Will the January Jobs Report Show Any Signs of Weakness in Hiring?

Economists forecast another healthy reading on employment but are on watch for cracks in the foundation.

Even as technology company layoffs mount and key parts of the economy weaken, forecasts for the January 2023 jobs report call for another month of healthy readings on employment. The question is: How much longer can job growth defy gravity?

Recent weeks have seen big-name companies such as Microsoft MSFT, Amazon.com AMZN, and Google’s parent company Alphabet GOOGL announce job cuts. Meanwhile, manufacturing industry indicators reflect weakness, housing is in a slump, and retailers are growing cautious as consumers draw down on their savings. Before long, these trends should translate into a more significant slowing of hiring than seen in late 2022, economists say.

But when the Labor Department releases the January jobs report on Friday morning, it’s expected to show another solid month of hiring.

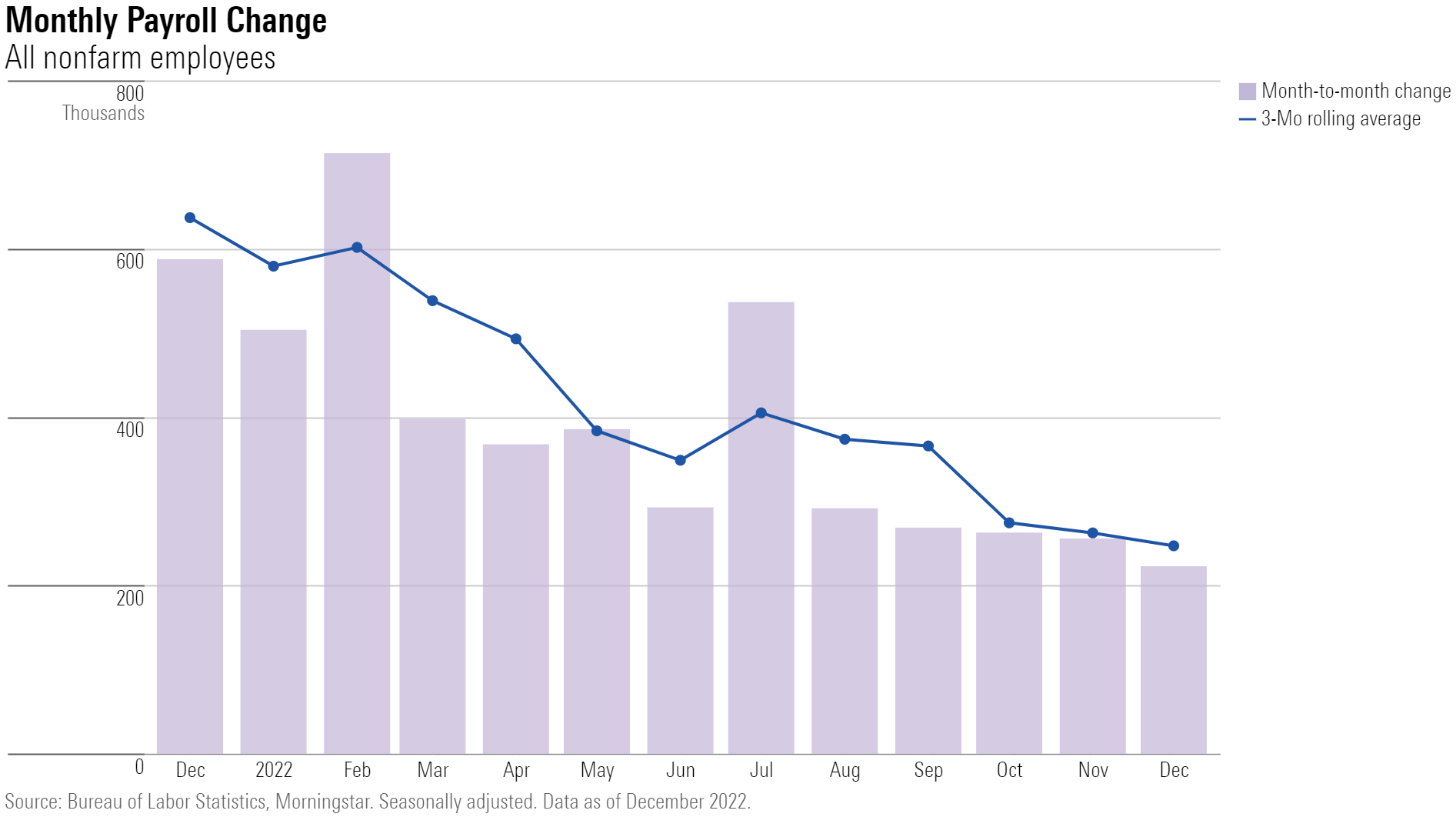

Economists forecast that just shy of 190,000 new jobs were created last month, according to FactSet, and the unemployment rate is forecast to come in at 3.6%. While this would mark a slightly slower pace of hiring than in December, when 223,000 jobs were created and the unemployment rate was at 3.5%, the January forecast reflects a jobs market that continues humming along despite the Federal Reserve’s most aggressive federal-funds rate increases on record.

“It’s surprising that the aggressive pace of hiring has continued as long as it has,” says Morningstar senior U.S. economist Preston Caldwell.

January Jobs Report Consensus Forecast

- Nonfarm payroll employment up 187,500 versus a 223,000 increase for December.

- An unemployment rate of 3.6%, up from 3.5% in December.

Economists caution that the monthly series is volatile, and investors shouldn’t put too much weight into a single report. That’s always the case, but the January report will see routine annual revisions to previous months’ data that could cloud some comparisons. In addition, economists at UBS caution that one-offs such as returning strike workers and unseasonably warm weather could also make the data for January harder than normal to interpret.

Still, at the headline level, a gain of nonfarm payroll employment in the vicinity of 200,000 reflects a still growing economy, not the recession that has been expected for months.

“The job market will likely stay strong in January,” says Jose Torres, senior economist at Interactive Brokers. “The labor market has been absolutely resilient besides some tech layoffs from companies that really overhired because demand trends were very difficult to predict,” he says.

Torres’ forecast stands close to consensus, with a slightly softer rise of 170,000 in January payroll employment, and he expects the unemployment rate to come in at 3.5%.

