Concerned About Plastic Packaging Waste? These 3 Stocks Are Worth a Look

These companies have made good progress addressing plastic pollution, and their stocks are currently undervalued.

Every day, consumers rip open packaged goods and discard the single-use plastic wrapper. That makes plastic pollution the key environmental concern for consumer packaged goods firms—and the target of increasing scrutiny from regulators, consumers, and investors.

For investors seeking to minimize environmental, social, and governance risk, we recommend finding companies that have made good progress addressing plastic pollution and that also boast durable competitive advantages and attractive valuations. These include Estee Lauder EL, Clorox CLX and L’Occitane.

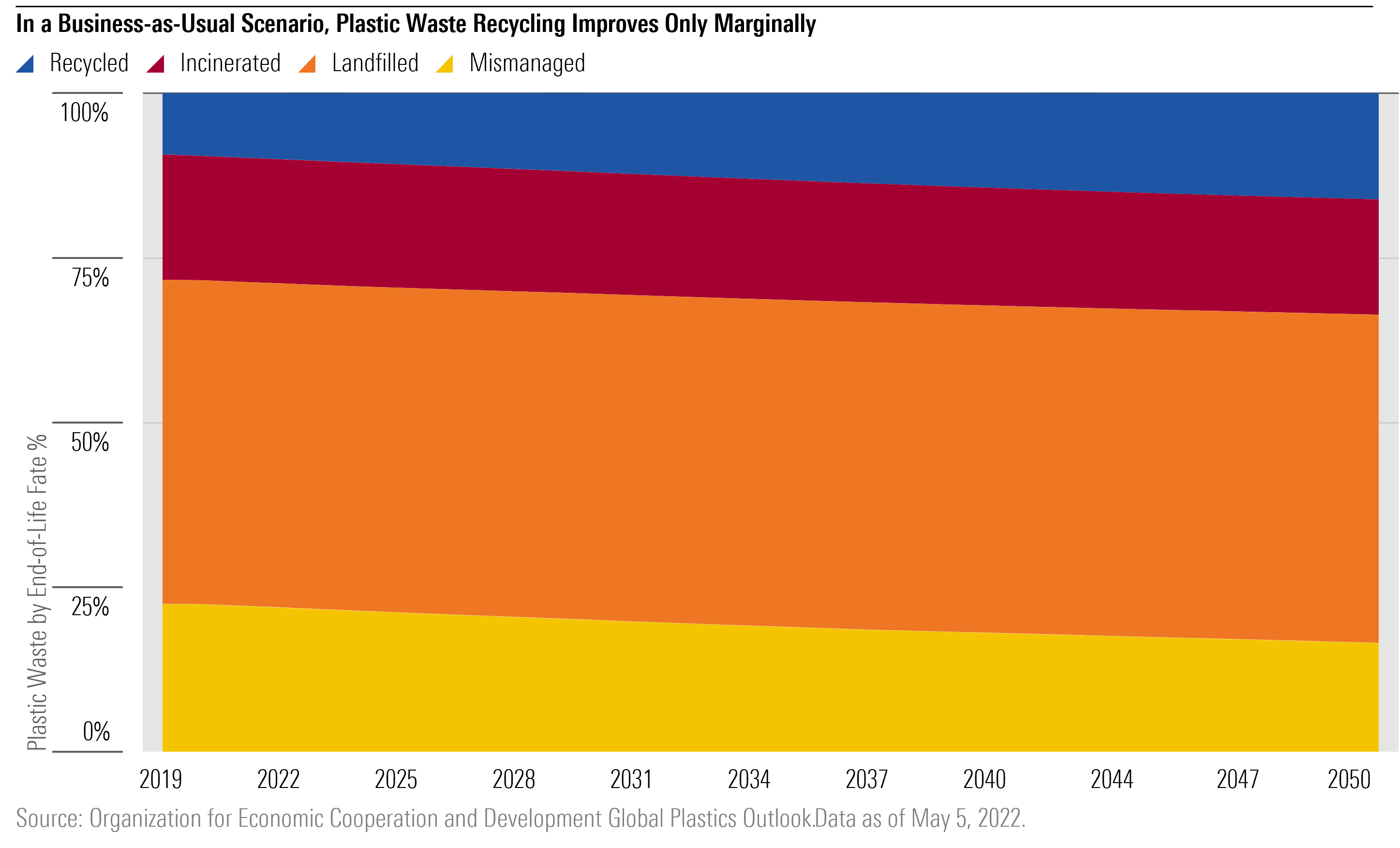

What makes plastic so appealing is also what makes it problematic. There are countless varieties. Less than 10% is recycled because of underdeveloped collection, sorting, and recycling facilities worldwide. Plastic also degrades slowly.

