Don’t Bring Bad Money Habits Into 2023

We’ll review the top stocks, funds, and exchange-traded funds this week as well as updates you can make to your portfolio.

What You Missed

This week, we take a look at model portfolios to keep an eye on, bond funds to consider, and investment mistakes to avoid in 2023. Carole Hodorowicz talks financial lessons in 2022, Ruth Saldanha shares Morningstar’s 2023 financial resolutions, and Amy Arnott tells you her top portfolio moves for 2023.

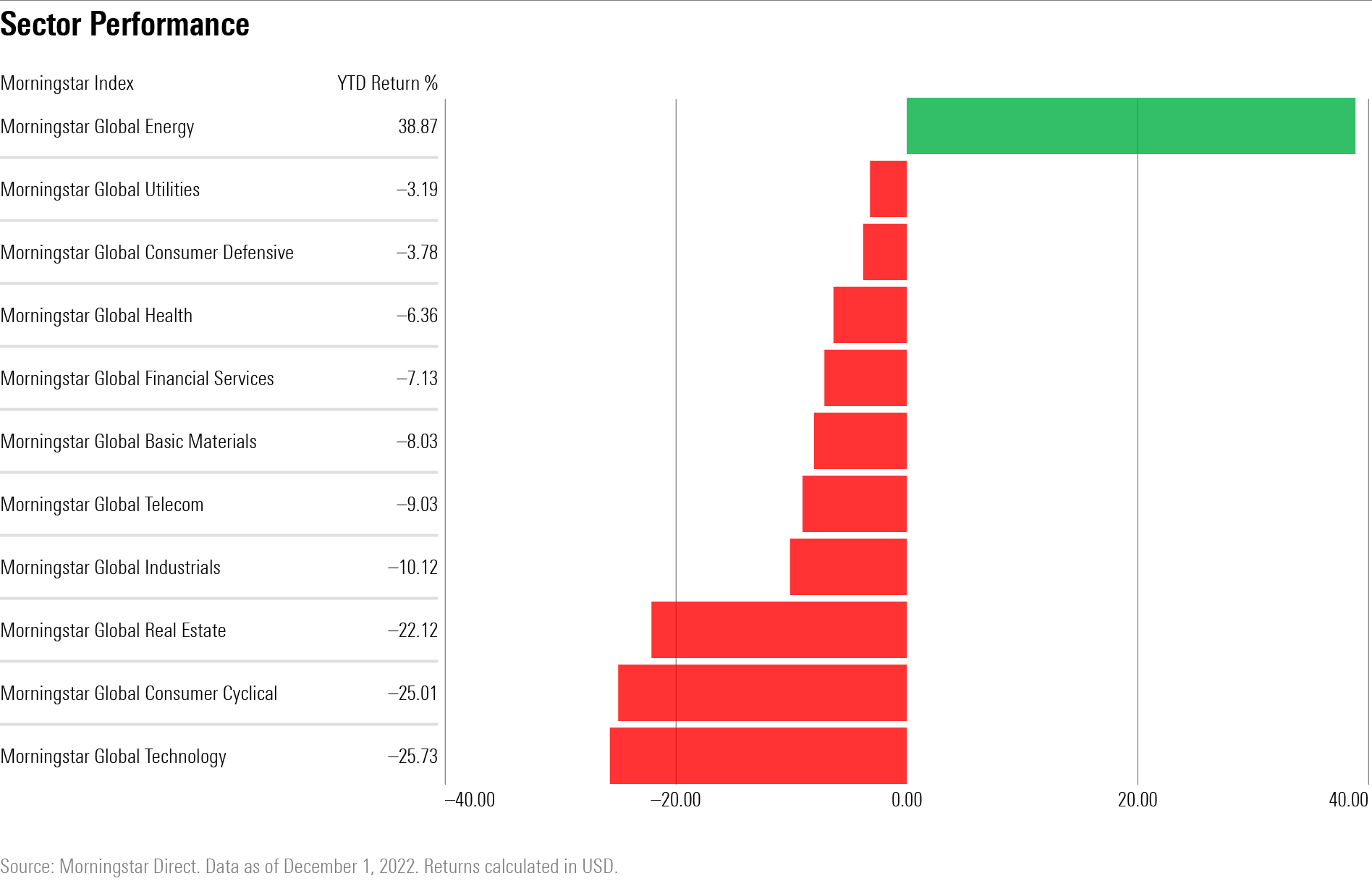

Chart of the Week

4 Investment Mistakes to Avoid in 2023

How to accept uncertainty and prepare your investments for different scenarios.

