4 Stats to Watch in the December Jobs Report

Job growth expected to moderate, but wage growth will be a focus for inflation concerns.

When the last monthly jobs report came out, investors saw worrying signs on wage inflation and it showed continued robust hiring. What will the December report due out this Friday show?

Forecasts for the December jobs report center on another month of healthy hiring, but at a slower pace than had been the case for much of 2022.

But much of the attention will be on the details below the one-month headline jobs growth figure.

December Jobs Report Forecast Consensus

- Nonfarm payroll employment up 210,000 versus a gain of 263,000 in November.

- Unemployment rate of 3.7%, unchanged from November.

Here are four key areas for investors to watch with the December jobs report:

Will Job Growth Continue to Moderate?

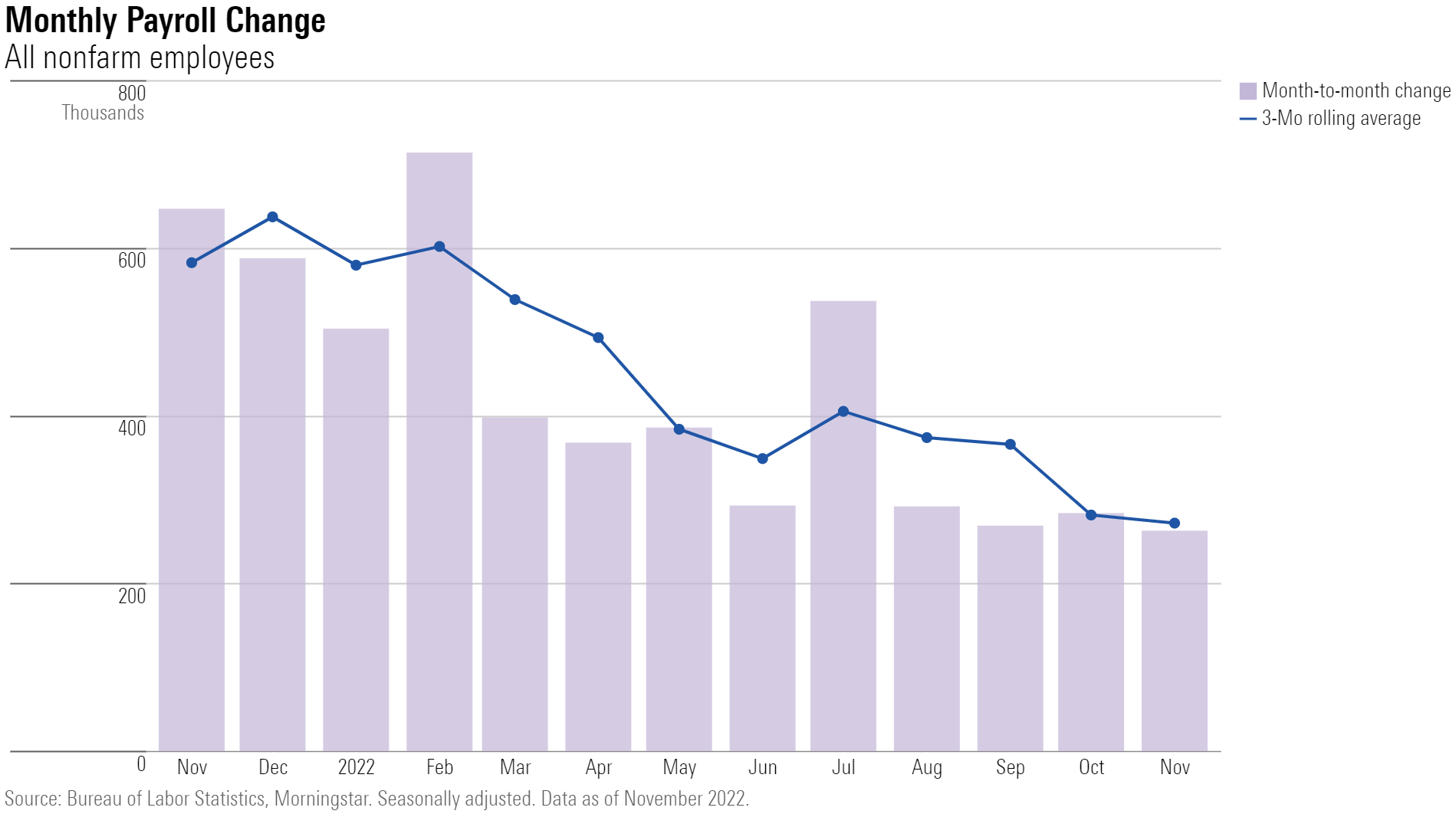

Economists forecast slower job growth in December, according to FactSet. If jobs growth does slow to the consensus 210,000 increase, that gain would reflect a continued healthy economy. But economists say investors should look beyond the one-month number—which has the potential to be volatile and see significant revisions in the coming months—and look at longer-term trends, such as the three-month rolling average.

At a 210,000 increase in December, the three-month rolling average would slip to 252,000 from 272,000 as of November. That may not seem like much of a change, but monthly job growth had averaged 392,000 in the first 11 months of 2022, and 562,000 per month in 2021.

“The trend has broadly been lower,” says Joseph LaVorgna, chief economist at SMBC Nikko Securities. Employment growth, “has been moderating after the big postpandemic rise.”

LaVorgna says that even though job growth has remained healthy, investors should view the payrolls statistics as a coincident indicator—telling us where the economy is now—as opposed to a leading indicator. “It’s not unusual to have very good readings (on hiring) just before the economy goes into recession,” he says.

