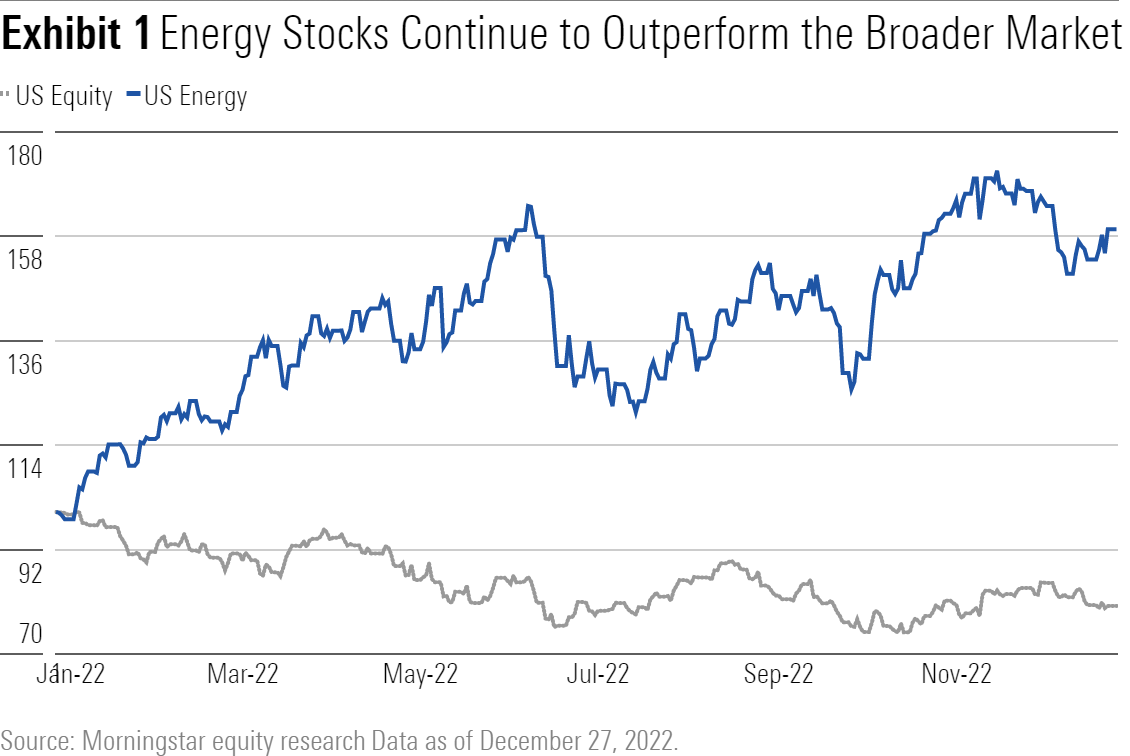

Energy Markets Face Further Volatility in the New Year

From war in Ukraine to weaker demand growth in Asia, a number of variables will make this year an especially volatile one.

Oil and natural gas prices have simmered down from summer highs, but the respite is probably temporary. Europe has shored up its gas inventories to reduce its dependence on Russian exports. And the impact of sanctions on Russian oil exports has so far been milder than expected, as aggressive discounting has helped Russian products find a way to market. Meanwhile, demand growth in Asia has been weaker than expected due to ongoing zero-COVID-19 policies, and U.S. government stock releases have helped prevent more severe shortages. Thus, while Organization for Economic Cooperation and Development, or OECD, oil inventories are still well below the 5-year average, the deficit marginally improved during 2023. But we suspect the market may have been lulled into a false sense of security.

In 2023, the war in Ukraine will continue to suppress supply. In December, the EU implemented a price cap of $60 on Russian crude in order to stem the tide of funds to the petro state. Western powers hope that even if neutral countries don’t participate in the cap, they will be able to use it to secure wider discounts, squeezing Russian revenue without necessarily stemming the flow of crude any further. But the Kremlin has said it will not sell to countries participating in the cap and if it sticks to this position, Russian exports will fall further and push prices higher. Either way, the concurrent EU embargo on Russian oil will force a further reshuffling of trade flows, and we doubt that the rest of the world can accommodate the 2 mmb/d of Russian oil that the EU was previously consuming.

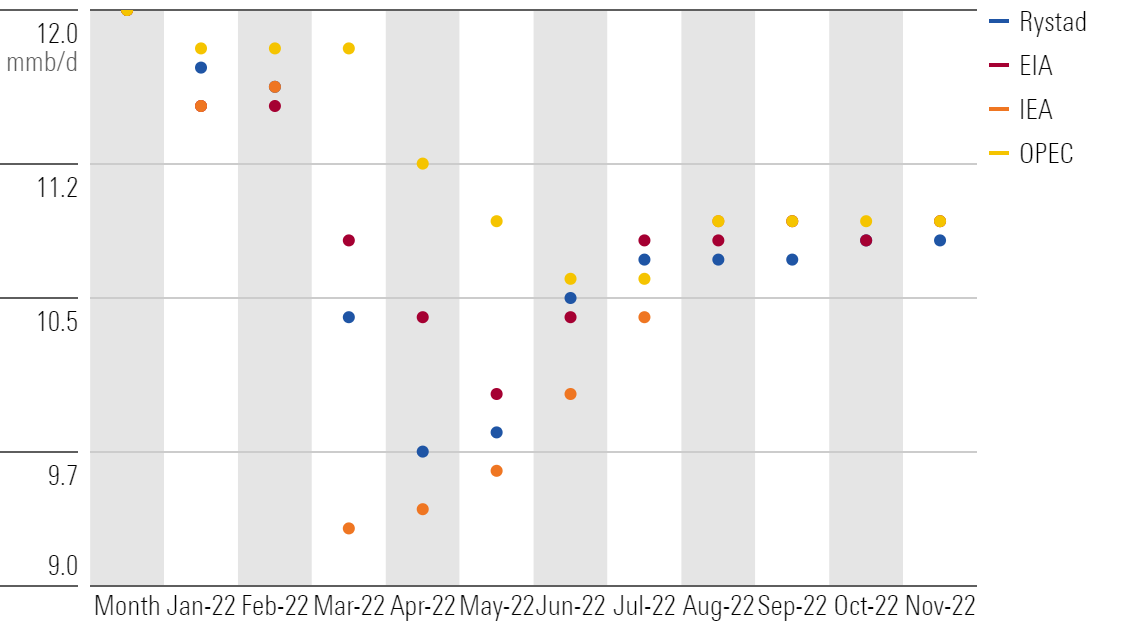

Another variable to watch is OPEC. Members are watching markets closely to inform their next move. In its December meeting, the cartel remained steady on production, continuing to defy calls from overseas consumers to increase production.

The political unrest in Iran makes progress on the nuclear deal almost impossible, putting sanctions relief out of sight. The U.S. (traditionally another swing producer) is unlikely to deliver substantial growth either. Producers remain committed to capital discipline and would rather funnel surplus cash to shareholders rather than invest in accelerated drilling. But on the demand side, it now looks like China will attempt to wind down zero-COVID-19 policies further in 2023, bringing a massive consumer back to the market. As a result, 2023 is shaping up to be another year of insufficient supply growth and high oil prices.

See our analysts’ Top Picks in the Energy Sector.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/17f48ad3-acb4-4abc-982b-fb3b14ceda2f.jpg)