Shareholders Step Up Voting Efforts on Racial Equity

In 2022, racial-equity resolutions doubled and expanded.

The start of another Black History Month marks a good opportunity to reflect on the seismic changes in attitudes toward racial inequalities and injustices that have taken place so far in the 2020s, both in the United States and further afield.

Of course, there’s still a long way to go on fostering a more equitable society. But we can recognize how the world has taken steps to respond to stark inequalities laid bare by events such as the death of George Floyd and the coronavirus pandemic. After all the corporate pledges, there is evidence that companies have done better on racial equality in the past three years. In part, that’s because asset managers have ramped up their efforts on this important and sensitive theme. There’s evidence that more action lies ahead.

Amid Increasing Calls for Company Action, Racial-Equity Resolutions Double

We recently published an in-depth analysis covering asset managers’ voting records on shareholder resolutions at U.S. companies. It revealed that there was a 60% increase in the number of shareholder resolutions addressing social and environmental issues in the 2022 proxy-voting year. (A proxy-voting year represents the 12 months to June 30, as most shareholder meetings are held in the first half of the calendar year.) There were 273 such proposals in 2022, having risen from 171 the previous year.

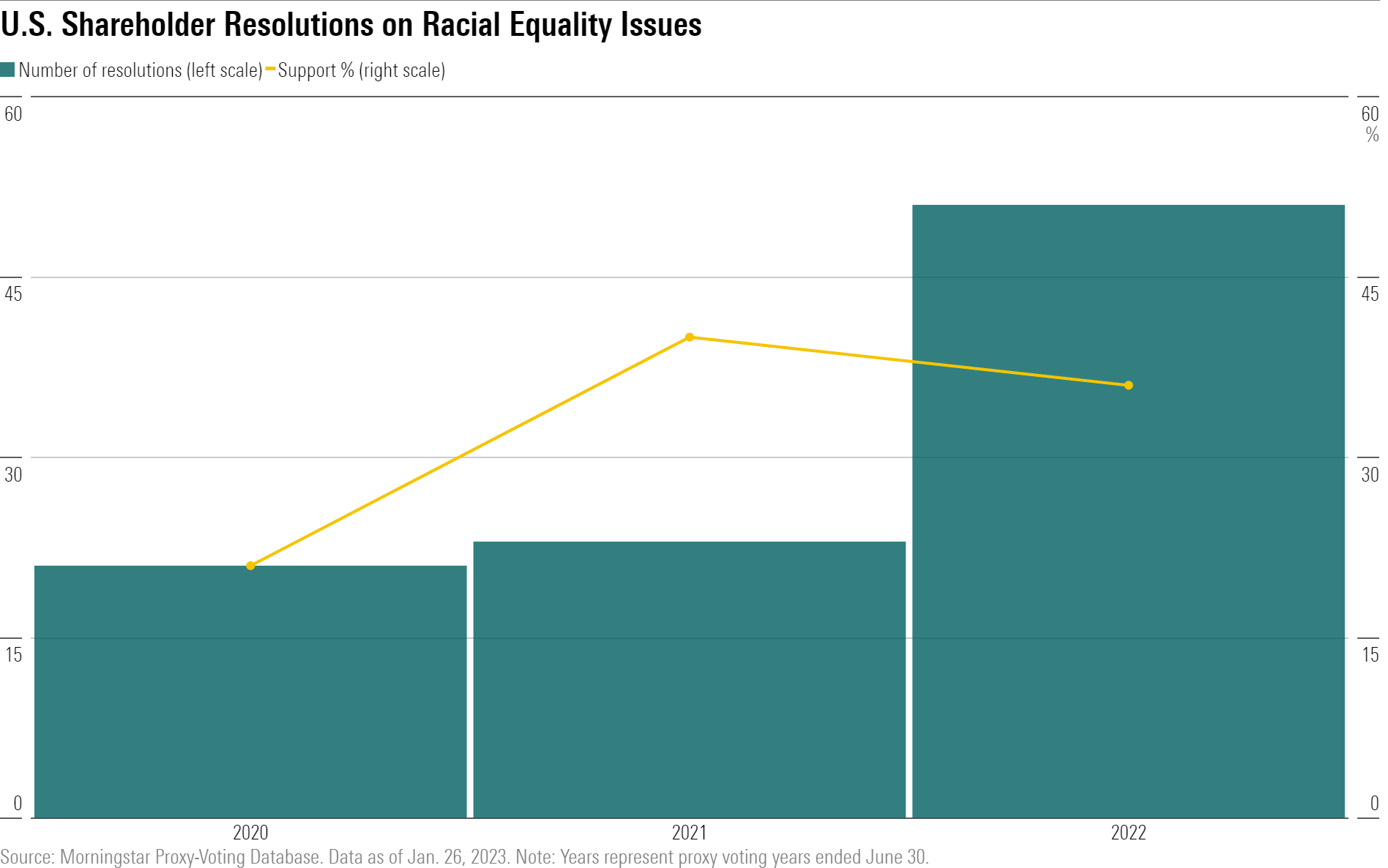

For resolutions that specifically targeted racial equality issues, the rise was even steeper. Fifty-one such resolutions were voted on in the 2022 proxy year, more than double the level seen in previous years.

Furthermore, the level of support for resolutions on racial equity issues is remarkable. It doubled to 40% in 2021, the first proxy season after the death of George Floyd. Average support has remained close to this relatively high level in 2022, at 36%. This is against the backdrop of a wider pullback in support for shareholder resolutions by asset managers, who consider that many of the resolutions filed in 2022 make demands that are too prescriptive to support.

Clearly addressing racial inequality has become a matter of increasing importance within the investor community. We see two key reasons for this:

- Asset managers view measures that aim to reduce the impact of societal inequalities as an important way of reducing material risks to companies.

- Support for proposals aiming to tackle racial inequality is seen as an important way for sustainability-conscious investors to vote their own values.

