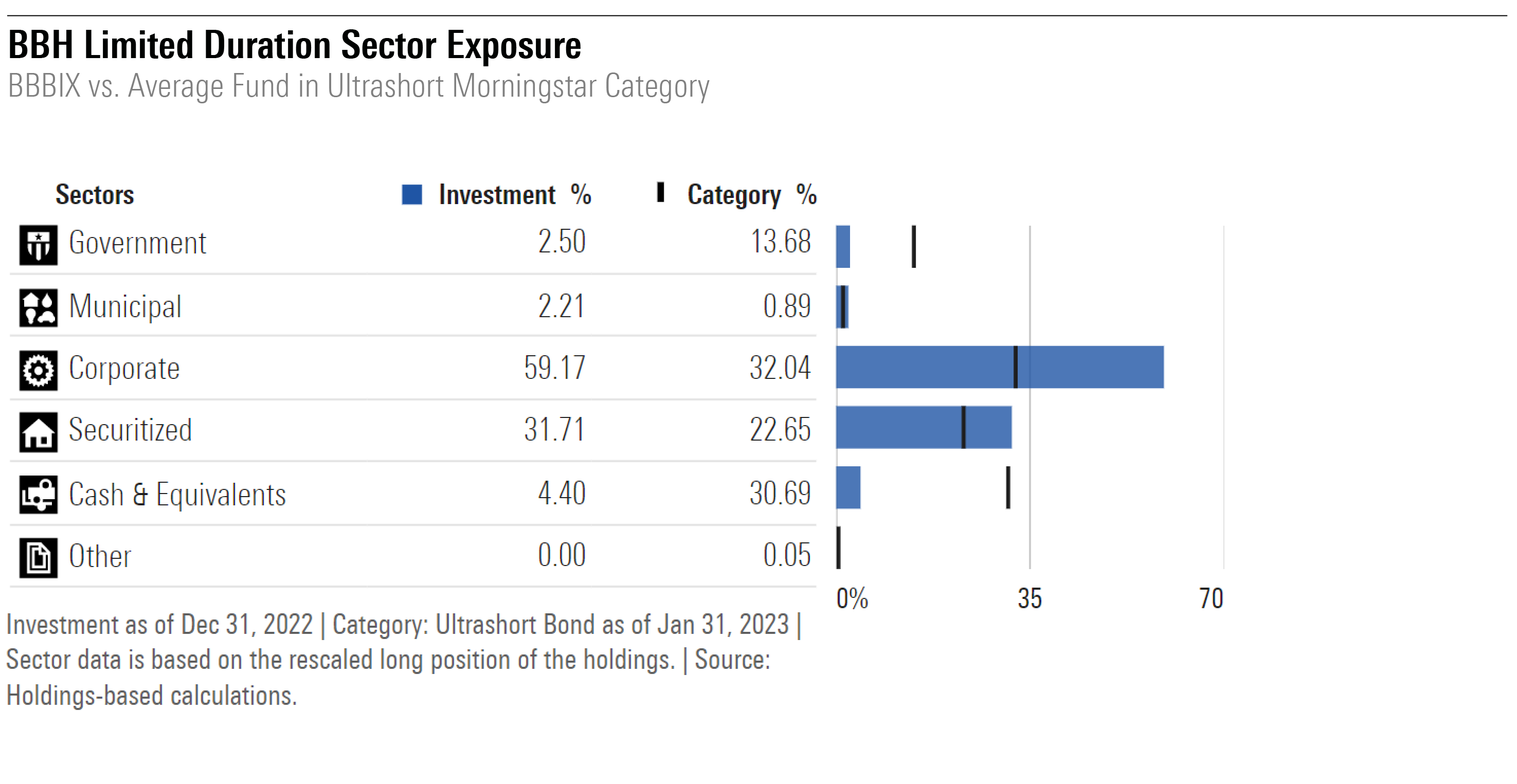

Among the ultra-short-term funds rated Bronze, Silver, or Gold by Morningstar analysts, the $9 billion BBH Limited Duration BBBIX carried the highest yield, with a 4.8% SEC yield as of Jan. 31. However, Morningstar analyst Saraja Samant says the strategy takes on more risk than most peers by investing in bank loans and asset-backed securities.

The average ultra-short-term bond portfolio has only 32% in corporate securities, but BBH Limited Duration keeps nearly 60% of the fund in corporate bonds. (You can view the sector exposure of any bond fund in the portfolio section on its Morningstar fund page.)

This strategy is helping the fund offer a higher current yield but also means it could struggle if the United States enters a recession, hurting credit-sensitive sectors. So far in 2023, as rates have moved lower, the fund has gained 1.4%, while the average fund in the ultrashort Morningstar Category advanced 0.9%. Last year, the fund posted a larger loss than similar funds; it lost 0.9%, while the average ultra-short-term fund declined only 0.1%.

Putnam Ultra Short Duration Income PSDQX also carries a higher yield that most funds in the category but does so without investing in bank loans. “This is a higher-credit-quality offering than many ultrashort bond category peers because it doesn’t have any allocation to high yield or illiquid bank loans,” writes senior analyst Peter Marchese. The $11.3 billion fund aims to outperform money market funds by 50 basis points on an annual basis over the long term, and in 2022, it managed to do so. The fund posted a gain of 1%.

The $5.8 billion Fidelity Conservative Income Bond FCNVX takes a cautious approach in the ultrashort category. “The managers favor higher-quality fare in what they consider to be resilient, yield-advantaged sectors such as financials and banks,” writes Samant. The Silver-rated fund carries a SEC yield of 4.50% as of Jan. 31. Last year, it was one of the top-performing ultra-short-bond funds after it recorded a gain of 1.3%.

Among Pimco’s offerings is Pimco Short Term PTSHX, where the managers have a broad range of securities to chose from. “The comanagers actively adjust sector allocations within wide ranges to build a diversified portfolio,” writes senior analyst Paul Olmsted. The fund mainly invests in investment-grade credit, securitized debt, and U.S. Treasuries but can also venture into high-yield bonds, non-U.S. debt, and foreign currencies, he writes. The $11.9 billion fund carries a 4.62% SEC yield.

For a less risky approach, there is $8.4 billion Pimco Enhanced Short Maturity Active ETF MINT, which is also yielding 4.62%. “The fund is more constrained than its more adventurous sibling and sticks with investment-grade debt while eschewing foreign currencies and derivatives,” writes Olmsted.

“The strategy’s extra precautions may cause it to lag during sanguine markets that reward competitors that take on more non-investment-grade credit and liquidity risk,” he writes. The fund’s loss of 0.1% last year was greater than Pimco Short Term’s 0.1% decline, but the ETF is up more this year. As of Feb. 17, it gained 1.1%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)