Markets Brief: January CPI Report Forecasts Show a Bump in the Road to Lower Inflation

A hot reading on inflation in the CPI report could mean higher rates for longer.

Following the very strong January jobs report, investors are now looking to the January Consumer Price Index report due out Tuesday for hints on how long the Federal Reserve will have to keep interest rates elevated in order to push inflation lower.

Forecasts for the January CPI report suggest the run of good news on inflation could hit a pause, and some economists see an increasingly bumpy path ahead. The strong wage inflation and low unemployment rate seen in the latest jobs report is what’s complicating the picture, according to Stephen Juneau, economist at Bank of America Merrill Lynch.

“In terms of inflation, we’ve seen meaningful improvement in past months—but we can’t bank on that continuing, especially with the job market in such strong shape.” Juneau also says that with the unemployment rate at its lowest level since 1969 and wage inflation still growing, the CPI report will likely show more volatility in the coming months.

Forecasts for the January CPI report show an expected worsening of the inflation picture, according to FactSet. The CPI is expected to rise 0.5% for the month, which would be its biggest increase since October. So-called core CPI, which excludes volatile food and energy costs, is expected to rise 0.4%, which would match December’s reading.

January CPI Report Forecast

- CPI to rise 0.5% for the month versus 0.1% in December, according to FactSet.

- Core CPI (excluding food and energy) to rise 0.4% for the month after rising 0.4% in December.

- CPI, year over year, to rise 6.2% versus 6.5% in December.

- Core CPI, year over year, to rise 5.5% versus 5.7% in December.

In fact, revisions to the December CPI report offer another example of how the path to lower inflation might not be as smooth as many have been thinking: When the report was first released, headline CPI for December showed a decline of 0.1% month over month. The Bureau of Labor Statistics has now adjusted its reading to show that consumer prices actually rose 0.1% in December.

“This morning’s revision in [December CPI] ... is adding to angst among investors who are struggling with a hawkish Fed that appears to have minimal tolerance for inflation,” writes José Torres, senior economist at Interactive Brokers.

Juneau forecasts a headline CPI rise of 0.4% month to month, or 6.1% year over year, for January on the back of rising energy prices. For core CPI month over month, Juneau’s expectations lie at a 0.3% increase and for a 5.4% year-over-year increase, roughly in line with consensus.

