The 2022 U.S. Sustainable Funds Landscape in 5 Charts

Sustainable flows sink. Vanguard jumps into first place. And despite a weak 2022, sustainable funds outperformed in the long term.

Inflows into sustainable funds plunged, behemoth BlackRock lost its crown in the race to grab new sustainable assets, and weak 2022 returns failed to erase the long-term outperformance of sustainable funds. Those were just some of the findings of our 2022 Sustainable Funds Landscape. Keep reading for more.

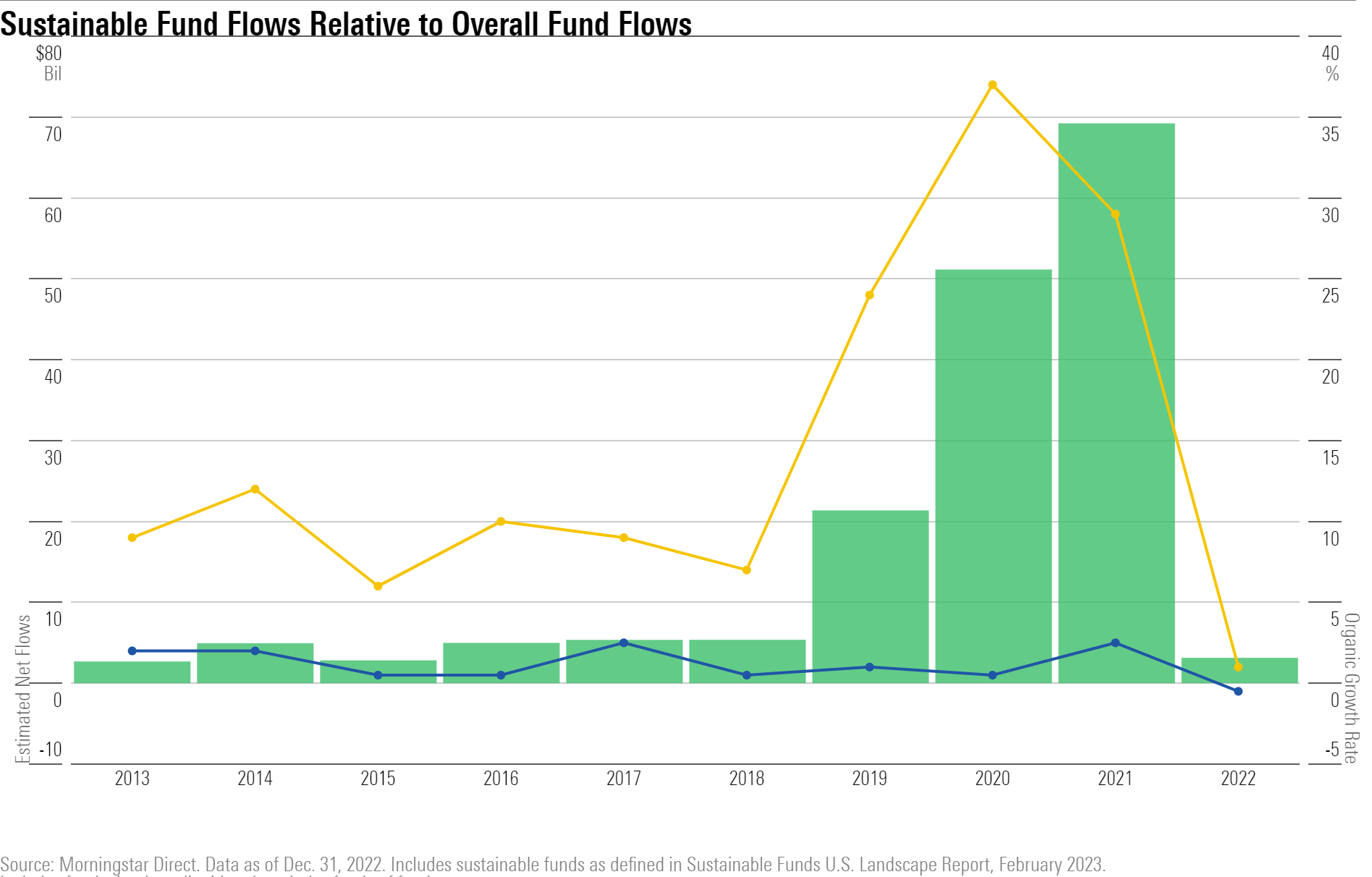

1) Sustainable Fund Flows Sank to Their Lowest Level in Seven Years

Flows into U.S. sustainable funds have fallen steadily since their record $21.5 billion haul in the first quarter of 2021. Although U.S. sustainable funds ended 2022 in positive territory—a departure from the broader U.S. fund universe, which suffered the worst flows year on record—their $3.1 billion net annual inflow was well below the average $47 billion annual collection these funds had enjoyed over the previous three years.