Since many of plastic’s applications lack suitable alternatives that could match its strength-to-weight ratio or its food preservation benefits, we don’t expect to see widespread bans that would limit its demand. However, we believe regulation will be instrumental in significantly increasing plastic circularity (finding ways to reuse it or use it for longer)—and its recycling rate—by 2050.

Tightening regulation will force consumer packaged goods, or CPG, firms to address their plastic waste footprint and absorb some of the costs of tackling plastic pollution. Even so, such measures are not expected to greatly impact their financials or brand equity. This is especially true for high-quality, competitively advantaged firms, which are easy to come across in the sector and which should be able to pass cost inflation to consumers.

CPG Firms are Addressing Plastic Pollution

Many large CPG firms have already made ambitious voluntary commitments to improve recycled content use and packaging recyclability. For example, signatories to the Ellen MacArthur Foundation’s Global Commitment to tackle plastic pollution account for 20% of the world’s plastic packaging market and include many of the world’s largest CPG firms. Together they have pledged a 26% inclusion of recycled content in plastic packaging by 2025, up from the 10% reported in 2021.

Many consumer goods companies have also set targets for 100% recyclable, reusable, or compostable packaging by 2025. Most large CPG firms already report up to 80% of packaging as technically recyclable.

Consumer Preferences Play a Key Role but Are Far from Straightforward

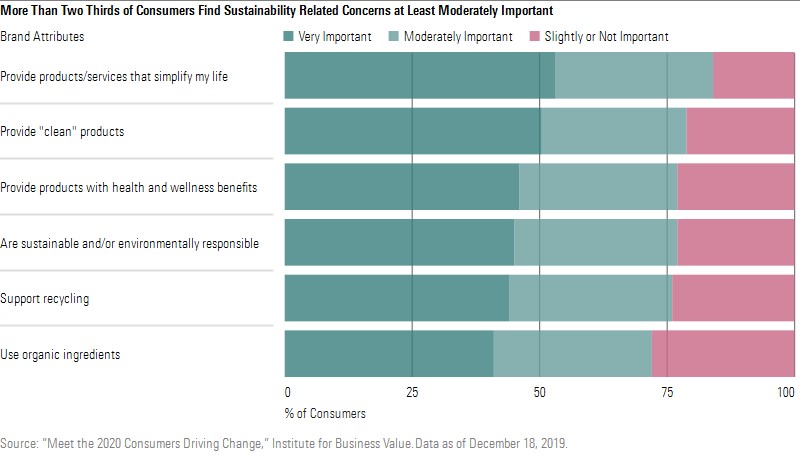

Meanwhile, consumers are increasingly embracing brands with strong environmental and social credentials. Recent studies show that purpose-driven consumers now represent the single-largest cohort of consumers.

To be sure, studies also show that consumer unwillingness to pay up for sustainable products is a frequent phenomenon. Recent price inflation is also likely to have made any additional sustainability premium less palatable.

Look for Undervalued, Moaty Companies on Track to Meet Plastic Targets

Plastic pollution isn’t the only environmental consideration on the agenda of CPG firms, but it is the area over which they have the most control.

Investors seeking to incorporate this theme into their investment decisions must also be vigilant about valuation and the competitive advantages that can help firms better navigate an ever-changing regulatory environment.

We recommend investors look for undervalued companies that have earned a wide or narrow Morningstar Economic Moat Rating, on top of those that are making good progress in addressing their plastic pollution footprint. Three companies meet the criteria.

- Estee Lauder—Recent stock market weakness has resulted in a rare opportunity to buy wide-moat Estee Lauder at a discount to the fair value estimate of our Morningstar analyst. The stock is trading in 4-stars territory amid concerns related to its large business in China or the potential that a recession could inhibit sales, which are overstated in the current share price. The company is also taking meaningful steps to address the circular use of plastic. In 2022 it reported good progress toward its target of 25% postconsumer recycled material in packaging by 2025, achieving an actual delivery of 17%.

- Clorox—Despite being dogged by soaring inflation and marked gross margin erosion, wide-moat Clorox is poised to offset these pressures through higher prices at the shelf (which were slow to come on owing to massive supply/demand imbalances during the pandemic) and efficiency savings (which had been impeded by strangled supply chains). Its inclusion in 2021 of 11% PCR plastic in its packaging positions it well compared with its 2025 target of 17%.

- L’Occitane—Trading in 5-star territory, this narrow-moat company is deemed by our Morningstar analyst to have an attractive outlook over the long run. Acquired brands like Elemis and Sol de Janeiro are expected to drive most of the growth of the company through a combination of geographic and channel expansion. In regards to its exposure and management of ESG risks, L’Occitane has been assigned a low ESG Risk Rating by Morningstar Sustainalytics and is well on track to reach its 2025 PCR plastic target of 20% (17% reported in 2021), while also making good progress in reducing the total amount of virgin plastic used in packaging.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)