4 Undervalued ESG Stocks for 2023

Sustainalytics highlights companies that are well-positioned for the long term.

ABB ABB, Airbus EADSY, Nio NIO, and Splunk SPLK are just a few of the sustainable stocks poised to benefit from emerging trends, according to Morningstar Sustainalytics’ annual forecast of promising themes in sustainable investing. For investors looking for appealing opportunities, the four companies also trade below Morningstar’s fair value estimates, as of Jan. 25, 2023.

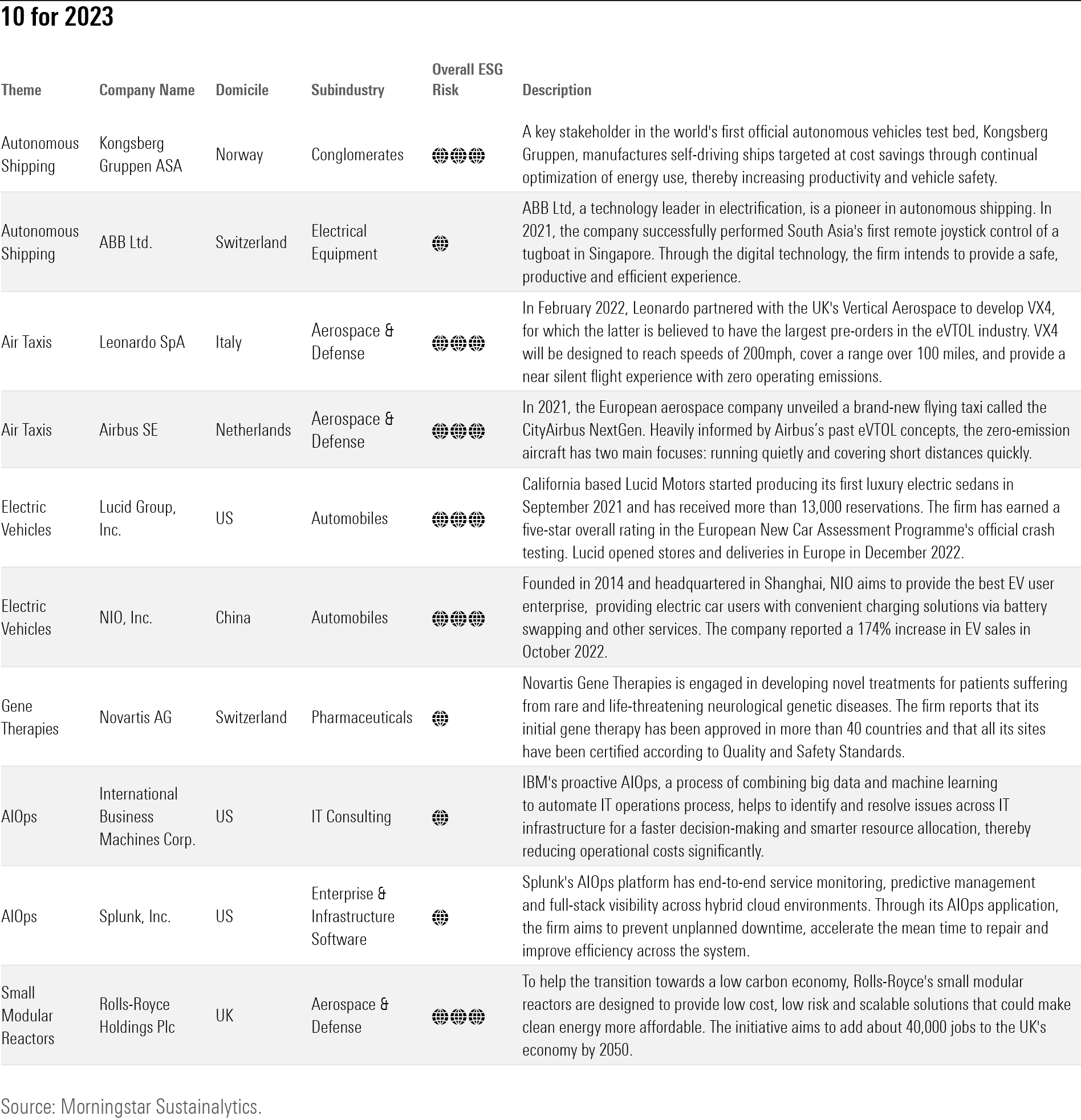

The companies are part of six emerging themes for investors: autonomous shipping, air taxis, electric vehicles, gene therapies, artificial intelligence for IT operations, and small modular reactors. They are described in Sustainalytics’ report “10 for 2023: Investing in Emerging Technologies.” Sustainalytics provides ESG research, ratings, and data for investors.