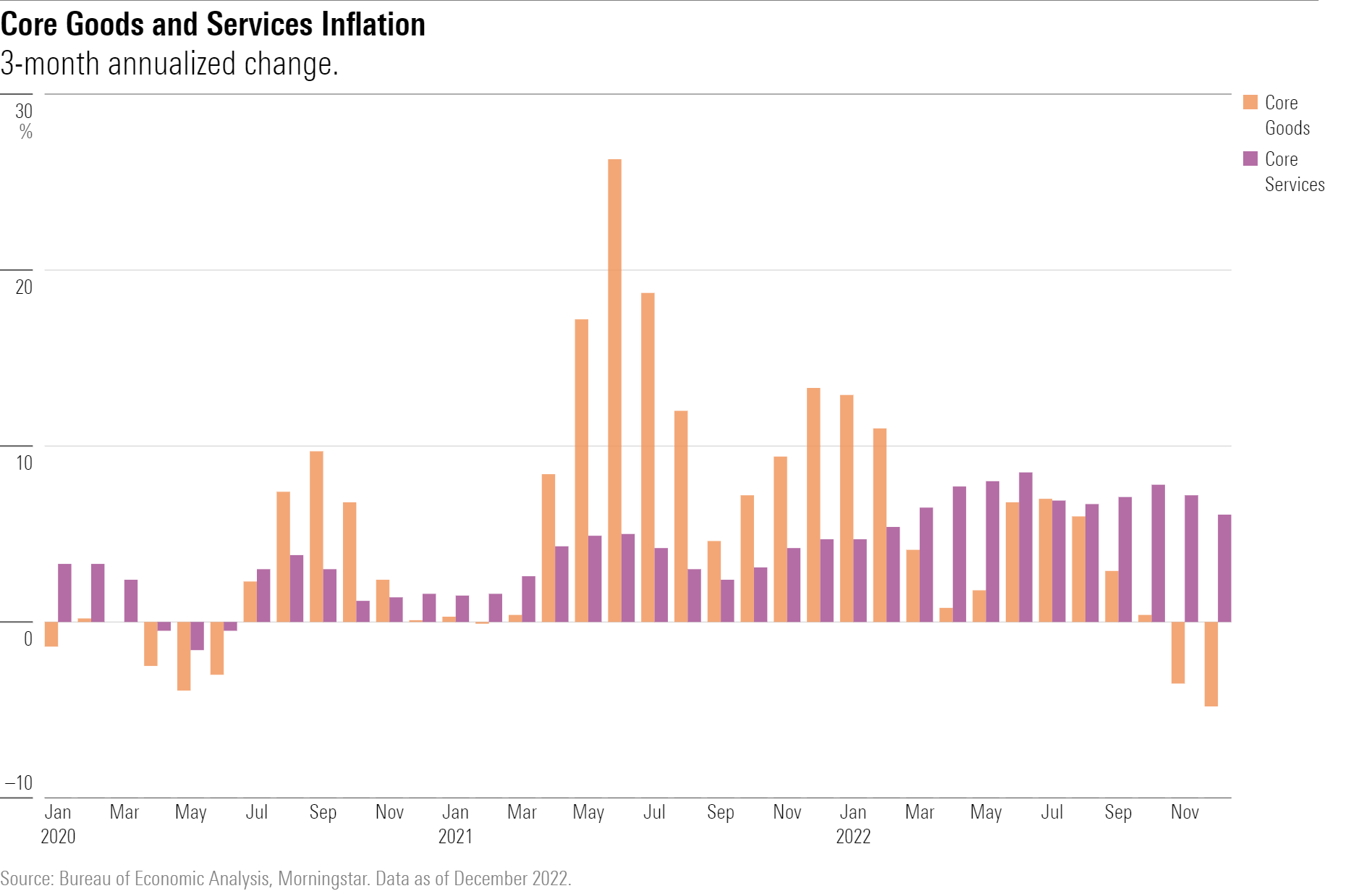

Watching Services Inflation in the CPI Report

“Our focus in this report is on services prices, outside of shelter,” Juneau says. “They’re directly tied to labor market pressures.”

Other economists are also keeping a close eye on this section of the CPI report. “The most concerning thing would be if core services prices start to accelerate again,” says Donald Rissmiller, chief research officer at Strategas Research Partners. “That would set off the alarm bells for the Fed.”

For January CPI report forecasts, Rissmiller points to the Cleveland Fed’s Inflation Nowcast, which as of Friday showed headline CPI to rise 0.6% month over month, or 6.5% year over year in January. For core CPI, the tracker estimated 0.5% month over month and 5.6% year over year.

“We won’t get through this without some bumpiness,” Rissmiller says. “It’s not simple to remove inflation once it’s entrenched, and that’s why there’s so much effort to wring it out right now, before it gets worse.”

A Hot CPI Report Could Keep Rates Higher

For now, Rissmiller says, the Fed seems to accept that we’ve passed peak inflation, but everyone will be looking closely at core services components, including but not limited to medical, education, and recreation. “These components will give us the most info on what the trend in inflation is going to be when all the noise settles out.”

The Fed has clearly telegraphed that its upcoming moves will be two more 0.25-percentage-point interest-rate hikes at its March and May meetings, Rissmiller says. But if the January CPI report looks concerning, the terminal rate—the highest the Fed will take interest rates before cutting them back down—could go even higher or stay in place longer.

Market participants currently expect the federal-funds rate to reach a range of 5.00%-5.25% at the Fed’s May meeting and stay that way through November 2023. That’s up from a 4.50%-4.75% target today. A month ago, most expected the rate to reach only 4.75%-5.00% and for the Fed to start easing in September.

Events Scheduled for the Coming Week Include:

- Monday: Palantir Technologies PLTR reports earnings.

- Tuesday: January Consumer Price Index report.

- Wednesday: Energy Transfer ET, Roblox RBLX, and Cisco Systems CSCO report earnings.

- Thursday: DoorDash DASH, Paramount Global PARA, and Marathon Oil MRO report earnings.

For the Trading Week Ended Feb. 10:

- The Morningstar US Market Index fell 1.4%.

- All sectors were down for the week except energy, which rallied 4.6%.

- The worst-performing sector was communications services, down 6.2%.

- Yields on 10-year U.S. Treasuries rose to 3.74% from 3.53%.

- West Texas Intermediate crude prices rose 8.6% to $79.72 per barrel.

- Of the 851 U.S.-listed companies covered by Morningstar, 249, or 29%, were up, and 602, or 71%, declined.

