Be Cautious When Considering Crypto, Even If It’s in a Fund

Lack of regulation and differing approaches to exposure cause inconsistencies in this category.

The cryptocurrency market had a tough ride in 2022, and it only got worse when FTX, a large crypto exchange, filed for bankruptcy in November 2022. After a CoinDesk report published on Nov. 2 called into question FTX’s capital reserves, rumors spread of FTX’s balance sheet turmoil, and customers rushed to withdraw their assets from the exchange, further exposing FTX’s financial mismanagement. By Nov. 11, FTX had filed for bankruptcy, and on Nov. 16, Congress asked FTX’s founder and CEO Sam Bankman-Friedman to testify at a hearing regarding the collapse of FTX. The pain rapidly echoed further into crypto markets during those two weeks of tumult. Bitcoin, already down over 50% for the year, slid another 19% between Nov. 2 and Nov. 16, 2022.

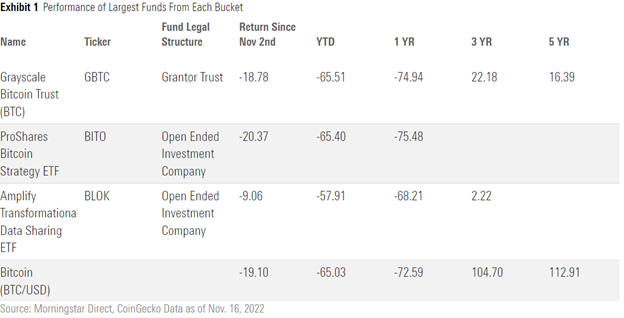

Funds investing in digital assets and crypto markets also suffered heavily, but some managed to weather the storm better than others. On average, funds in the digital assets Morningstar Category lost 15.28% between Nov. 2 and Nov. 16, 2022. The largest fund in the category, Grayscale Bitcoin Trust (BTC) GBTC, lost 19.08% during the same period. On the other hand, First Trust Indxx Innovative Transaction & Process ETF LEGR was up 7.74%.

The stark difference in performance between these funds is peculiar at first blush. It demonstrates the variety of structures and methods targeting exposure to digital assets in the category. Finding the fund with the right makeup depends on what the investors want from the investment. Here, I will define three types of digital assets funds, the risks inherent to each group, and considerations for investors to mull over before they submit a buy order.

Defining Digital Assets Funds

Morningstar minted the digital assets category in April 2022, as the number of funds exploded that invest in areas like decentralized finance, stablecoins, currency assets, smart contracts platforms, and nonfungible tokens, or NFTs, among others. Of the 53 funds in the category at year-end, 40 were launched between February 2021 and December 2022.

Like crypto markets, this category is heterogeneous and fragmented. Funds provide exposure to digital assets and crypto markets in various ways. To make sense of the category’s composition, funds fall into three loosely defined buckets:

1) Futures-Based Cryptocurrency ETFs

So far, the SEC has not approved a spot crypto exchange-traded fund or mutual fund that directly holds cryptocurrencies, like bitcoin. Instead, the SEC allowed funds to hold cryptocurrency futures contracts. We have previously delved into the details of how these funds are constructed and their limitations in tracking the spot market. Currently, there are 11 futures-based funds in the category. The largest futures-based cryptocurrency ETF was the ProShares Bitcoin Strategy ETF BITO with about $548 million of assets under management, as of December 2022.

Futures contracts introduce a new set of challenges for investors. First, these funds are susceptible to roll yield. Futures contracts come with an expiration date, so before contracts expire, the funds need to sell the contracts they own and roll into ones that expire further in the future. The cost of rolling contracts depends on the difference between the futures prices.

When subsequent months’ futures contracts trade at higher prices than the current month’s contract, the futures curve is upward sloping. This is known as contango. This creates drag for fund performance because they are forced to sell low and buy high each month. Conversely, when subsequent months’ futures contracts trade below the current month’s contract, the curve slopes downward: a state referred to as backwardation. Backwardation can give futures strategies a boost from roll yield, as they will be selling current month exposure for a higher price than the pay for exposure in the new month. Roll yield can add up for investors and cause futures-based funds’ performance to diverge from spot prices.

In addition, futures-based funds can face capacity issues. The CME Group limits the proportion of futures contracts that any one entity can own for a given contract month. As funds take in new money, these limits can force them to invest further out on the futures curve. The further a futures contract is from expiration, the less correlated it is to the spot market. This can cause a meaningful divergence between the fund and the current prices of the cryptocurrency.

