3 Undervalued, High-Quality Cyclical Stocks

The bear market has left a large number of cyclical stocks trading at attractive prices.

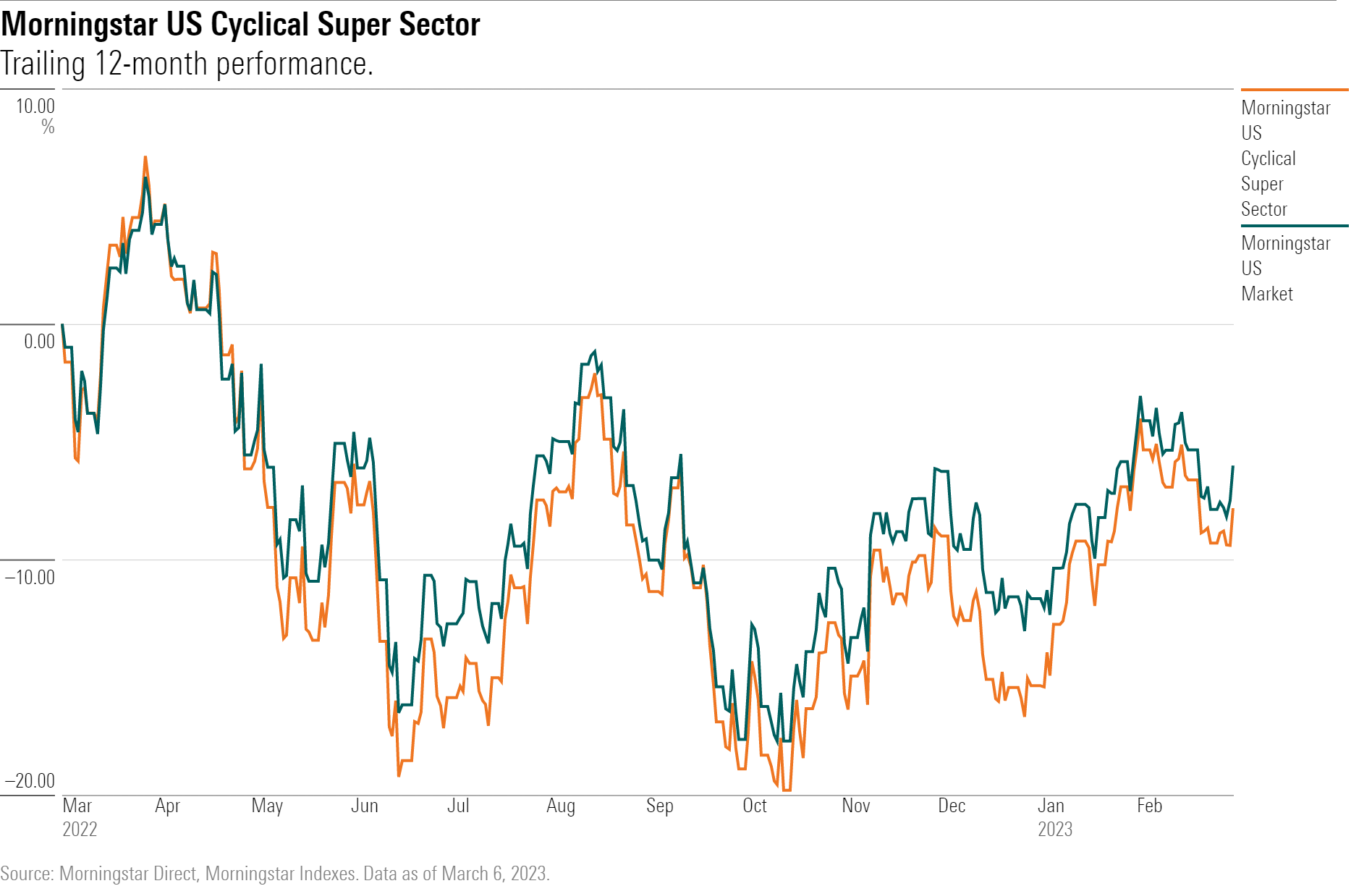

Amid ongoing worries about the possibility of a recession, cyclical stocks--those most closely tied to the economy’s ups and downs--have had a rough year.

