2022’s Best-Performing Bond Funds

Just about the only safe haven from rising rates were these ultrashort bond funds.

In one of the worst years in history for bond funds, there were few places of refuge for investors.

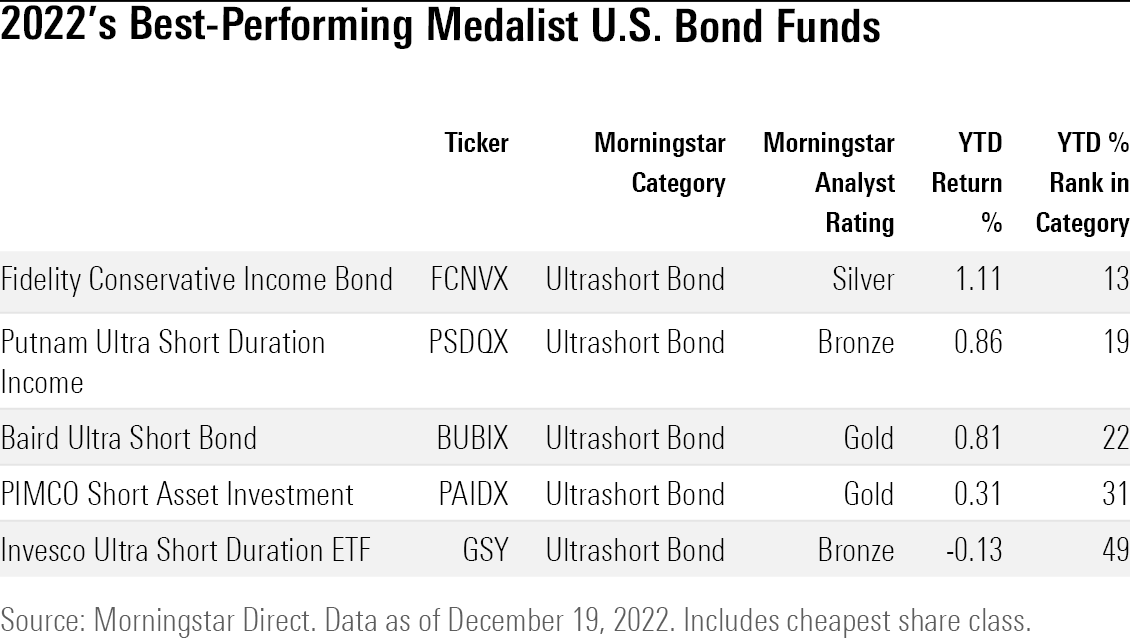

Only four Morningstar Medalist funds eked out positive returns in 2022. These funds carry Morningstar Analyst Ratings of Bronze, Silver, or Gold.

The catalyst for double-digit losses in many bond funds was the Federal Reserve’s aggressive interest rate increases. As a result, funds that were the least vulnerable to rising rates proved to be the most buoyant: ultrashort bond funds.

Ultrashort bonds are less sensitive to changes in interest rates because of their very short maturities, and on average, ultrashort bond funds are down 0.2% in 2022. These funds’ performance may seem underwhelming, but those returns compare with a 12% decline on the average U.S. intermediate core bond fund.

