Gold Set a Low Bar in 2022

The disappointing year highlights the risks of investing in gold-equity funds.

Gold and gold-equity investors headed into 2022 with high expectations, only to be disappointed. Even as inflation and geopolitical tensions rose and the global economy slowed—conditions that have sent some investors scrambling for gold at times in the past—the metal finished the year flat, and gold-mining stocks ended much lower. Gold and gold equities’ struggles in 2022 highlight how their reputed utility as inflation and market hedges often proves illusory and that most investors can build well-diversified portfolios without them, particularly gold-equity funds.

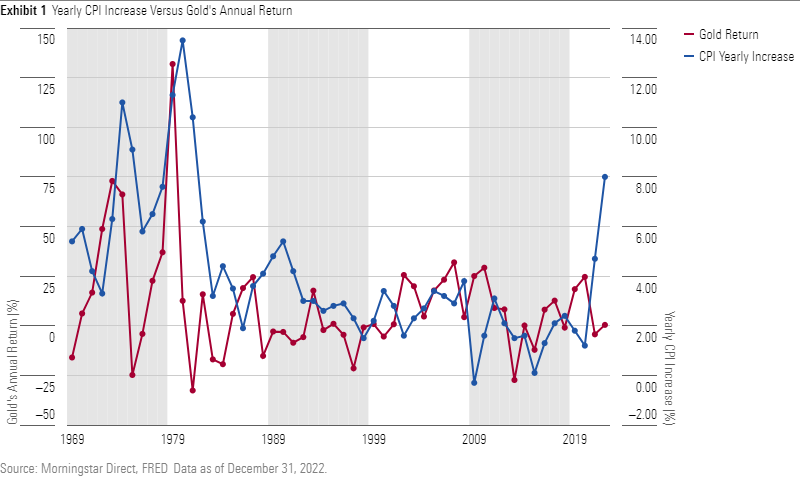

A Haphazard Hedge

Contrary to investing lore, gold has not been a good inflation hedge. Although the metal soared to new highs in the 1970s amid high inflation, a strong dollar, fiscal stimulus, and low interest rates in recent years have dulled gold’s allure. Even as inflation crested 9.0% in 2022, the year showed that gold doesn’t always rally when inflation rises.

The Active Conundrum

Many investors use exchange-traded funds that passively track gold’s price, like SPDR Gold Shares GLD, or active funds that own the shares of gold miners for their exposure to the metal. The latter is a small and concentrated investment universe. There are hundreds of smaller, so-called junior miners, but big companies such as Barrick Gold GOLD and Newmont NEM account for most of the industry’s output and market capitalization. So passive index funds, such as VanEck Gold Miners ETF GDX, which tracks the NYSE Arca Gold Miners Index, lean toward the industry’s largest companies. At the end of 2022, the fund had roughly 45% of its assets in its top five holdings.

The conundrum for active gold stock fund managers is how to differentiate their portfolios from their benchmarks without loading up on too many of the junior miners, which are often not as profitable or well-run as the index’s larger, more liquid holdings. Most managers underweight the largest index constituents and overweight the smaller, more speculative junior miners.

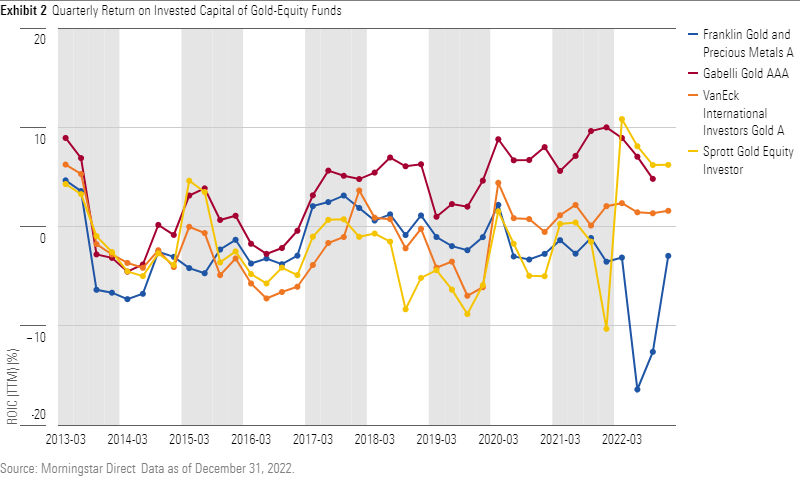

So, most active gold-equity funds tend own a lot of low-quality stocks. The average holding of the four gold-equity funds that Morningstar covers tends to have low or even negative returns on invested capital. The mean holding’s return on equity and return on assets also are often low and its debt/equity ratio inflated.

A Bumpy Ride

If that was not dicey enough, these companies’ reliance on the price of gold makes them volatile, often more so than the underlying commodity. Gold miners are essentially a leveraged bet on the price of gold. For example, if the price per ounce of gold goes from $1,900 to $2,000, that’s about a 5% gain for the metal. However, if, for the sake of illustration, gold’s breakeven price is $1,500 per ounce, the price increase can boost the producers’ revenue by 25%, 5 times as much.

