Are We in a Low Return World? We Doubt It

Why Morningstar Investment Management expects positive real returns for long-term portfolios.

Much of the post global financial crisis period was marked by loose monetary policy and low inflation, which provided fertile ground for financial markets. The pandemic, which took the shackles off any policy restraint, further propelled these trends. Developed nations, spearheaded by the United States, launched unprecedented fiscal stimulus programs to support economic activity during the coronavirus lockdowns. These policy measures fueled a speculative frenzy in everything from meme stocks to cryptocurrencies, pushing asset prices to new highs.

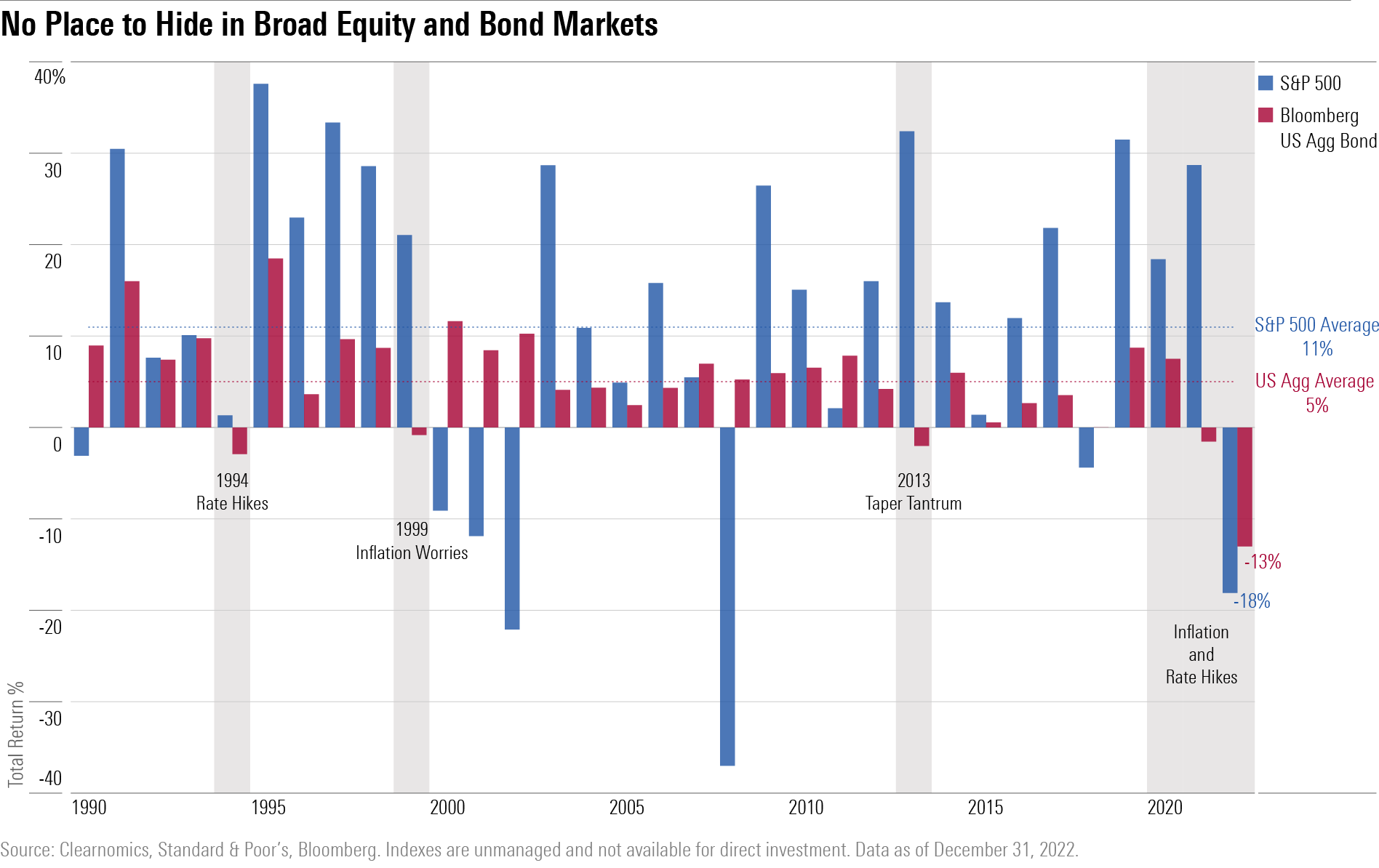

Inflation reaching four-decade highs in 2022 was the proverbial wet blanket that caused these trends to go into reverse. Central banks took “forceful and rapid steps” to bring inflation down, push bond prices up, and deflate risk assets. The most rapid increase in interest rates on record propelled a double-digit selloff in both stocks and bonds, leaving investors with only a few places to hide as markets adjusted to the new environment.

The 2022 Downturn Will Create a Better Long-Term Investing Environment

The double-digit selloff in both stocks and bonds left investors wondering whether low returns are in store for the foreseeable future. We doubt it. Taking a longer-term perspective, the 2022 downturn has set the stage for a much-improved long-term investing environment.

One reason for optimism comes from fixed income. The 10-year U.S. real yields are at their highest level since 2009—offering meaningfully positive return prospects after inflation—following an extended period of not keeping up with consumer prices. As a result, we see a more balanced reward-for-risk picture within core U.S. fixed-income markets today. Major investment-grade bond markets are priced to deliver a return after inflation between 1.5% and 2% over the next decade.

Equity market valuations were significantly better in late 2022 than a year prior, too. This improvement has been reflected in the percentage of assets trading at a positive spread-to-fair value. For example, there were no developed country equity markets that were undervalued using our valuation models in late 2021. In contrast, at the end of October 2022, almost 30% of countries were cheap compared with their long-term fair-value expectations.