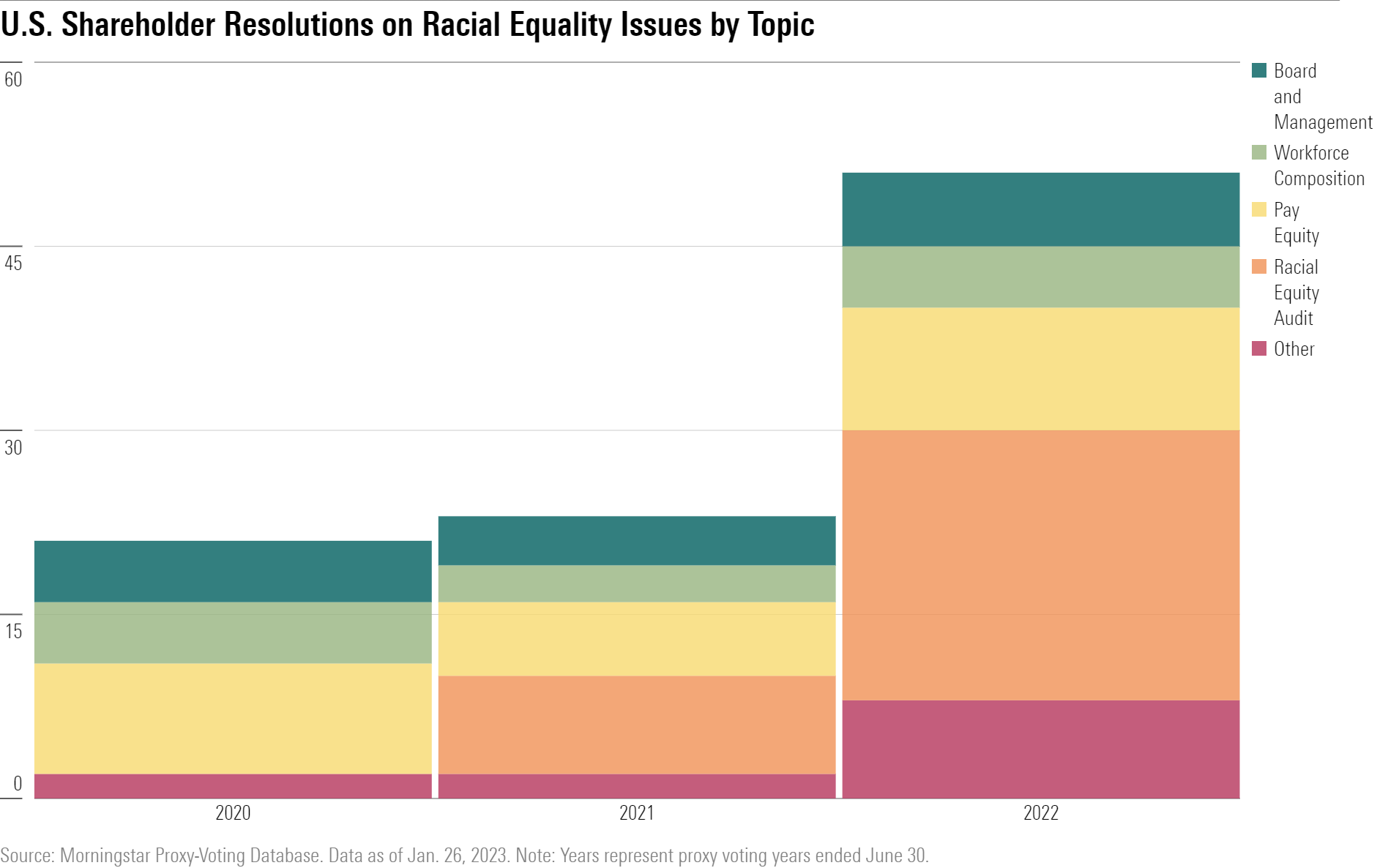

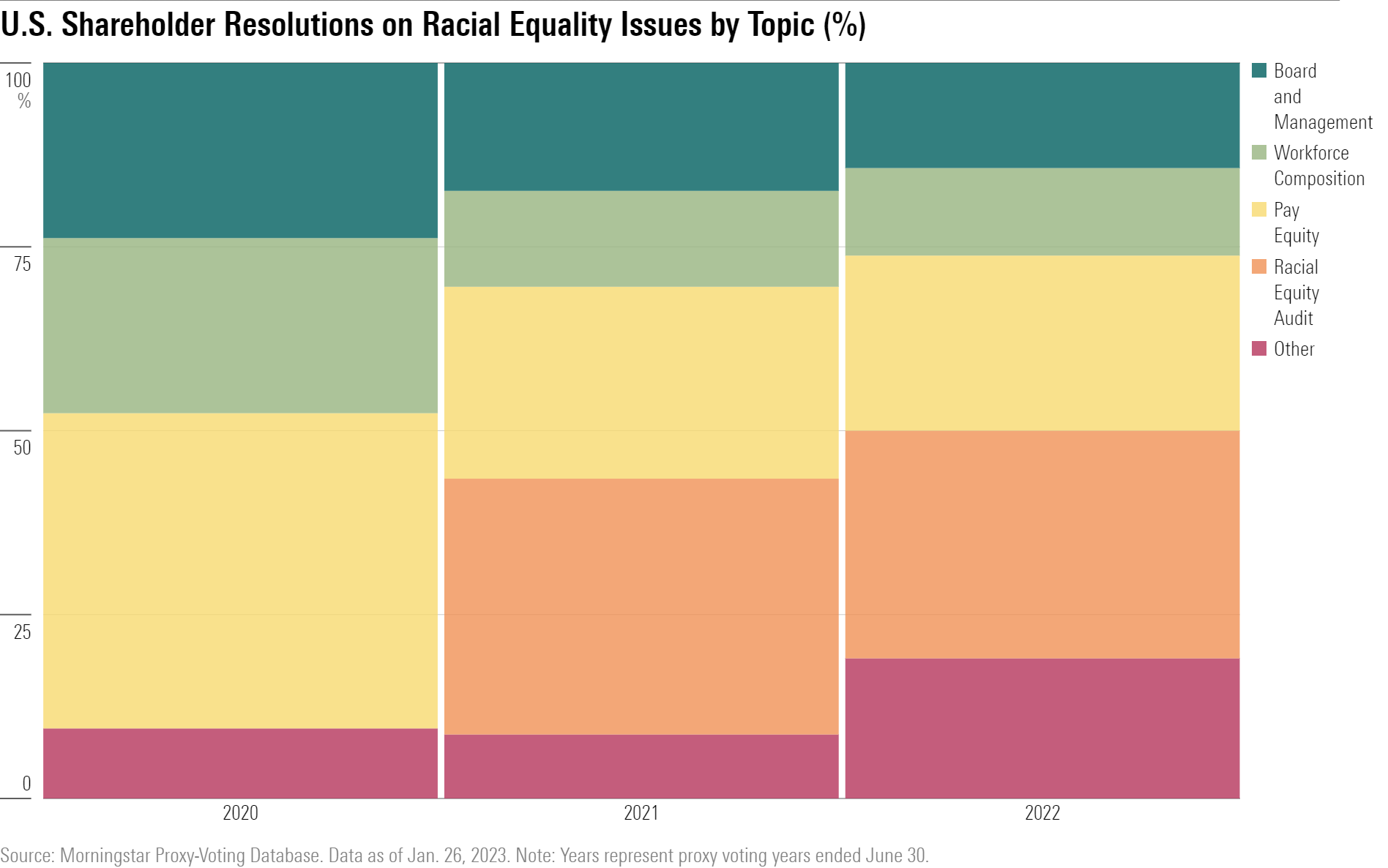

In light of this, we expect these resolutions to continue to feature strongly on the proxy-voting agenda in the years to come. What’s especially interesting, though, is that the nature of the proposals has broadened recently. In the 2020 proxy year, the overwhelming majority of the 21 shareholder resolutions about race addressed issues within companies: pay, board and management composition, or workforce composition.

Shareholders Consider Wider Impacts of Race

By 2022, not only were there twice as many proposals in total, but they addressed a much broader slate of issues affecting wider society beyond the workplace, particularly inequality in income, and access to capital and services. In short, shareholders are thinking more about the wider systemic impacts of race in the United States, not just who is on the payroll and how much they earn at any particular business.

Shareholders Seek Racial-Equity, Civil Rights Audits

The increase in shareholder resolutions requesting racial-equity and civil rights audits at U.S. companies in the past couple of years has been particularly noteworthy. In the 2021 and 2022 proxy years, they made up around one third of all shareholder proposals addressing racial equality. These proposals request an analysis of a company’s “impacts on nonwhite stakeholders and communities of color,” usually with input from community stakeholders, employees, customers, and civil rights organizations.

