Stocks Surged in January but Still Look Undervalued

Headwinds will slow additional gains to a grind for the first half of the year.

Takeaways

- U.S. equity market surged in January, yet remains undervalued.

- However, with economy weakening and monetary conditions still tightening, the easy returns have been captured.

- 4Q earnings—not all that bad, but guidance generally softer than expected.

In our “2023 Stock Market Outlook: Near-Term Turbulence, but Clearer Skies Ahead,” we noted that the US equity market was trading deep within undervalued territory. In fact, dating back to 2010, the market had only traded at that much of a discount less than 5% of the time. As the pressures of tax-loss selling in December faded, and seasonal and other technical factors played out in January, the stock market has surged higher.

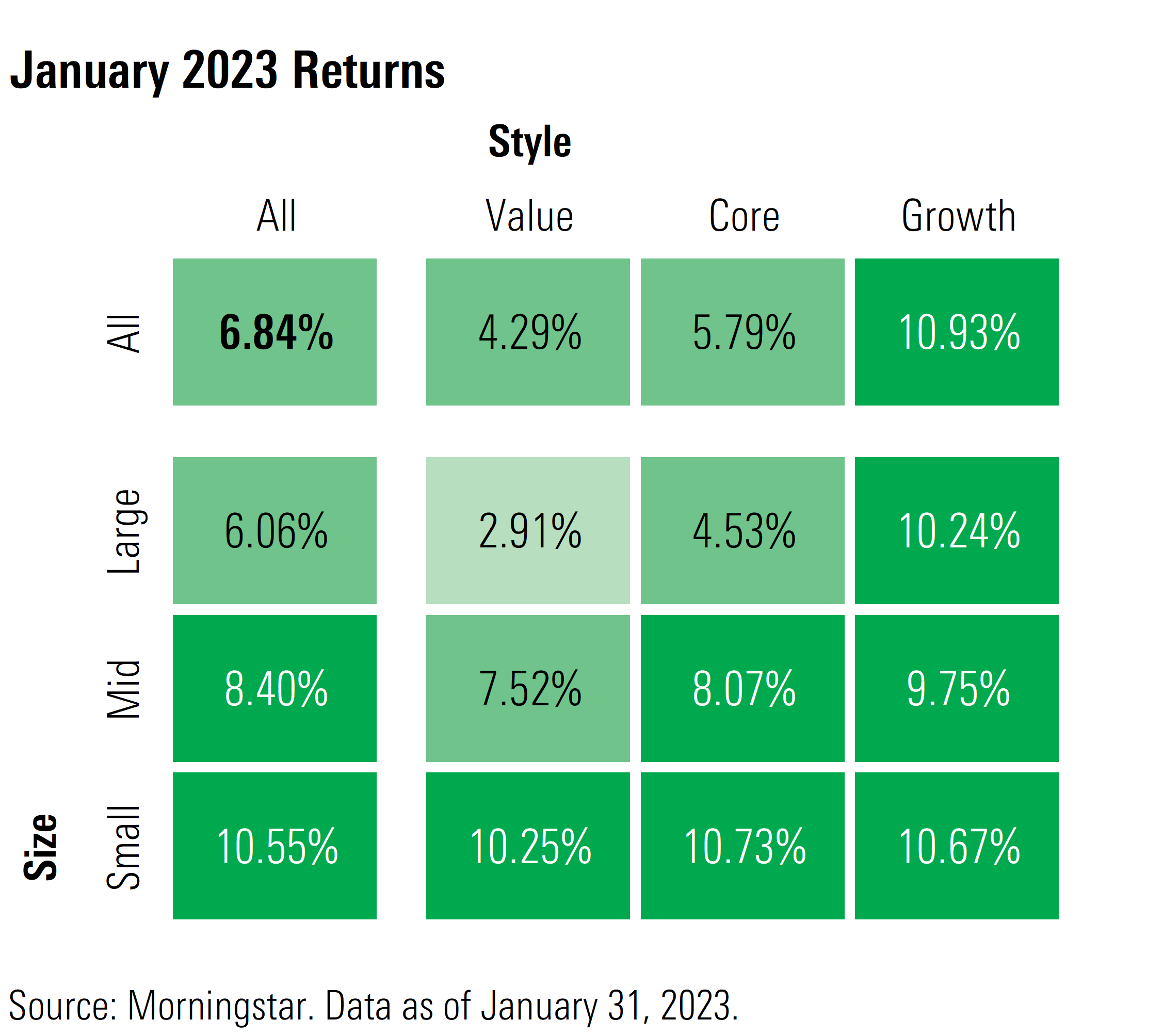

In January 2023, the Morningstar US Market Index rose 6.84%. Growth stocks outperformed the broader market as the Morningstar US Growth Index leapt 10.93%, followed by our US Core Index at 5.79%, and the Morningstar US Value Index lagging the market at 4.29%. By market capitalization, small-cap stocks performed the best, rising 10.55%, followed by mid-cap at 8.40%, then large-cap at 6.06%.

