Making the Most of Your Investments in Retirement

A long-term, cash-flow-driven approach to your retirement portfolio is key to success.

Retirement remains a complex word, meaning different things to different people. But almost unanimously, it means “the act of stopping work.” By extension, this usually means “relying on your own savings,” potentially supplemented with government support.

For those relying on their own money, 2022 was an incredibly tough year. It contained the double whammy of 1) inflation driving your cost-of-living higher, and 2) higher interest rates causing asset prices to fall. The good news is that this shift has created a far more positive footing moving into 2023—all else being equal.

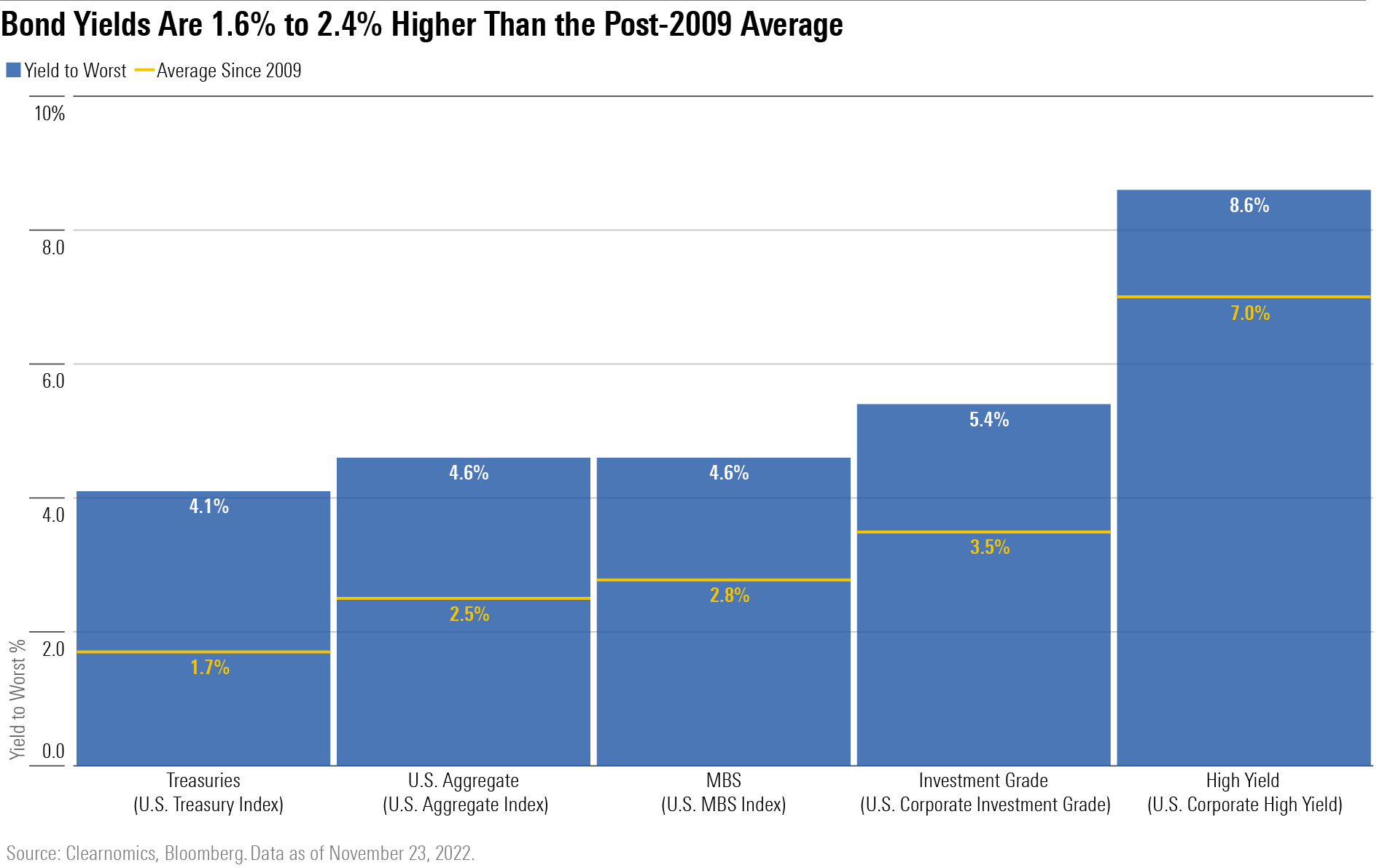

We Can All Embrace Higher Yields

As with the very best sporting teams, every asset in a portfolio plays a role—some assets are more proficient at defense and others press forward to attack—but they need to work together. It is also this cohesion that makes great portfolios. Throughout 2020 and 2021, the defensive portion of a portfolio was not well placed to do its role. Historically low yields meant that bonds could provide little resistance to broader economic stress. That has clearly changed, and it has big implications for retirees. Not only have the long-term prospects improved for equity markets, now the defensive portion of portfolios has a genuine prospect of providing some ballast.