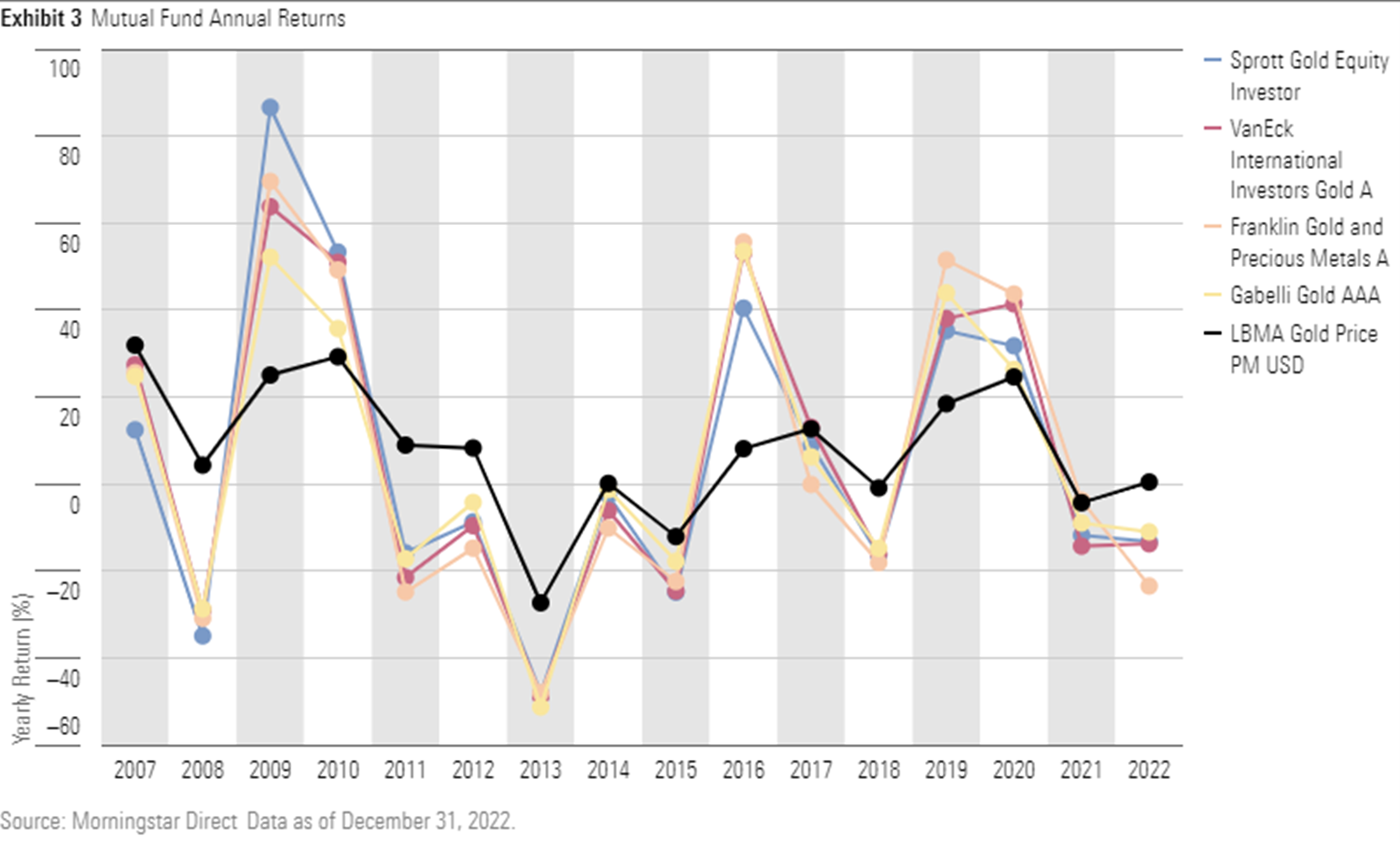

This is evident in gold-equity funds’ returns. When gold gained more than 25% in both 2009 and 2010, gold-equity funds gained between 50% and 90% and posted similarly eye-popping results the following year. But in 2013, when gold fell more than 25%, all four mutual funds plunged more than 45%.

Flat gold prices were not enough to buoy gold miners in 2022. Each of the four gold-equity funds Morningstar covers lost at least 10%, with Franklin Gold and Precious Metals FKRCX dropping 23%.