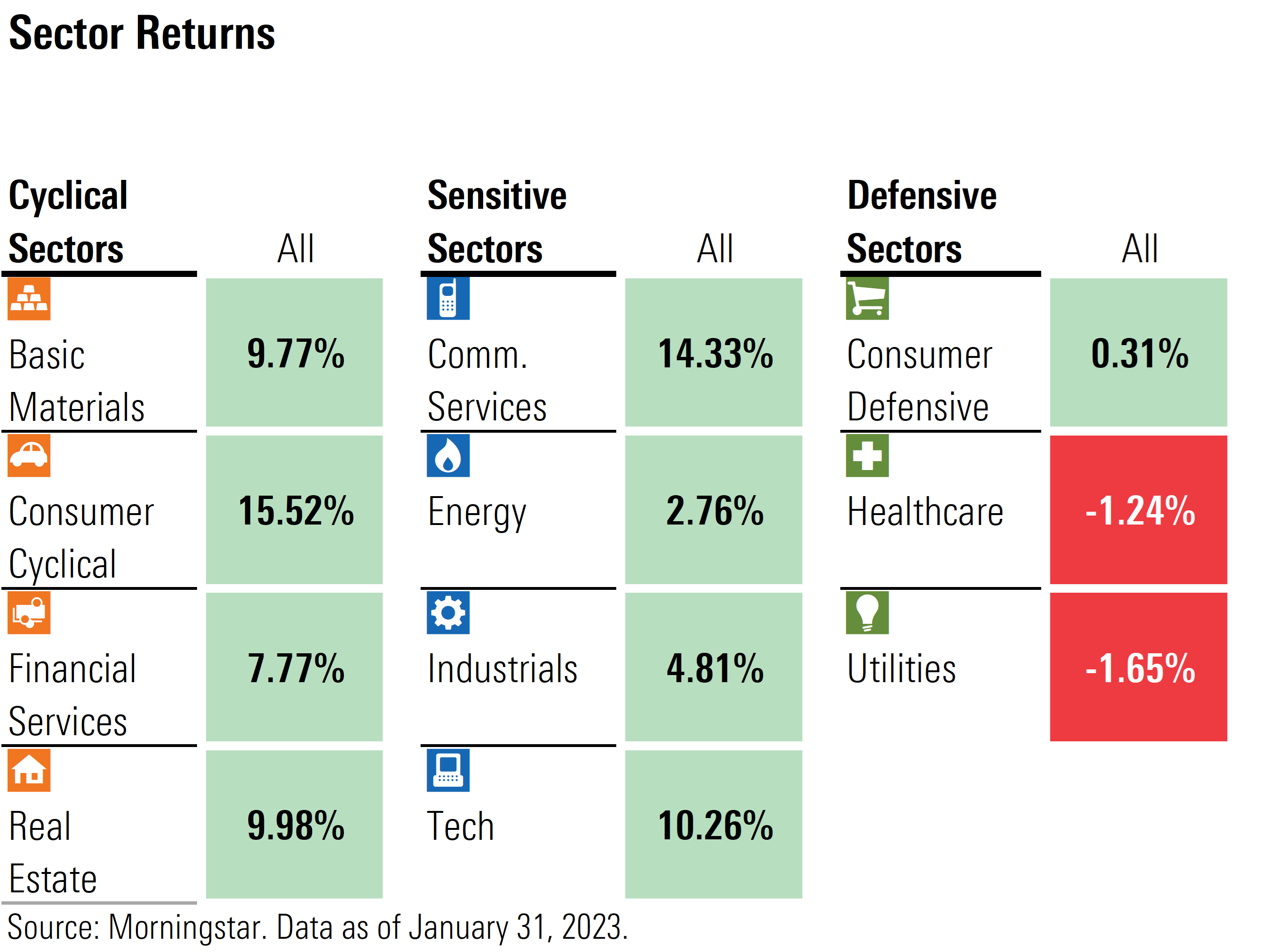

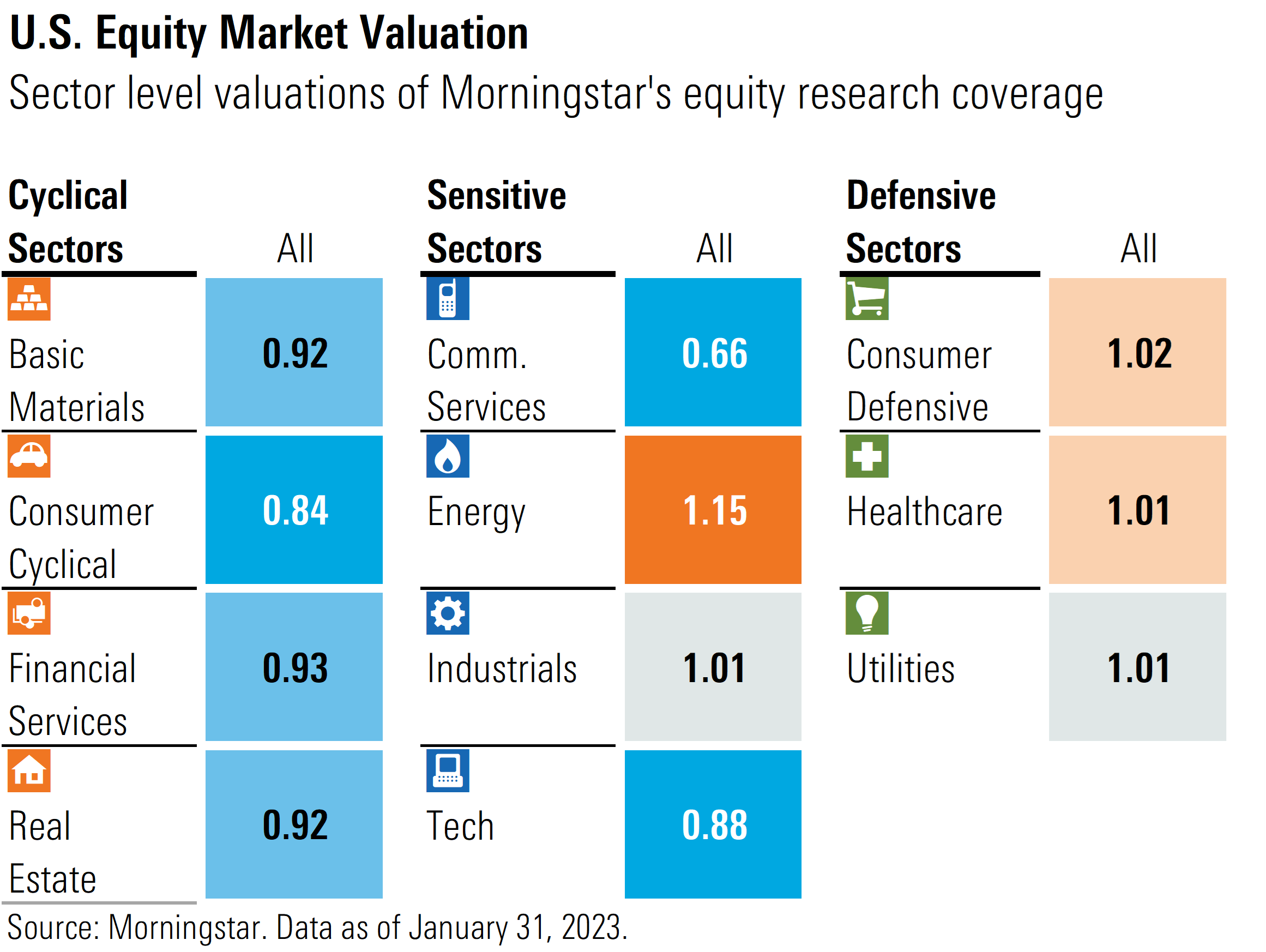

Among sector returns, those sectors that performed the worst in 2022 and were among the most undervalued by our calculations coming into 2023, were some of the best-performing in January. For example, consumer cyclicals and communication services rose 15.52% and 14.33%, respectively, and were the two most undervalued sectors coming into the year. Technology, real estate, and financial services were the next best performing, and were also among our undervalued sectors. However, those sectors that held up the best last year, but were also fully valued according to our valuations, struggled in January. For example, healthcare fell 1.24%, utilities dropped 1.65%, and consumer defensive barely eked out a gain at 0.31%.

After Exceptionally Strong January, What’s Next?

