No Fun for Stock Funds in 2022

Tech stocks bear much of the blame, but not all.

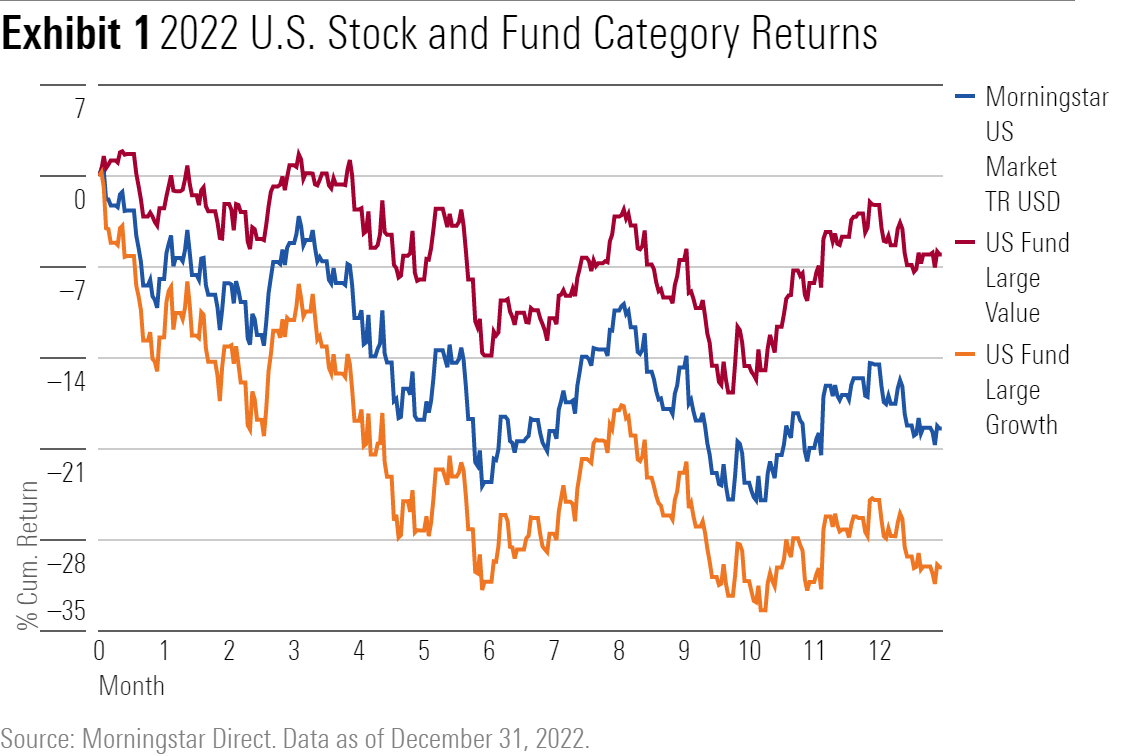

Whether equity-fund investors remember 2022 as a nightmare or a minor setback will likely depend on one data point: how much of their funds’ money was invested in growth stocks.

Last year featured an enormous performance gap between growth and value. The Morningstar US Growth Index plunged a nerve-wracking 36.7%, while the Morningstar US Value Index barely budged, losing just 0.7%. The chasm was widest among the biggest stocks, but a stunning margin between growth and value existed among small caps and mid-caps as well.

Funds felt the pain: The losses for the average fund in the three growth style-box categories ranged from 27.8% to nearly 30%, while on the value side, the declines—though less alarming—were still deep, ranging from roughly 6% to 10%. Some sector-fund categories fared even worse.

The growth/value gap held true for most of the year and continued in the fourth quarter even as market conditions improved. The Morningstar US Growth Index squeezed out a 0.2% gain in the year’s final three months, while the Morningstar US Value Index rose 14.7%.

