Markets Brief: European Stocks Shine Despite War in Ukraine

Resilient economies are helping European stocks outperform the U.S. market.

Find our weekly markets recap at the bottom of this article.

One year after Russia invaded Ukraine, world markets are showing their resilience, and for some investors, European stocks, which shuddered this time last year, are looking particularly attractive.

Despite the havoc wreaked initially by Russia’s act of aggression, notably disruptions to supplies of energy and agricultural staples, major European economies as well as the United States have so far managed to skirt severe recessions even as high rates of inflation have persisted here and abroad.

“The war still matters a great deal because it creates a risk of a lot of things that can go wrong,” says Andy Kapyrin, co-chief investment officer of CI RegentAtlantic, noting the potential for trade disruptions and commodity price pressures and higher inflation. “But the war’s moment of highest economic salience was last spring, and I expect it will impact markets and economies less and less as time goes on.”

Europe’s Economic Resilience

The eurozone market, in particular, has been buoyed by the success of navigating through numerous crises created by the conflict, including reducing its reliance on Russian natural gas and investing in its own energy infrastructure, says Peter Berezin, chief global strategist at BCA Research, a Montreal-based independent provider of global investment research. That’s created a “sense of optimism,” as has improved economic data, strengthening manufacturing and services numbers, and positive consumer sentiment.

“It’s good news for Europe and global markets,” says Berezin.

The Morningstar Europe Index is up 9.4% for the year to date, the Morningstar Germany Index has risen 12.9%, and the Morningstar France Index is nearing record highs, gaining 12.4% so far this year. These rallies compare with an advance of 8.25% in the Morningstar US Market Index.

Like Kapyrin, BCA’s Berezin expects the Russia-Ukraine “conflict will persist” and that could create “various tail risks” for countries already coping with high inflation.

One potential threat: higher oil prices, especially if Russian President Vladimir Putin makes good on his threat of cutting oil production and Saudi Arabia doesn’t produce more to offset the supply reduction. But “the bigger risk to the bullish view on Europe is if the conflict spills outside its current domain,” says Berezin, and the U.S. and its NATO allies get dragged into the fray.

Geopolitical Events Can Be Buying Opportunities

The strength in global markets demonstrates what many investment strategists noted a year ago when the war started: Geopolitical events might trigger emotional responses that jolt markets temporarily, but they don’t ultimately change the economic fundamentals on which investment decisions are made, instead, create buying opportunities.

“Knee-jerk reactions can be fraught with error,” says James St. Aubin, chief investment strategist at Sierra Investment Management. “The reaction can be an overreaction, and the results can be counterintuitive” as has proved true in Europe, where investors were initially spooked by the prospect of a calamitous energy shortage that never materialized, helped by a mild winter.

Berezin of BCA, however, considers geopolitical events to be more nuanced. While there are geopolitical shocks that have temporary impacts, there are those that represent structural shifts among global powers that can lead to profound changes in the global financial system. He points to tensions between the U.S. and China and the possible end of globalization as geopolitical forces that could result in long-lasting effects on the global financial system.

When we spoke with CI RegentAtlantic’s Kapyrin following the invasion last year, he predicted the Fed would embark on the fastest pace of rate hikes since 2002-03 despite the war and that technology stocks would continue to underperform as a result. He also noted U.S. stocks would be held back because of the heavy exposure to technology in the major indexes and recommended a weighting of at least 25% in international stocks, highlighting Europe as “the better opportunity.” All good calls. He still favors international diversification.

European Stocks Look Attractive

“It’s an attractive time to own European equities,” says Kapyrin, even if the region’s economies grow “relatively slowly.”

European and international stock markets have greater exposure to sectors that are expected to do well in a higher inflationary and higher rate environment, including major consumer brands, energy suppliers, and industrials, he says. They should also benefit from the reopening of China’s economy, he says.

Fund investors appear to see Europe as attractive as well.