Watch for Signs of Softening in Job Growth

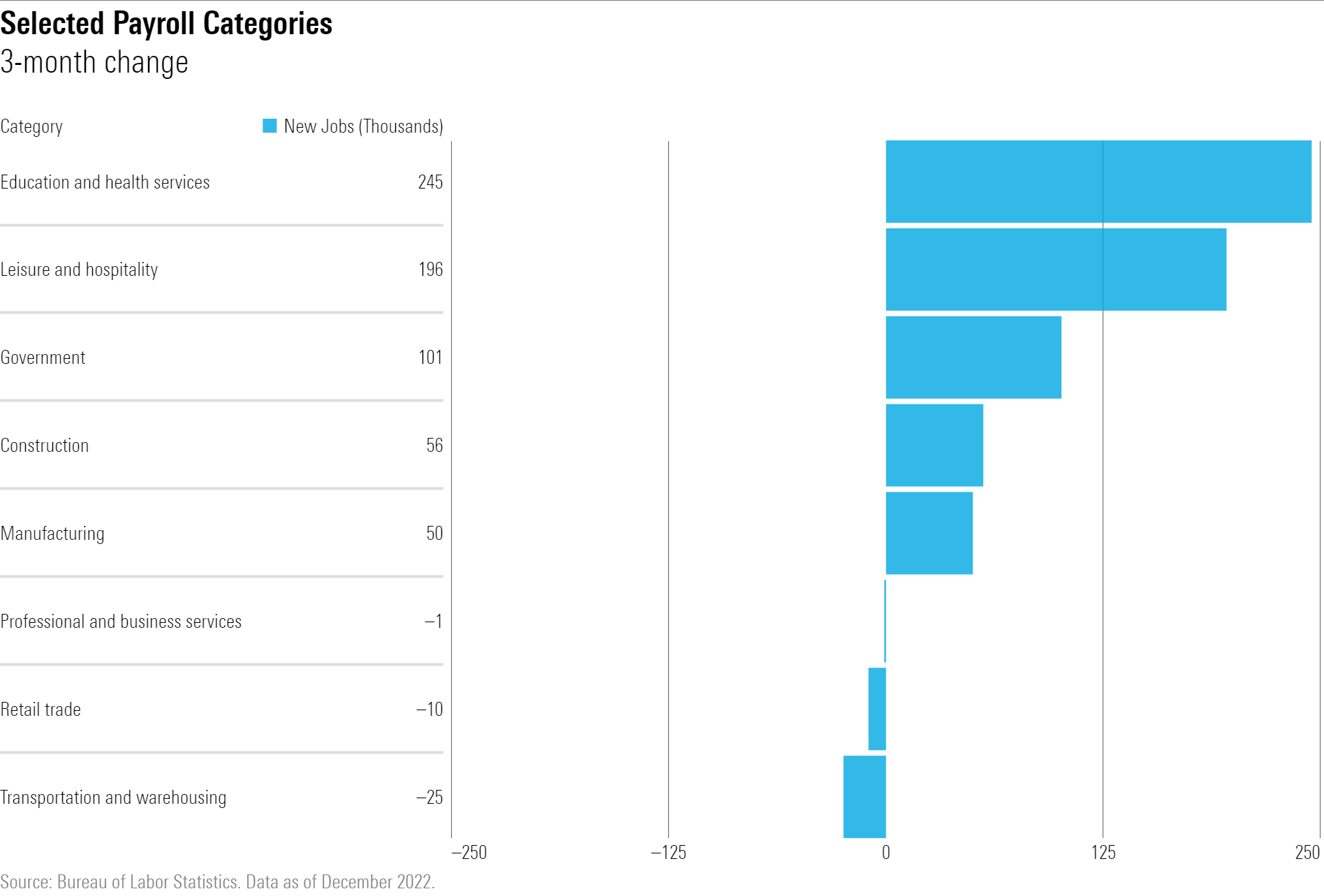

Still, Torres says to watch for some signs of softening. “Interest-rate-sensitive sectors like manufacturing and construction been showing some weakness,” Torres notes.

While announcements of job cuts among big technology companies aren’t significant numerically, Torres says that from an economic perspective, they’re important. “These are high-income jobs—some are triple the average salary for one worker,” Torres says. “The impact to demand overall is a lot greater from tech company employees getting laid off versus service workers and leisure and hospitality where spending power is lower.”

Morningstar’s Caldwell says that the economy broadly doesn’t appear to have seen much of an impact from the downturn in the housing market caused by higher interest rates. “The housing slowdown has yet to have any impact on the job market, with employment in construction and ancillary industries not having decreased at all yet,” he says. “That will almost certainly change in coming months.”

Economists point to another data point as foreshadowing a weaker jobs market in coming months: declining temporary services employment. At Bank of America, economists note that “earnings transcripts from employment agencies suggest demand for temporary workers was weak in January. Therefore, temporary help services employment, a leading indicator for recession, may fall for a sixth consecutive month.”

“While we expect another strong payroll print, we do think the details will show cracks in the foundation,” the Bank of America team wrote in its jobs report preview.

Morningstar’s Caldwell says that the current solid pace of job creation could start to become a negative for future hiring. “If (strong hiring) continues even as economic growth continues its downtrend, it will cut into profits, prompting companies to scale back their hiring,” he says.

So, when will these factors begin to combine and sharply reduce job growth? “I think we’ll see a gradual slowdown of employment growth to about zero by mid-2023,” Caldwell says.

Torres from Interactive Brokers sees a similar jobs landscape. “Job growth will turn negative sometime in the summer,” he says.

For now, “companies still want to do business, and their margins are high relative to history,” he adds. “They will take a hit on earnings” rather than be overly aggressive in letting go of workers.

