Why Bank Stocks Might Not Be a Good Buy Right Now

A tug of war between recession fears and benefits of higher rates has left bank stocks in limbo.

For a brief window last year, bank stocks were seen as benefiting from a strong tailwind in the form of rising rates, which can help fatten loan profits. But fears of a recession, which can lead to loans going bad, proved to be a more significant headwind, and many bank stocks struggled.

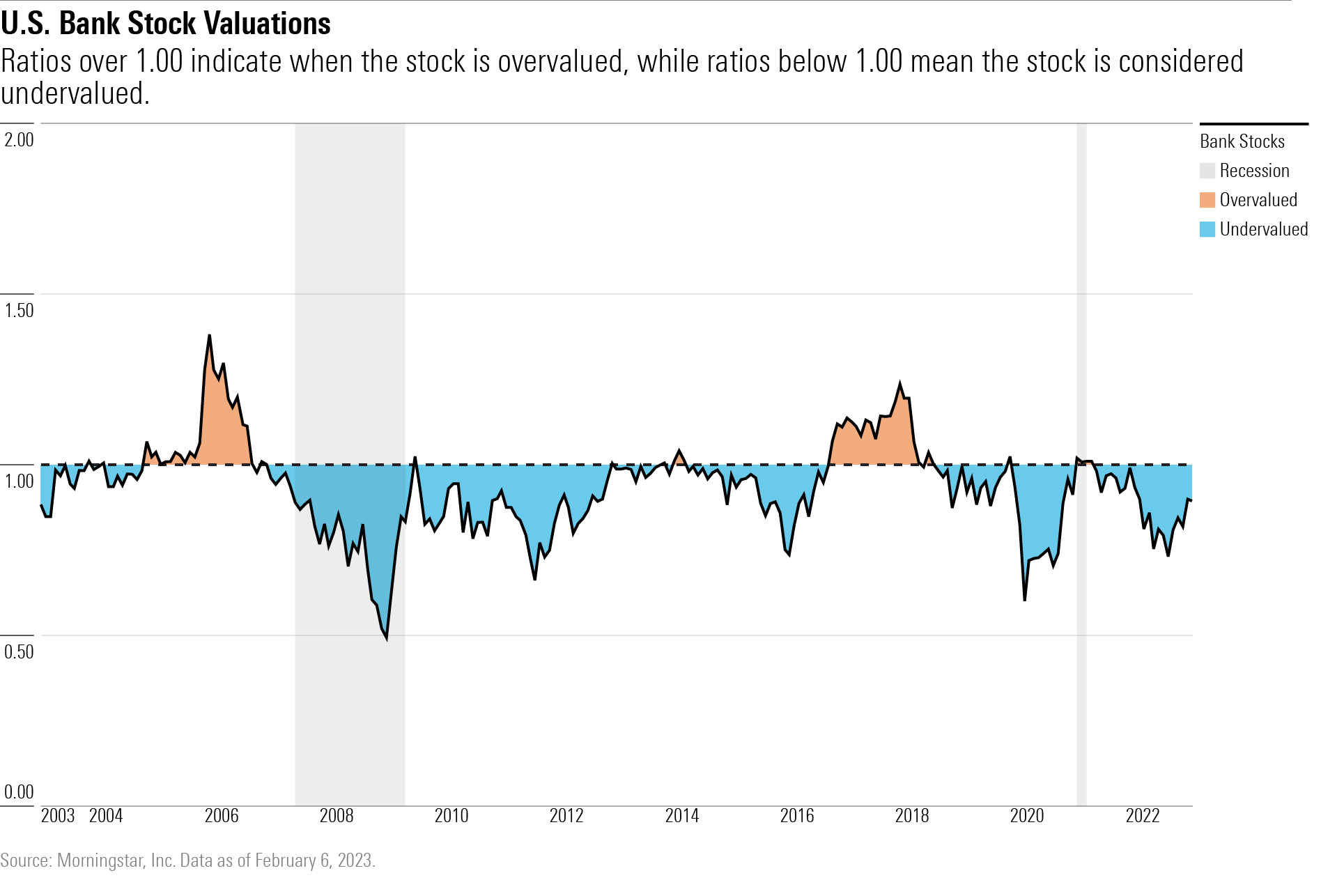

For investors, this means treading carefully with bank stocks. Last year’s poor performance has left many bank stocks trading at attractive valuations, according to Morningstar analysts. U.S.-listed bank stocks covered by Morningstar analysts are trading about 11% below their fair value estimates on average.

But the outlook for the U.S. economy in 2023 remains unclear, making the path forward for bank stocks similarly murky. And significantly, the lift in profits from higher interest rates seems to be in the rearview mirror.