But as a result, many cyclical stocks have fallen into undervalued territory. For long-term investors looking beyond the potential for a recession in 2023 and considering buying cyclical stocks, that means there are opportunities.

To find those undervalued names, we turned to the 573 stocks in the Morningstar US Cyclical Super Sector Index and looked for undervalued names. The Morningstar US Cyclical Super Sector Index measures the performance of stocks from the cyclical sectors, which are basic materials, consumer cyclical, financial services, and real estate.

As of March 6, 2023, the index lost 7.8% for the trailing 12-month period while the broader market fell 6%, as measured by the Morningstar US Market Index.

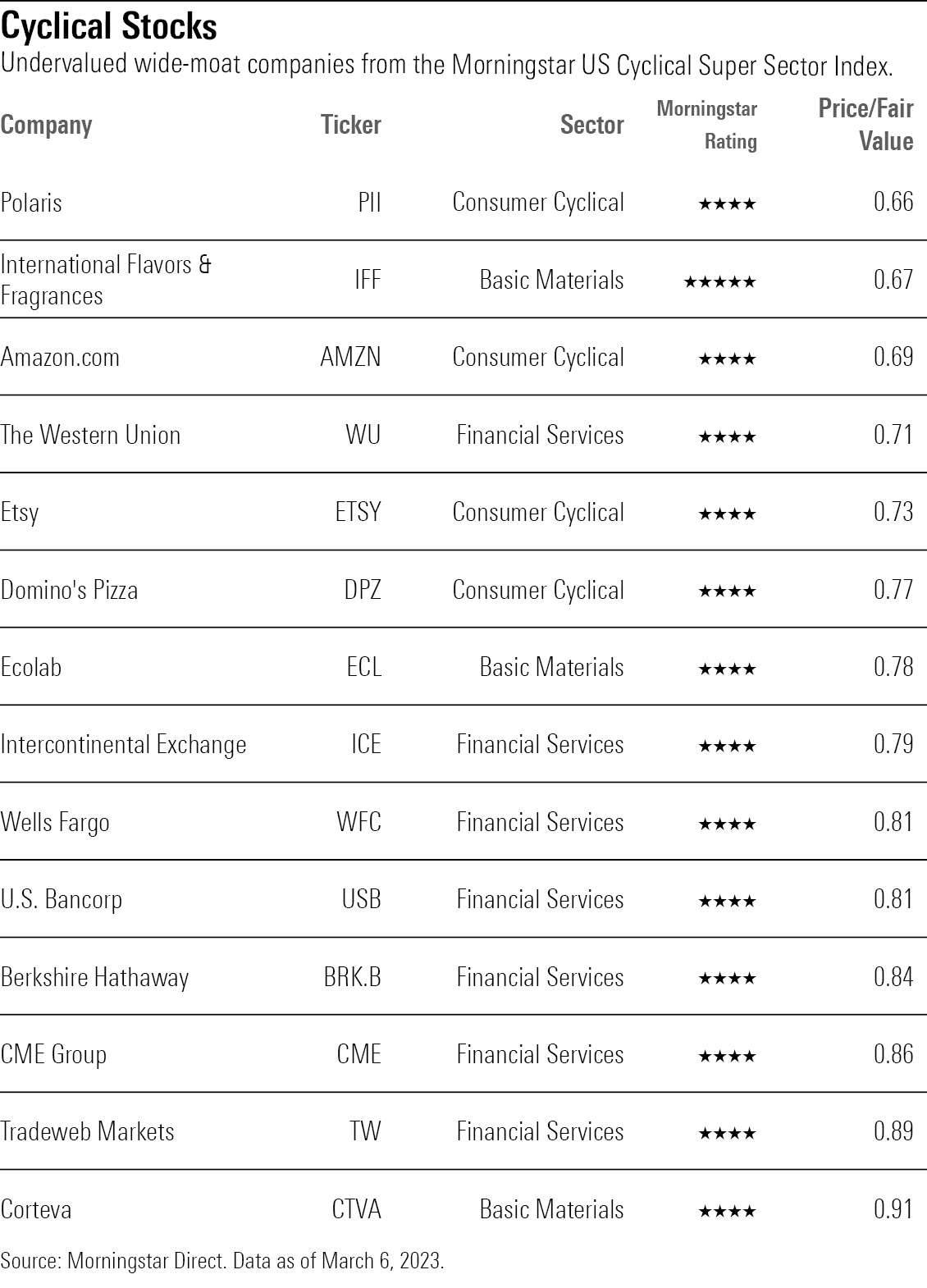

With cyclical stocks having suffered broad-based declines, there’s a long list that are in the undervalued territory with a Morningstar Rating of 4 or 5 stars. Out of the 221 stocks in the Cyclical Super Sector Index covered by Morningstar analysts, 109--nearly half the stocks in the index--were undervalued as of March 6, 2023.

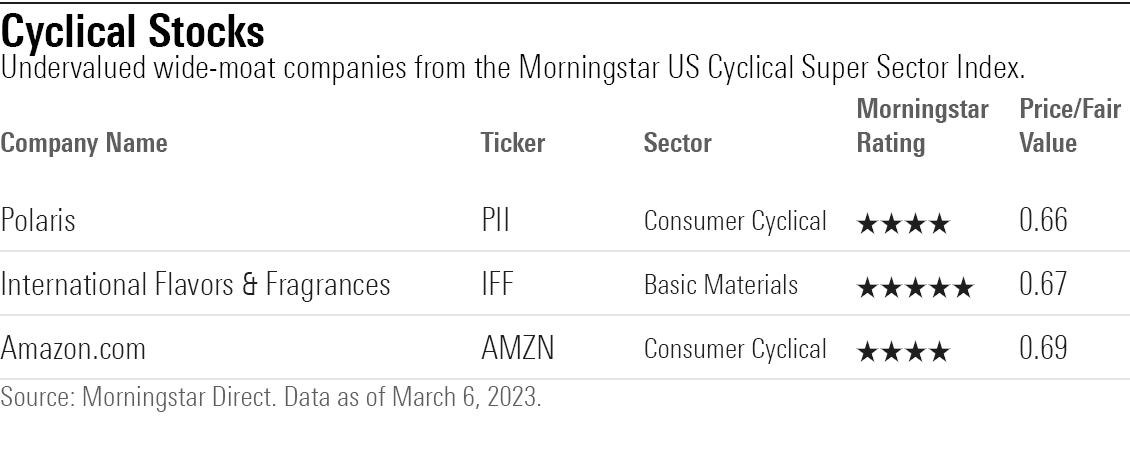

To trim the list down, we pulled the undervalued stocks that have earned a Morningstar Economic Moat rating of wide to find companies with the strongest durable competitive advantages. The three most-undervalued stocks in our list were Polaris PII, International Flavors & Fragrances IFF, and Amazon.com AMZN, all of which are trading more than 30% below their fair value estimates. Our full list, which includes even more wide-moat undervalued names, can be found at the end of this article.

Our list focuses on only those stocks with wide economic moats--meaning their competitive advantages are expected to last more than 20 years into the future--and there are even more attractively priced companies within the index that have narrow moats (meaning their competitive advantage will likely endure for the next 10 to 20 years). This combination of undervalued stock prices and status and wide-moat stocks can offer greater odds of future outperformance.

What Is a Cyclical Stock?

Cyclical stocks are those that follow the overall economy, rising and falling alongside macroeconomic trends. That’s largely because many of the industries within the Super Sector are dependent on discretionary spending. These industries include basic materials, consumer cyclical, financial services, and real estate. JPMorgan Chase JPM, Tesla TSLA, and McDonald’s MCD are among the largest companies in the cyclical Super Sector Index.