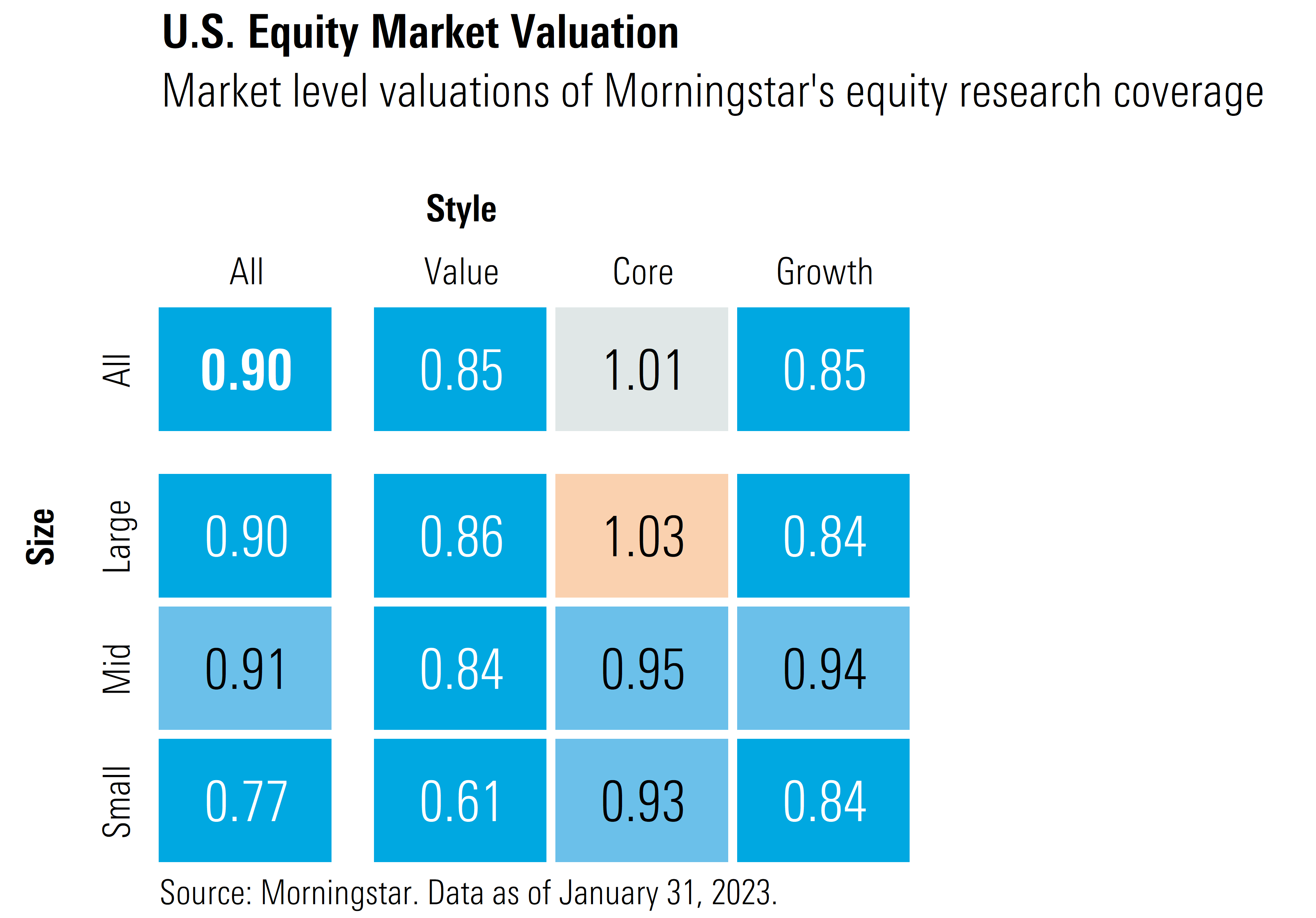

Looking forward, by our calculations, the U.S. equity market remains undervalued, albeit much less undervalued than at the beginning of the year. According to a composite of the over 700 stocks we cover that trade on U.S. exchanges, as of Jan. 31, the broad U.S. market was 10% undervalued. However, while we view the broad markets as undervalued for long-term investors, in the short-term we think the easy returns are behind us. Looking forward, we suspect that the market will be entering a stage where economic and monetary headwinds will slow additional gains to a grind over the first half of the year.

We continue to think that 2023 will be a year of two halves. For the first half of the year, the market will continue to contend with two main headwinds: tightening monetary policy and a weakening economy. The Federal Reserve just raised the federal-funds rate by 25 basis points to a range of 4.50%-4.75% and, according to the CME FedWatch Tool, the market is pricing in an 83% probability the Fed will hike another 25 basis points following the March meeting. Earnings growth will likely be under pressure for the next two quarters as our U.S. economics team is forecasting that the U.S. economy will be stagnant, to potentially recessionary, for the first half of 2023. This projection has been bolstered as many companies have been providing weaker-than-expected guidance during their earnings conference calls. Lastly, while we don’t expect the negotiations over the debt ceiling will result in the U.S. defaulting on its debt, dire headlines in the media could damp investor risk sentiment.

