10 Cheap Stocks With Wide Moats and Low ESG Risk

For sustainable investors, explore opportunities in GSK, Guidewire, Disney, TSMC, and more.

What a difference a year makes. Only 12 months ago, the investing world was applauding environmental, social, and governance factors like net-zero commitments, SEC-mandated carbon disclosures, and optimism following the U.N. COP26 climate summit in Glasgow. While this trend continues to gain steam, we’ve also seen the rise of serious anti-ESG sentiment; underperformance of ESG strategies versus the general market; and geopolitical, inflation, and other macroeconomic issues taking precedence. But make no mistake: Considering ESG risks and opportunities is essential to forming a complete view of potential investments.

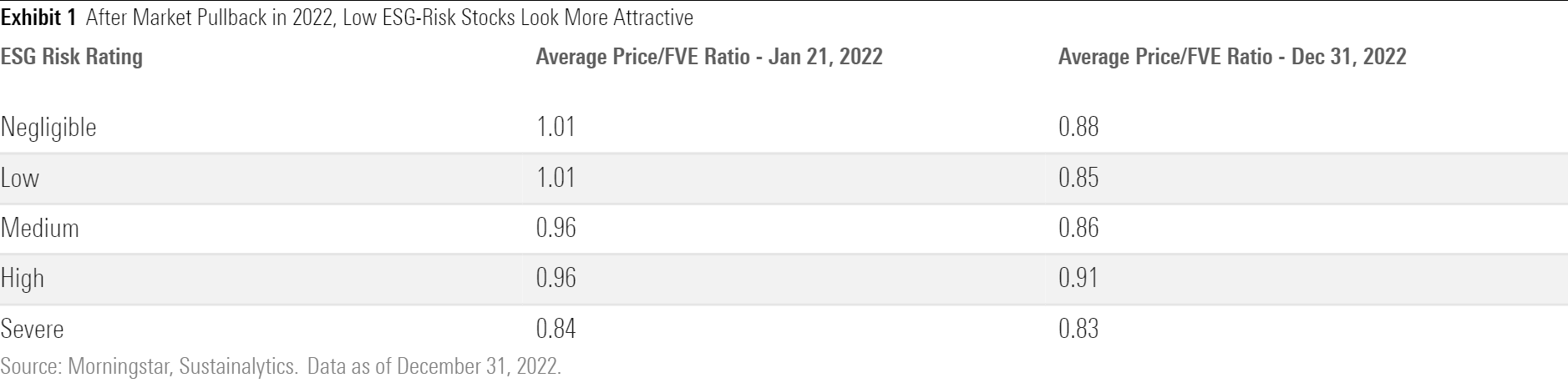

Yet a new year brings new opportunities—including new stocks to consider for your portfolio that score more highly on sustainability than their peers. One reason: Stocks with low ESG risk have much more favorable valuations than a year ago. All categories of Morningstar Sustainalytics’ ESG Risk Ratings are currently undervalued. On average, a screen of the nearly 1,500 companies we cover shows that Negligible and Low risk stocks now look attractive, with average price/fair value estimate ratios of 0.88 and 0.85, respectively, at the end of December. (Fair value estimates are what Morningstar thinks the stock is actually worth.) This is quite a shift from the beginning of 2022, when we noted that the opposite was true. Back then, stocks with Sustainalytics’ ESG Risk Ratings of Negligible and Low looked expensive (with average price/fair value estimate ratios slightly above 1.00).

To be sure, as Exhibit 1 shows, even the riskiest stocks are cheaper than they were in early 2022. For example, on average, companies with Severe risk trade at a sizable 17% discount to our fair value estimates. Serendipitously, our cheapest-looking sectors are also those that face the lowest average ESG risk: communication services, consumer cyclical, technology, and real estate. Comparatively, sectors like energy and utilities, with the most-material ESG concerns, are closer to fairly valued.