Watch the Unemployment Rate

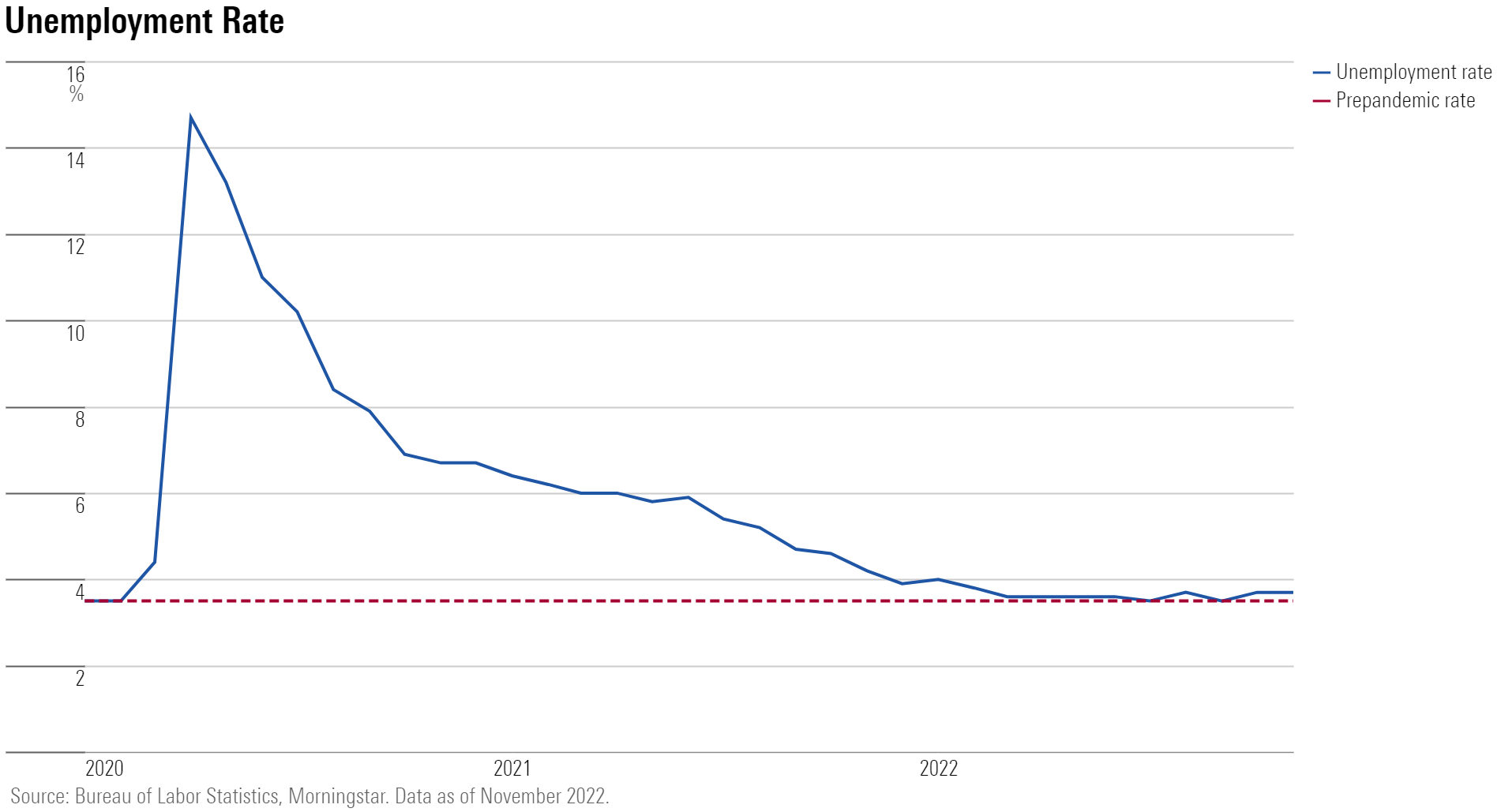

With a consensus forecast of 3.7%, the unemployment rate remains quite low by historical standards. LaVorgna is keeping an eye on what the unemployment rate might suggest about the timing of a recession that he thinks will be in the cards for 2023.

The unemployment rate bottomed at 3.5% in July and September, and historically, he says, an increase in the unemployment rate of 0.6 percentage points is a significant predictor of an economic downturn. When the unemployment rate has risen by that amount it has meant that, “generally we’re in a recession or on the cusp of one every time going back to World War II.”

“History says if we get to 4.1% we’re going to be in a recession,” LaVorgna says. With the December report, “if we trip back to 3.6% or 3.5% that would tend to push out the timing of a recession.”

Is the Labor Force Growing?

