Contrarian Picks for 2023 and Beyond

There are likely some future winners in these out-of-favor growth and fixed-income funds.

Last year was the worst for bonds in decades and the worst for global stocks since 2008. There are sure to be opportunities amid the wreckage, though. One approach that has proved effective is Morningstar’s Buy the Unloved study. Each year since 1994, we’ve looked for contrarian mutual fund investment ideas among the Morningstar Categories that suffered the most outflows in the previous year, or the unloved, while avoiding the groups that received the highest inflows, or the loved.

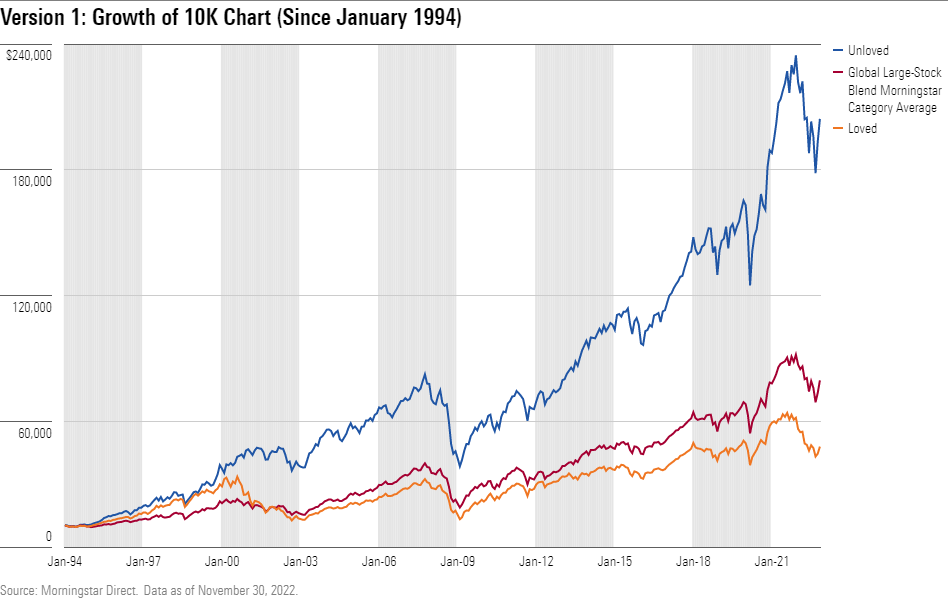

There are two versions of Buy the Unloved. The first, original iteration recommends investing equal sums in the three equity categories with the most outflows from the previous calendar year, holding them for three years, and then repeating the process. This version excludes categories where flows are less useful indicators of investor sentiment, such as the target-date, trading, and leveraged categories.

It’s been a successful approach over its more than 25-year history.

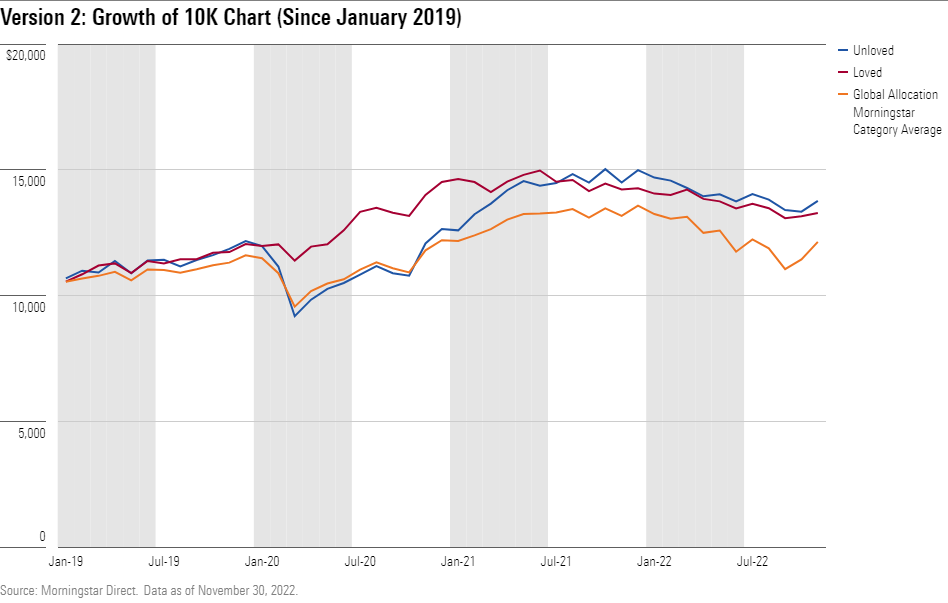

Launched in 2019, version two expands the universe of eligible categories to the bond and allocation groups. It averages the rankings of each group’s flows in absolute dollar and percentage change terms to capture smaller categories whose cash flows rarely would crack the top or bottom three.

