Here’s Some Wisdom: Expect the Unexpected

Morningstar Indexes reveal tough investing lessons from a tough year.

Editor’s Note: This article was first published in the Q1 2023 issue of Morningstar magazine.

There’s no shortage of pearls of wisdom in the investing world. Any trader or broker can reel off old saws like “Don’t fight the Fed” or “Buy the rumor, sell the news.” Rules of thumb try to explain what moves markets, how assets interact, and which investments best suit the macro environment.

Much of this wisdom is flawed, however. The forces that drive financial market behavior are unpredictable, and relationships between assets are fluid. Investment claims are often made by those who have something to sell. What can sound axiomatic often violates actual truisms like “Past performance is no guarantee of future results,” “The plural of anecdote is not data,” and “The best company can be a bad investment at the wrong price.”

Markets were vexing in 2022. Generationally high inflation, a belated but aggressive monetary policy response, and Russia’s invasion of Ukraine wreaked havoc on stocks, bonds, and other assets. For investors, the year delivered painful lessons that defied conventional wisdom. Here are five things we learned from 2022.

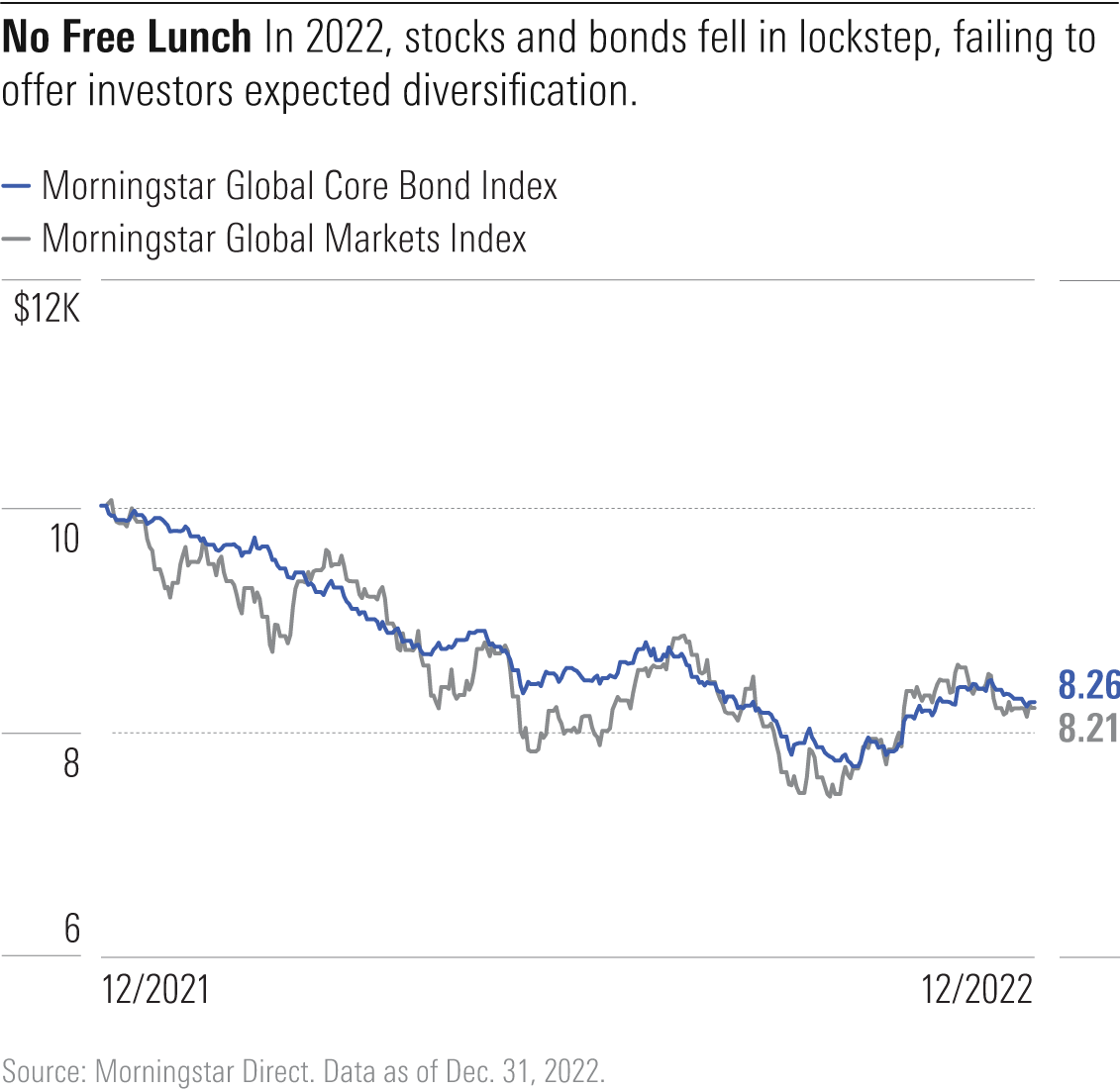

Lesson 1: Sometimes Diversification Makes You Pay for Lunch

Diversification has long been referred to as the only free lunch in investing. But classic stock/bond diversification did not work in 2022. Stubbornly high inflation in most major markets, a string of steep interest-rate hikes by central banks, recessionary worries, and conflict in Europe took a heavy toll on both major asset classes. The Morningstar US Moderate Target Allocation Index, which represents the traditional mix of 60% stocks and 40% bonds, declined 15.3% in 2022. Morningstar’s range of multi-asset indexes for investors in Australia, Canada, the eurozone, Japan, New Zealand, and the United Kingdom also suffered losses for the year thanks to the synchronized swan dive for both equities and fixed income, as represented by the Morningstar Global Markets and the Morningstar Global Core Bond indexes.

Ballast is a popular metaphor for bonds. Fixed income is supposed to be a boring but stable asset class, capable of keeping a portfolio steady even in the stormiest waters. This is exactly the role fixed income played in the three most recent bear markets for equities before 2022—at the onset of the coronavirus pandemic in the first quarter of 2020, the global financial crisis of 2007–09, and the dot-com bubble in 2000–02, when the crash of technology, media, and telecom stocks was followed by recession and 9/11. In each period, the Morningstar Global Core Bond Index was in positive territory when the Morningstar Global Markets Index suffered heavy losses.