Much of 2022′s decline was driven by the broader market environment. In 2022, the broad universe of U.S. funds suffered more than $370 billion in withdrawals, cementing their first calendar year of outflows since Morningstar began tracking data in 1993. However, the conversation around sustainable investing was increasingly marked by concerns about greenwashing and a political backlash against ESG investing. Prominent Republican politicians in the United States have spoken out against ESG investing, and some have taken measures to limit state investment funds from doing business with asset managers based on perceptions of those managers’ ESG approaches.

In each of the past three calendar years, sustainable funds have grown at a faster pace than their conventional peers, but 2022′s expansion was significantly more muted than previous years. Sustainable funds continue to constitute a small portion of the overall U.S. fund universe, so the organic growth rate (calculated as net flows as a percentage of total assets at the start of a period) puts the magnitude of fund flows into perspective. In 2022, sustainable funds grew by 0.9%, and the overall U.S. fund universe contracted by 1.3%. In 2021 and 2020, the sustainable funds universe swelled by 30% and 39%, respectively.

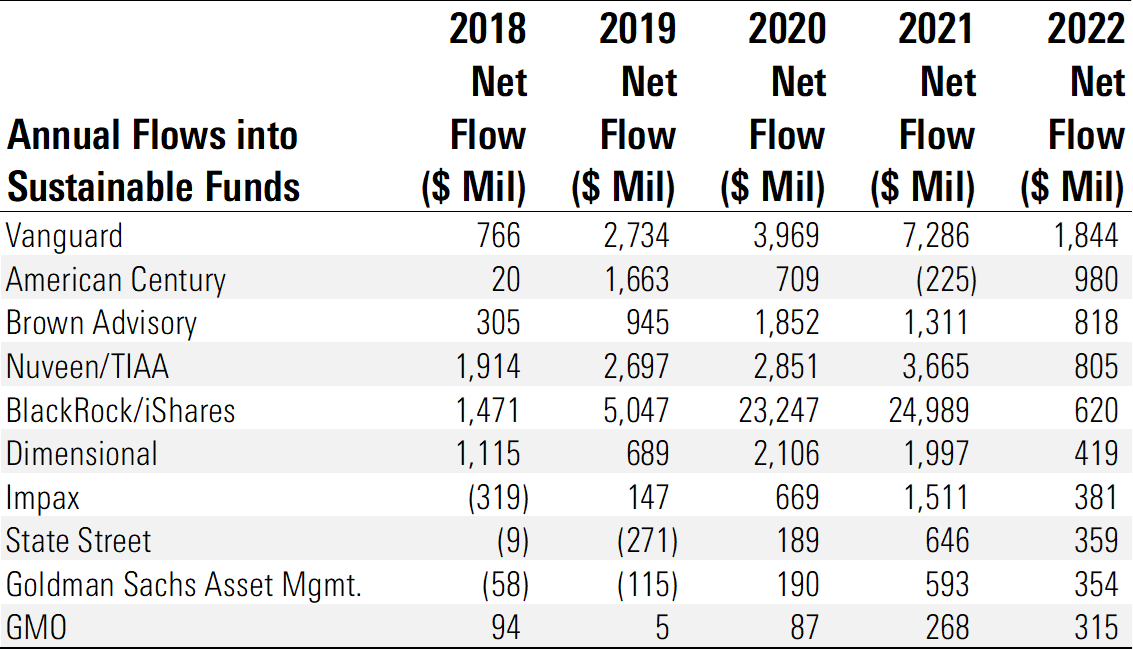

2) Behemoth BlackRock Lost Its Crown

BlackRock’s $620 million intake into more than 60 sustainable funds in 2022 was less than 2.5% of its annual flows into sustainable funds in 2021. It remained among the top 10 sustainable asset managers in terms of annual flows but slid behind Vanguard, American Century, Brown Advisory, and Nuveen to land in fifth place for the year. Even five years ago, when BlackRock only offered 16 sustainable funds, it took in more than twice as much compared with demand in 2022. Environmental and social issues, and the investment strategies that prioritize those, have increasingly come under scrutiny from Republican politicians, and BlackRock has been the target of more criticism than other sustainable fund managers.

