Biopharma Stocks Face Rising ESG Risks. What’s an Investor to Do?

Moats can help. Attractive opportunities in Bayer, GSK, and Roche.

The regulatory risks facing drug producers have risen in the past year, boosting uncertainty for investors. For example, the Inflation Reduction Act of 2022 caps patient out-of-pocket costs for prescription drugs and prevents drug companies from raising prices faster than inflation. Such drugs include treatments for severe conditions like multiple sclerosis, where drug price hikes from 2006 to 2016 led annual costs to more than quadruple and raised out-of-pocket patient costs sevenfold. Partly as a result of the price caps, Morningstar reduced our long-term forecasts for 2031 U.S. biopharma sales.

So, what’s an investor to do? One approach is to educate yourself about potential environmental, social, and governance risks that can threaten company valuations and then see whether existing valuations are cheap enough to reflect these challenges. Most biopharma stocks have economic moats reflecting their competitive advantages. Examining the ESG risks to biopharma firms can be complicated, but it is important for investors seeking exposure to a vital part of the economy. We see attractive picks in Bayer BAYN, GlaxoSmithKline GSK, and Roche ROG. All three are currently undervalued in 5-star territory.

To help investors, we’ve identified two substantial ESG risks, which can lead to drug price cuts or litigation expenses for affected companies. Because their corporate strategies and product portfolios vary, companies face meaningful differences in overall ESG risk.

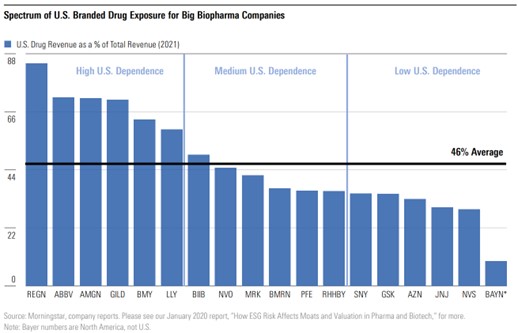

Access to Basic Services, Particularly in the U.S. Market

According to Morningstar Sustainalytics, whether a company provides Access to Basic Service is a material risk. Access to Basic Service measures how biopharma firms balance pricing with ensuring patients have access to therapies, especially innovations. Exposure to the U.S. market is particularly important for measuring this risk, as it accounts for about 40% of sales and half of profit in the $1.4 trillion global prescription drug market despite having only 5% of the world’s population. Biopharma companies covered by Morningstar derive roughly 46% of sales from U.S. branded drugs, although exposure varies among firms.

Affordability is another issue. U.S. regulators have tried to address affordability concerns in this market through government-funded plans and pricing mechanisms. Various Medicare and Inflation Reduction Act policies penalize firms for raising prices above the rate of inflation annually and introduce mandatory price cuts. These policies reduced Morningstar’s forecasts for 2031 U.S. biopharma sales by a low-single-digit percentage. However, despite these efforts, robust price increases still occur.

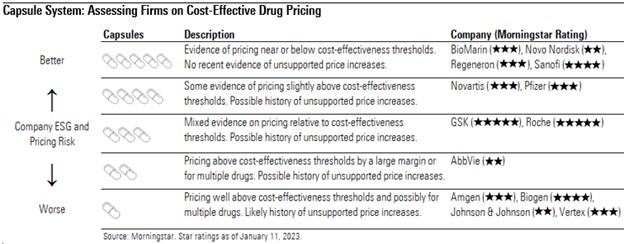

Measuring Drug Pricing Risk: The Capsule System

To assess drug pricing risk, we directly incorporate The Institute for Clinical and Economic Review’s analysis into our biopharma firm ratings through our capsule system. We look at how closely a firm prices key drugs relative to ICER’s analysis of the value provided to the patient, look at whether the firm has a history of unsupported price increases for top-selling drugs, and then assign a number of capsules to each firm. More capsules means less risk. Across the 18 largest biopharma firms in our coverage, we found that pricing risk falls on a wide spectrum.

Heightened ESG risk from drug pricing can lead to potential adjustments to the Morningstar Uncertainty Ratings for firms. For example, Amgen’s AMGN 1-capsule score led us to increase its Uncertainty Rating to High from Medium in June 2022, given its high exposure to U.S. branded drug sales. However, Biogen’s BIIB 1-capsule score has no impact on its Uncertainty Rating, as we believe our rating already factors in the risk of pricing pressure.

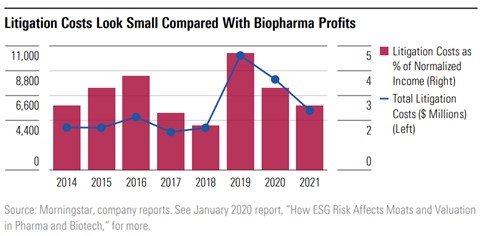

Product Safety Can Lead to Litigation Costs

Biopharma companies face many types of product governance risks, ranging from complex drug design and manufacturing to substantial research and development costs. All bear the risk of failure. Poor protection of user safety and the risk of unknown side effects can further lead to expensive legal costs.

Litigation costs for biopharma companies have totaled billions of dollars historically. However, while large, they are much smaller compared with the affected firms’ profits. In fact, litigation costs averaged just 3% of normalized income for large drug companies between 2014 and 2021. With large-cap biopharma firms averaging net margins above 30%, these costs look manageable.

Additionally, the characteristics of the disease affect the chances for lawsuits. Generally, chronic diseases of low severity are most likely to generate hefty costs, while acute, severe illnesses are less likely to see expensive consequences, mainly because the disease’s severity tends to outweigh any unintended side effects that can emerge during treatment.

Most Biopharma Firms Are Protected From ESG Risks by a Moat, but We See 3 Particularly Undervalued Stocks

Every major biopharma firm under our coverage has either a Morningstar Economic Moat Rating of narrow or wide, typically supported by intangible assets related to patents and innovation. Despite ESG risk exposure across the industry, we see attractive picks in Bayer, GSK, and Roche. All three are currently undervalued in 5-star territory.

- Bayer: We think the market is underappreciating wide-moat Bayer and continues to place too much concern on past glyphosate litigation pressures. The firm recently won three cases on this topic, which should help limit additional costs around the litigation and eventually help remove the perceived legal headwinds that have weighed on the stock’s valuations for several years. Further, strong data on a high-dose version of ophthalmology drug Eylea could help extend exclusivity of the drug, where a reset on the drug’s patent could hold upside for the stock’s valuation.

- GlaxoSmithKline: We continue to view wide-moat GSK as undervalued, with too much investor concern on the Zantac litigation. With the majority of scientific data showing no consistent link between the drug and cancer, we view the risk of a settlement over $10 billion (implied by the August stock price reaction) as unlikely. We expect the litigation process will play out for over a year, with the first of several bellwether cases likely to start in February 2023. We expect a lengthy legal process before GSK likely settles claims at a level below $1 billion.

- Roche: Wide-moat Roche shares remain undervalued, even following the recent failure of Alzheimer’s disease drug candidate gantenerumab. We remain bullish on Roche’s established portfolio and strong pipeline in oncology, as well as continued solid growth prospects for other key drugs in immunology and hematology.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)

/s3.amazonaws.com/arc-authors/morningstar/64f4b163-f518-4e34-84eb-bda92c5b0e33.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/220f0649-85f9-4004-a281-b91d9bc53139.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/64f4b163-f518-4e34-84eb-bda92c5b0e33.jpg)