Is It Time to Pick Up the Pieces After Last Year’s Bond Market Storm?

Reflections on a grueling year, and two funds to consider should bonds bounce back.

There may well be more bond market volatility ahead, but higher yields and deeply discounted bond prices could present investors with good opportunities. Here’s a look at what went wrong in 2022, what could go right in 2023, and what to do about it.

It Was Going to Storm … Eventually

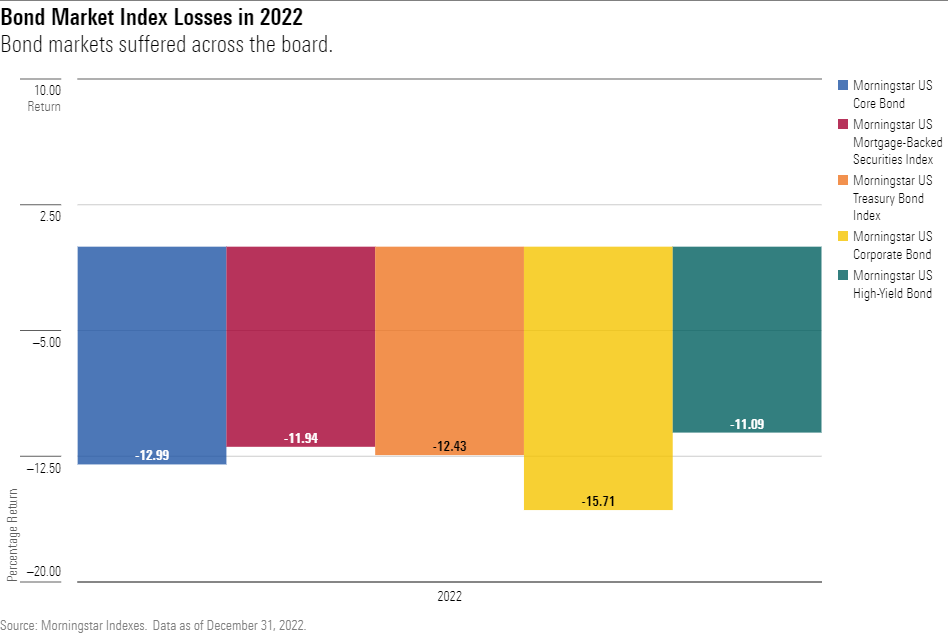

By historical standards, bonds were a debacle in 2022. Instead of holding up as stocks fell, almost every type of bond—from government to junk—posted double-digit losses. The Morningstar US Core Plus Bond Index fell 12.9%.