In retrospect, the 2022 fixed-income meltdown looks obvious. Thanks to rock-bottom interest rates in response to the pandemic, bond yields were at historic lows in many markets. Then came inflation and rate hikes. Yields soared and prices sank. It should be noted that low bond yields in the aftermath of the global financial crisis did not presage disaster for fixed income, despite many warnings of “bond bubbles” and commentators writing off bonds as “return-free risks.” The raging inflation foreseen by the doomsayers of the 2010s didn’t materialize. Perhaps the cries of wolf from those years begot recent complacency.

What about other forms of diversification in 2022? Gold, a millennia-old store of value, did not serve that function, and neither did cryptocurrency, supposedly a more modern inflation hedge. Some alternative strategies, such as trend-following, finally did well after many years of languishing.

Among traditional stocks and bonds, energy-related equity investments were a real bright spot in 2022. Morningstar indexes representing upstream, midstream, and downstream nodes of the energy value chain all saw heady gains. The trouble is that many investors had given up on their commodities-related investments after years of poor returns and had little exposure. The energy sector shrank from 11% of the Morningstar Global Markets Index in 2011 to just 3.5% at the end of 2021.

Where do investors go from here?

The good news from both an income and total return perspective is that bond yields have risen steeply in most major markets. The Morningstar Global Core Bond Index, for example, has seen its yield rise from 1.05% at the start of 2022 to 3.3% at year’s end. Niche areas within fixed income offer juicier yields. The Morningstar LSTA US Leveraged Loan Index, for example, carried a 10.0% yield at the end of 2022, while the Morningstar European Leveraged Loan Index yielded 8.6%.

During years of low interest rates and depressed bond yields, market watchers talked of TINA (there is no alternative) to equities. Fixed income increasingly offers an alternative, which may not be great for equities, but certainly gives debtholders and income investors much to celebrate.

Lesson 2: Rising Rates Don’t Have a Predictable Impact on Stocks

The performance divergence between growth and value stocks in 2022 was staggering. The Morningstar Global Value Target Market Exposure Index, a broad gauge of equities with value characteristics, outperformed its growth counterpart by more than 20 percentage points for the year.