Vanguard’s compact lineup of seven sustainable funds attracted more than $1.8 billion during the year, boosting the firm into first place for 2022. Vanguard ESG US Stock ETF ESGV accounted for nearly half of the firm’s total sustainable fund flows. The fund features a straightforward approach to portfolio construction that harks to the early days of socially responsible investing. It tracks a diversified equity index that screens out firms involved in tobacco, cannabis, civilian firearms, and coal and oil. The fund’s popularity is largely driven by its low fee of just 9 basis points.

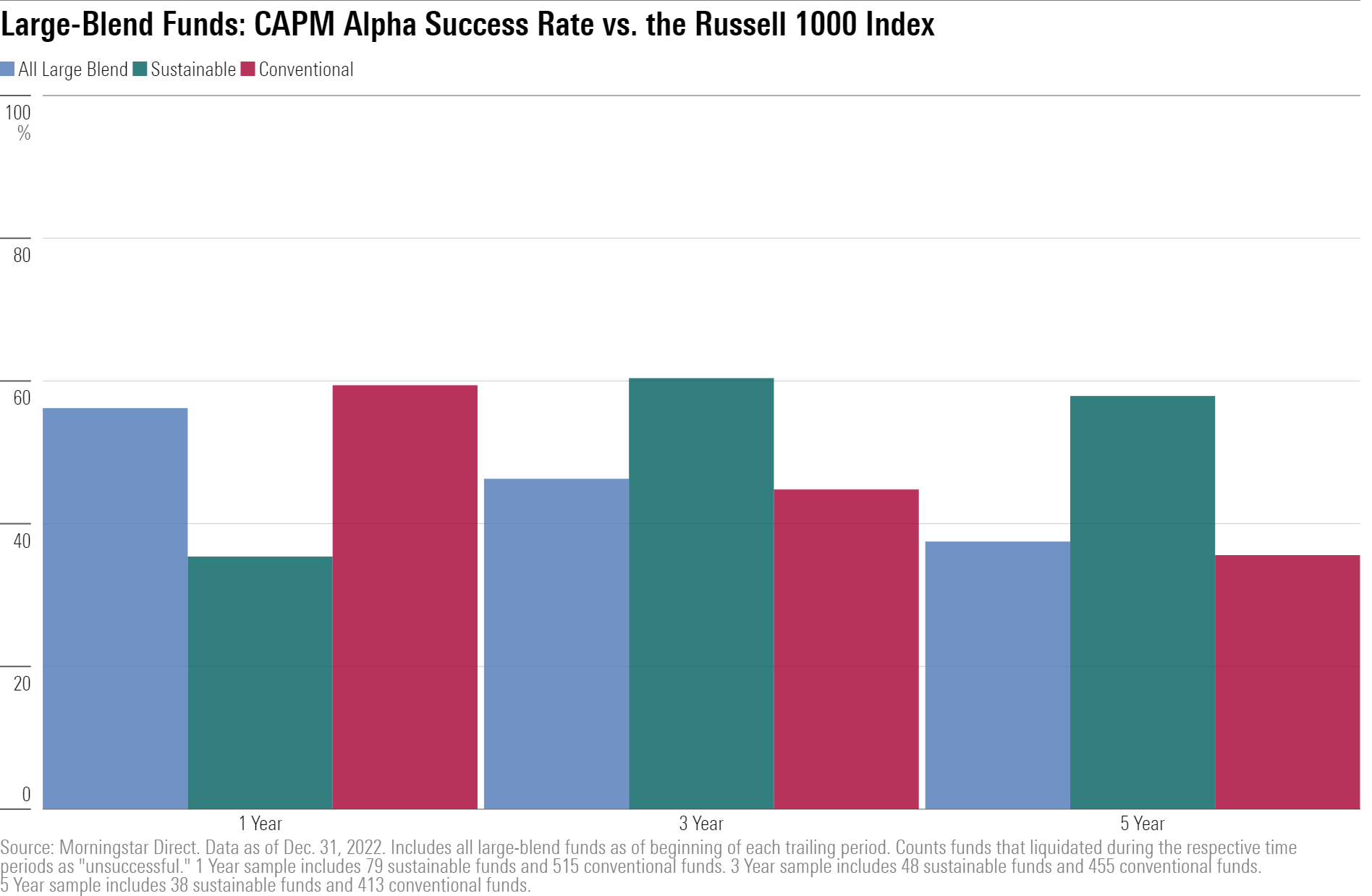

3) 2022 Didn’t Erase ESG Funds’ Long-Term Outperformance

Sustainable U.S. large-blend funds underperformed their conventional peers in 2022, which is reflected in their lower success rates (defined as surviving and beating the relevant index) for the year. Only 35% of sustainable funds outperformed the Russell 1000 Index during the year, while nearly 60% of their peers did so. It is even more impressive, then, that sustainable U.S. large-blend funds outperformed their conventional peers so heartily in the longer term.