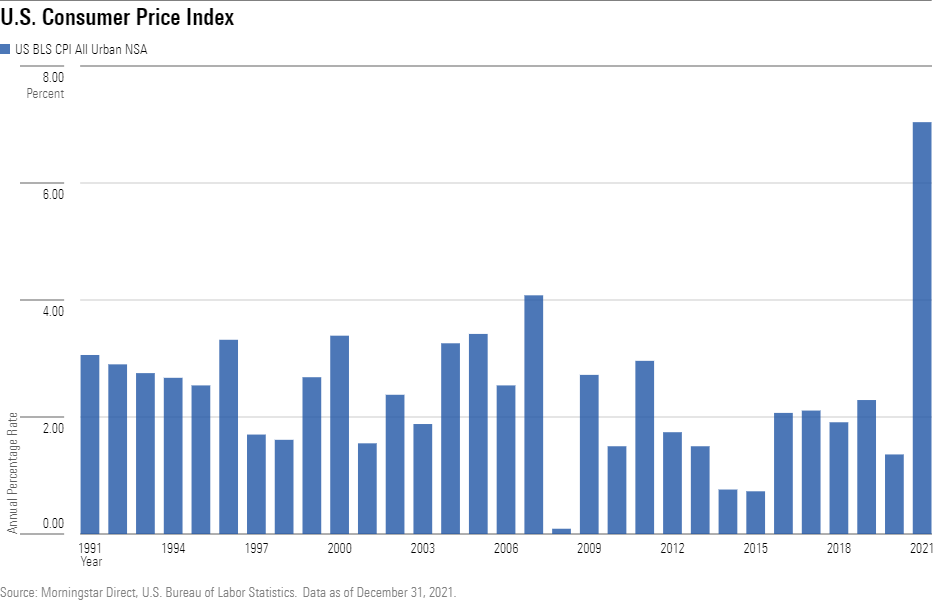

The fiasco was not entirely unforeseeable. Even if it would have been hard to predict the confluence of a global supply chain coronavirus hangover with Russia’s invasion of Ukraine, many bond managers had long worried about the possibility of a stagflation-driven recession scare and a bond market rout.