Rising interest rates are commonly blamed for growth stocks’ travails. Higher rates, the explanation goes, are worse for growth stocks because of their longer durations. It sounds logical. But research from AQR disputes the link between style performance and interest rates. Writes AQR’s CIO Cliff Asness:

“Growth stocks have much longer-dated cash flows than value stocks and thus should be a ‘longer duration’ asset and move more with longer-term interest rates, right? ... This is all taken as axiomatic given in countless pundit and press observations. However, it’s not nearly that simple, and mostly it’s just not true.”

Consider style performance in prior periods of rising rates. The Federal Reserve hiked rates by 2.25 percentage points from 2015 to 2018, but growth stocks thrived. It was the FANG market, led by Facebook (now Meta Platforms META), Amazon.com AMZN, Netflix NFLX, and Google (now Alphabet GOOG). Morningstar’s global growth and global value indexes were both up big in those years. Then there was 1999, a year in which the Fed raised interest rates three times, but the dot-com bubble propelled growth stocks into the stratosphere.

In 2022, dividend-paying stocks shone. That’s notable because a common line of thinking sees rising rates as bad for dividends. Why? Higher bond yields supposedly diminish the appeal of equities for income investors and raise their debt-servicing costs. Yet, the Morningstar Global Markets Dividend Yield Focus Index shrugged off rate hikes to return 0.67% in 2022.

Why did dividend payers hold up so well? Several factors were at play. It’s certainly true that rising rates lifted yields on cash and bonds. But, as discussed above, fixed income was a disaster from a total-return perspective. Sector dynamics also boosted the dividend-paying section of the market. Energy, a dividend-rich area, was by far the best-performing equity sector. Meanwhile, dividend payers in defensive sectors like healthcare, consumer staples, and utilities weathered the storm far better than the dividend-light technology sector, which led the market down in 2022.

Historically and globally, the link between dividend payers and rates is weak. To cite one example, from 2004 to 2006, rates rose but dividend stocks dramatically outperformed the market. In a recent study, we examined the performance of high-yield equities in the United States, U.K., Germany, Japan, and Australia and found no clear relationship between rates and dividends.

The lesson for investors? Don’t try to time the macro environment. Growth stocks, especially technology, entered 2022 carrying sky-high valuations after years of market leadership. Energy and other dividend-rich areas on the value side of the market were priced more reasonably. For dividend investors, fundamental factors like quality and financial health are far more important than interest rates.

Lesson 3: Sustainable Investments Aren’t Immune to Market Cycles

Consider the struggles of the Morningstar Global Markets Sustainability Leaders Index in 2022. The index excludes several classes of stock and selects companies with the lowest environmental, social, and governance risks, according to Morningstar Sustainalytics. It had outperformed its parent index by 28 percentage points in cumulative terms for the five years ended in 2021. It wasn’t alone. For the five years through 2021, 80% of Morningstar sustainable indexes with five-year histories outperformed their conventional equivalents.

So, what happened in 2022? A growth bias hurt sustainable equity funds, according to an analysis by Morningstar’s Jon Hale. Many growth companies handle ESG risks well. But in late 2021, Morningstar research concluded that “investors are paying too much for good ESG companies.” Too little energy exposure and too much technology hurt the Sustainability Leaders index in 2022, just as the opposite was true in previous years.

What happens when the growth bias is removed from a sustainable portfolio? The Morningstar Global Sustainability Large-Mid Cap Value Index lost only 10.6% in 2022, well ahead of the market.

The Morningstar Global Markets Sustainability Dividend Yield Focus Index fared even better in 2022. As we discussed, dividends were a bright spot last year.

The value and dividend-screened sustainability indexes reveal another important point about sustainable investments. They’re not a monolith. Sustainable investments vary in their motivations and applications. Each approach has its own goals. Each has its own profile.

At the end of the day, any investment that deviates from the market portfolio will outperform in some market conditions and underperform in others. Just as the five years through 2021 undermined skeptics who dismissed sustainable investing as requiring a performance sacrifice, returns in 2022 showed that “doing good” doesn’t always lead to “doing well.”

