10 Outperforming Actively Managed Stock ETFs

Low-volatility strategies and energy-heavy portfolios helped these hybrid fund strategies deliver for investors.

Investors looking for both the advantages of exchange-traded funds and the opportunity to outperform the market through active stock-picking have been checking into a growing number of actively managed ETFs as options for their portfolios.

Actively managed ETFs combine stock-picking with a more tax-efficient vehicle, the exchange-traded fund, and often come with lower fees than investors pay for traditional mutual funds.

In some cases, these actively managed ETFs are clones of existing traditional mutual funds. In other cases, they are stand-alone strategies.

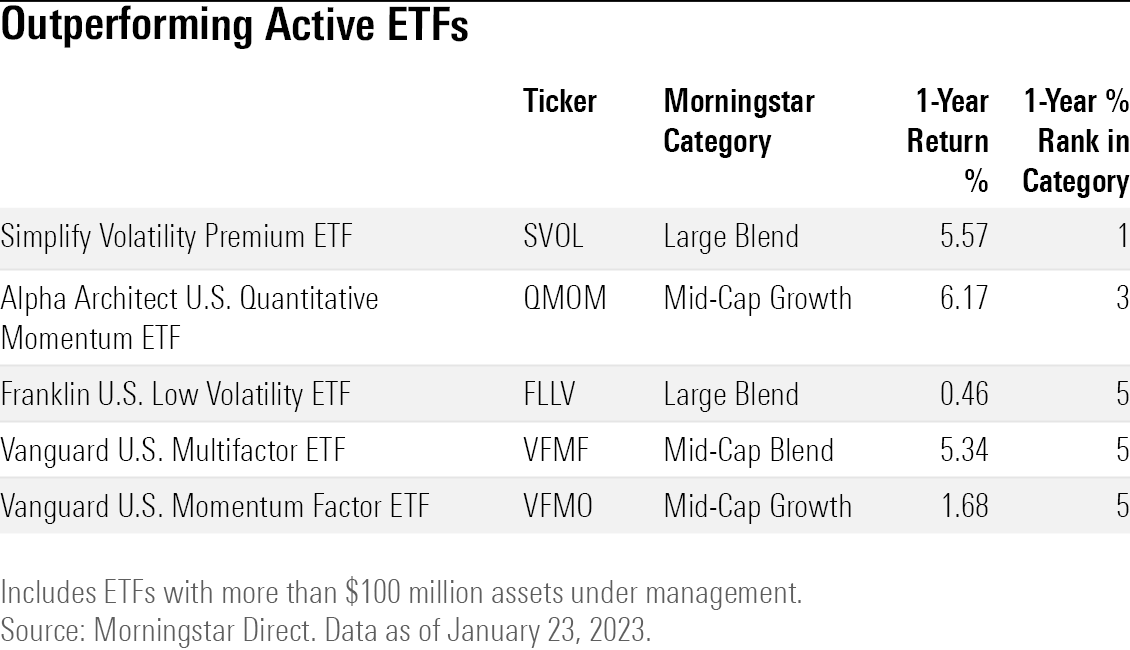

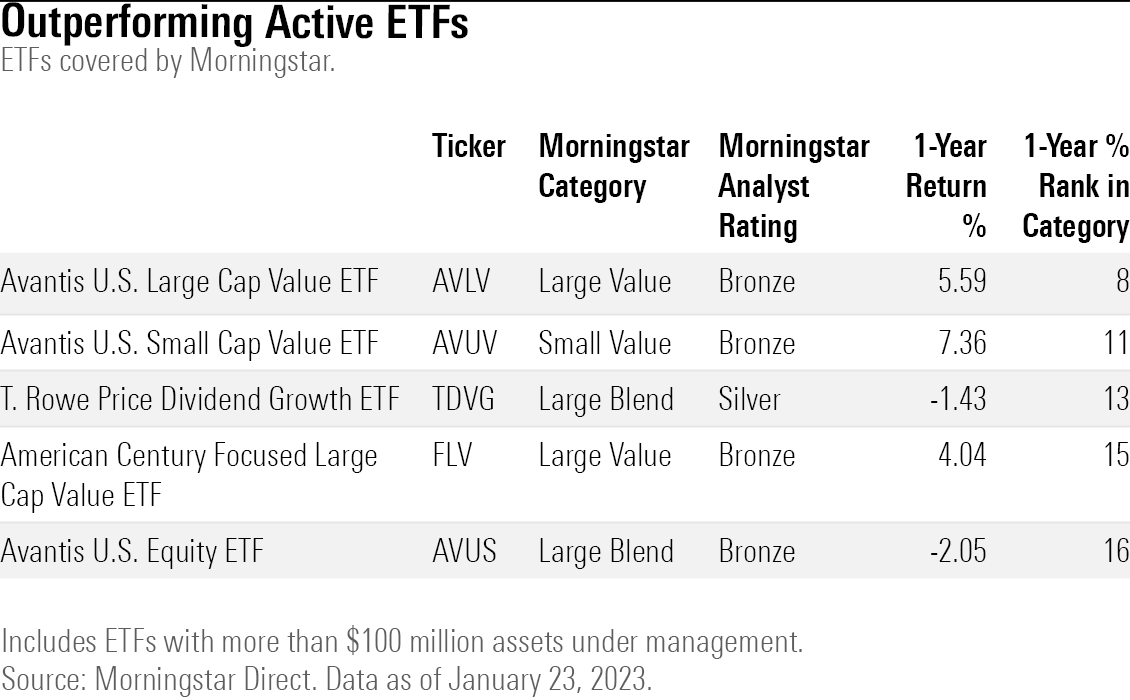

We screened for the overall best-performing actively managed ETFs in their Morningstar Categories over the past year and the best performers among those covered by Morningstar analysts. To make the final cut, the ETFs had to have more than $100 million in assets.

Top-Performing Active Stock ETFs

Actively managed low-volatility ETFs, which attempt to provide investors with a smoother ride through the stock market’s ups and downs, came out ahead over the past year. The $151.7 million Simplify Volatility Premium ETF SVOL gained 5.6%, while the average large-blend fund lost 6.3%. The fund tracks the inverse performance of the widely watched volatility index, the Cboe Volatility Index (VIX), while also providing income to investors.

Funds that attempt to ride along with trends in the stock market also did well. In the mid-cap growth category, $145.8 million Alpha Architect U.S. Quantitative Momentum ETF QMOM advanced 6.2%, while the average fund declined 9.9%.