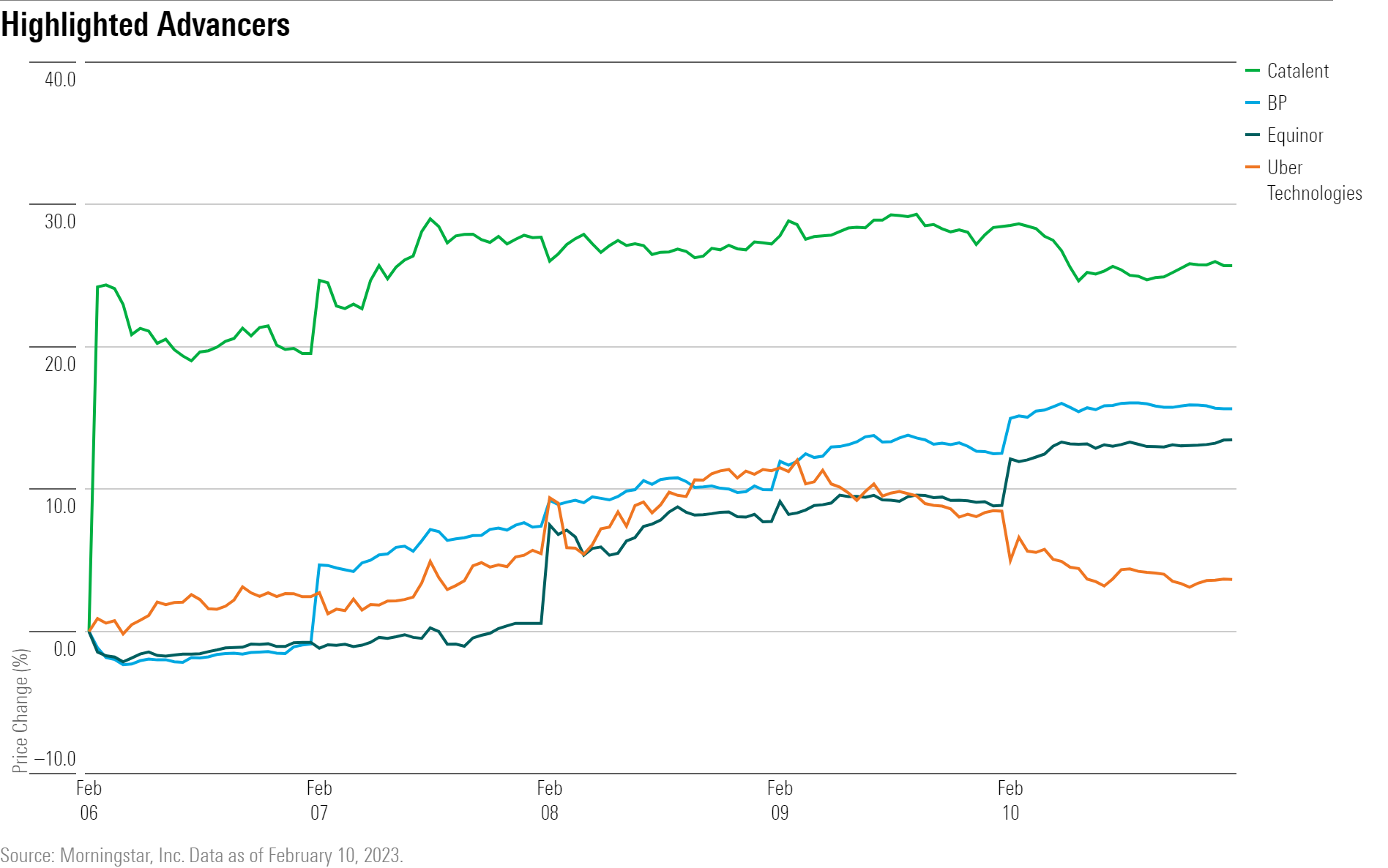

What Stocks Are Up?

Catalent CTLT, a drug development and manufacturing partner for pharmaceutical companies, rallied after posting solid fiscal 2023 second-quarter results. The company saw a decrease in coronavirus-related workloads and revenues but was partially offset by growth in its gene therapy program, says Rachel Elfman, equity analyst at Morningstar.

“There have also been news reports speculating that Danaher could potentially acquire Catalent,” says Elfman; however, the company did not provide any comments on the topic.

BP BP surged after the firm not only reported revenue of $69.3 billion, ahead of estimates of $55.4 billion, but also announced an increase in oil and gas production that “imply its 2030 production levels will be higher than previously guided, although still declining, but with growth through 2025,” says Allen Good, strategist at Morningstar.

Similarly, oil and gas firm Equinor EQNR also rallied. Although the firm beat earnings expectations, Good attributes the rally to the company announcing a 50% increase in its quarterly dividend and its decision to maintain the level of its buyback program from 2022 into 2023.

Uber Technologies UBER stock rallied after the ride-sharing app company posted fourth-quarter results that showed impressive year-over-year growth in users and monetization. Management also expressed confidence in being able to reach profitability in 2023, says Ali Mogharabi, senior equity analyst at Morningstar.