Banks “have this potential recession hanging over them. You have what many would describe as a more uncertain, higher risk, environment going forward,” says Morningstar strategist, Eric Compton, who follows bank stocks. Even so, Compton says the market has yet to fully price in recession risk for bank stocks. “For a typical recession, I would expect banks to be closer to 25% to 30% below my fair value estimates.”

Adding to the unknowns of a recession, bank stocks face concerns about competition for customer deposits, rising expenses, and a weaker outlook for fees—all of which could damp the profit picture.

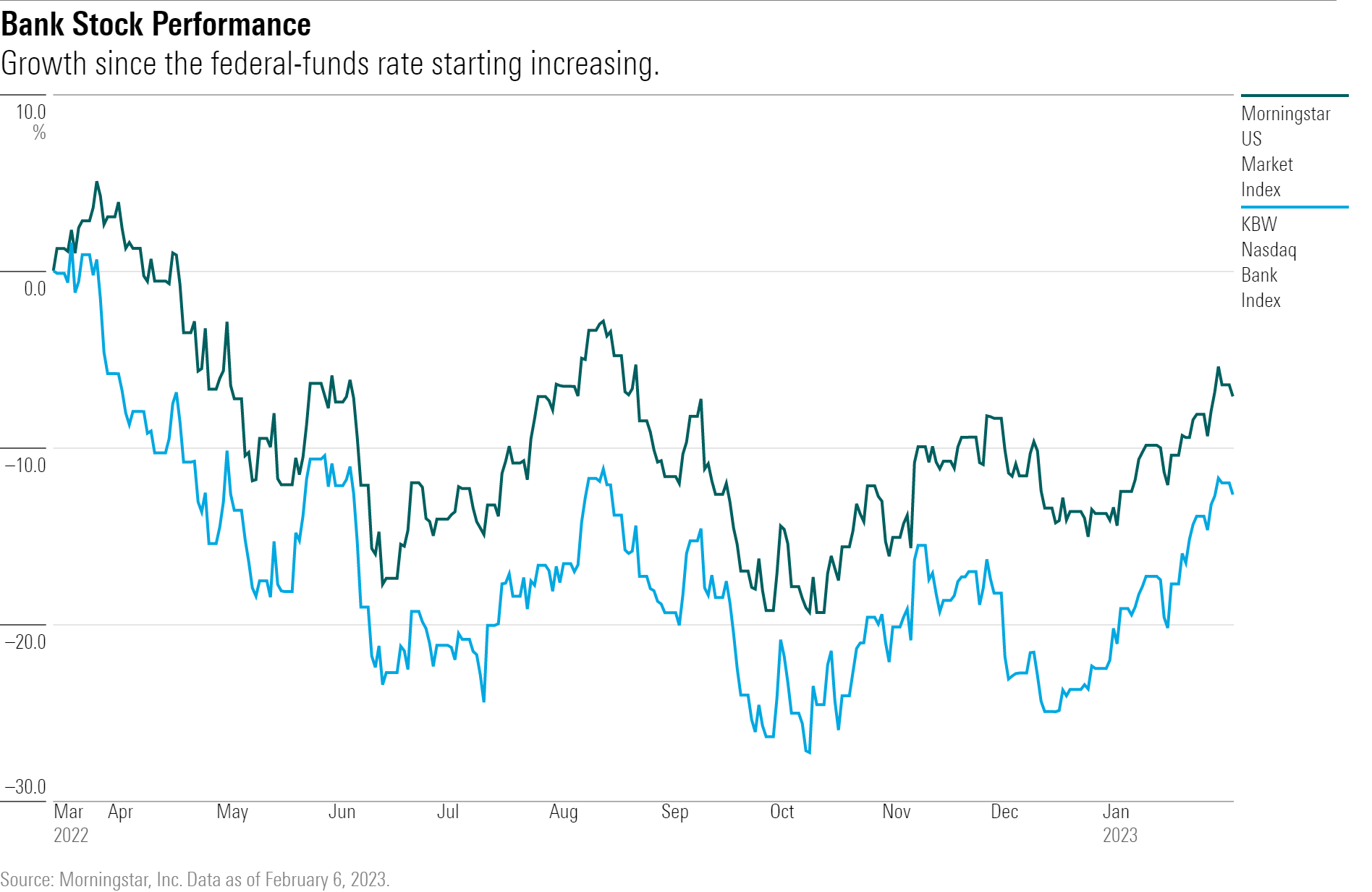

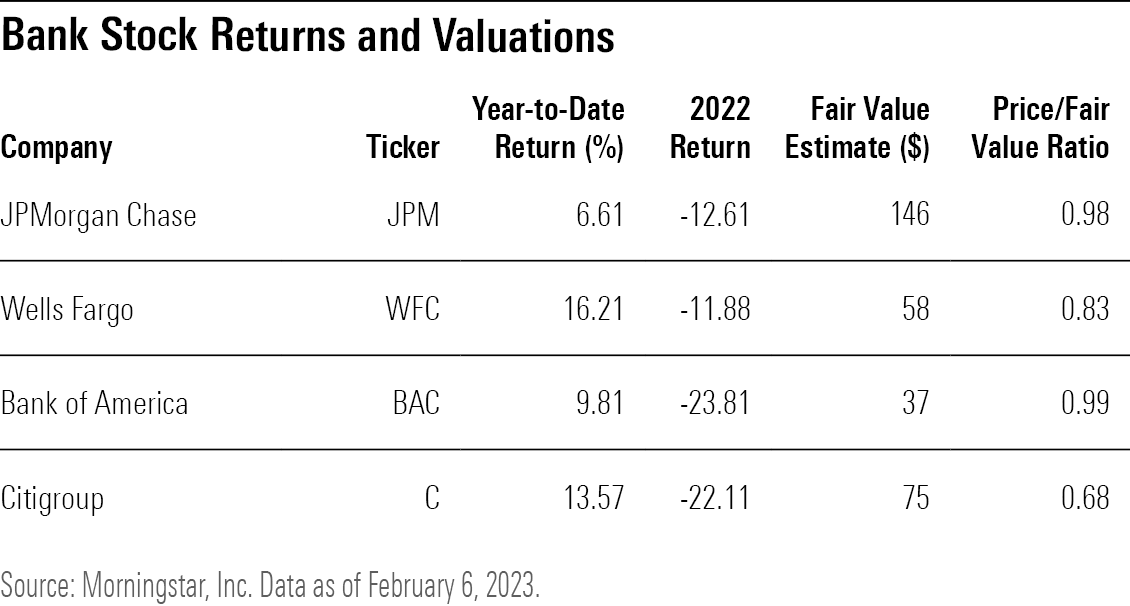

Still, banks have started 2023 with a bang as investors have grown more confident that the U.S. economy can avoid a significant recession or possibly not slide into a recession at all. The KBW Nasdaq Bank Index has risen nearly 13% for the year to date, ahead of the Morningstar US Market Index’s gain of 7.7%. Key contributors to this year’s gains include Citigroup C stock, up 13.6%, and Wells Fargo WFC stock, up 16.2%.

It’s a major turnaround from 2022 when most banks finished the year in the red, with the KBW falling 23.7% and underperforming the market’s 20.7% decline. Among the bank stocks with big losses in 2022 were First Republic Bank FRC, down 40.1% and Bank of America BAC, which lost 23.8%.

Why Interest Rates Matter to Bank Stocks

The Federal Reserve’s moves on interest rates are a key variable in the profitability of many banks. Since the start of 2022, the Fed has raised its federal-funds rate target from zero to its current target of 4.5%-4.75%.

The key metric for banks related to interest rates is known as net interest income, which is the margin between rates charged borrowers on loans and the yields that banks pay out on customers’ deposits.

A higher federal-funds rate means banks can charge higher interest on loans, increasing the margin between loans and deposit rates and, therefore, their net interest income.