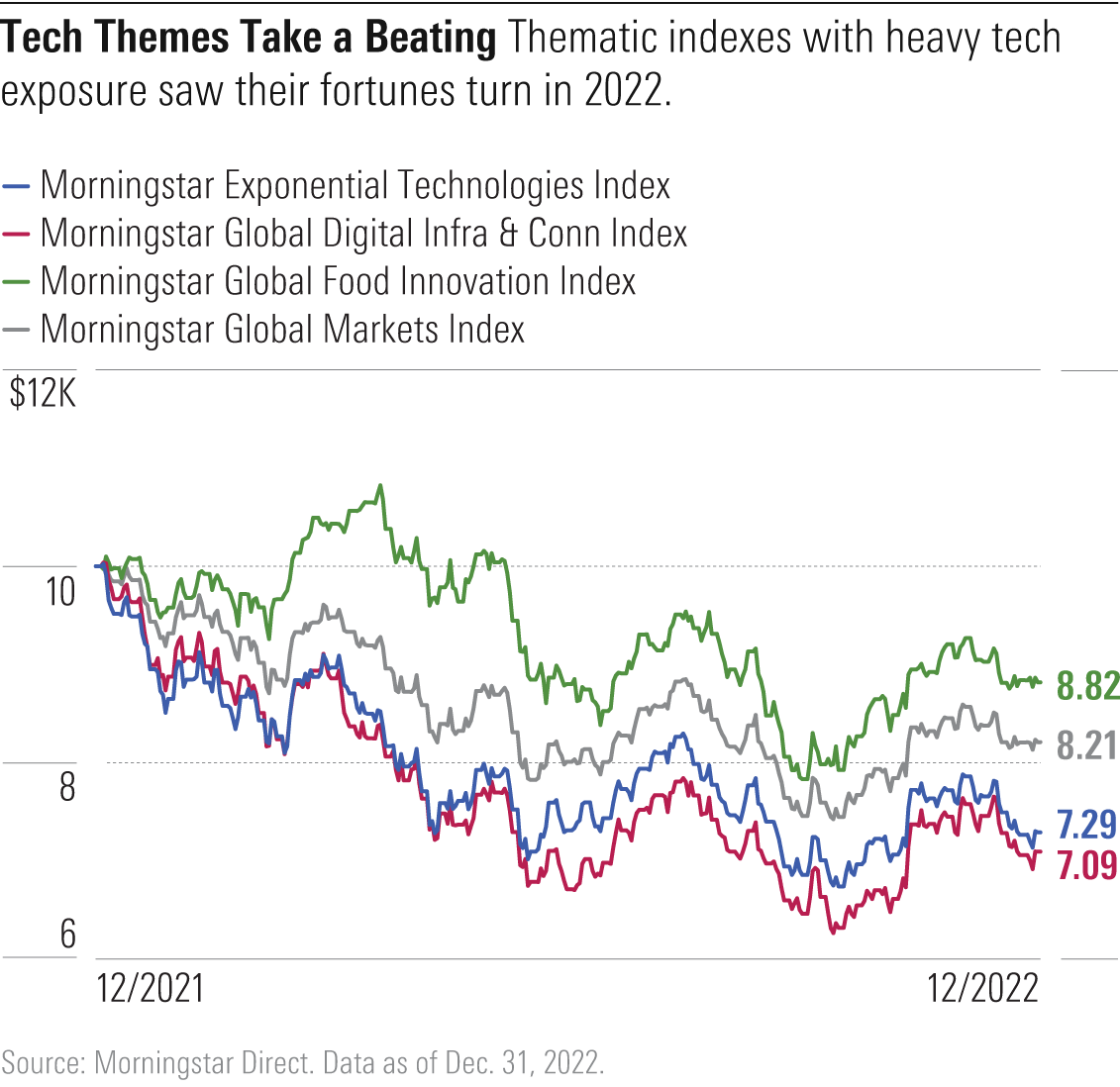

Lesson 4: Growth Themes Don’t Always Grow

Identify a trend and invest in its beneficiaries. How can you lose? From cybersecurity to connected cities to the blockchain, investments focused on themes tripled their market share in the decade that ended in 2021. Thematic investments possess far more intuitive appeal than esoteric factor strategies like “minimum volatility.”

A bull market has also helped. Consider the performance of the Morningstar Exponential Technologies Index, which includes 200 global stocks exposed to nine themes, including cloud computing, healthcare innovation, and robotics. For the five years through the end of 2021, the index rose 171% in cumulative terms, versus a 97% advance for its global equities parent. But fortunes turned in 2022, as the index fell more than 27%. Another thematic index, the Morningstar Global Digital Infrastructure & Connectivity Index, was down even more, declining 29% in 2022.

Thematic indexes that have less exposure to technology performed better. The Morningstar Global Food Innovation Index fell just 11.8%, well ahead of global equities.

