How to Have More Productive Conversations About Money

Certain phrasing can help your clients think long term about their finances.

Onboarding is one of the most crucial parts of financial advising for both advisors and investors. The process allows advisors to uncover clients’ goals, establish rapport, and set expectations while allowing investors to do the same.

Because of this, there is no dearth of advice regarding the questions advisors should use during the onboarding process, but there is not much by way of rigorous research or agreement on the topic. In our latest work, we endeavored to help advisors identify how the framing of a question can influence the mindset of their clients with the end goal of promoting better outcomes.

There are several compelling reasons to focus on mindset. For one, people with a future-oriented mindset tend to have greater goal motivation. Second, people operating with a more abstract mindset tend to be able to exert more self-control. As such, an abstract and future-oriented mindset may assist clients in the financial-planning process.

Testing the Power of Language

Language can play a pivotal role in how people think. Consider previous work from Morningstar that showed how investors were more willing to exchange part of their 401(k) for a “guaranteed income stream for life” than for an annuity (that is, the same offer by a different name).

In a similar vein, in this study, we examined whether two popular, seemingly similar questions—“What is important about money to you?” and “Why is money important to you?”—yield different mindsets in participants.

In our research, we asked 1,001 participants to read a vignette in which they were meeting a financial advisor for the first time. At the end of the vignette, participants were posed one of two questions by the imagined financial advisor: “What is important about money to you?” (Group What) or “Why is money important to you?” (Group Why). Participants then wrote their responses to the question, which we evaluated for how future-oriented and abstract they were.

Asking ‘What’ vs. ‘Why’

Through textual analyses of participants’ responses, we found that people in Group What gave more future-oriented and abstract responses than people in Group Why. Group What was more likely to use words pointing toward the future—like “later,” “a year,” and “retirement”—versus those in Group Why who used words grounded in the present—like “tomorrow,” “every day,” and “soon.” Likewise, Group What was more likely to use abstract words—like “knowing,” “peace,” and “value”—compared with those in Group Why who used more-concrete words—like “work,” “house,” and “food.”

In short, people exhibit more future-oriented and abstract thinking when asked what is important about money to them instead of why money is important to them.

We also evaluated responses using a natural language-processing machine-learning technique called topic modeling. Topic modeling seeks to uncover pre-existing topics within a body of text—in this case, participants’ responses—by identifying clusters of words that frequently occur together.