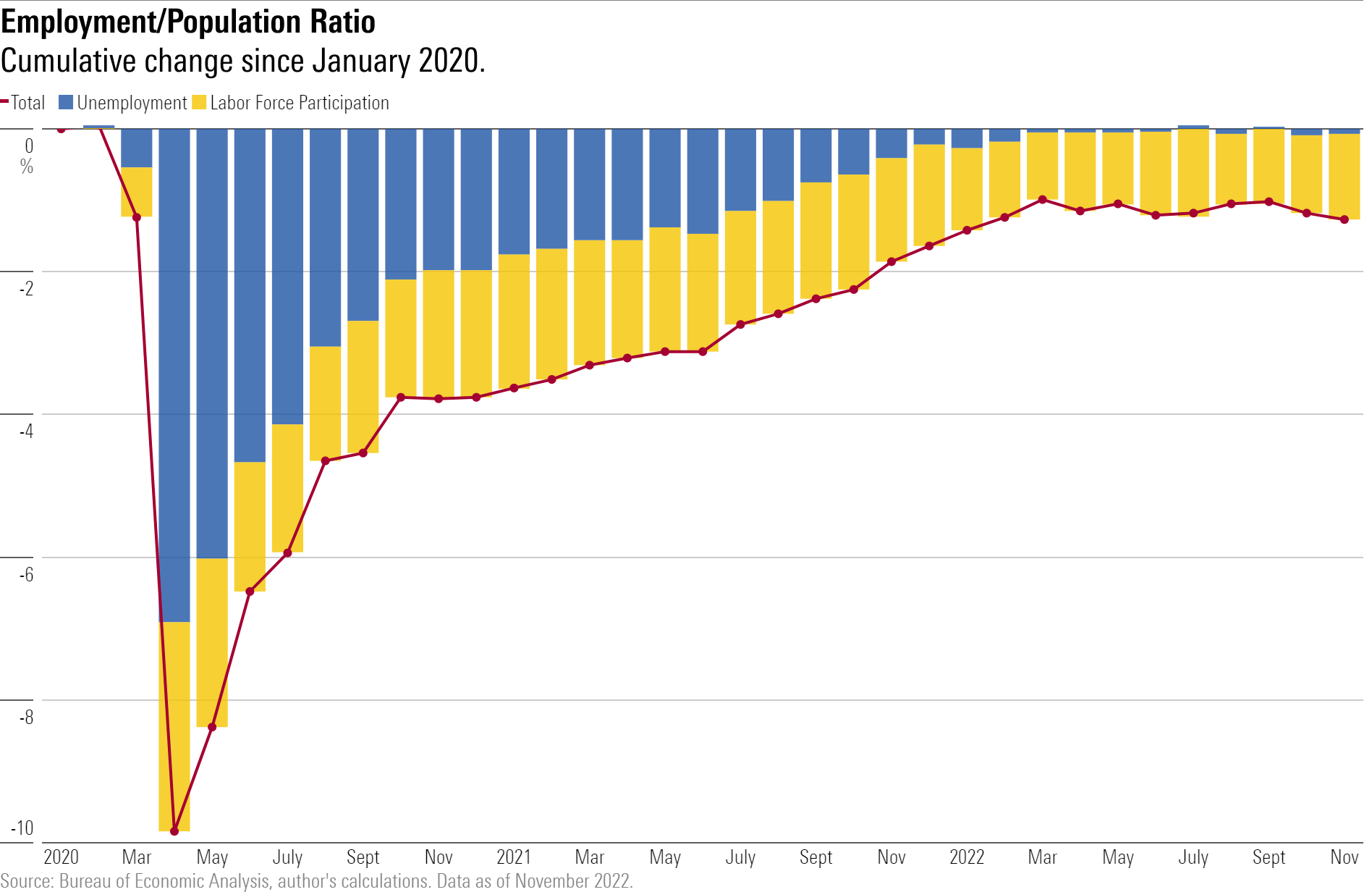

Among the many unexpected patterns in the economy in the wake of the pandemic is the large number of workers who never returned to the job market after losing jobs, or quitting, when COVID-19 hit.

The labor force participation rate stood at 62.1% in November, and the employment/population ratio was 59.9. Both of these measures are 1.3 percentage points below levels seen in February 2020.

Federal Reserve Chair Jerome Powell and other officials have indicated they are watching the dynamics around the labor force as it relates to upward pressure on wages. The smaller labor force is seen by some as having contributed to higher wages as employers have had to face increased competition for workers. If the labor force were to show signs of expanding, the Fed could see that as tailwind in their battle against inflation.

While LaVorgna doesn’t put much weight in labor force trends as a predictor of inflation, “it’s what the Fed thinks that is important,” he says. “The Fed is the proverbial straw that stirs the drink.”

Will Wage Growth Moderate?