The struggles of many thematic portfolios in 2022 illustrate the challenges inherent to the approach. A successful thematic investment must get three bets right:

- The theme will materialize as expected.

- Investable securities will benefit from the theme.

- Beneficiaries will become good investments.

Consider some historical examples. China’s economic growth was a powerful theme that did not translate into stock market gains. China’s gross domestic product grew from $3.4 trillion in 2007 to more than $18 trillion in 2022. Yet the Morningstar China Index gained just 16.7% in cumulative terms for the 15-year period through December 2022, while the Morningstar Global Markets Index was up 125.6% over that span.

In the late 1990s, the market identified an important theme as the internet changed the way we all live and work. But successful internet business models had yet to emerge. Even great companies like Amazon carried valuations that implied unrealistic expectations. It took years for Amazon to regain its 1999 valuation and for companies like Google and Facebook to come to market.

The struggles of many thematic indexes in 2022 did not invalidate their themes in the long term or mean the wrong securities were selected. The Morningstar thematic indexes cited above use equity analyst insights to identify themes and companies poised to benefit from them. Similar to the discussion of sustainable investments above, it points to the inevitability of performance cyclicality for any deviation from the market portfolio.

It also speaks to the importance of valuation. In the case of the Morningstar Exponential Technologies Index, a portfolio of overvalued growth stocks harmed performance in 2022.