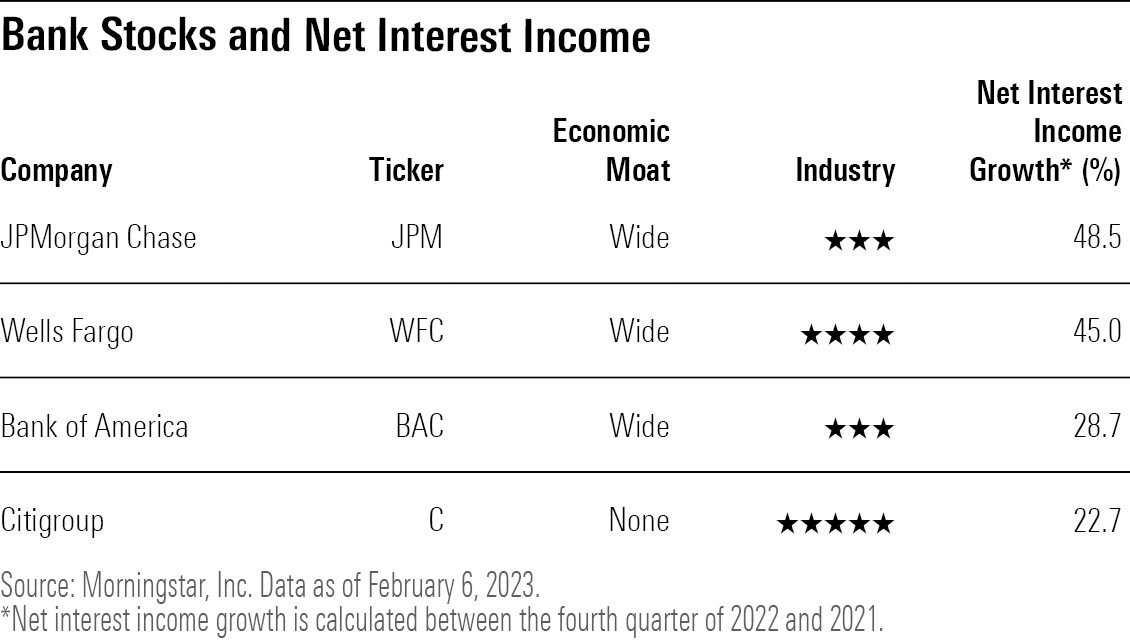

The impact can be seen in the total net interest income from the banks that comprise the KBW Nasdaq Bank Index, which rose roughly 34% between the fourth quarter of 2022 and 2021.

The End of Bank’s Net Interest Margin Boom

However, the benefit of rising rates can only go so far. While higher interest rates help improve net interest margins by raising the ceiling for how much banks can competitively charge interest for loans, it’s not a long-term tailwind.

The benefit to net interest margins only occurs early on in a rate-hiking cycle, says Compton. Eventually, savings rates—the interest provided to customers to keep their money at a bank account or in another investment vehicle—also start increasing.

As savings rates rise, clients tend to move their money away from their bank accounts to investments such as certificates of deposits or money market funds, or even into another bank that offers more-attractive yields, says Compton.

That kicked off increased competition between banks for customer deposits in recent months, as banks fight to keep customer deposits, which impact the amount of money they have available to loan out.

As the rate-hiking cycle becomes more mature, it creates “offsetting forces in the banks; they’re making more on the loans they’ve given out, but they’re also paying more on things like deposits that they use for funding,” says Compton.

From here on out, net interest margins will likely be under increased pressure as banks approach a negative interest-rate sensitivity.

JPMorgan Chase JPM is one bank that has already started to see negative impacts to its net interest income from a rising federal-funds rate. Furthermore, major banks such as Wells Fargo and Bank of America have announced lower-than-expected revenue guidance for the first quarter of 2023, foreshadowing a compression in net interest margin.

Banks Face Rising Expenses

Another challenge for bank stocks is rising expenses that in large part tie back to worries about a recession.

Bank expenses accelerated more than expected during the fourth quarter, driven by an increase in loan-loss provisions, which are funds set aside to cover losses for bad debts, which would likely rise during a recession. Growing loan-loss provisions eat into banks’ net income.

Provisions are still coming off from the low levels set when banks released the major reserves they had set aside during the coronavirus recession in 2020. Still, loan-loss provision for banks in the KBW Nasdaq Bank Index has risen about 47% between the third and fourth quarters of 2022.

Compton sees banks continuing to build up their loan-loss reserves throughout 2023 and part of 2024, which he attributes to a mild recession potentially occurring toward the end of 2023.

Weak Fee Revenue Growth Until 2024

The uncertain economic environment has also led to a decline in fee revenues for banks across the board. Wealth management fees have dwindled as a result of last year’s plunge in stock and bond prices, as lower levels of assets under management generate less revenue.

More broadly, a tougher economic outlook has slowed mergers and acquisition activity, leading to a decline in investment banking fees at the bigger banks.

“I have a hard time seeing a strong recovery in fees until after a recession,” says Compton. “I’m projecting a much better growth in fees in 2024.” Following the recovery from that recession, fees should improve as a recovered market would increase wealth fees, alongside bringing back investment deal flow.

Bank Stock Valuations Above Usual Recession Lows

With Morningstar’s forecast calling for a mild recession in later 2023, Compton says investors may want to exercise caution and hold off on investing in the sector until valuations hit a typical recession low of about 25% to 30% below his fair value estimates. “Things tend to get cheaper when a recession actually happens … there will be better opportunities ahead if you’re thinking about just investing in the sector overall,” he says.

On the other hand, he notes that the potential upcoming recession is “one of the most anticipated recessions in recent memory … so you could just be sitting around waiting and the market just kind of totally looks through the recession.” That could mean bank stocks don’t fall to typical historic valuation lows for a recession, he says.

When it comes to opportunities in the sector right now, Compton highlights banks working through idiosyncratic issues that are trading cheaper than the average bank stock, namely Citigroup and Wells Fargo. Wells Fargo has faced years of stepped-up regulatory scrutiny and is on a multiyear journey to raise efficiencies. Likewise, Citigroup is focused on improving internal controls and risk management per regulator orders, as well as the sale of its international consumer operations.

Compton also highlights KeyCorp KEY and Truist Financial TFC as notable cheap options among regional banks. Both stocks trade at around a 17% discount to their fair value estimate.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)