Expanding Our Model Portfolio Coverage With Quantitative Ratings

The Morningstar Quantitative Rating knows U.S. model portfolios all too well.

Sorting through the wide-ranging model portfolio universe can be daunting. To help advisors find the right model portfolios for their clients, we expanded the Morningstar Quantitative Rating, or MQR, coverage in November to include model portfolios.

This increased the number of model portfolios receiving forward-looking Morningstar Ratings from 500 to roughly 1,600, or about two thirds of the universe.

In this article, we’ll highlight the need for more tools to assess the ever-sprawling model portfolio opportunity set and how the MQR for models accounts for the peculiarities of models relative to registered investment vehicles. We’ll also review the initial results.

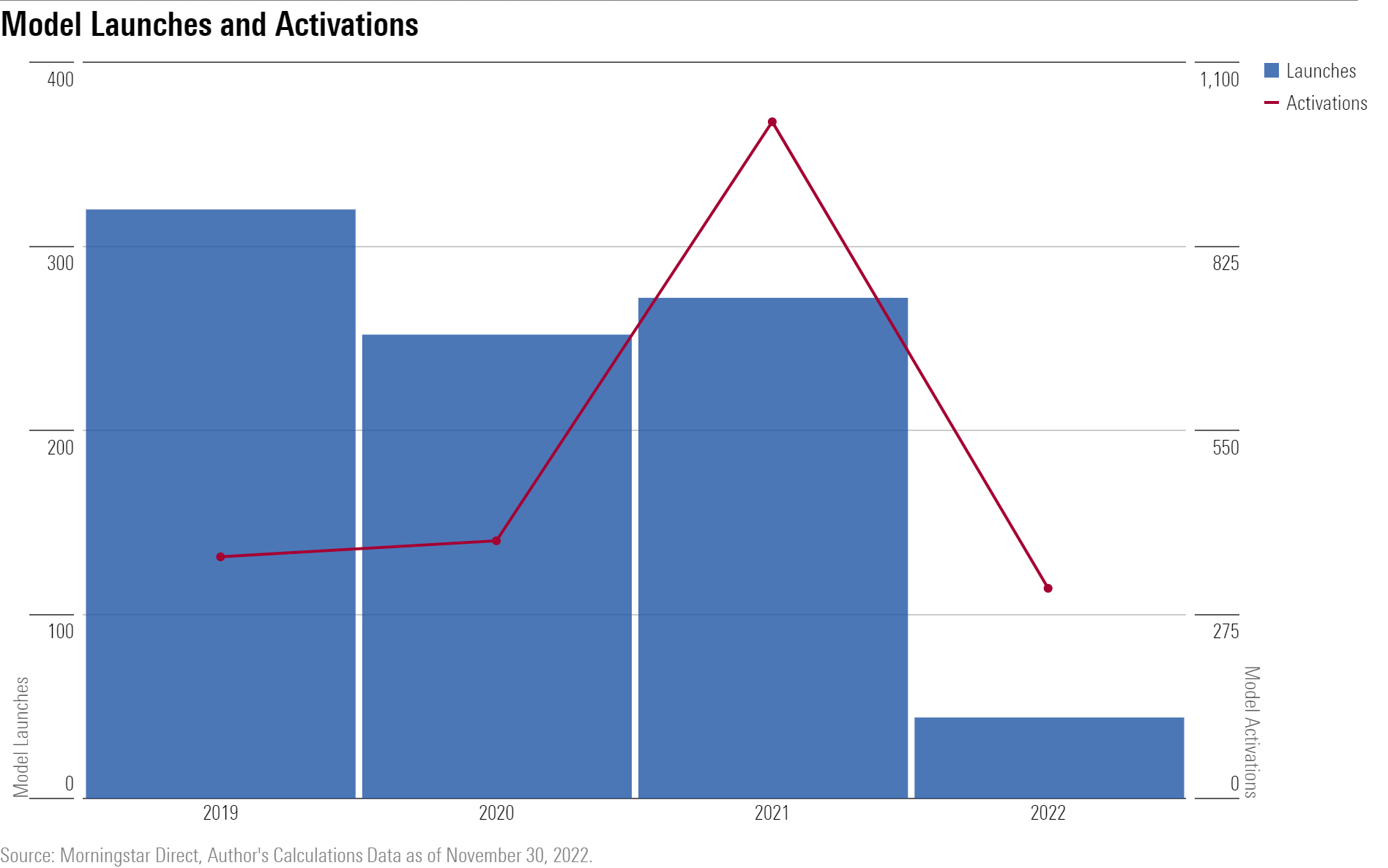

Model Product Development Has Not Calmed Down

Even with this year’s unusually high volatility, another 44 model portfolios have been launched and 312 more have been activated (since models are voluntarily reported there is typically a lag between launches and when they are activated in Morningstar’s products). For comparison, only 10 new allocation mutual funds have been launched in 2022 through the end of November. Morningstar’s model portfolio database includes more than 2,500 models as of November 2022, up from around 1,000 a couple of years ago.

Exhibit 1 shows the number of model portfolio launches and activations by year.