Yet, this near-term turbulence should lead to clearer skies in the second half of the year. The Fed will likely halt any further monetary tightening following the March meeting. Then, by early summer, we expect leading economic indicators should begin to turn upward as the economy re-accelerates. Our economics team also forecasts that inflation will continue to moderate over the course of the year. In fact, before the end of the year, we expect that the combination of low inflation and weak economic growth in the first half will provide the Fed the room it will need to begin to reverse course and begin to ease monetary policy.

What Should Investors Be Doing Today?

Based on our valuations, we continue to see the best positioning for long-term investors in a barbell-shaped portfolio: overweight value and growth stocks, which are both 15% undervalued, and underweight core stocks, which are trading at fair value. By market capitalization, small-cap stocks remain the most undervalued, trading at a 23% discount to fair value.

Sector Valuations and Undervalued Picks

Across our sector coverage, even after a 14%-plus return in January, the communications sector remains the most undervalued, trading at a 34% discount to fair value. The average sector valuation is skewed by Alphabet GOOGL and Meta Platforms META, which together represent over half the market cap of the sector and are two of our more-differentiated calls from the market.

Yet, even aside from these two stocks, we continue to see a significant amount of undervaluation in traditional communications and media stocks.

Consumer cyclical is next most undervalued sector. Looking forward, we think market is over-extrapolating expected economic softness to last longer and/or be deeper than our projections.