Investors need to be aware of the limitations of futures contracts and their associated costs because they could cause the fund’s returns to differ from the price of the cryptocurrency it aims to track.

2) Grantor Trusts

The largest and oldest crypto fund, Grayscale Bitcoin Trust (BTC), was launched in 2013 as a grantor trust. Grantor trusts are managed investment vehicles that trade like closed-end funds, and they are allowed to directly hold cryptocurrencies. However, these vehicles face challenges unencountered by ETFs, which we have covered before. There are 18 grantor trusts in this category.

Unlike open-end funds and ETFs, grantor trusts cannot efficiently add or remove shares from the market to handle inflows and outflows. The only entity able to create and remove shares from the market is the issuer. It does so through private placements and redemptions, which are only available to accredited investors on a periodic basis at the firm’s discretion.

This process isn’t as seamless as ETFs’ creation/redemption mechanism, which is purposefully built to keep a ETF’s price close to its net asset value. Grantor trusts’ relatively fixed number of shares fail to respond to large changes in supply and demand, allowing a fund to deviate substantially from the trust’s NAV. If there are too few shares available, investors can end up paying $1 for $0.85 worth of bitcoin, for example.

Trusts can fail to accurately track the price of the underlying holding. For example, GBTC has traded at a premium of over 100% to NAV and a discount of nearly 50% below NAV. Its relative performance has differed substantially from the price of bitcoin. And it tends to be highly expensive, with GBTC charging 2% annually, for example.

3) Crypto-Adjacent Equity Funds

The third and largest bucket of crypto funds is made up of thematic equity funds that invest in companies benefiting from investing or trading in crypto markets or other related activities. These funds tend to concentrate in technology and financial stocks with crypto exposure.

There are 27 funds in the digital assets category that I deem to be “crypto-adjacent.” Amplify Transformational Data Sharing ETF BLOK is the largest, with $357 million in AUM as of December 2022. It invests 81% of its portfolio in technology and financial stocks, like the crypto exchange Coinbase COIN, as of December 2022. It goes without saying that these funds come with a fairly large dose of active risk since they concentrate highly in one or two sectors of the market. Such risks are not expected to be rewarded over the long run. These funds are also exposed to crypto markets’ volatility since their holdings are—at least in theory—fundamentally linked to crypto markets. Active sector risk coupled with high volatility can be a disastrous mix. Investors should be vigilant of the potential impact from these funds on their portfolios.

As with all thematic funds, investors place a trifecta bet when investing in these crypto-adjacent funds:

1) The theme must be right,

2) The fund must properly represent the theme, and

3) The price must be right.

Anyone kicking the tires on crypto funds probably believes in the long-term merit of crypto. But crypto-adjacent funds express their crypto exposure differently. Investors may be surprised to see AT&T T, CME Group CME, or JPMorgan Chase & Co JPM in the top 10 holdings of their crypto-adjacent fund. These companies may derive revenue from digital assets, but that is not their core business. As such, the purity of exposure to digital assets differs from fund to fund.

Whether the price is right for buying the fund is the toughest call to make. There was a tremendous amount of growth and projection built into prices of crypto-related companies and currencies in recent years, and much of that dissipated in 2022′s rocky market. Whether this has created a buy-low opportunity or there’s still more room to fall is anyone’s guess. Proper sizing of bets is critical given the uncertainty.

Performance

Funds in the digital assets category tend to move in the same direction as crypto markets, though at different velocities according to their specific structures and limitations. For example, GBTC’s returns pale in comparison to those of bitcoin over the last five years because of its limitations as a grantor trust and its lofty 2% fee. Similarly, BLOK has only returned 2.22%, while bitcoin gained 104% over the three years through Nov. 16, 2022. Investors need to be aware of the boundaries of crypto exposure in these funds. None of these funds will perform in lockstep with bitcoin or other cryptocurrencies.

The lack of comprehensive regulations in crypto markets and differing approaches to crypto exposure cause a large dispersion in the construction and performance of digital asset funds. This year proved that investors ought to be cautious when investing in digital assets. Without the SEC’s approval of a spot crypto ETF, investors need to go a step further in their due diligence of crypto funds. The crypto industry may still be emerging, but investors shouldn’t buy into the trend without first looking under the hood of prospective funds.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)