Version two has a decent albeit short record, so far.

Based on open-end and exchange-traded fund net flows in 2022 through November, version one′s most unloved equity categories were large growth, foreign large growth, and mid-cap growth. In contrast, large blend, foreign large blend, and large value were the loved categories. Here are some ideas for the unloved categories, including options for investors who prefer passive funds.

Large Growth

This is the 18th time in the last 19 years that large growth has been among the unloved categories. Harbor Capital Appreciation HACAX fell much harder than its category peers in 2022, but it remains a great option. This is a high-conviction aggressive growth portfolio run by an experienced, stable, and talented team. Its tendency to load up on high-expectation stocks in sectors like technology and consumer cyclicals makes it prone to rough patches in bear markets. For the patient investor, the strategy has paid off over the long term, though.

Vanguard Growth Index VIGAX is an excellent passive option in this area because of its low turnover, tight index tracking, and razor-thin expense ratio.

Foreign Large Growth

American Funds EuroPacific Growth AEPGX is an excellent option for those willing to go against the grain. Its massive asset base is the category’s largest, but it spreads that money around 11 independent managers from three subsidiaries of parent company Capital Group to help avoid getting in its own way. The managers chart their own courses—some aggressive, some conservative—but the portfolio tends to consistently land in the growth portion of the Morningstar Style Box. Diversification and a more moderate risk profile than peers have helped the strategy do well in a variety of market cycles. Modest fees don’t hurt.

For passive investors, Vanguard International Dividend Appreciation Index VIAAX is a great choice.

Mid-Cap Growth

MFS Mid Cap Growth OTCAX is a fine option in this category. Two experienced comanagers have led this strategy for over a decade, but MFS further bolstered the strategy’s leadership by adding a third manager in 2021. The three managers will continue to use their patient investment approach to look for high-quality companies that can benefit from secular growth trends. The original duo built a strong record that consistently topped peers over rolling three- and five-year periods. The new manager should only strengthen the team, and the addition will help develop the next generation.

Vanguard Mid-Cap Growth Index’s VMGMX low-turnover, market-cap-weighted portfolio, and sizable cost advantage should make it a terrific option for passive investors.

Version 2

According to version two, the most unloved in 2022 were three fixed-income categories: muni-national short, multisector bond, and muni-national long. Derivative income, long government, and systematic trend were the most loved categories. Here are some options for version two′s unloved categories.

Muni-National Short

An experienced team at T. Rowe Price Tax-Free Short-Intermediate PRFSX makes it a solid option. Industry veteran Charlie Hill has run this strategy since 1995. He has plenty of help, including seven other managers, 10 analysts, and several traders. The team uses in-depth research and sophisticated quant tools to find value across the municipal-bond market, while also avoiding the riskiest muni bonds. The team keeps duration close to its Bloomberg Municipal 1-5 Year Blend Index benchmark’s duration, which is typically longer than that of the muni-national short category. Solid security selection has driven returns over the past decade.

IShares Short-Term National Muni Bond ETF’s SUB new target index and low fees make it a strong option for passive investors.

Multisector Bond

Pimco Income PONAX is one of the top choices in this category. Firm veterans Dan Ivascyn, Alfred Murata, and Joshua Anderson use the firm’s robust resources to generate consistent payouts in addition to performance. A world-class team of investment professionals supports them. Even with rising global bond yields, the strategy did better than many peers in 2022. Pimco used its scale to buy up big chunks of nonagency mortgage debt, which held up better than other securities in 2022′s historic fixed-income bear market. The fund may not always be able to secure such a deal in the future, but this team knows how to use Pimco’s expertise and size to its advantage.

Unfortunately, there are limited options for passive investors in this category, as the wide-ranging investment universes of the varied flexible approaches are hard to capture.

Muni-National Long

A skilled and collaborative team makes Fidelity Tax-Free Bond FTABX an exemplary choice in this category. Managers Cormac Cullen, Elizah McLaughlin, and Michael Maka all have several decades of industry experience and employ a cautious and well-designed approach to identify mispriced muni bonds. Investors shouldn’t expect high-flying returns in market rallies, but the strategy typically provides some protection in challenging markets. The fund’s relatively low fees also provide a nice cushion.

For passive investors, Invesco National AMT-Free Municipal Bond ETF PZA is a reasonable choice.

Conclusion

Don’t use Buy the Unloved as a core component of your portfolio. It’s a complement. Outflows do not always correlate with low valuations and high future returns, but they can point toward beaten-down or unpopular market segments that may be due for an eventual rebound. It’s also a good reminder to think twice before chasing the most popular funds. They often don’t stay popular forever.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/f941dc8b-2530-4a0b-ad78-555027eae4c1.jpg)