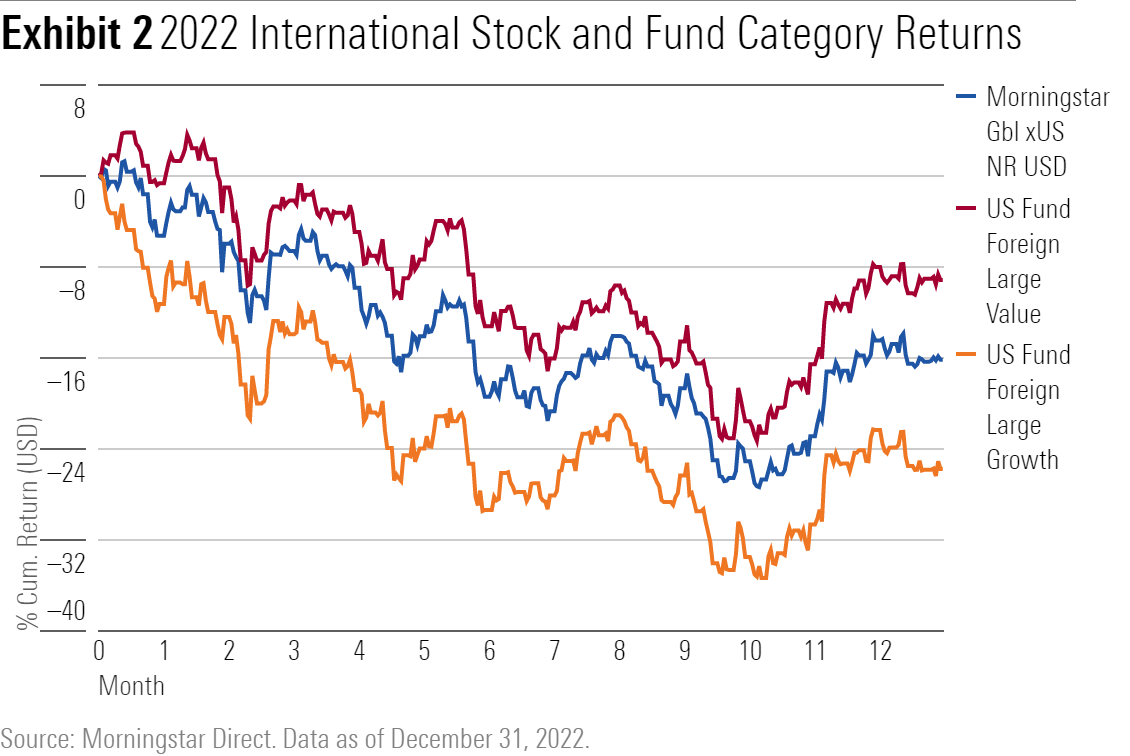

This phenomenon was not limited to the United States. International markets also endured major declines and saw a vast difference in returns between growth and value. In short, equity-fund investors likely didn’t spend New Year’s Eve celebrating their returns no matter which style or location they favored.

U.S. Offered Few Places to Hide

Funds investing in U.S. growth stocks took the most serious hits in 2022, but value-oriented strategies certainly didn’t escape the storm. The large-growth Morningstar Category plummeted 29.8%, and the large-value Morningstar Category lost 5.9%.

A look at sector-fund returns nails the main culprits. With index stalwarts and major portfolio holdings Meta Platforms META, Microsoft MSFT, and Alphabet GOOGL suffering losses of 29% to 65% in 2022, and many less-heralded firms faring as badly or worse, the technology Morningstar Category suffered an average loss of 37.1% and the communications Morningstar Category dropped 33.8%. (Amazon.com AMZN, which is classified in the consumer cyclical sector, also inflicted damage on many funds by losing nearly half its value.)

Only one equity category endured a worse fate than the tech or communications groups. That’s the young digital-assets Morningstar Category that includes offerings that focus on cryptocurrency-related holdings and the like. That one plunged 66.7%. (For those readers attuned to omens, the exact figure was 66.66%.)