Glossary Term of the Week

A 401(k) loan is money investors can take from their 401(k)s to finance emergency or large expenses. The limit investors can take is $50,000 or 50% of their vested accounts, whichever is less.

See Morningstar’s Investing Definitions and Financial Terms for the full definition.

Check out Carole Hodorowicz’s article “Can I Take a Loan From My 401(k)?”

What to Watch

Pre-Retirees: Is Your Asset Allocation Too Aggressive?

How to determine whether your asset mix is out of whack, your overall portfolio diversification is lacking, or you own too many investments.

Articles We Love

Top 6 Portfolio Moves for 2023

While the market environment remains uncertain, there are a few key changes worth considering.

If it’s been a while since you checked the asset-class weights in your portfolio, it might be time to make some adjustments. When rebalancing, I like to start with the broadest level (the mix of stocks and bonds) and also consider the weights within each asset class, such as domestic and international stocks and growth and value issues.

On the equity side, value stocks have fared significantly better than growth issues over the trailing 12-month period through Nov. 30, 2022. If you started out with equal weights between the two a year ago, your portfolio might now be heavy on value and light on growth.

Our Top Financial Resolutions for 2023

Morningstar staffers resolve to sell losers, pick winners, and prioritize our children’s futures.

This year felt like it had a decade’s worth of newsworthy moments, though that’s almost certainly my recency bias talking.

In case you’ve forgotten, 2022 saw Russia’s invasion of Ukraine, runaway inflation leading to consecutive interest-rate hikes, the death of British monarch Queen Elizabeth II, the EU gas shortage and glut, the rise of anti-ESG forces, increased tensions in the Taiwan Strait, and Elon Musk’s Twitter takeover. The year also saw the end of the long-running Canada and Denmark Whisky War, but admittedly that might be interesting only to me.