Over the trailing three- or five-year period, an investor seeking long-term returns would have been better off in a sustainable fund than in one of its conventional peers. Of the 451 U.S. large-blend funds an investor could have chosen in January 2018, 169 survived and beat the Russell 1000 Index, while 282 either closed or underperformed. Nearly 60% of the sustainable options succeeded, while only 35% of their conventional peers did.

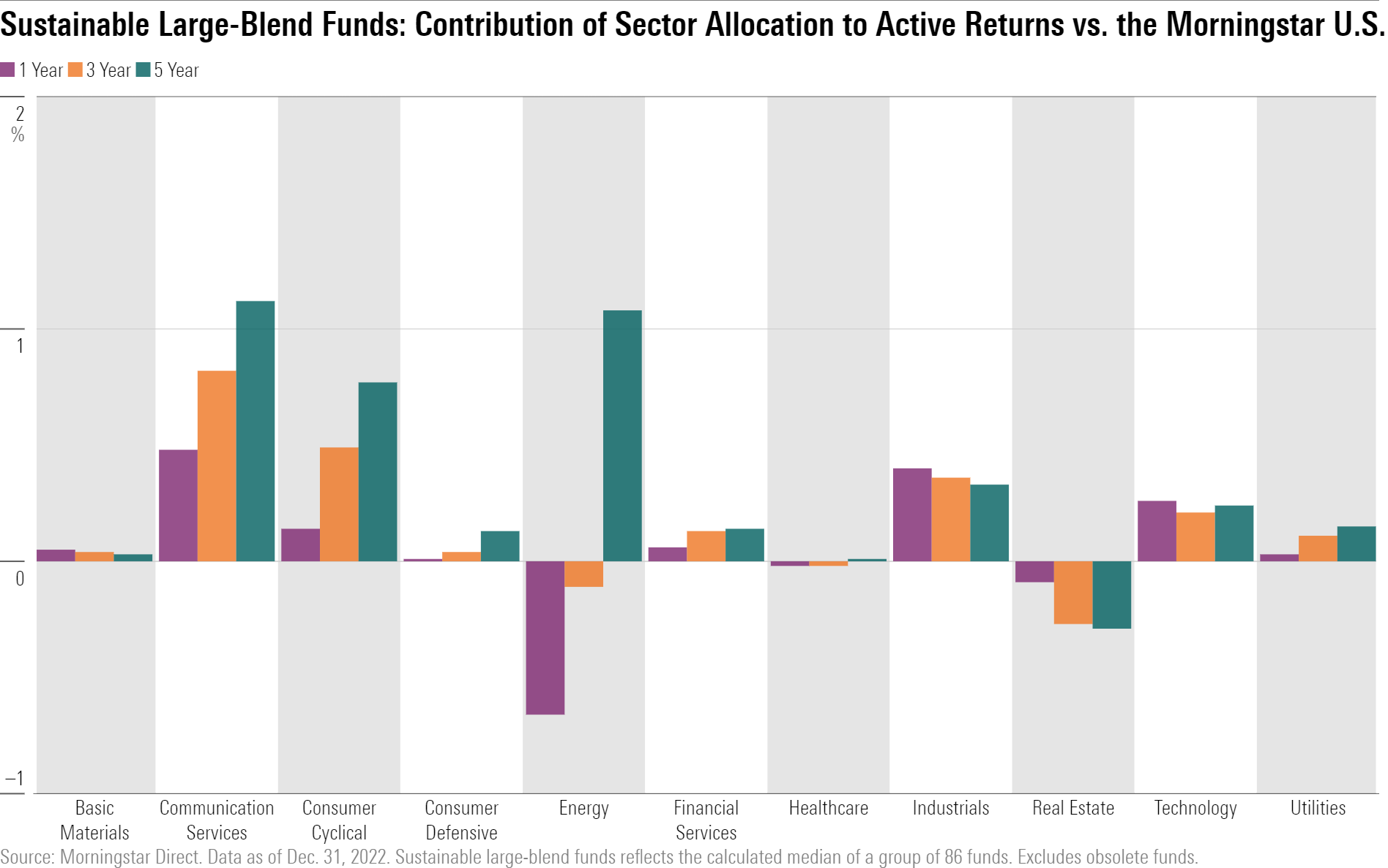

4) As Energy Skyrocketed, ESG Funds Suffered

Furthermore, the typical sustainable large-blend equity fund’s sector allocation was overwhelmingly additive over the trailing three- and five-year periods. The main detractor was, surprisingly, their modest overweighting in real estate, versus the Morningstar US Large Cap Index.