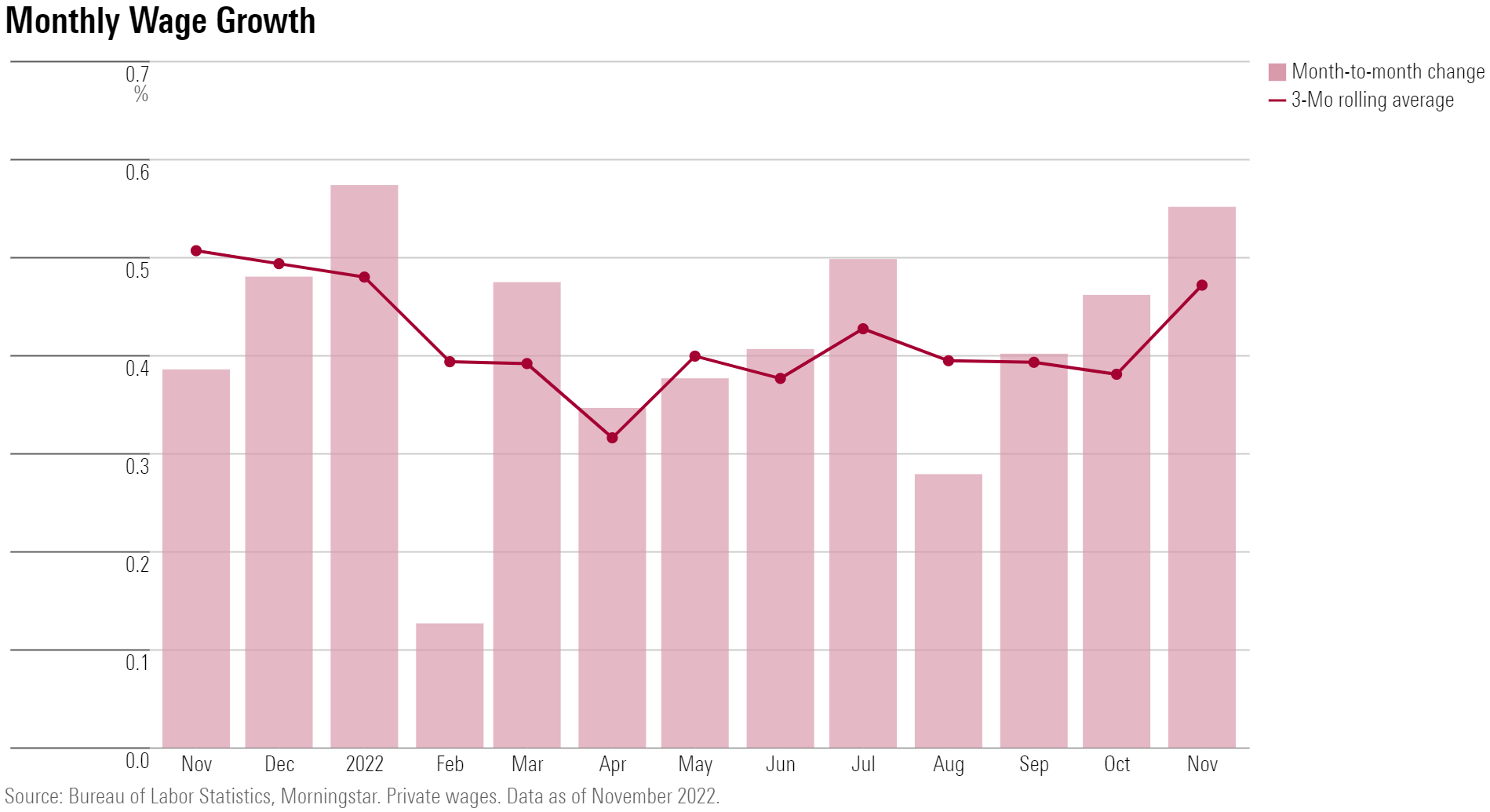

The most unwelcome piece of news in the November jobs report was an unexpected 0.6% increase in average hourly earnings. That amounted to a 5.1% year-over-year increase in wages. The concern is that upward pressure on wages remains strong, and that could help keep inflation higher than the Fed would like to see.

Preston Caldwell, chief U.S. economist at Morningstar, notes that prior to the November report there had been some hopeful signs on the wage inflation front. When the wages data was reported for October, it showed wages growing at a 3.9% annual rate. But with revisions to previous months’ data and the November report, wage growth jumped to a 5.8% annual growth rate.

“I’ll be watching wage growth, which showed a surprise uptick last month,” Caldwell says. “Moderation in wage growth is still required in order to ensure that inflation can be brought back to normal.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)