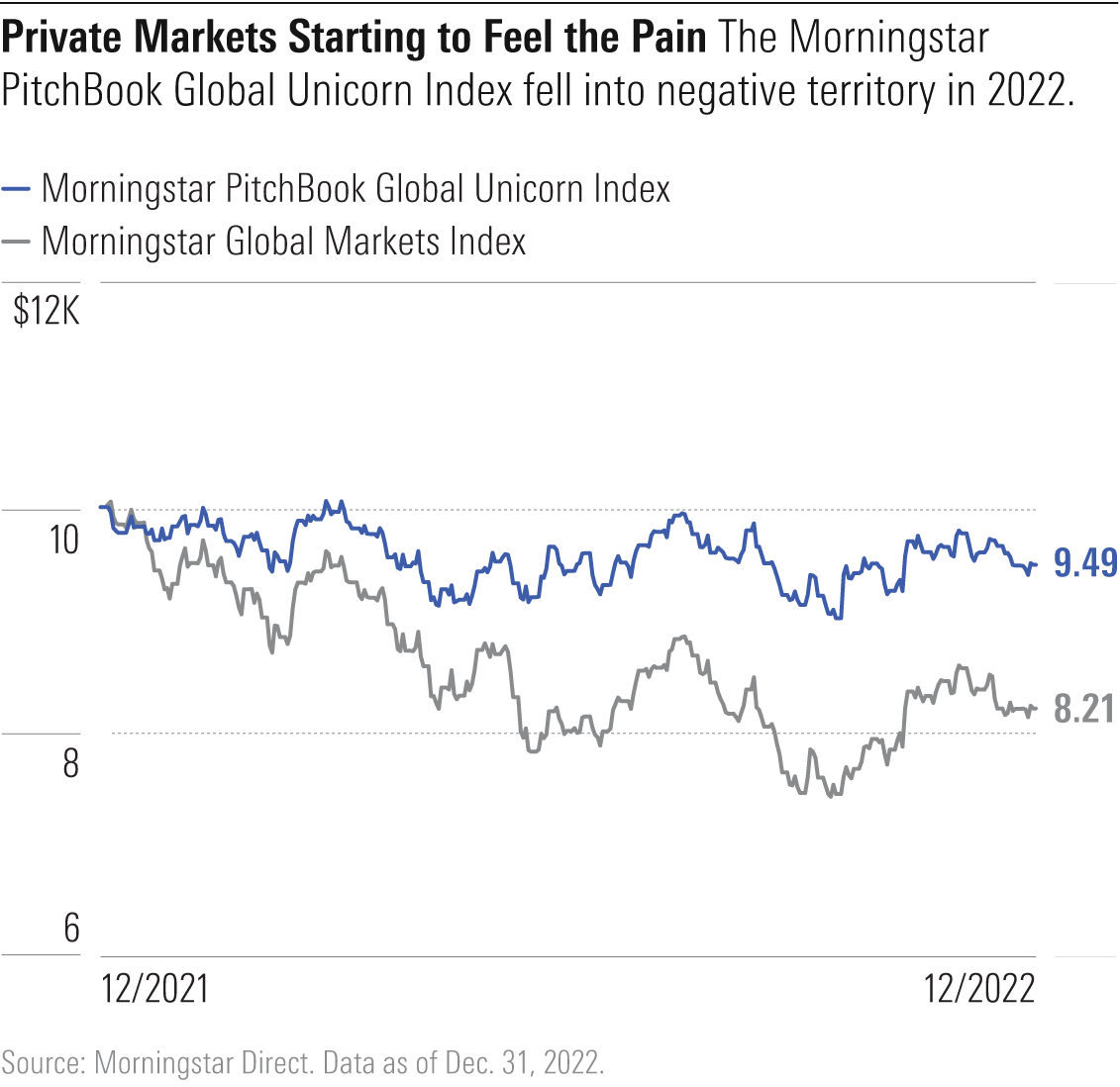

Lesson 5: Private Markets Don’t Only Go Up

One way to measure the boom in private-market investing in recent years is the performance of the Morningstar PitchBook Developed Markets Listed Private Equity Index, which includes the shares of public companies focused on private assets (Blackstone BX, KKR KKR, and Partners Group PGPHF are top constituents). The index, which relies on data from PitchBook, a Morningstar company specializing in private markets, rose more than twice as high as its public counterpart for the five years through 2021. As in many of the stories discussed above, 2022 saw a reversal of fortunes. The index fell twice as far as its parent. Even as private equity and venture capital funds continued to report strong performance, public markets sniffed trouble ahead.

Measuring returns for private companies that are not marked to market is difficult, though the Morningstar PitchBook Global Unicorn Index and its regional carve-outs attempt to do just that. To value constituents such as ByteDance, Stripe, and SpaceX, the indexes employ a pricing model that considers not just a company’s valuation as of its last funding round but also comparable data from both private- and public-market peers. The cohort of private companies with $1 billion-plus valuations lost steam last year, with estimated valuations for the 1,215 companies in the global unicorn index showing the group having lost more than 5% of collective value in 2022.

Because pricing is estimated, magnitude is less important than direction. In 2022, we saw the high-profile crash of Klarna, whose 85% valuation haircut was reminiscent of the WeWork WE debacle, and the well-publicized blowup of cryptocurrency exchange FTX. Propping up index returns were massive fundraising rounds from companies like Shein, a Chinese fast-fashion business, and SpaceX, whose valuation climbed to $127 billion in June. Whereas public markets can often be leading indicators, it can take time for private markets to reflect change.

Unicorn creation, a key metric, has slowed. The number of index constituents grew from 986 at the start of 2022 to 1,215 at year-end. In 2021, the global unicorn index saw its ranks swell from 574 to 986 by year-end. PitchBook observes that private-market deal flow has also slowed.

Headwinds include rising interest rates, potential recession, and public-market struggles. Unicorns looking for an exit do not want to IPO in a down market. Many have cash on hand and are biding their time. But a reckoning may be imminent. In 2023, “we’ll see companies that are forced to come back to market in an unforgiving environment,” warns PitchBook senior analyst Kyle Stanford.

But no matter the short-term outlook, structural factors mean private markets are likely to remain an important feature of the investment landscape. Regulation has made staying private more compelling. Many companies are keen to avoid the cost, disclosure requirements, and scrutiny of public markets. Raising funds in private markets is easier than ever thanks to more than $11 trillion in assets in private equity, venture capital, and other private-market vehicles.

According to PitchBook data as of Sept. 30, 2022, $3 trillion of that capital is considered “dry powder,” meaning it has been allocated but yet to be deployed. Asset owners like pension funds and sovereign wealth funds commonly allocate 20%-plus to private assets. Crossover investors, including equity mutual funds, commonly hold stakes in private companies, and efforts are being made to broaden access to small investors. Even if we’re in for a downturn in private markets, it’s likely that an increasing number of future portfolios will feature both public and private assets.

Accept Uncertainty

Ultimately, one year is a short time frame in investing. For many, the best course of action is to tune out and hang on. Investment performance in 2022 may end up as a small blip on a long upward-sloping chart. More important, perhaps, are the lessons that have been learned—about expecting the unexpected, preparing for the worst, and accepting how little certainty there is in investing.

This article was first published in the Q1 2023 issue of Morningstar magazine. To subscribe to Morningstar magazine, click here.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)