In January, Europe-focused equity exchange-traded funds attracted $5.1 billion in flows, the most since May 2021 and second only to emerging-markets exchange-traded funds, which pulled in $5.4 billion, according to Morningstar Direct. That’s a sharp reversal from a year in which investors steadily sold off European equities. For the trailing 12 months, outflows from European equity ETFs totaled $6.4 billion through January.

The JPMorgan BetaBuilders Europe ETF BBEU, based on the Morningstar Developed Europe Target Market Exposure Index, took the top spot of all ETF strategies, attracting $3.6 billion in net assets for the month of January and returning 9.56% for the year to date.

In contrast, U.S. exchange-traded funds recorded outflows of $1.4 billion for the month.

Events Scheduled for the Coming Week Include:

- Monday: U.S. stock and bond markets closed in observance of Presidents Day.

- Tuesday: The Home Depot HD and Walmart WMT report earnings.

- Wednesday: Nvidia NVDA reports earnings. Federal Reserve Open Market Committee February meeting minutes released.

- Thursday: PG&E PCG reports earnings

For the Trading Week Ended Feb. 17:

- The Morningstar US Market Index was flat, declining by only 0.05%.

- The best-performing sectors were consumer cyclical, up 2.0%, and consumer defensive, up 1.1%

- The worst-performing sector was energy, down 6.8%.

- Yields on 10-year U.S. Treasuries rose to 3.83% from 3.74%.

- West Texas Intermediate crude prices fell 4.2% to $76.34 per barrel.

- Of the 851 U.S.-listed companies covered by Morningstar, 488, or 57%, were up, and 363, or 43%, declined.