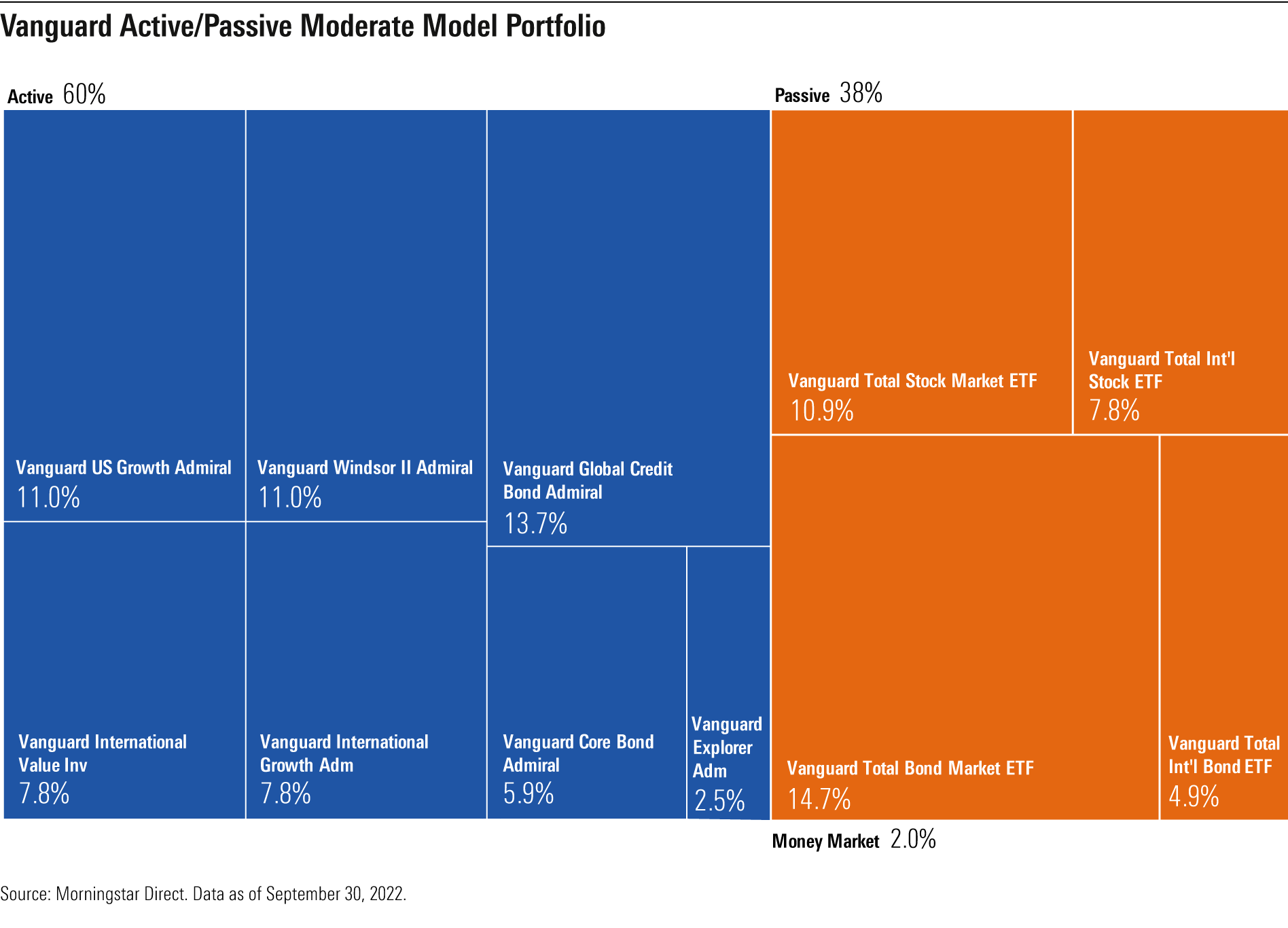

Model Portfolios to Keep an Eye On

With new model portfolios continually hitting the market, we’ve highlighted three series on Morningstar’s radar.

The model portfolio landscape continues to grow at a rapid pace, expanding the opportunity set for advisors and their clients. Since Morningstar launched its model portfolio database in 2019, asset managers and investment strategists have flooded the space with new offerings. As of mid-December, the database included over 2,500 individual U.S. model portfolios. In 2022 alone, 44 models were launched and over 300 were activated, or added, into Morningstar’s database.

Morningstar Manager Research analysts currently apply their qualitative assessments, known as the Morningstar Analyst Rating, to nearly 500 of those portfolios. However, keeping pace with the steady growth can be a difficult feat. That said, analysts closely monitor the coverage for new and interesting offerings that model providers have released to the market.

5 Things I Learned About Money in 2022

From inflation and rising interest rates to budgeting 101 and crypto’s demise, here are the biggest money lessons.

It’s that time of the year again! Time to overdecorate our apartments, go above and beyond while baking (or attempting to) holiday-themed treats, and reflect on what the past 11 or so months have taught us—all while listening to Mariah Carey’s “All I Want for Christmas Is You” on repeat.

Here are a few things that I learned this year that I think will stick with me (or in some cases, haunt me) next year.

Inflation and Rising Interest Rates Are Terrible

Remember when inflation reached 7% and we thought that was high? This year, we watched it reach new heights—and it forced us to find new ways to stretch our paychecks (hint hint, nudge nudge Morningstar). And in response, the Federal Reserve has been raising interest rates to combat inflation. Although analyst Preston Caldwell expects Fed rate hikes to moderate next year, there are some valuable lessons to take with us into the new year:

Stocks, Funds, and Exchange-Traded Funds

Southwest Airlines’ Holiday Travel Woes Don’t Change Our Long-Term Outlook

Southwest Airlines’ (LUV) stock traded lower on Dec. 27 as the no-moat carrier struggled to normalize its operations after a wave of systemwide flight cancellations and delays. While inclement winter weather was certainly a main contributor to Southwest’s issues, other U.S. airlines reported far fewer cancellations, which suggests company-specific factors may be involved. In our view, this event demonstrates a weakness of Southwest’s point-to-point service model as opposed to the hub-and-spoke model employed by most other U.S. airlines. However, we’ve heard other explanations as well, from overbooking to inadequate operating systems.

2 Emerging-Markets Bond Funds to Consider

Emerging fixed-income markets have struggled in recent years, as have mutual funds that focus on them.

In 2022, markets have endured the Russian invasion of Ukraine, China’s grappling both with coronavirus lockdowns and extreme weakness in its property markets, and a stronger U.S. dollar. As a result, the average fund in the emerging-markets bond Morningstar Category was down 14.5% over the trailing one year through Dec. 27, 2022, while the average emerging-markets local-currency bond fund was down 9.9% over the same period.

Missed Us?

Check out our investing specialists on Twitter:

Christine Benz @Christine_Benz

Jeff Ptak @syouth1

Sarah Newcomb @finance_therapy

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)