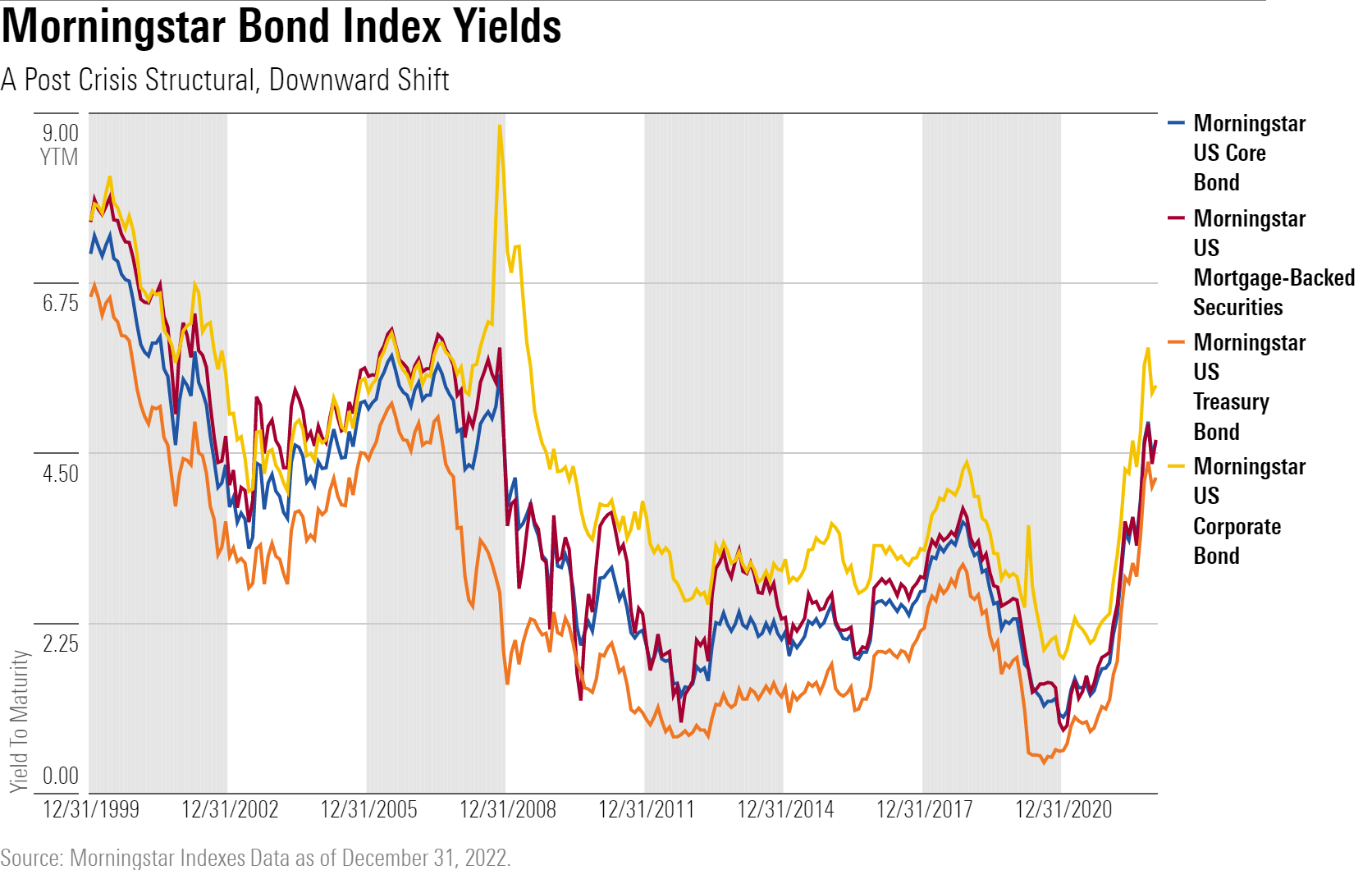

Plodding inflation and Federal Reserve bond-buying via its quantitative-easing policy had held long-term bond yields under 3% for most of the decade before 2022, with the 10-Year Treasury yield dropping to 1.5% at the end of 2021. Furthermore, riskier bonds had offered historically small yield premiums over government bonds at the start of 2022. Conditions were fertile for a selloff.

Before 2022, conventional bear-market scenarios focused on rising rates in response to inflation and a hot economy, similar to 1995 when the Fed hiked and Treasuries spiked as the economy grew. Corporate financials, in this line of thinking, stayed healthy and corporate debt valuations remained comparatively tight, so company debt provided some ballast during the Treasury market selloff.

Even those who feared the worst for bonds struggled to predict the actual timing. Pundits had been arguing Treasuries were in a bubble and set to implode every year—for years—and the inflation needle barely moved as globalization advanced, oil prices seemed to peak, and the U.S. appeared to achieve energy independence. The relative success of the Fed-led response to the 2020 COVID-19 crash also gave some (arguably false) reassurance that the central bank could cope with just about anything.

Still, with rates so low and spreads so tight, many entered 2022 with a nagging feeling that a bond rout could occur at almost any time, and precious little indication of when—or what might trigger it. The time it took to finally arrive made years of vigilance exhausting, costly, and seemingly Pollyannaish. It finally took a strike at the foundations of the post-World War II global order—Russia’s invasion of Ukraine—to set off the fixed-income storm of the century.

Partly Sunny or Partly Cloudy?

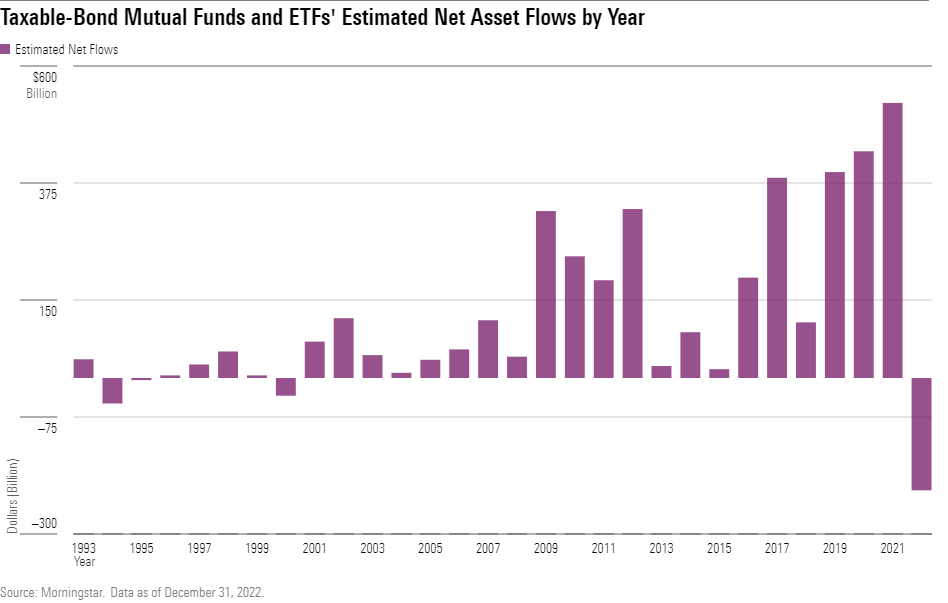

Many investors seem to think the tempest isn’t over. Taxable-bond funds and exchange-traded funds saw $216 billion in outflows last year, making 2022 not just the worst year for outflows since Morningstar began calculating the data three-plus decades ago but more than 4 times worse than any prior calendar year.