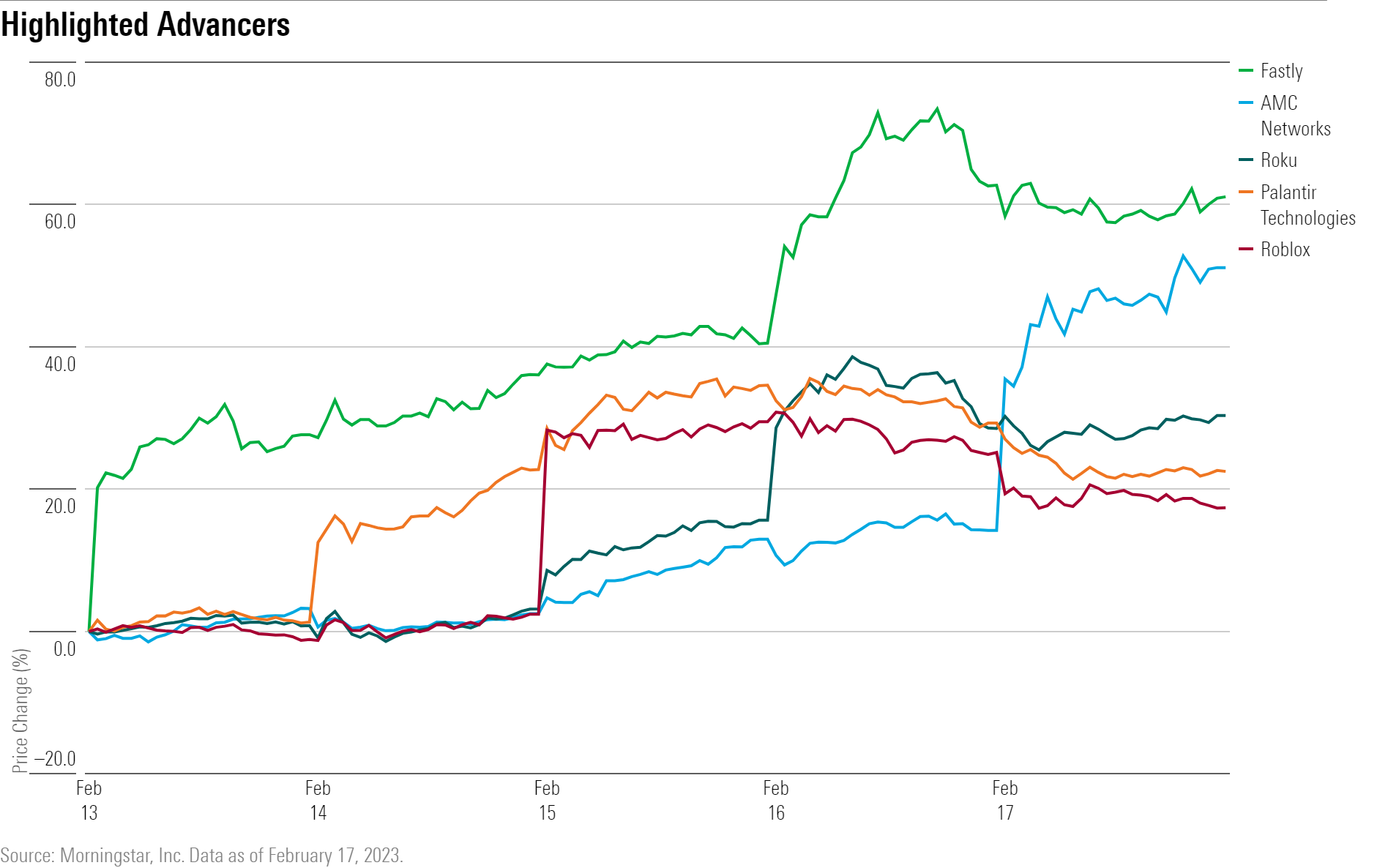

What Stocks Are Up?

Fastly FSLY, an online content delivery network operator, saw shares surge after it reported “very good” fourth-quarter results, according to Morningstar equity analyst Matthew Dolgin. “Margins in the fourth quarter improved significantly from earlier in the year, and management’s 2023 guidance implies the firm will be moving quickly toward profitability,” he says.

AMC Networks AMCX stock rallied after the company reported fourth-quarter results that showed earnings per share coming in at $2.52, more than double the estimates of $1.02. The network also added 700,000 subscribers during the fourth quarter.

Similarly, Roku ROKU also rallied after posting strong results. “Fourth-quarter revenue came in well ahead of guidance, and net new active accounts tied for the second strongest behind the pandemic-influenced fourth quarter of 2020,” says Neil Macker, senior equity analyst at Morningstar.

Palantir PLTR stock rose after the software company posted its first-ever profitable quarter. The company has dialed down its spending, leading to increased profitability, says Malik Ahmed Khan, Morningstar analyst.

Better-than-expected earnings results also led to gains in Roblox RBLX and Airbnb ABNB.

What Stocks Are Down?