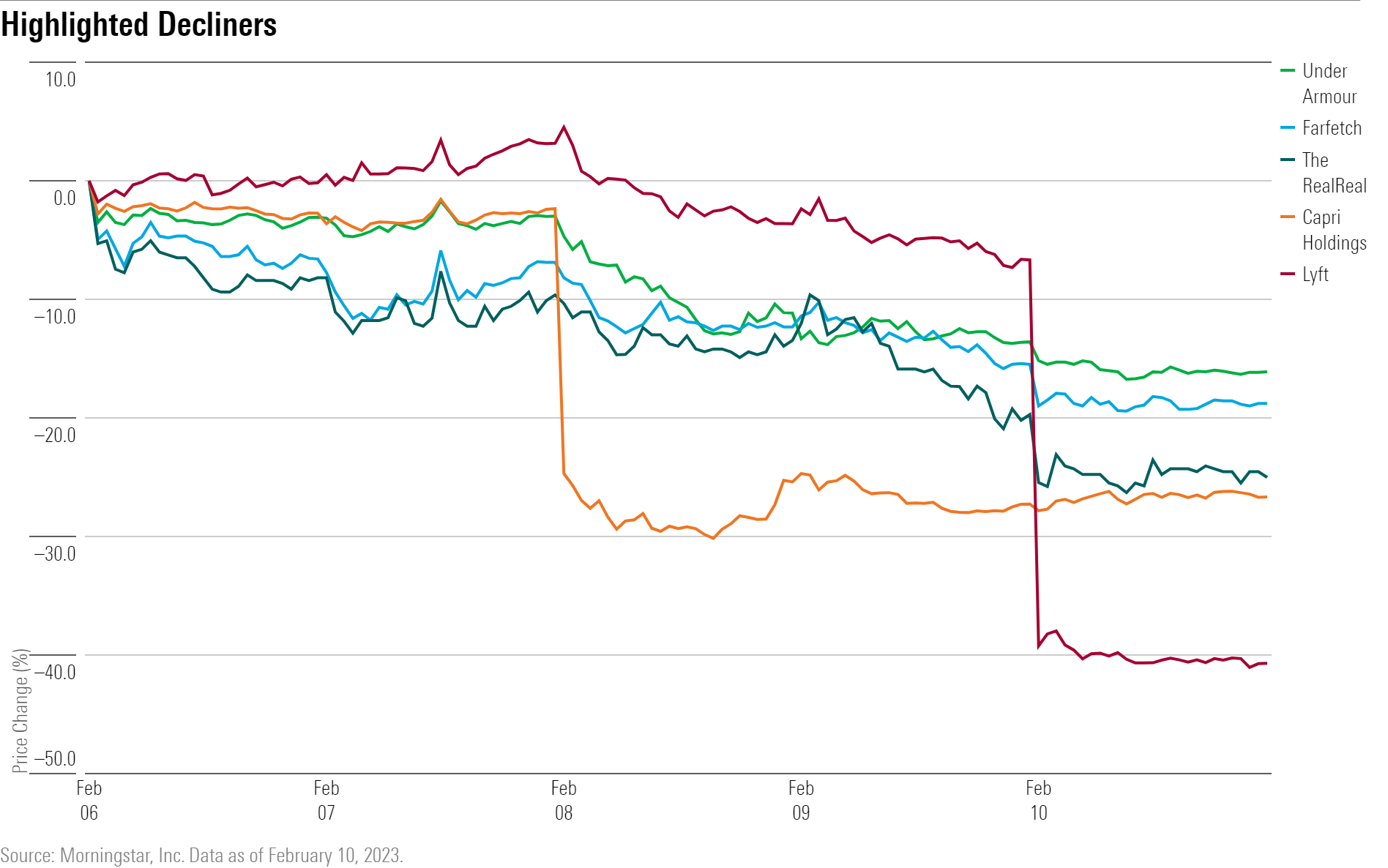

What Stocks Are Down?

Lyft LYFT stock plunged after the Uber competitor reported weak revenue guidance of $975 million versus former consensus estimates of $1.09 billion, according to FactSet.

Shares of apparel retailers faced a tough week as disappointing earnings and guidance hammered the industry along with remaining high levels of inventory. Shares of upscale apparel retailer Capri CPRI stock tumbled after the firm missed both earnings and revenue estimates. Guidance was also set to about $1.28 billion, undercutting FactSet consensus estimates of $1.41 billion.

Under Armour UA stock slid despite beating fiscal 2022 third-quarter estimates as results showed that the firm “struggled to maintain volume and pricing in a holiday season characterized by slowing consumer demand and excess inventory,” says David Swartz, senior equity analyst at Morningstar.

Luxury fashion resale platforms The RealReal REAL and Farfetch FTCH also both saw their stocks slide ahead of their own earnings results in late February.

Correction: This article was updated to reflect a change in the core CPI forecast numbers.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)