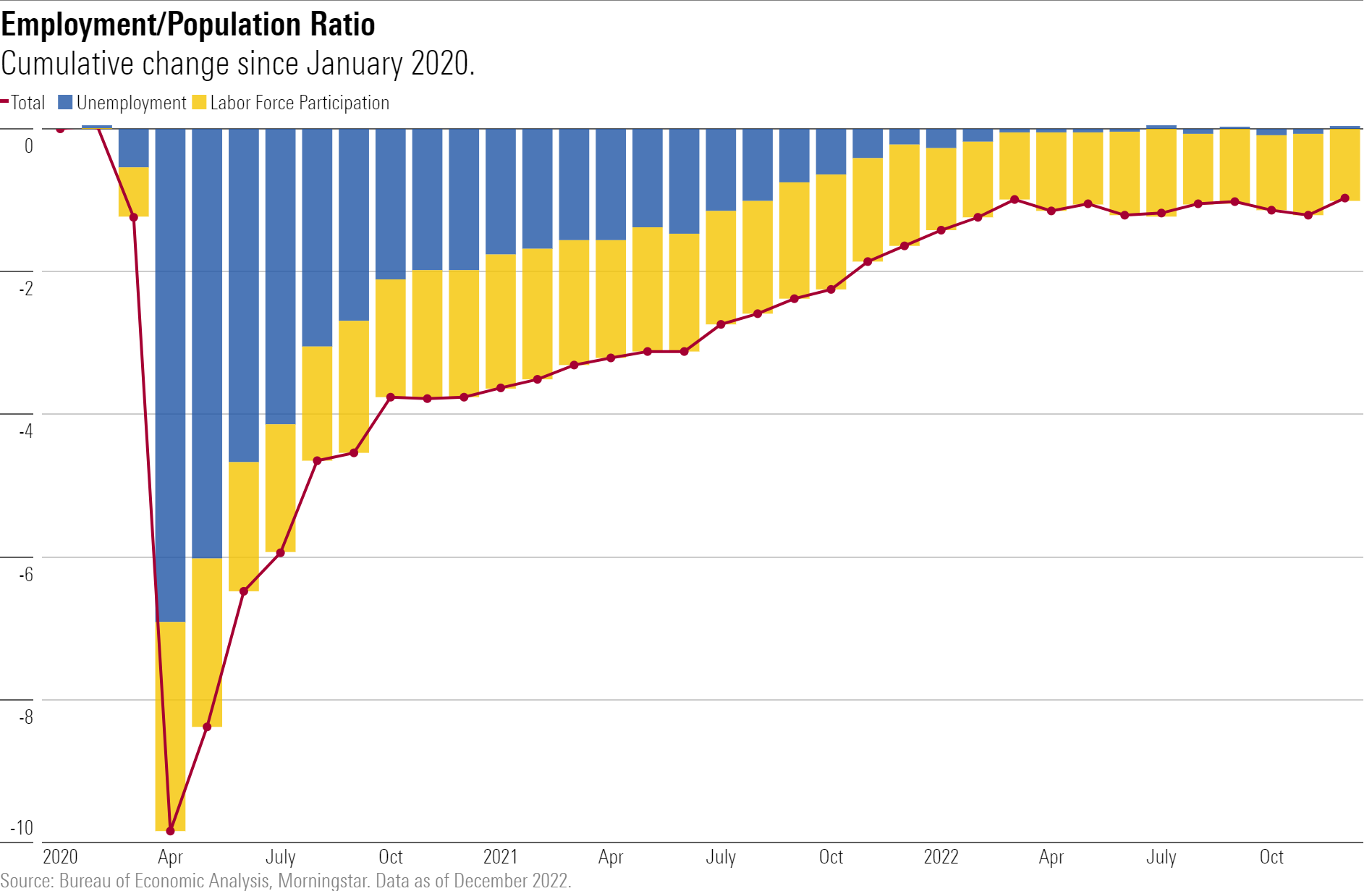

Torres expects that even though the economy will start shedding jobs this summer, dynamics in the labor market after the pandemic shutdown suggest that the jobs outlook may not be as bleak as in prior downturns. “We’ll have unemployment go up to about 5% to 6% but not the 8% to 10% that we saw during the Great Recession” of late 2007 through 2009.

“The pandemic changed the labor market; there’s 1.8 job openings for every unemployed person,” he says. “That’s going to keep job growth more elevated than most recessions.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)