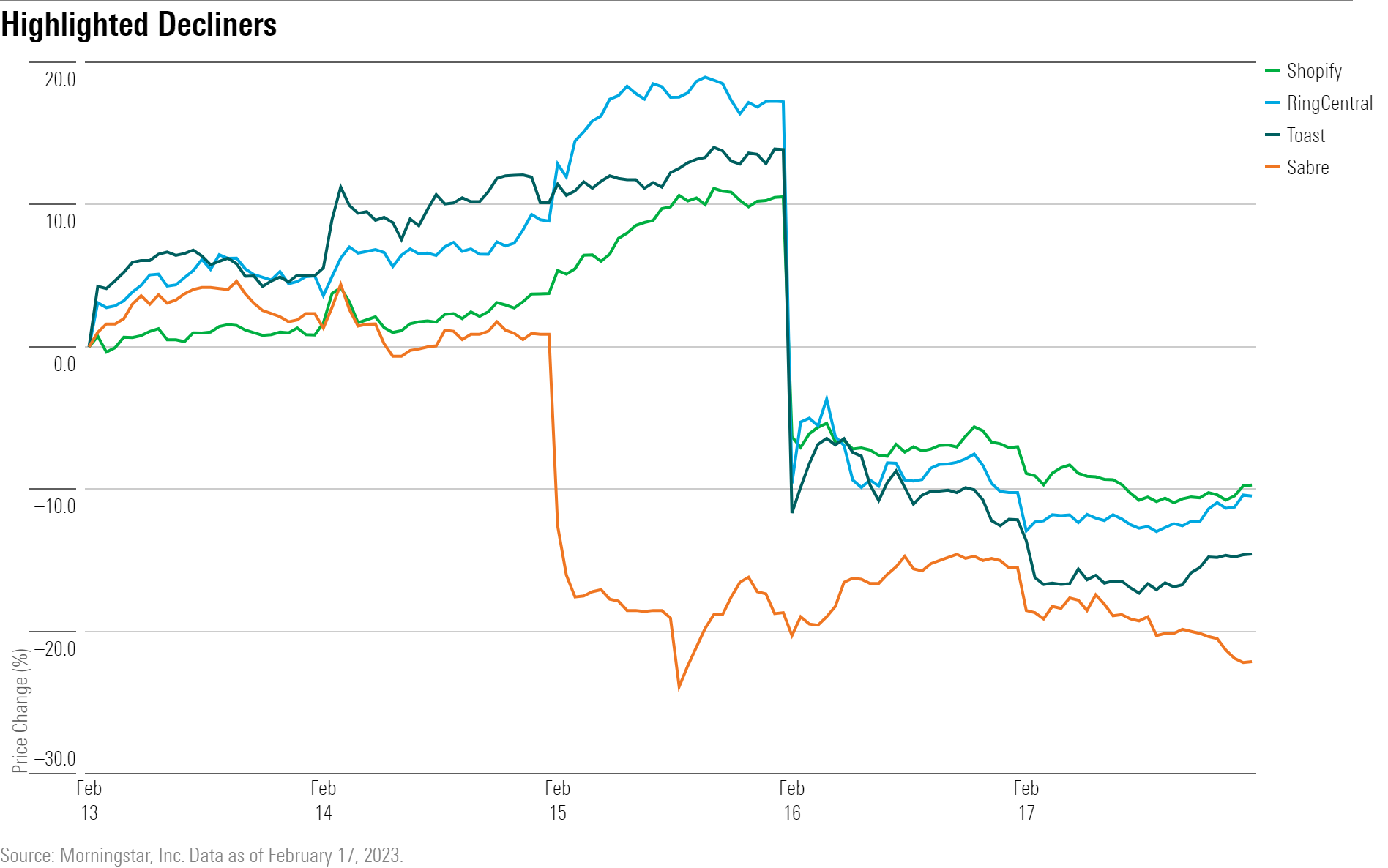

Sabre SABR, which offers technology solutions to the travel industry to book and manage trips, saw its stock plunge after the firm delivered disappointing quarterly results. The company missed both revenue and earnings estimates and also notes a $100 million sales headwind due to a change in Russian law that “requires all travel IT activities to be owned and operated within the country, resulting in the decommissioning of a former [Sabre] customer,” says Dan Wasiolek, Morningstar senior equity analyst.

Shares of Toast TOST, a payment processing platform for restaurants, fell after the firm posted worse-than-anticipated losses, raising concerns over profitability, says Sean Dunlop, Morningstar equity analyst. Dunlop expects to lower Toast’s current fair value estimate of $25.50 by a midteens percentage.

Despite beating revenue and earnings estimates, Shopify SHOP stock was sold off by investors after the company unveiled a weaker-than-expected outlook. Analysts were expecting revenue to grow about 20% based on revenue estimates from FactSet; however, the company released guidance that sales were likely to grow by a “high teens” percentage.

Likewise, RingCentral RNG set a lower-than-expected revenue guidance range of $526 to $530 million, versus former FactSet estimates of $544 million, contributing to a decline in its stock price.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)