Q4 Rally Is Cold Comfort for Battered Bond-Fund Investors

Most fixed-income funds rallied in 2022′s final quarter but not enough to avoid a historically bad year.

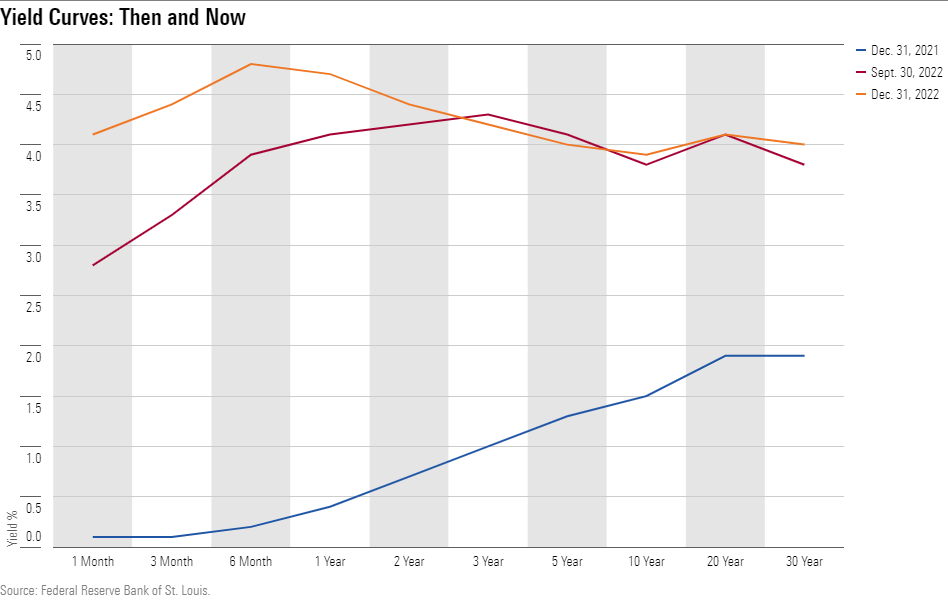

Even though the Federal Reserve continued aggressively raising short-term interest rates during the fourth quarter, longer-term, high-grade bond yields were mostly stable, and buyers in credit-sensitive sectors demanded less yield for their risks. As a result, all the major fixed-income Morningstar Categories rallied during the last three months of 2022, but not enough to erase the painful losses the year’s first three quarters.

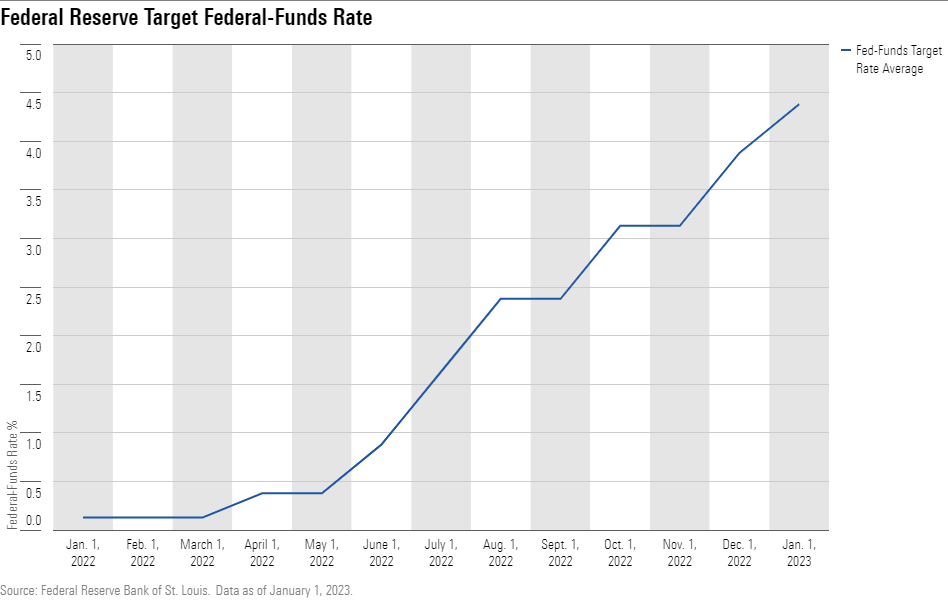

The Fed battled record-high inflation in 2022 by raising short-term interest rates at the fastest clip in almost 40 years, ending the fourth quarter in a range of 4.25% to 4.50%, 425 basis points higher than they were in January. For the year’s first 10 months, investors drove longer-term market yields higher ahead of the Fed’s rate increases as U.S. inflation soared faster than most economists’ forecasts, trampling bond-fund returns. The average taxable-bond fund in the United States dropped by 10.3% for the year, while the average municipal-bond fund gave back 9.2%.

The market finally breathed a sigh of relief in November and December with many Fed governors sounding less hawkish as inflation data moderated. U.S. Treasury yield increases in the fourth quarter were very tame. As of Dec. 31, 2022, the yield on Treasury notes maturing in two years rose 8 basis points to 4.36% during the quarter, while the 10-year Treasury yield rose 5 basis points to 3.88%. Yields for both notes had risen more than 350 and 230 basis points, respectively, during the previous three quarters.