Of course, investors don’t own categories, they own funds. And some of the most prominent had a brutal time of it. If an award existed for Most Awful 2022, a leading candidate would have to be Morgan Stanley Institutional Growth MSEQX, with its shocking 60.3% loss. Over his long tenure, lead manager Dennis Lynch has enjoyed tremendous success plying an aggressive-growth approach. But that style proved no match for last year’s market. The fund’s top four holdings entering 2022 all suffered devastating declines. Snowflake SNOW (down 57.6%), Shopify SHOP (down 74.8%), Cloudflare NET (down 65.6%), and Roblox RBLX (down 72.4%) all cratered. These stocks carried weightings between 4.4% and 7.4% of assets entering the year, and all were still major portfolio holdings as of Sept. 30, the most recent public disclosure.

Not all the news was so grim. Several commodities-related categories posted gains last year, and the natural-resources group dropped only 2.8%. Among the U.S. equity style-box categories, though, even the best performer, the large-value Morningstar Category, had a rough time: As noted above, that group dropped 5.9%.

Some U.S. stock funds in the Morningstar Style Box categories did manage to post gains. American Century Focused Large Cap Value ALVSX underwent a few changes of process in the past five years in search of better performance, and its more-concentrated approach led to a 2.6% return for its I shares last year. That showing landed in the top decile of the large-value Morningstar Category. (The fund rose 13.7% in the fourth quarter.) The fund benefited from a nearly 6% rise in the stock of Johnson & Johnson JNJ, its top holding all year (at least through November)—with a weighting consistently above 5%.

A Weary World

The investing climate was also dismal outside the United States. A string of events that included the war in Ukraine, drastic pandemic lockdowns in China, political and financial turmoil in the United Kingdom, and sharply rising interest rates pummeled stock markets around the world.

An equally important story entering the fourth quarter was the toll that plummeting foreign-currency values took on the returns of U.S.-based mutual funds. Once again, international-stock funds appeared destined to trail those that focus on U.S. stocks by meaningful margins. But a fourth-quarter rebound by those beleaguered foreign currencies helped international-stock funds avoid a worse fate. Even then, the yen ended the year down 13% versus the U.S. dollar, the euro fell 6%, and the British pound lost 11%, but those declines were much milder than they had been earlier in the year.

By year-end, the story for international-stock funds thus resembled that in the U.S., with similarly sized losses, a large gap between growth and value, and a modest improvement in the fourth quarter. The foreign large-growth Morningstar Category dropped 25.3% in 2022, while the foreign large-value Morningstar Category fell 9.1%. The worst performer among international-stock categories was foreign small/mid-growth, down 30.2%.

One of the worst performers among international-stock funds was a strategy more familiar with the upper reaches of the rankings than the bottom. Vanguard International Growth VWIGX had beaten the foreign large-growth average—often by wide margins—in seven of the nine years before 2021, when it stumbled but lost less than 1%. In 2022, it suffered from the aggressive-growth tack of one of its subadvisors, Baillie Gifford. The fund’s institutional shares fell 30.9%, more than 5 percentage points below the category average.

One surprise in 2022: Emerging-markets funds didn’t fare that much worse than developed-markets strategies, despite the disruptions that battered the China market and Russian stocks suddenly losing all (or nearly all) of their value after Russia’s invasion of Ukraine. True, the diversified emerging-markets Morningstar Category dropped a painful 20.8%, but that was only 3 percentage points behind the Europe-stock group (which focuses almost entirely on that continent’s developed markets) and 4.5 percentage points better than the foreign large-growth Morningstar Category.

China’s turmoil did exact a toll on funds specifically targeting that market and its neighbors. The China region Morningstar Category endured a 25.2% decline, the worst showing of any country- or region-specific group. The best of the regional bunch was Latin America stock, which managed to eke out a 3.1% gain, bolstered by the predominance of energy firms and other commodity-related stocks in that category’s portfolios. However, relatively few investors enjoyed that meager windfall; the Latin America stock Morningstar Category contains just four open-end funds, with total assets of only around $1.1 billion.

There’s no telling what 2023 will bring. But one thing is certain: If this year’s market performance is anything like last year’s, financial advisors who specialize in calming panicky investors will find their services in great demand.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/657019fe-d1b1-4e25-9043-f21e67d47593.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/657019fe-d1b1-4e25-9043-f21e67d47593.jpg)