In 2022, on the other hand, the energy sector was the best-performing unit of the S&P 500 index, gaining a remarkable 66%. Funds with a structural underweighting to the energy sector, including many sustainable funds, suffered as a result.

5) Not All Sustainable Funds Voted for Key ESG Resolutions

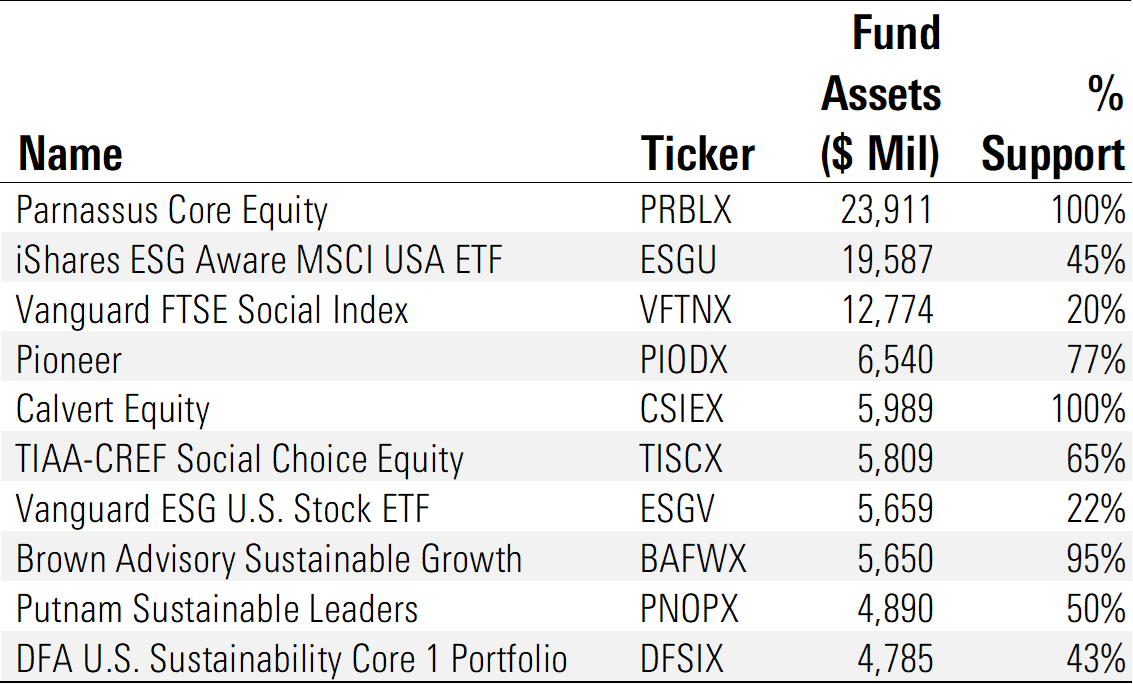

As investors put more money into sustainable funds, the collective influence of these strategies via their proxy voting also grows. Because of their size, larger funds have greater influence on any particular vote than do smaller funds, and the largest asset managers wield significant power. On average, sustainable funds managed by BlackRock, Vanguard, and State Street supported 48% of the key ESG resolutions on which they voted in 2022, representing $56 billion in assets.

Overall support for key ESG resolutions among the largest sustainable funds was largely positive in 2022. Across the 10 largest voting funds, average support for the key resolutions was 62%. At the high end, Parnassus Core Equity PRBLX and Calvert Equity CSIEX each supported 100% of key ESG proposals. Both firms have been dedicated ESG shops since their founding, so the high level of support is unsurprising.

On the other hand, Vanguard’s largest ESG funds—Vanguard FTSE Social Index VFTNX and Vanguard ESG U.S. Stock ETF—supported less than one fourth of the key ESG resolutions on which they voted in 2022. This is lower than Vanguard’s overall level of support, which may surprise investors in those funds. On average, Vanguard funds have supported 36% of key ESG resolutions over the past three years. Active ownership is one of the most powerful tools investors can use to effect sustainable change, and we expect increasing focus on it in the years to come.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)