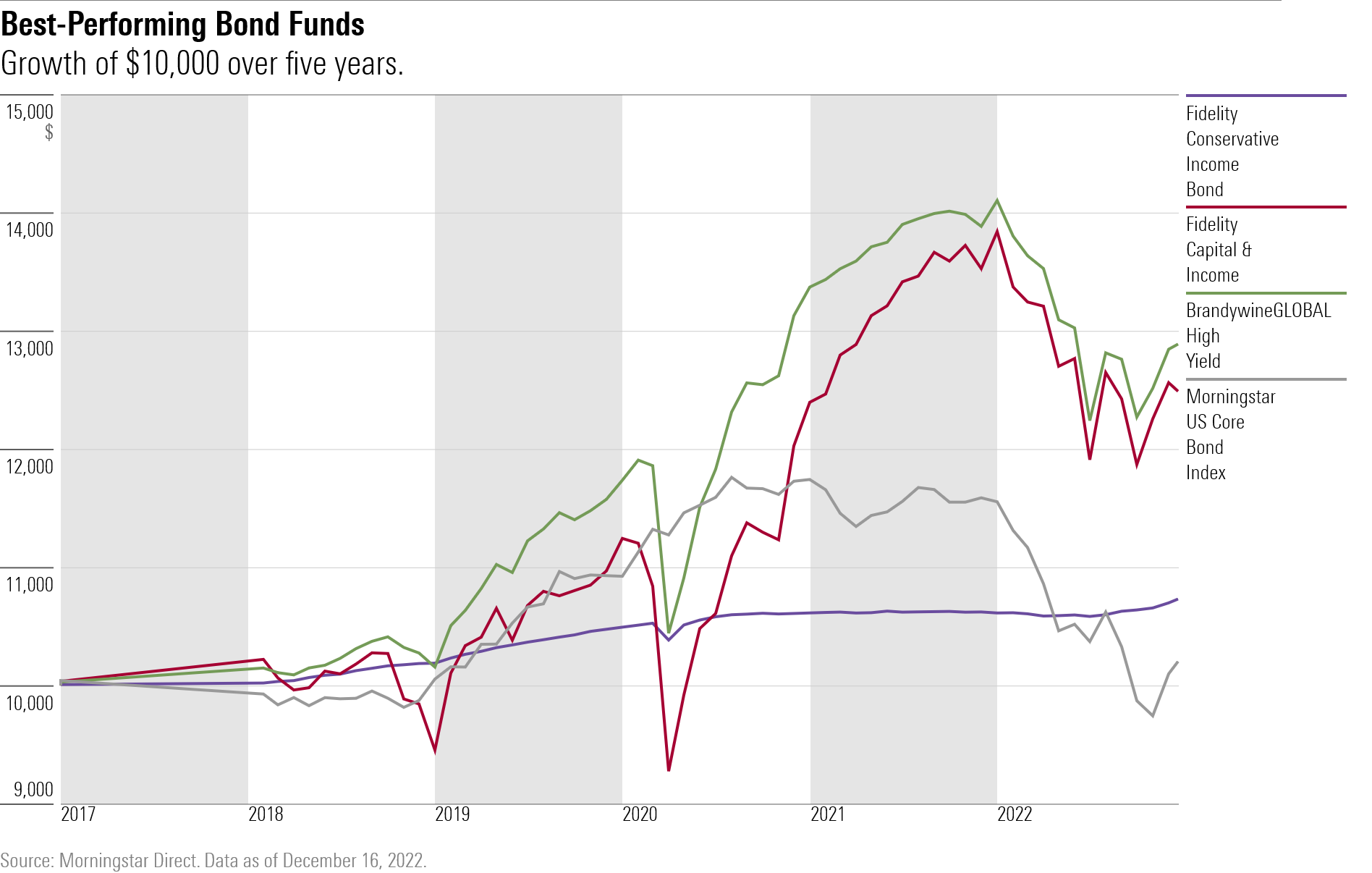

Over three- and five-year periods, the performance tables paint a vastly different picture. Even with losses in 2022, the best-performing bond funds are mainly those with much greater risk: high-yield bond funds. High-yield bonds tend to be less sensitive to interest rates, and performance is more closely tied to the stock market.

Best-Performing Funds for 2022

Ultrashort bond funds already carry minimal interest rate risk, but those that outperformed in 2022 often took even more conservative bets that helped them when interest rates rose. The key metric for them is duration, a measurement in years that assesses the interest-rate sensitivity of bonds. It’s often related to the maturity of bonds.

Fidelity Conservative Income Bond (FCNVX) performed best of all Morningstar medalists this year, gaining 1.1% through Dec. 19. The fund runs at a shorter duration than its typical peer, writes Morningstar analyst Saraja Samant. “This helped it outperform in rate-driven selloffs such as the first half of 2022,” she writes.

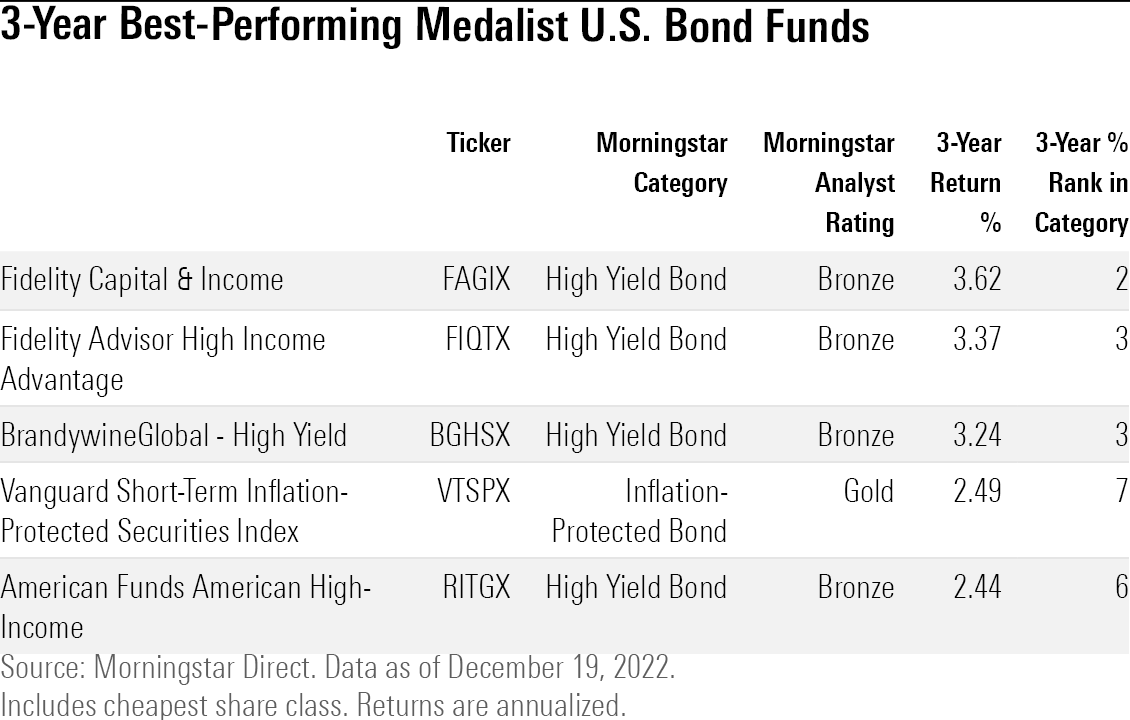

3-Year Best-Performing Bond Funds

The terrible year for bonds has depressed longer-term records for most bond funds. But strong gains in high-yield bond funds that followed a March 2020 crash have cushioned against more recent losses for longer-term investors.