Continuing to shun bond funds after their harrowing 2022 losses, however, could be a mistake.

Where to Go When the Rain Stops?

Bonds across most sectors are now deeply discounted. While they could get cheaper if economic conditions or fundamentals further deteriorate, driving prices lower and yields even higher, they still make regular coupon payments and, unlike stocks, their prices eventually rise to par before returning principal.

Most bonds’ $100 par value (shorthand for $1,000 per bond) functions like a magnet as bond prices converge to their redemption price over the time left until maturity. In other words, even if yields move up and down a lot today, a bond’s price will eventually close in on $100.

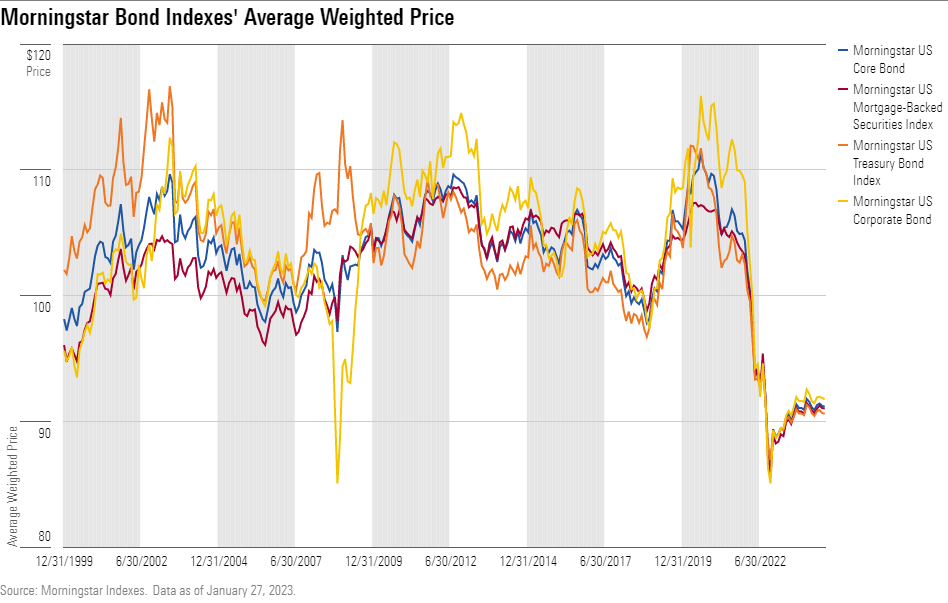

That’s why prices for major sectors such as Treasuries, corporates, or mortgages that dominate the U.S. market and the Morningstar Core Bond Index (which includes all three) generally stayed in a range from $95 to $100 over the 20 years leading to 2022. The trajectories and timing of the back-and-forth often vary given that, even in the worst of times economically, Treasury bonds typically rally while others are selling off, or Treasuries and mortgages tank while credit-sensitive assets surge.

What made 2022 different? So many bond sectors fell to deep discounts at the same time. In fact, it was the first time in 20 years that all the major sectors dipped below $90.

As of late January 2023, the average bond in the Morningstar Core Bond Index carried a yield to maturity of around 4.3% and a price of 91 cents on the dollar, with the average among investment-grade corporate bonds at a roughly 5% yield and a $92 price.

For a pessimist, that’s little compensation for the risks that central banks around the globe fail to keep inflation from surging or bond prices from falling. If a panic were to trigger a selloff that drove the Morningstar Core Bond Index’s yield up by 1 percentage point, its value would likely drop by more than 6% to $86.50 based on its duration (a measure of interest-rate sensitivity).