“These technologies are still at the early stages of design, development, or deployment,” write Sustainalytics analysts Martin Vezer and Poulomi Sengupta. “While companies in these spaces face mounting risks related to environmental, social, and governance considerations, some offer solutions that may be aligned with a sustainable investment thesis.”

4 ESG Stocks to Buy Now

The report identifies 10 publicly traded companies that are well-positioned on ESG criteria, as shown in the table below. Of the 10, seven are covered by Morningstar analysts and are discussed here. Four of these sustainable stocks are attractively valued.

1. ABB ABB benefits from the autonomous shipping theme: It successfully performed South Asia’s first remote joystick control of a tugboat. In 2021, its marine segment accounted for 22% of revenue in its process automation division. It is well-positioned to benefit from growing demand for industrial automation and robotics, while margins are expected to expand on the company’s restructuring. ABB has a Medium Morningstar Uncertainty Rating related to noncore acquisitions and cybersecurity, according to analyst Denise Molina. ABB has a Morningstar Economic Moat Rating of wide and a Morningstar Rating of 4 stars. At $34, the ADR trades below Morningstar’s fair value estimate of $37.

2. Airbus EADSY gains from the theme of air taxis, which are highly automated aircraft designed to cover short distances of less than 250 kilometers, or around 150 miles. According to Deloitte Insights, the U.S. market for so-called electric vertical takeoff and landing vehicles could reach $3.4 billion by 2025 and top $17.7 billion by 2040. In 2021, Airbus unveiled a brand-new flying taxi called CityAirbus NextGen. The firm is also working on developing the world’s first zero-emission commercial aircraft by 2035. Airbus’ popular narrow-body planes “will enable fleet growth and may replace many aging midsize aircraft,” writes analyst Nic Owens. Airbus has a High Uncertainty Rating, reflecting a “choppy” recovery during the ongoing pandemic and exchange rate risk, says Owens. The firm has a wide moat and a 4-star rating. At $32.81, the ADR trades below its fair value estimate of $38.

3. Nio NIO is poised to gain on expanding demand for EVs, which Morningstar believes will account for 30% of total auto sales in 2030. Shanghai-headquartered Nio offers a power service that provides chargeable, swappable, and upgradable batteries for users, reducing problems related to range. Nio has an Uncertainty Rating of Very High because it competes in a cyclical, capital-intensive industry, writes Morningstar analyst Vincent Sun. The company has no moat. However, it sports a 4-star rating. At $11.68, the ADR trades at a discount to its fair value estimate of $16.

4. Novartis NVS benefits from growing demand for gene therapies, which is expected to grow at a 20% annual rate, driven by the prevalence of chronic, rare, and genetic disorders, according to a recent Facts & Factors report. Novartis received U.S. approval for its first gene therapy drug in 2019. Its initial gene therapy for spinal muscular atrophy has been approved in more than 40 countries. The drug giant has a Low Uncertainty Rating, owing to “the high level of diversity within the company’s broad drug portfolio,” says analyst Damien Conover. Novartis has a wide moat and a 3-star rating. At $92, the shares trade just above the fair value estimate of $90.

5. International Business Machines IBM is poised to benefit from the growing market for artificial intelligence in IT operations. According to industry research firm The Insight Partners, the market for AIOps should grow to $20 billion by 2028 from $3 billion in 2021. IBM reports that its AIOps system helps users reduce app alerts, retire legacy software, and limit unplanned downtime and bugs. IBM has a Medium Uncertainty Rating owing to intense competition, moderated by IBM’s large, slow-to-change customer base, says Morningstar analyst Julie Bhusal Sharma. IBM has a narrow moat and sports a 2-star rating. At $141.49, the stock trades at a premium to its fair value estimate of $126.

6. Splunk SPLK sells software that enables access to data, analytics, and automation. Key products use AIOps to resolve data-related issues. Splunk has a High Uncertainty Rating “due to its ongoing cloud transition, place in a high-growth market, and execution risk,” says Morningstar analyst Malik Ahmed Khan. The company has a narrow moat and a 4-star rating from Morningstar. At $92.32, the stock trades at a discount to its fair value estimate of $120.

7. Rolls-Royce Holdings RYCEY is a beneficiary of the expected growth in small modular reactors, which, compared with most legacy nuclear plants, use more passive safety systems, have fewer operator oversight requirements, and are more stable at higher temperatures. Rolls is currently planning three factories to manufacture a fleet of SMRs in the United Kingdom. It has a High Uncertainty Rating from Morningstar, owing to the aviation industry’s choppy recovery from the pandemic and uncertainty around the Ukraine war, writes Morningstar analyst Joachim Kotze. Rolls-Royce has a narrow moat and a 3-star rating from Morningstar. At $1.35, the ADR trades just below its fair value estimate of $1.40.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)