Over the past three years, Fidelity Capital & Income (FAGIX) has done the best. The Bronze-rated fund gained 3.62% on an annualized basis over the past three years. After losing 29.3% in the COVID-19 selloff, the fund went on to gain 33.7% over the last nine months of 2020, writes senior manager research analyst Sam Kulahan. “As rates spiked and risk assets stumbled during 2022′s volatile first seven months, a well-timed reduction in equities and a relatively cautious stance on high yield helped the strategy limit its fall to 8.6% over the period, in line with the category norm.”

Inflation-protected bond funds have posted mixed results as inflation roared in 2022, but Vanguard Short-Term Inflation-Protected Securities (VTSPX) is one of the best. The fund gained 2.5% this year, whereas the average inflation-protected bond fund is down 8.9%. The fund’s shorter-duration portfolio “shielded it from rising interest rates,” writes associate manager research analyst Mo’ath Almahasneh.

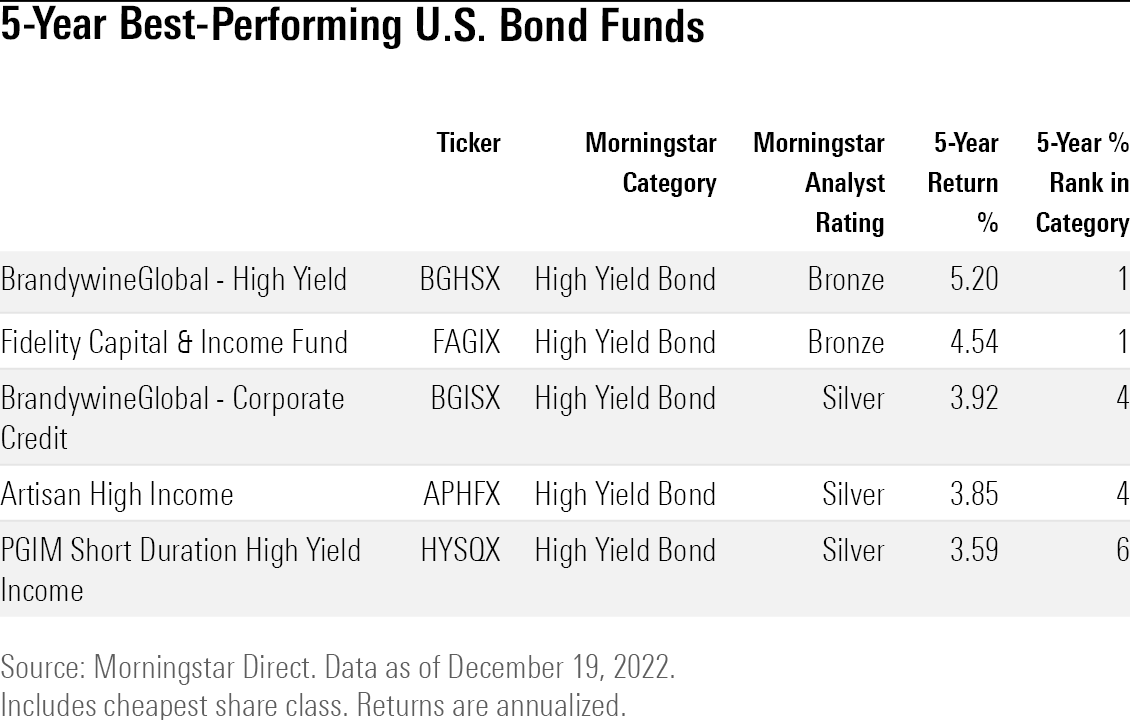

5-Year Best Performing Bond Funds

Over the past five years, BrandywineGlobal High Yield (BGHSX) has chalked up the best returns among all medalist taxable bond funds. The fund is up 5.2% on an annualized basis over the last five years.

“The strategy’s shift to a conservative posture helped it hold up better than most rivals for the year to date through August 2022, as interest-rate spikes and Russia’s invasion of Ukraine rocked markets,” writes manager research analyst R.J. D’Ancona. The fund also offers one of the highest yields among medalist bond funds.

PGIM Short Duration High Yield Income (HYSQX) has balanced higher yields with less interest-rate sensitivity, which has helped the fund as interest rates rise. The fund lost only 4.7% this year and is up 3.6% on an annualized basis over the past five years.

Correction: Dec. 22, 2022: A previous version of this article included an incorrect ticker for BrandywineGlobal High Yield (BGHSX).

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)