The Bad Has Outweighed the Good

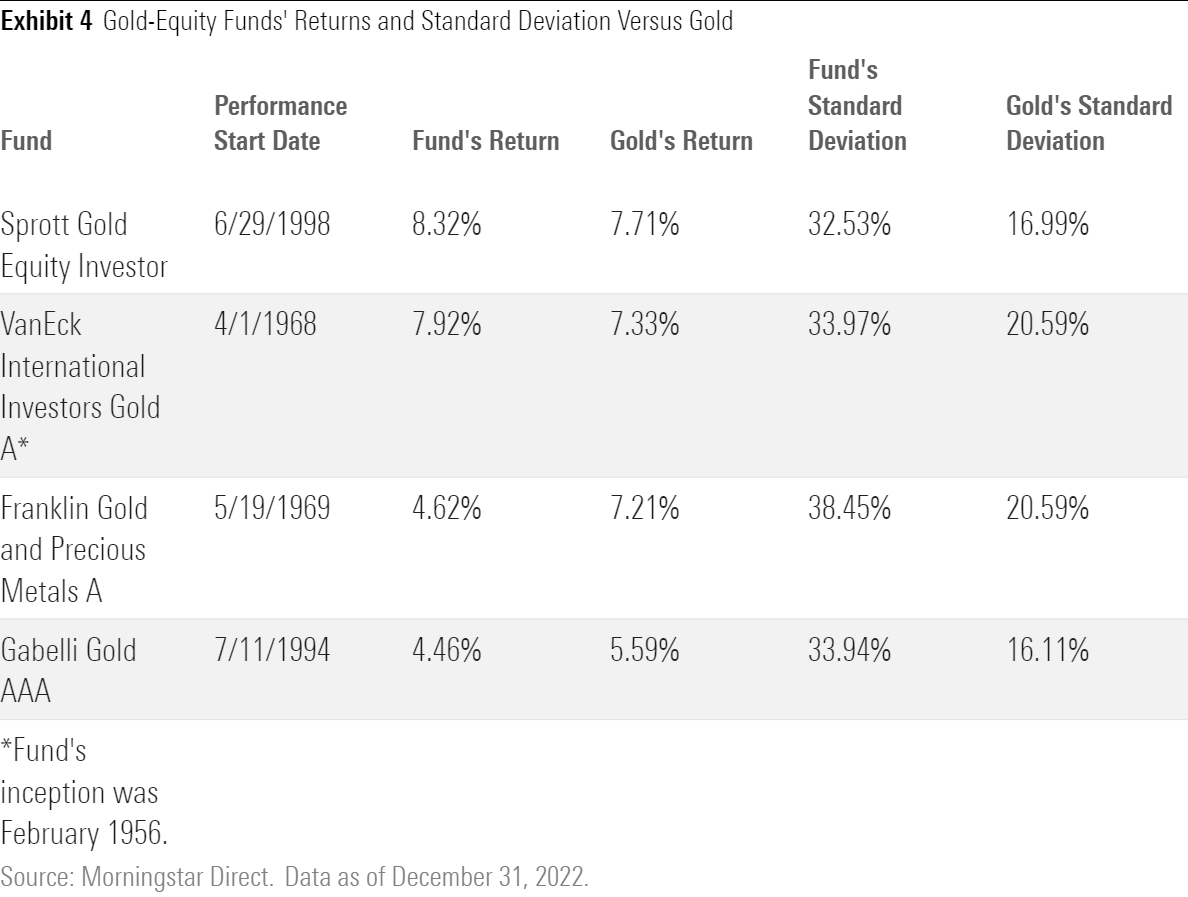

Since their respective inceptions (or since the LBMA Gold Price’s data became available in January 1968) through 2022, the four funds turned in mixed results. Sprott Gold Equity SGDLX and VanEck International Investors Gold INIVX beat the metal, while Franklin Gold and Precious Metals and Gabelli Gold GOLDX lagged it. Risk-adjusted results for each, however, were mediocre at best. Both Sprott Gold and VanEck International Investors Gold have historically allocated at least 10% of their assets to physical gold, which has damped their volatility.

Nuggets of Wisdom

Gold-equity funds’ 2022 struggles were a microcosm of their long-term issues. They failed to even keep pace with inflation and provided little relief to investors hoping for diversification in bond and stock bear markets. But these funds did offer a few lessons:

1) Market-timing is fool’s gold.

If you must own a gold-equity fund, don’t buy based on your forecasts for the commodity’s price, which is difficult—if not impossible—to predict. Since 2000, evidence shows that investors have done a poor job timing their gold-equity fund purchases and sales, typically investing after the funds have already benefited from a gold surge and selling after a drop. The investor returns (or results weighted by investor inflows and outflows) of the four funds that Morningstar covers lagged their total returns from 2006 to 2008, when the metal soared. Investors did a poor job of timing their gold-equity buys and sells again in 2022, making an already disappointing year even more so. Only one of the four funds had a better investor returns than total return for the year.

2) Gold-equity funds are a luxury, not a necessity.

You don’t need gold-equity funds to get exposure to gold equities. A diversified index fund or actively managed portfolio may already own all you need. For instance, Vanguard Total Stock Market ETF VTI and SPDR S&P 500 ETF SPY both own industry behemoth Newmont. Since the metal and the shares of companies that mine it are volatile, vulnerable to fickle macroeconomic winds, and prone to prolonged periods of poor performance, you don’t need much more exposure than you may already have.

3) Own a little, pay little.

If you can’t resist gold and gold equities, keep your exposure small and cheap. The four gold-equity funds that Morningstar follows topped VanEck Gold Miners ETF since its 2006 inception, and SPDR Gold Shares has bested the gold-equity funds. Low costs are a big reason why. The future course of gold and its miners may be unknown, but at least you know the fund gives you relatively cheap exposure.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ac242d77-42e4-4165-951a-b300b089a834.jpg)