Bank Loans Still Buoyant

Bank loan was the top-performing fixed-income category for all of 2022 but still lost money for the calendar year. Despite gaining 2.6% for the fourth quarter, the Morningstar/LSTA US Leveraged Loan Index still fell 1.1% for the year. Bank-loan funds attracted many investors after the Fed started hiking interest rates primarily because their interest payments are tied to short-term benchmarks that move closely with the fed-funds rate, and because they reset every one to three months. Credit Suisse Floating Rate High Income CSHIX, which earns a Morningstar Analyst Rating of Bronze, gained 1.6% in the quarter but was down 1.6% for 2022, landing in its category’s second quartile.

High Yield Rebounds

For the fourth quarter, high-yield bond was the top-performing U.S. fixed-income category. The category gained an average of 4.3% in the period, shrinking its year-to-date loss through Dec. 31 to 9.8%. The ICE Bank of America U.S. High Yield Index gained 5.0% for the quarter but lost 10.5% for the year. Silver-rated Federated Hermes Institutional High Yield Bond FIHBX matched the index’s performance for both periods. This fund offers a compelling process that focuses on companies with stable business models. The fund finished the quarter in the top third of its peer group but in the middle of the pack for calendar 2022.

Investment-grade corporate bonds staged a similar late-year rally. The average fund in the corporate-bond category gained 4.4% for the quarter but was still down 15.4% for the year, the worst-performing domestic-bond category for 2022. The category’s longer duration (a measure of interest-rate sensitivity) than the high-yield group hurt results.

A Modest Inflation-Protected Bond Rally

While inflation-indexed bond funds rose in the fourth quarter, their rally was much more muted compared with corporate-bond indexes. The inflation-protected bond category rose 2.2% on average, leaving the group with a loss of 11.0% for the year. Silver-rated Vanguard Inflation-Protected Securities VAIPX slipped 0.2% for the quarter and 11.9% for the year, finishing in the middle of the pack of its inflation-protected bond peers.

The category’s 11.0% loss may have been surprising when compared with the average 9.8% decline of the high-yield bond category, given that a mostly U.S. government-bond category hardly ever does worse than a high-yield category. U.S. Treasury Inflation-Protected Securities funds—most of which stay in range of their market benchmarks—typically carry very long durations, though, making them especially sensitive when other government-bond yields soared earlier in the year. Even after those losses, though, TIPS funds still yielded less than 2%. By contrast, many high-yield funds are now offering investors much more enticing yields—greater than 8%.

Core Bonds’ Unremarkable Turnaround

Silver-rated American Funds Bond Fund of America ABNDX gained 2.0% in the quarter but dropped 12.5% for the year, edging the returns of the Morningstar US Core Bond Index, the Bloomberg U.S. Aggregate Bond Index, and most of the intermediate core bond category. The fund’s moderate duration and selective use of TIPS helped buoy it a bit relative to more-rate-sensitive offerings.

Dollar Damage Reversed

Emerging-markets bond funds enjoyed topnotch returns during the quarter after being pummeled for most of 2022. The unexpectedly strong rally in the U.S. dollar for the first nine months of the year—which threatened many emerging economies and made paying foreign debts more difficult—peaked at the end of September. That was when many Fed governors sounded less hawkish, curbing the rise in longer-term interest rates and, by extension, dollar demand. The U.S. dollar has given back roughly half its gains since October, bolstering many markets and the JPMorgan EMBI Global Index, which gained 7.4% in the fourth quarter to lessen its calendar-year loss to 16.5%. Bronze-rated Pimco Emerging Markets Bond PEBIX matched the index’s return for the quarter but slightly underperformed it for the year with a 16.7% loss.

Municipal Yields Tumble

Municipal-bond yields plunged far more than taxable-bond yields during the fourth quarter. The yields on two-year and 10-year AAA rated bonds fell 40 and 62 basis points, respectively, closing 2022 at 2.67% and 2.64%, boosting the Bloomberg Municipal Bond Index to a 4.1% gain for the quarter and tapering its loss to 8.5% for the year. Silver-rated Fidelity Advisor Intermediate Municipal Income FZIIX gained 3.2% during the quarter but lost 6.4% for the year, which was better than the benchmark and good enough for a top-quartile ranking in the muni-national intermediate category.

Despite similar gains in many muni strategies, investors continued to pull their money out of muni funds. The U.S. municipal-bond category group saw an estimated $115 billion in outflows in 2022, the most since the global financial crisis of 2008. Silver-rated MainStay MacKay High Yield Municipal Bond MMHIX rose 4.5% during the quarter and lost 14% for the year, lagging both the benchmark and the peer median return of the high-yield muni category.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/9013a0d5-fa3f-4647-b61d-dd40a8994f6d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9013a0d5-fa3f-4647-b61d-dd40a8994f6d.jpg)