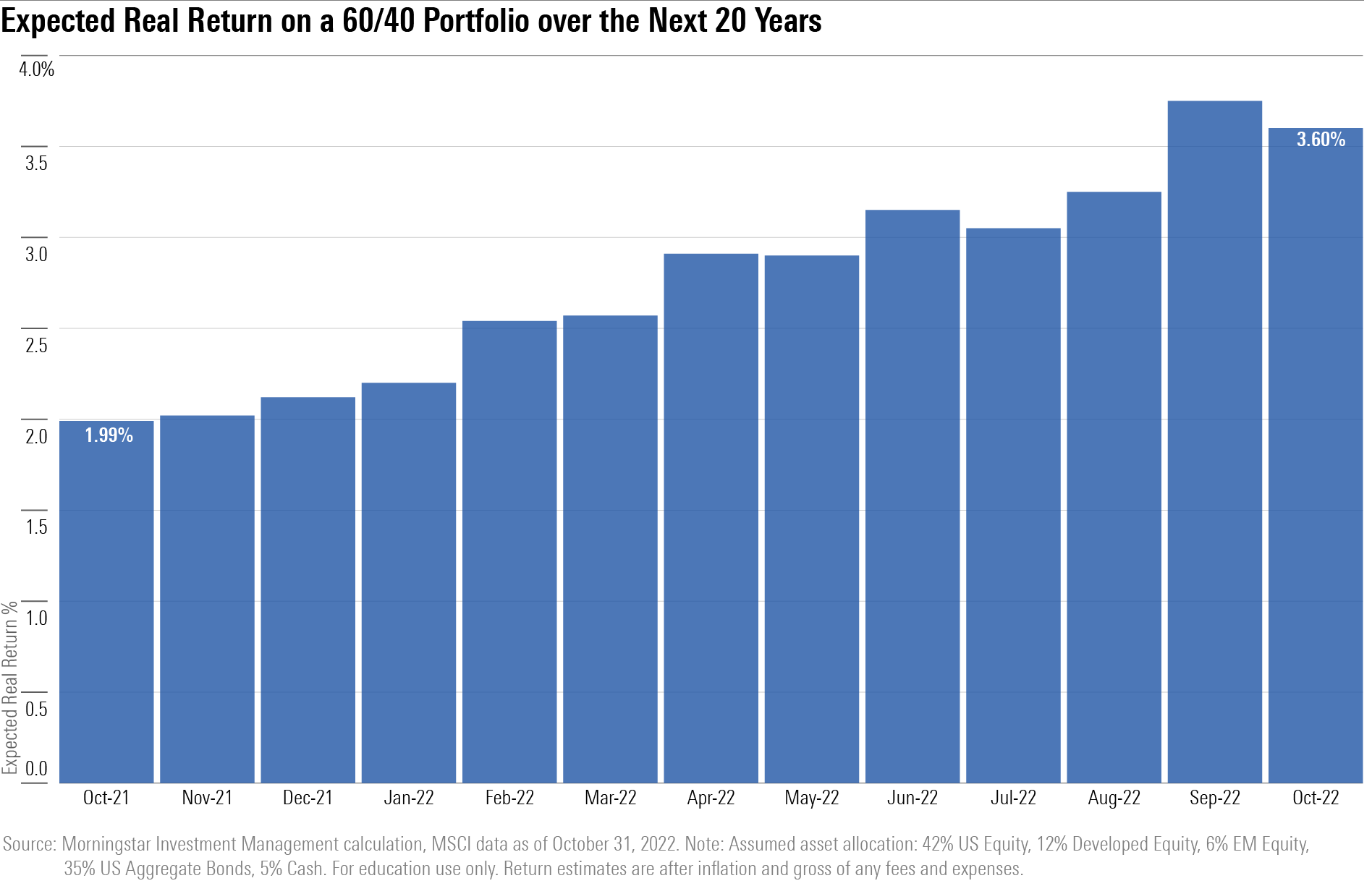

Considering the improvements in equity and fixed-income valuations over the course of 2022, our valuation models suggest that the 60/40 portfolio stands to deliver a return after inflation of 3.6% over the next two decades. This is a 1.6% improvement from 12 months before.

We See Buying Opportunities Across the Equity Market

Rotation within equity markets was another key theme over the course of 2022: Those assets displaying the best prospects a year ago are not displaying the best prospects today. This rotation has seen some assets fall away in their appeal and others rise over the course of a year. For example, energy companies stood out through 2020 and much of 2021 as one of the most attractive assets, but that trend didn’t hold in 2022. Meanwhile, communication services companies became appealing. Twelve months ago, the communication services sector was ranked sixth out of the 10 world sectors. Today, it sits at the top.

Communication services is a truly diverse sector, encompassing internet media companies (like Alphabet GOOGL and Meta Platforms META), media and entertainment companies, and telecom services providers. In part because of weak recent share price returns—experienced by a number of its most significant constituents—global communication services now possess one of the highest valuation-implied return estimates among the sectors we cover.

We also see significant opportunity within emerging-markets equity. This asset class, which encompasses a wide swath of countries in the “developing” world, experienced broadly negative share returns in 2022—especially in U.S. dollar terms. Given our assessment of valuation, the fundamental risk picture, and contrarian elements, we conclude that absolute and relative valuations have improved to the degree that it merits an upgrade in our overall view of the asset class.