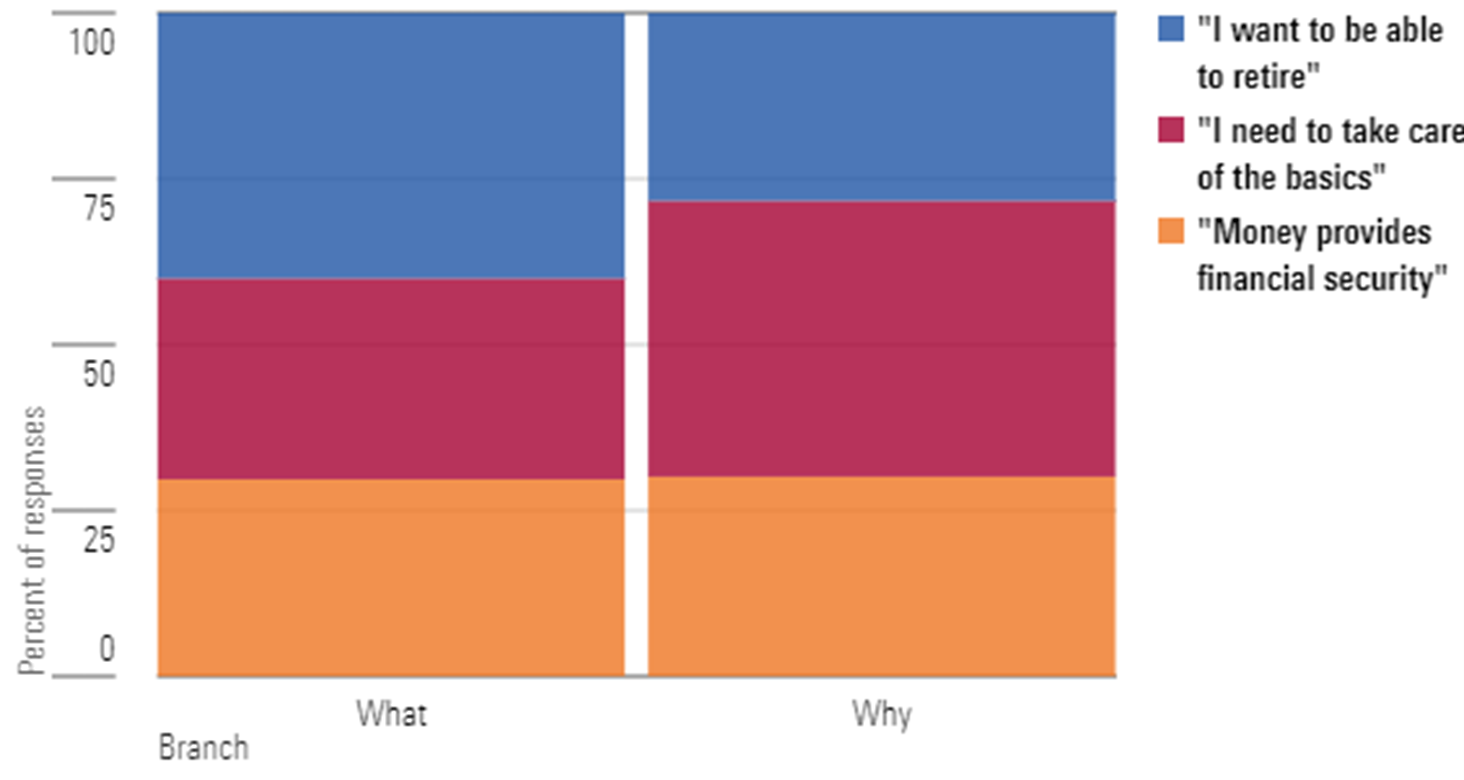

We found three topics in participants’ responses, which we labeled:

- “I want to be able to retire.”

- “I need to take care of the basics.”

- “Money provides financial security.”

Responses from Group What were more likely to be categorized into the retirement topic, and responses from Group Why were more likely to be categorized in the basic needs category. Retirement is both an abstract and future-oriented topic, whereas affording the daily basics is concrete and present, suggesting again that Group What was more future-oriented and abstract-minded.

What Does This Mean for Your Onboarding Process?

Our study demonstrates that the wording of a question may influence the mindset of the client answering it. We found that asking, “What is important about money to you?” elicited more future-oriented and abstract responses than asking, “Why is money important to you?” Our findings are not prescriptive, though, as clients may have unique responses to each question and there is no ‘one-size-fits-all’ approach to financial planning.

Instead, we call attention to how small shifts in language can lead your clients into a different mindset, for good or ill. We encourage you to attend to the language that both you and your clients use to understand the role that mindset plays in your onboarding conversations. Regardless of the questions you ask a client, there are simple steps you can take to recognize a client’s mindset and make changes to ensure a more productive onboarding experience:

1) Diagnose your client’s mindset.

Is your client often using words like “tomorrow,” “every day,” and “day to day” instead of talking about the future? If so, their mindset may be stuck in the present. Is your client often using words like “work,” “house,” “car,” and “market” instead of talking about bigger goals like retirement? If so, their mindset may be focused on concrete issues.

2) Tailor your follow-up to their answers to guide them to a more productive mindset.

If you notice your client is present-minded, you may prompt them with techniques such as future visualization exercises to encourage them to think about the long term. If your client is stuck in a concrete mindset, you may prompt them to explain what they value about their concrete goal to encourage them to think about their more abstract motivations. You may also guide clients into thinking about long-term goals and their abstract motivations by engaging them in a goal-identification exercise designed to help people go beyond top-of-mind, superficial goals.

3) Review and revise the standard list of questions you ask new clients.

As you talk to more clients and diagnose their mindsets, you may find that some of your questions are not eliciting the long-term, abstract mindset you’d like your clients to have. If so, set some time aside to review the questions you ask new clients. Identify which questions seem to be leading your clients astray and resolve to revise them. Examine recommended questions from trusted sources, and talk to colleagues who you’d like to emulate to see how they ask similar questions. Remember that small changes in language can make a big difference.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)