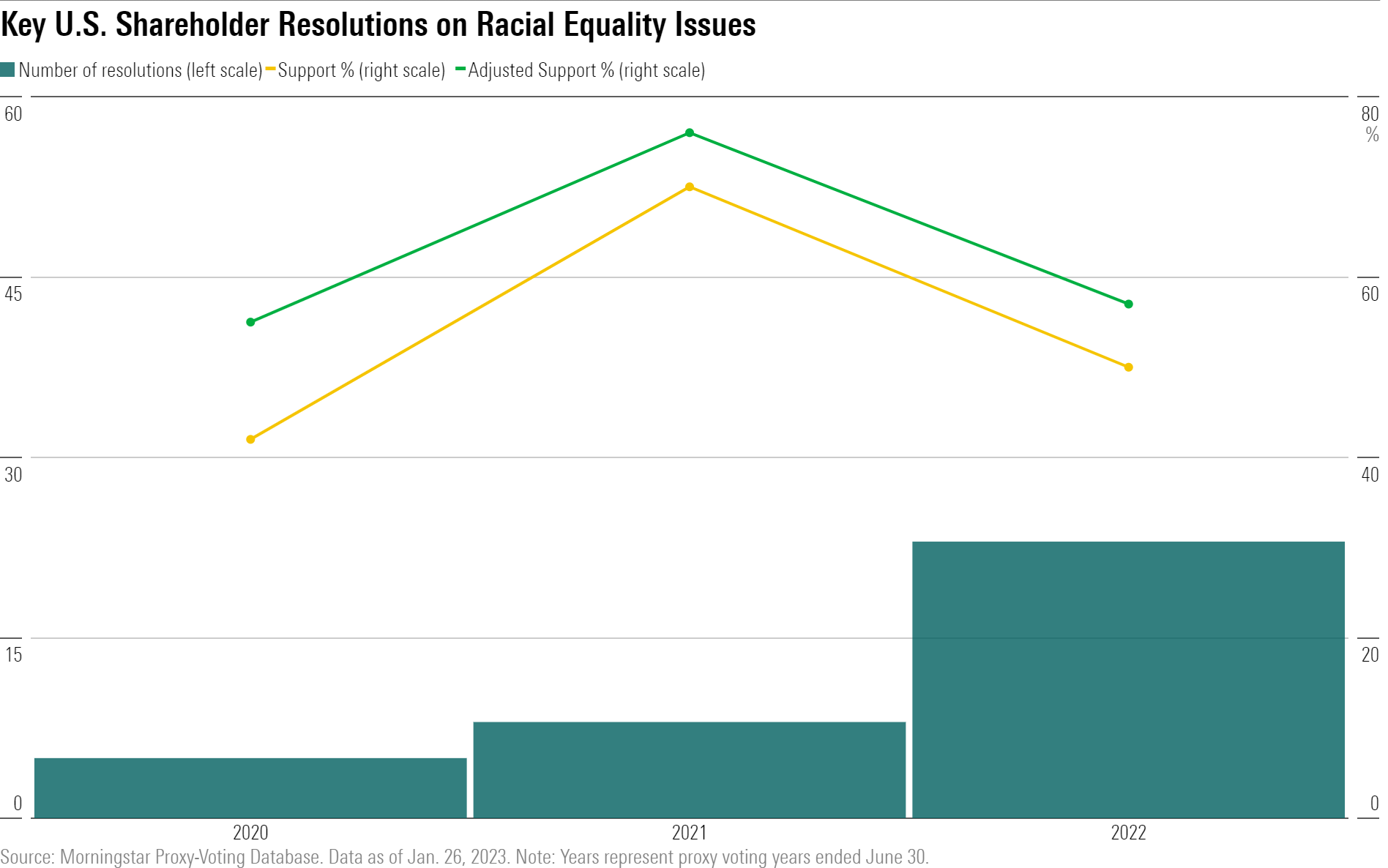

There were eight such resolutions in 2021, when they first started to appear on U.S. companies’ proxy cards. This increased to 22 in 2022. On average, these proposals were supported by close to 50% of company shareholders in 2022, rising to a majority if we consider adjusted support (that is, counting only votes by shareholders who are not company insiders, who tend to oppose shareholder resolutions). Following such strong shareholder support, companies including Alphabet GOOGL, Microsoft MSFT, BlackRock BLK, Meta Platforms META, Starbucks SBUX have committed to conducting racial-equity audits.

The analysis of key resolutions in our research paper also indicates strong shareholder support for well-crafted proposals addressing racial equality. Key resolutions are shareholder proposals that have been supported by at least 40% of a company’s independent shareholders (that is, those who are not company insiders or strategic investors). As a general rule, U.S. shareholder resolutions with more than 30% support are considered a strong prompt for management action, so this is an important group of such votes. There were 67 such resolutions in the 2020 proxy year, 72 in 2021, and 102 in 2022.

By the 2022 proxy year, more than one in five key resolutions addressed racial equality themes, and these key resolutions have consistently been supported by a majority of independent shareholders at U.S. companies, as the chart above shows.

There is clearly a long way to go in addressing racial equality within society, but it’s clear that the investment community is prepared to demand action from companies on this important issue.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XTXQYAMAL5EKRLGIS3IDVAZ3R4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3J75DKCBIZCTJMRFWSSJSHHCJ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DJVWK4TWZBCJZJOMX425TEY2KQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20726617-027d-4959-87ab-429b60ece7ce.jpg)