A Closer Look at the Best Cyclical Stocks to Buy Now

These were the three most undervalued, wide-moat stocks in the Morningstar US Cyclical Super Sector Index as of March 6:

- Polaris

- International Flavors & Fragrances

- Amazon.com

Polaris is the most undervalued cyclical stock, trading at a 34% discount to the fair value estimate set by Morningstar analysts.

Polaris

- Industry: Recreational Vehicles

- Stock Price: $115.11

- Morningstar Fair Value Estimate: $175

“Polaris is one of the longest-operating brands in powersports. We believe that its brands, innovative products, and lean manufacturing yield the firm a wide economic moat and that it stands to capitalize on its research and development, solid quality, operational excellence, and acquisition strategy. However, Polaris’ brands do not benefit from switching costs, and with peers innovating more quickly than in the past, it could jeopardize the firm’s ability to take price and share consistently, particularly in periods of inflated recalls or aggressive industry discounting.”

“We believe Polaris has established a wide economic moat, delivering healthy adjusted returns on invested capital (averaging 21%, including goodwill, during the past five years). We believe innovative product offerings and growth of adjacent categories through acquisitions (and organically) have positioned the business to continue to capture increasing volume and profits as it reaches new end users.”

“We are maintaining our $175 per share fair value estimate for Polaris after incorporating third-quarter results, which were affected by depressed retail sales (down 8%), resulting in market share declines across its ORV and marine segments. We believe this stems from a dysfunctional supply chain and expect market share losses to reverse as parts availability improves over the next six months, supporting our hypothesis that Polaris will continue to carry a topnotch brand intangible asset.”

— Jaime M. Katz, senior equity analyst

International Flavors & Fragrances

- Industry: Specialty Chemicals

- Stock Price: $91.80

- Morningstar Fair Value Estimate: $140

“International Flavors & Fragrances is a global leader in the specialty ingredients space. The company has grown rapidly via acquisition, having added DuPont’s nutrition and biosciences business in 2021 and Frutarom in 2018.

“IFF holds an enviable portfolio focused on value-added products used in food and beverages, fragrances, personal care, enzymes, probiotics, and pharmaceuticals. Its legacy business operated in the $20 billion-plus flavors and fragrances industry with a roughly 25% market share.”

“The company faces stiff competition across its ingredients markets. Additionally, there is no guarantee that its investments in R&D to create new specialty ingredients will bear fruit. If IFF is unable to develop new products to replace off-patent formulas or develop new ingredients to align with changing consumer preferences, its ability to command premium prices and generate attractive margins would deteriorate.”

— Seth Goldstein, strategist

Amazon.com

- Industry: Internet Retail

- Stock Price: $93.75

- Morningstar Fair Value Estimate: $137

“Amazon dominates its served markets, notably e-commerce and cloud services. It benefits from numerous competitive advantages and has emerged as the clear e-commerce leader thanks to its size and scale, which yield an unmatched selection of low-priced goods for consumers. The secular drift toward e-commerce continues unabated with the company continuing to grind out market share gains despite its size. Prime ties Amazon’s e-commerce efforts together and provides a steady stream of high-margin recurring revenue from customers who purchase more frequently from Amazon’s properties. In return, consumers get one-day shipping on millions of items, exclusive video content, and other services; this results in a powerful virtuous circle where customers and sellers attract one another. Kindle and other devices further bolster the ecosystem by helping attract new customers while making the value proposition irresistible in retaining existing customers. Through Amazon Web Services, Amazon is also a clear leader in public cloud services.”

“Amazon must protect its leading online retailing position, which can be challenging as consumer preferences change, especially post-COVID-19 (as consumers may revert to prior behaviors), and traditional retailers bolster their online presence. Maintaining an e-commerce edge has pushed the company to make investments in nontraditional areas, such as producing content for Prime Video and building out its own transportation network. Similarly, the company must also maintain an attractive value proposition for its third-party sellers. Some of these investment areas have raised investor questions in the past, and we expect management to continue to invest according to its strategy, despite periodic margin pressure from increased spending.”

— Dan Romanoff, senior equity analyst

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b6df6e65-17f1-42fc-b7b8-eb07615d9eef.jpg)