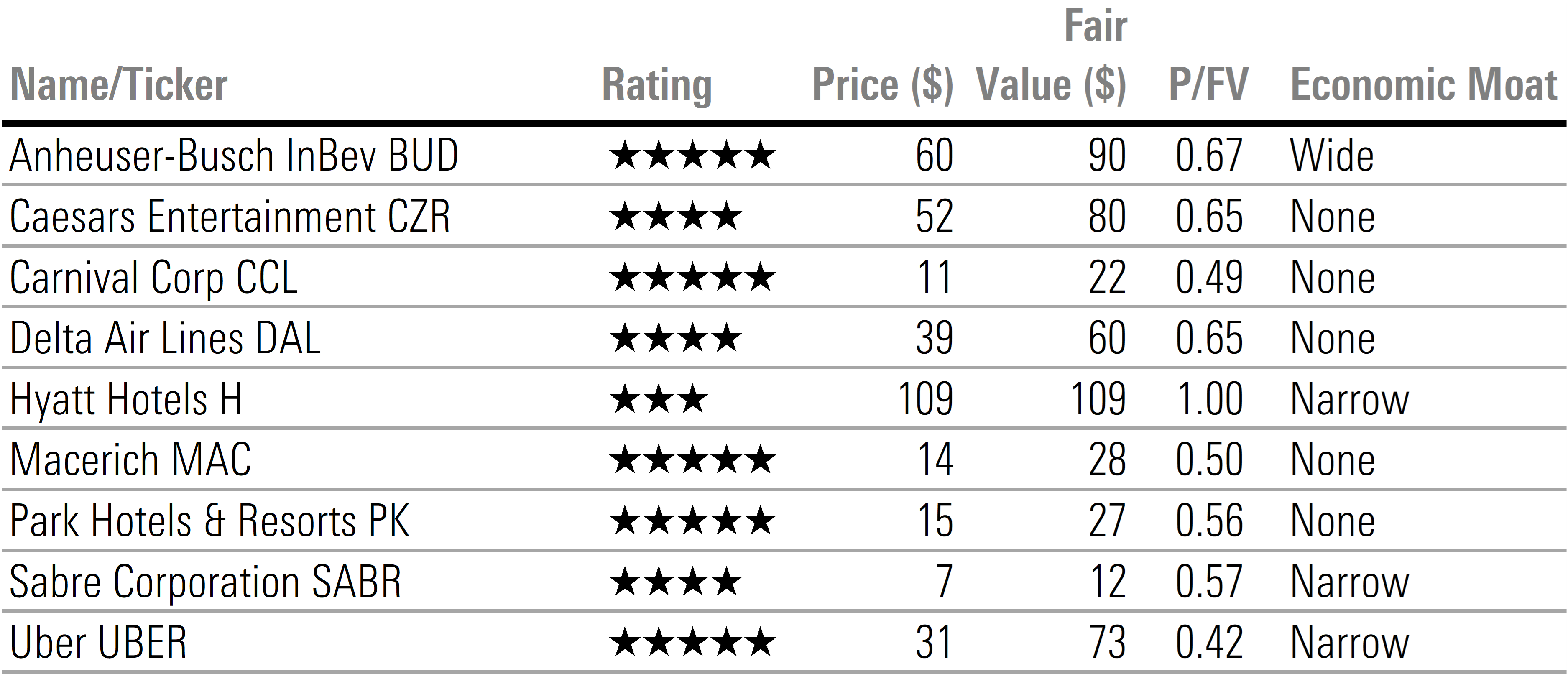

As the coronavirus pandemic recedes, we expect continued normalization in consumer behavior, for spending to revert to prepandemic norms, and to shift again into services and away from goods. Stocks leveraged to this theme include:

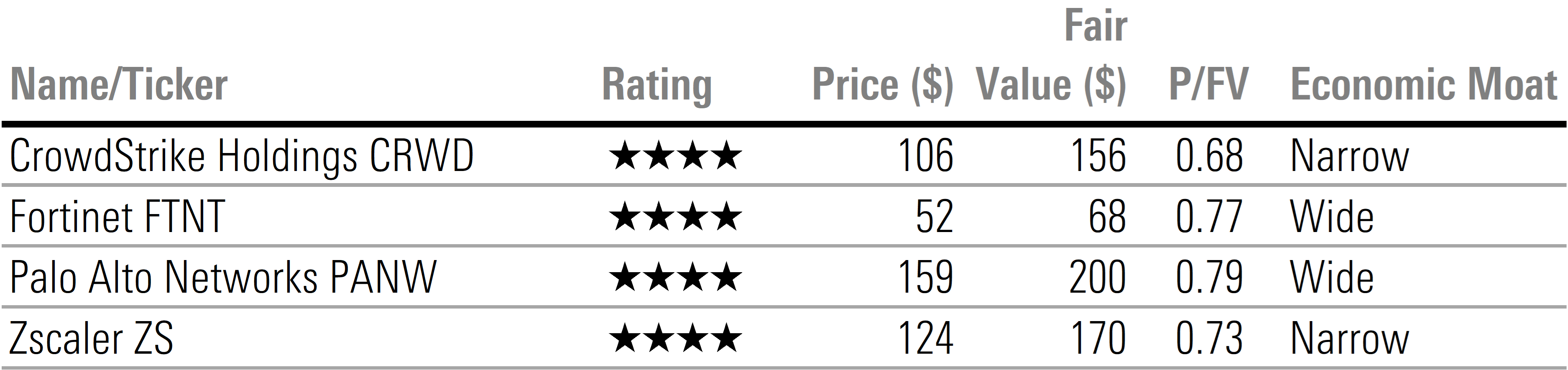

The technology sector has also fallen too much and is now significantly undervalued. One long-term secular theme technology investors should consider is the growth in the cybersecurity industry. This industry has especially attractive growth dynamics, as companies need to remain at the forefront of cybersecurity to counter geopolitical risks as well as to thwart cyber ransom, cyber crime, and other hacking incidents. Cybersecurity spending is a relatively low percentage of overall IT budgets, but owing to the high severity of cyber events when they occur, it’s an area where management teams can ill afford to fall behind.

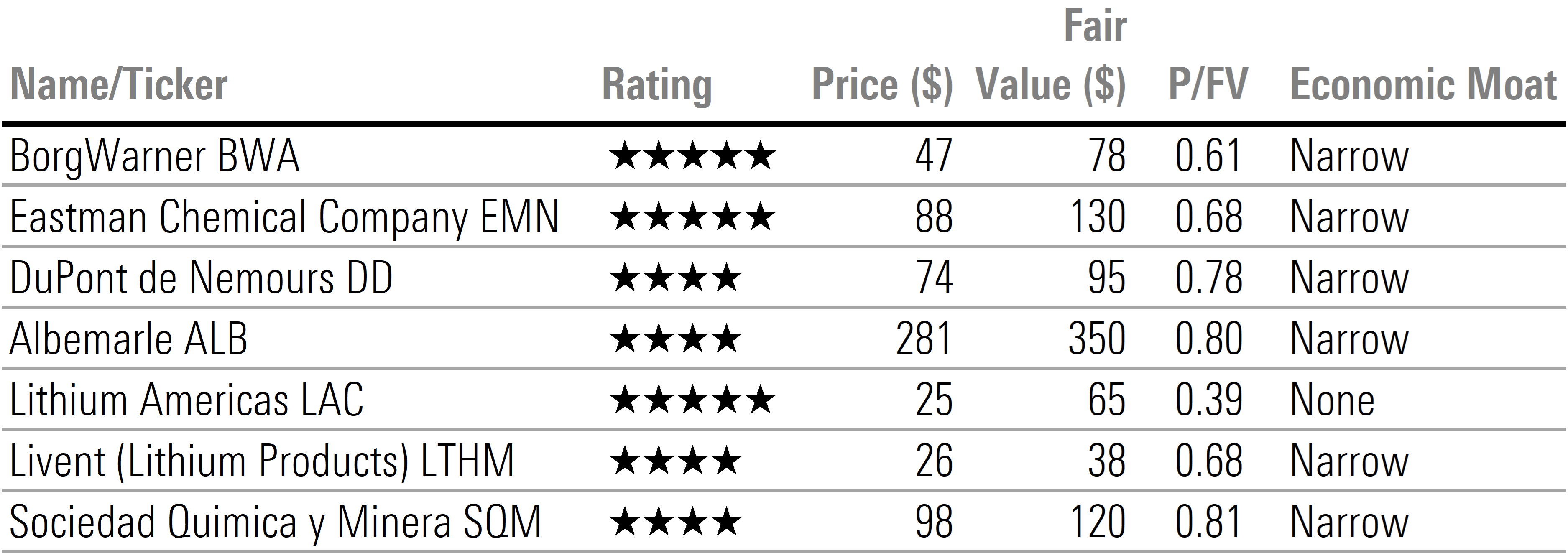

Basic materials had been under pressure from a weak economic outlook, but one area where we see long-term secular growth is in those stocks leveraged to growth in electric vehicles. We forecast that lithium will be undersupplied over the next decade. In addition, it takes 2 ½ to 3 times as many specialty chemicals in the manufacturing process to build an EV as compared with internal combustion engine.

While the energy sector was the most undervalued coming into 2022, following a 60%-plus return last year, we now think the energy sector is significantly overvalued. In our opinion, the market is pricing in high oil prices lasting for too long; our energy team is forecasting long-term oil prices to subside to $55 per barrel. Within this sector, the only remaining area where we see many undervalued opportunities is within the pipeline industry.

Lastly, we note that those sectors that held up best last year—consumer defensive, healthcare, and utilities—are fully valued.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)