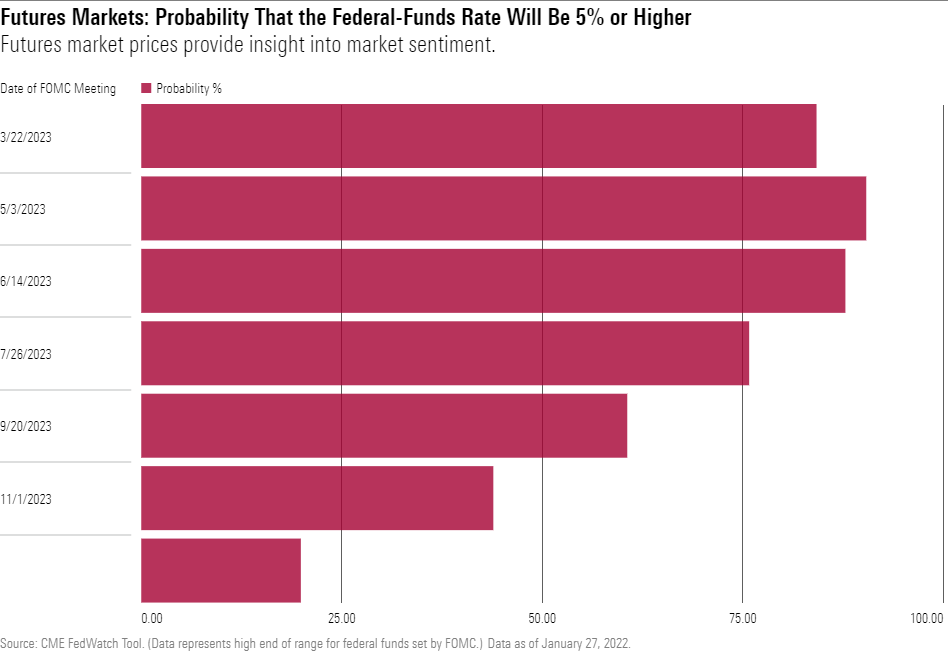

An optimist, however, would say the bond market is already pricing in Fed’s hawkish stance and point to futures market prices predicting that the Fed will hike short-term rates another 50 basis points by April and keep them near 5% until the end of September.

From that perspective the index’s 4.3% yield to maturity reflects expectations that the Fed will remain committed to keeping inflation in check, and that there is modest risk of yields rising, and prices falling further. Even if the pessimist is right, and you assume the index’s yield were to rise and then stay at 5% for years (implying no market appreciation) its newly adjusted average price of $86.50 would leave a lot of room for bonds to appreciate further as they age. That’s only an average, of course, and active managers focused on producing attractive total returns would invariably look to take advantage of that dynamic.

Two Funds for When the Bond Market Sun Shines

The bond selloff knocked a lot of portfolios’ allocations out of whack. For those seeking to rebalance or opportunistically dollar-cost-average into fixed income to take advantage of better prices while keeping risk in check, stick with funds in the intermediate core bond Morningstar Category that mostly own investment-grade bonds. Baird Aggregate Bond BAGIX, which has a Morningstar Analyst Rating of Gold, is a favorite. It stays away from derivatives, leverage, or esoteric fare and matches its interest-rate sensitivity to its Bloomberg U.S. Aggregate Bond Index benchmark’s. Plus, with a $10,000 minimum investment level and 0.30% net expense ratio, it is accessible, and the fee hurdle its managers must clear is modest.

More venturesome investors might consider an intermediate core-plus bond offering, which often can take on more risk, usually among high-yield and emerging-markets debt, or even currencies. Gold-rated BlackRock Total Return, whose cheapest institutional share class (MPHQX) costs 0.38% per year for those with at least $5 million, can use some of the tools Baird eschews but uses them well. It makes numerous small bets rather than a couple of large ones that could overwhelm the portfolio if they go wrong.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1b991ddd-b85f-490e-8687-e60e3f136800.jpg)