Investors of all types can appreciate higher yields, but this is especially relevant to retirees. It reduces the “capital gains hurdle” you need to jump, allowing you to lean more heavily on the income component of your total return. This is most pronounced in bonds, which retirees tend to have more of. Bonds can now deliver income in excess of the so-called “4% safe withdrawal rate” (which remains a good rule of thumb, despite its weaknesses).

Keep a Close Eye on Sequencing Risk

Despite the good news on yields, one must think carefully about further downside risks, too—especially with sequencing risk staring at every retiree. Sequencing risk is the danger of a near-term decline in your assets causing you to overwithdraw, or the risk of a big decline early in your retirement wiping out a big part of your nest egg. This risk is ever-present, but it may feel prominent in an environment that could be recessionary. By the same token, there is a key conundrum between sequencing risk and longevity risk. That is, we don’t really know how long we need our capital to last for, so retirees do need to maintain some level of growth assets to ensure their savings can last.

Fortunately for investors, higher yields impact both the equity and fixed-income assets in the portfolio—and how they work together. Notably, improved defensive characteristics from bonds can provide more scope to actively pursue those assets with the best prospects in the growth portion of portfolios. And those assets look very different today than they did in 2021.

To put it simply, the opportunity set has shifted, so there could be value in portfolio adjustments. By the same token, volatility can be used within a retirement portfolio to position for future outcomes. The key is time frame—and this is even more relevant for those in retirement. Recalling the words of the legendary Sir John Templeton, “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Consider the Bucket Approach to Building Your Retirement Portfolio

The obvious temptation in recessionary conditions is to tighten the wallet. This makes sense as an act of safety, but the true task of investing positively in retirement is to maximize utility. Specifically, you want to preserve capital, but not to the extent that you can’t live life (achieve goals). Short-term thinking is often the enemy here, believing that you need to act more cautiously than is required over the long run.

A positive way to handle this is to use bucketing. There are different approaches that have merit, but the central idea is to ease the mental accounting by splitting your nest egg up into short-term, medium-term, and long-term buckets. The longer-term bucket would naturally carry more risk (typically via stocks), which will move higher and lower but will top-up your shorter-term buckets over time. The beauty of doing this is that is works really well with a valuation-driven asset allocation. This means favoring cheaper assets that are fundamentally attractive. These assets can often take a while to harvest but tend to have higher yields. If you get this approach right consistently, it has the potential to really add to your retirement cash flow over time.

Cash Flow Matters

The ongoing debate about an income approach versus a total-return approach continues, but in our mind it misses the point. Aftertax cash flow is most important—not necessarily how you achieve it. Specifically, retirees want to make sure they can generate enough cash flow to meet their short-term needs and any emergencies while preserving their capital base. It shouldn’t matter whether this cash flow is generated from an asset that delivers high levels of income or by reducing the capital of an asset. In both instances, the capital base remains broadly the same (a dividend reduces the price of the share by the amount of the dividend). This dynamic only changes when the tax treatment is different for income and capital.

It is therefore not our job to predict which approach will steer investors to a better outcome in 2023—the key here is to maximize utility and always think about the total cash flow. To our way of thinking, a valuation-driven approach shines here, too. It means you focus on buying assets at a low price, boosting the cash-flow-generating prospects in a manner that can also keep overall risks lower (buying a low-priced asset carries less “valuation risk”). If done correctly and consistently, this can offer the best prospect for achieving your goals in retirement.

The Income Approach vs. the Total-Return Approach

For those who prefer an income approach, we note a far wider range of assets delivering yields of above 4%. This avoids the problems of late 2021, when elevated levels of risk were required to achieve the same levels of income, such as risky high-dividend stocks and bonds with low credit quality. Some of the same challenges apply, though, with some higher-income assets exhibiting no growth in income (a risk in the face of inflation) and potentially elevated credit risk. We think yield-chasing is a cardinal sin when it is taken to the extreme; it’s a bad idea to move up the risk curve without a thorough understanding of what you own and why you own it.

With a total-return approach in 2023, there is likely to be a greater tailwind from yield generation anyway, potentially avoiding the need to sell part of the portfolio periodically to meet your withdrawal needs. With a total cash flow mindset, one of the upsides to this approach is that you can potentially access lower-yielding assets at lower prices, which could add to your cash flows over time. Healthcare companies, for example, can offer different risk and return drivers to a portfolio.

A Wildly Better Environment for Retirees

In 2021, we said in our outlook, “2022 is likely to be a difficult environment for passive-income generation, with low rates and expensive assets a common challenge … with higher inflation eroding the purchasing power of your income.” To start 2023, we have higher yields and lower valuations, helping you with the three measures of retirement success: 1) cash flow stability, 2) source of withdrawals, and 3) likely ending account value.

This article was adapted from the Morningstar Investment Management 2023 Outlook published in December 2022. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)