These are just two ideas among many better opportunities. Yet, our valuation model suggests that both communication services and emerging-markets stocks are expected to deliver a real return (above inflation) of around 7% over the next decade.

Better Valuations Create Opportunity, but the Principles of Good Investing Still Apply

The above analysis is encouraging, especially after a challenging year. That said, we acknowledge that periods of market volatility can be unnerving. These are the times when special attention should be given to managing our behavioral biases as investors. Our approach is to follow a disciplined valuation-driven investment process guided by a set of investment principles that keep us focused on the long term and what matters fundamentally. Periods of uncertainty often lead to the biggest opportunities in the market, as market participants overreact to news.

Yet, the principles of good investing must still apply. As such, we put forward five key lessons that will hold us, and all investors, in good stead through 2023 and beyond:

1) To be long-term minded

2) To use a consistent framework for assessing value

3) To deeply assess fundamentals

4) To think contrarian

5) To understand where you are in the capital cycle

As we navigate markets today, we remind ourselves of these lessons and remain optimistic that the best days for investors lie ahead.

This article was adapted from the Morningstar Investment Management 2023 Outlook published in December 2022. Download the full report here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/571f02f7-3d9f-40ca-a254-c1ae121baeab.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/571f02f7-3d9f-40ca-a254-c1ae121baeab.jpg)