Momentum strategies generally bet that the stocks that are doing well now will continue to outperform. QMOM does this by investing in the 10% of stocks with the highest total return over the last 12 months, excluding the most recent month, according to the fund’s website. The fund has a hefty 51% weighting in energy stocks, by far and away the best performing sector of the past year. The Morningstar US Energy Index has gained 50.8% over the last 12 months as of Jan. 23, while the Morningstar US Market Index lost 7.4%.

Top-Performing Active Stock ETFs With Morningstar Analyst Ratings

Avantis ETFs captured three of the five spots for actively managed stock ETFs covered by Morningstar; these are managed by American Century.

As of Dec. 31, each of the Avantis funds held higher weightings of energy stocks than the average fund in their respective categories.

“Avantis ETFs and mutual funds intentionally place greater emphasis on stocks with low price/book ratios and high profitability,” says senior analyst Daniel Sotiroff, and “the energy sector looked attractive on both metrics last year.” The $857.5 million Avantis U.S. Large Cap Value ETF AVLV, launched in 2021, gained 5.6%, while the average large-value fund eked out only a 0.6% gain.

The $3.6 billion Avantis U.S. Equity ETF AVUS takes the same approach as the large-value strategy but applies it to a greater swath of stocks. It avoided losses as steep as the average large-blend fund’s over the past year; it lost 2.1%, while the average large-blend fund dropped 6.3%.

Being underweight in volatile technology and communication services names helped $289.5 million T. Rowe Price Dividend Growth ETF TDVG outperform. Instead, holdings in stocks that grow their dividends, like Eli Lilly LLY and EOG Resources EOG, helped keep the fund’s loss to only 1.4% over the past 12 months. “The fund’s focus on companies that are financially healthy enough to pay a dividend has led to a portfolio that’s been resilient in down markets,” writes senior manager research analyst Stephen Welch.

Correction (Jan. 30, 2023): The exhibits were updated to indicate that the lists include only funds that have over $100 million in assets under management.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)