Basic Materials Sector Outperforms, but We Still See Long-Term Opportunities Amid Broader Market Decline

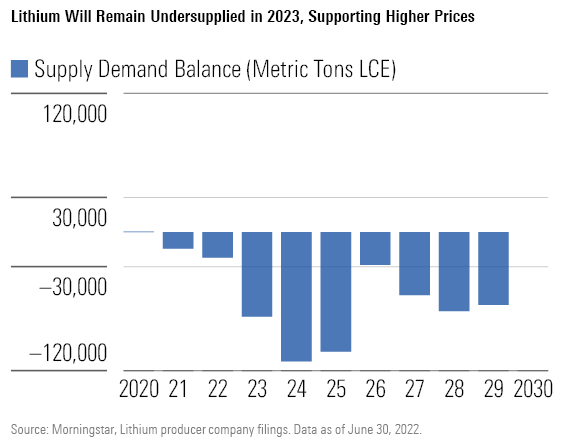

We forecast demand growth will outpace new supply in 2023, leading to a widening supply deficit, which should support prices remaining near current levels.

The Morningstar US Basic Materials Index outperformed the broader market during the fourth quarter of 2022, by roughly 840 basis points. The materials index rose 5.3% during the quarter, while the U.S. market index was down 3.1%. On a trailing 12-month basis, the materials sector outperformed the market by 1,190 basis points. Despite the relative outperformance, we see opportunities across the sector with the majority (54%) of the stocks trading in ether 5-star or 4-star territory.

Lithium demand will grow nearly 5 times by 2030 from 2021 largely because of increased electric vehicle adoption. The lithium market is currently undersupplied, leading to prices at all-time high levels above $70,000 per metric ton, up over 10 times from below $7,000 per metric ton in early 2021. We forecast demand growth will outpace new supply in 2023, leading to a widening supply deficit. This should support prices remaining near current levels. Based on our cross-price elasticity model, we forecast prices will average $70,000 per metric ton in 2023, which should allow low-cost producers to generate excess returns.

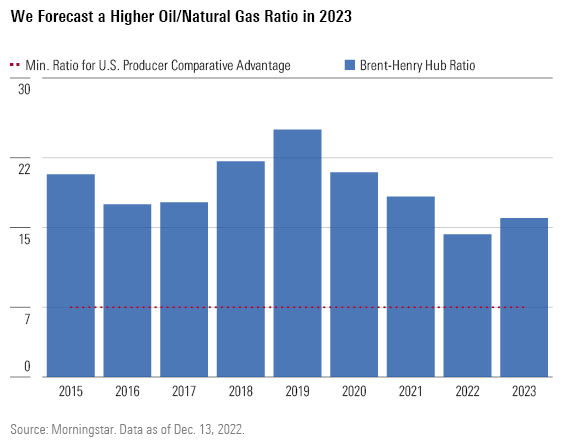

Following a decline in 2022, we see a more stable U.S. commodity-chemicals profit environment in 2023. A directional indicator of U.S. commodity chemicals profits is the ratio of Brent oil prices/Henry Hub natural gas prices. Oil-based naphtha feedstock is typically the marginal cost of production that informs prices, while U.S. producers make chemicals from natural gas-based feedstock. We forecast a rising Brent oil/Henry Hub price ratio in 2023. For low-cost chemicals producers, profits should stabilize even if an economic slowdown weighs on volumes.

Rising freshwater costs will boost demand for water management systems in manufacturing and industries, such as data centers, which use water for cooling. For specialty chemicals companies that sell water management systems and the chemicals used to recycle water, rising demand should boost sales and profits.

See our analysts’ Top Picks in the Basic Materials sector.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)