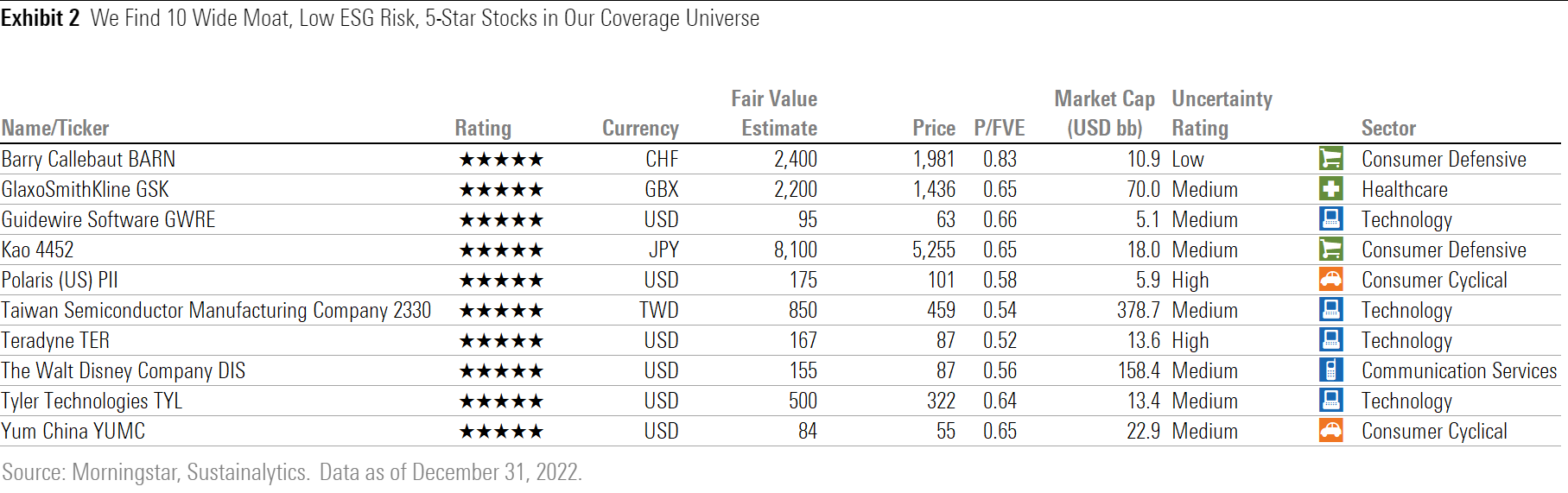

I used this approach as a good starting point to find cheap stocks with durable competitive advantages that aren’t facing substantial ESG risk. Next, I dug further using Morningstar’s fair value estimates and the Morningstar Economic Moat Rating, which is a rating reflecting a company’s competitive advantages over its competitors.

Exhibit 2 shows 10 wide-moat stocks with Low ESG Risk Ratings trading at substantial discounts. As always, our individual company research pages are great avenues to learn more about each of these firms.

New Year’s ESG Resolutions

Many of us plan to finally get to the gym or crack open the next book on our shelves as a new year begins. But it’s also a good time to think about our portfolios. Given the ongoing market and economic uncertainty, these three sustainable-investing resolutions are worth adding to your list:

1. Stick to valuation: Incorporating ESG risks into equity analysis is critical, but so is the price paid for stocks. While there are many paths to pursue sustainable investing, one overarching necessity is to avoid overpaying for any security. Consider Tesla TSLA, a favorite with some sustainable investors. The share price has tumbled 68% from its 2022 high, partly because founder Elon Musk funded his purchase of Twitter by selling Tesla shares. Tesla is now a 5-star stock. All investors will express their personal preferences in their portfolio, but buying—and selling—with a margin of safety is always a solid goal.

2. Focus on more than just carbon in “E”: While companies’ commitments to reduce their carbon footprint to net zero in the coming decades have dominated headlines, it’s also worth considering the potential valuation ramifications of other environmental concerns that may get less attention, like non-greenhouse-gas emissions or mineral resources. Different issues related to the environment—or social or governance, for that matter—will affect firms in different ways, and it’s important to focus on the factors that are most material to valuation, even if they’re off the beaten path.

3. Don’t get distracted by the noise: Although the U.S. midterm elections are behind us, anti-ESG sentiment—and potential action—remains a focus of many politicians and policymakers. And companies’ own sustainability statements can be misleading, too; the news has been filled with concerns of greenwashing, or companies making exaggerated claims about the sustainability of their products, and social washing. As I see it, it’s important to separate ESG risk consideration from impact and, in doing so, focus in particular on environmental, social, and governance issues that could threaten—or bolster—a firm’s future cash flows.

Looking Into the ESG Landscape for the Rest of 2023

Amid the ongoing market, economic, and political turmoil that has gripped the ESG landscape, there are several upcoming events that are sure to provide some additional fireworks. In the next few weeks, these include BlackRock CEO Larry Fink’s letter to fellow chief executives (particularly given that BlackRock has been in the political crosshairs of late) and the World Economic Forum in Davos, Switzerland, which began on Jan. 16. Later in the year, all eyes will surely also be on the COP28 climate summit in Dubai, United Arab Emirates, in November, where a transitional committee has been tasked to finalize details related to the “loss and damage” fund outlined at COP27.

Along the way, this column will provide insight, perspective, and analysis, with a particular focus on individual stocks. Our aim is to highlight financially material ESG risks and opportunities as part of a holistic investment analysis of companies and provide objective details that can be useful in incorporating this information in context of all potential issues facing a firm—ESG or otherwise. In doing so, our mantra is to remain focused on valuation, not values; while the latter can be an important consideration for each individual investor, the former is a key piece of the investing equation for all.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)