The proliferation of models isn’t without good reason. Advisors are increasingly turning to third-party models to outsource some, or all, of their investment management responsibilities. Models offer professionally managed, scalable portfolios that advisors can leverage to create more time for working with clients and growing their businesses. Finding the right model portfolios for their clients can still be a challenge though.

Advisors, You’re Not on Your Own

In 2019, Morningstar analysts started assigning forward-looking ratings to separate accounts representative of model portfolios. And in 2021, we expanded those ratings to include paper model portfolios with hypothetical performance.

The Analyst Rating is based on an analyst’s conviction in a model’s ability to outperform its Morningstar Category benchmark on a risk-adjusted basis over a full market cycle of at least five years. Nearly 500 models receive Morningstar Analyst Ratings as of December 2022. But the number of models that receive an analyst rating is limited by the size of the manager research team.

The MQR uses a machine-learning algorithm to mimic the decision-making processes of analysts. The methodology has been applied to open-end mutual funds and exchange-traded funds since 2017, and it was also rolled out to separately managed accounts in 2020. The full methodology can be found here.

How MQR Evaluates Models

Model portfolios have unique traits compared with other vehicles, and the MQR has been adjusted to account for that. For example, models often backfill returns prior to their appearance in databases like Morningstar’s. Further, they often do not submit historical portfolio data with their performance records, making it hard to analyze what has driven performance or how their managers have changed their asset allocations or underlying fund lineups over time.

There also are cases where preactivation returns reflect hypothetical, back-tested results. Even when reported returns reflect actual results, model providers have few incentives to voluntarily report models with poor performance. So, the possibility of managers only reporting flattering results rather than their entire record, warts and all, can lead to selection bias.

To ensure the integrity of the MQR for models, models must meet additional criteria to qualify for a rating. These requirements are similar to those for the Morningstar Rating for models, commonly known as the star rating.

- Firms need to be compliant with the Global Investment Performance Standards, or GIPS, or have a minimum of $10 billion in registered products, such as mutual funds or ETFs.

- A maximum of 18 months of preactivation performance is used to calculate the rating.

- In order to receive a Silver or Gold rating, models must have at least 18 months of postactivation returns.

- For most models, fees start with the prospective acquired fund fees, which is an asset-weighted calculation of the underlying funds’ and ETFs’ prospectus adjusted expense ratio.

- For firms that don’t report a strategist fee or use single securities instead of funds, we add a proxy fee of 0.35% for models in allocation categories. For other categories, the proxy fee ranges from 0.25% to 0.45%. The full list of proxy fees can be found in the methodology document.

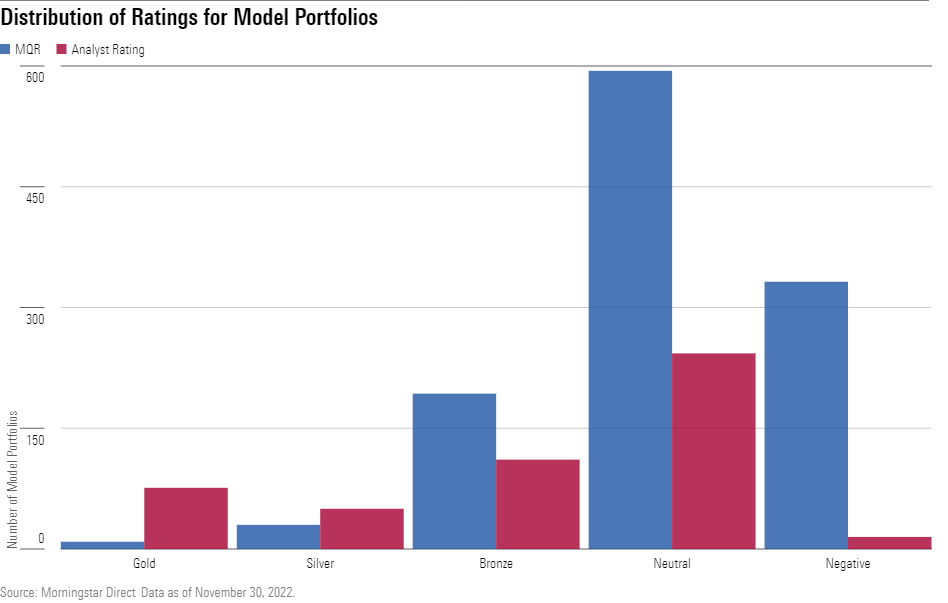

How the Ratings Shake Out

The initial distribution of MQR ratings skews more negatively than analyst ratings, but that’s to be expected. Exhibit 2 shows how the two ratings compare as of December 2022.

The MQR for models has identified far more Neutral- and Negative-rated model portfolios than Morningstar analysts, which is due to selection bias on the part of the analysts. Since we can’t cover everything, we tend to focus our coverage efforts on more-established model providers that have gained interest from advisors, like BlackRock, Vanguard, or American Funds.

MQR doesn’t have the same capacity limitations as analysts, leading to a much wider breadth of coverage. Since MQR was launched for mutual funds, it has shown a knack for identifying strategies likely to outperform or underperform so its results shouldn’t be dismissed. A breakdown of its efficacy after the first five years can be found here.

Lidia Breen, an associate product manager, contributed to this article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)